Nearing Impact: A U.S. Debt Crash Course

Economics / US Debt Nov 04, 2008 - 01:24 PM GMTBy: David_Haas

Over the past decade or so, I have occasionally seen an article - or sometimes a chart - referencing the dollar amount of marginal or “extra” U.S. Gross Domestic Product (GDP) that is generated by adding each new dollar of government debt . In other words, with their unique brand of wisdom, the federal government tries to “buy growth with debt”.

Over the past decade or so, I have occasionally seen an article - or sometimes a chart - referencing the dollar amount of marginal or “extra” U.S. Gross Domestic Product (GDP) that is generated by adding each new dollar of government debt . In other words, with their unique brand of wisdom, the federal government tries to “buy growth with debt”.

I admit, I haven't thought much about this topic for a while because I hadn't seen any good work presented on it until I spotted this article written on October 20th, 2008 by Karl Denninger. As you will see when you read his article, Karl is a masterful researcher as well being a highly-skilled and intelligent writer and I admire his work. Here is a direct link to this important post: “Congress: What Hank and Ben Aren't Telling You”

In many ways, Karl's topic relates directly back to one of my own posts (an absolute must-read!) that I wrote back in August: “The Great American Credit Binge: 1982 to 2006″ . For those of you who haven't taken the time to read that one, I highly recommend you do so to help establish a more solid “big picture” frame of reference from which to understand where we are now on our country's economic trajectory and where we might be going in the future. Reading my article - but especially the separate paper linked to it - will help you to get more value out of Karl's post, as well. I'd estimate that, together with what's linked on this post, all of this reading will take you about an hour, but it will be time well spent.

Anyway…in summary, what's really been happening is, beginning with Reaganomics - which was introduced in 1982 - our government began pursuing a new policy of trying to pump up our national economic growth rate by aggressively increasing both government spending and the national debt while cutting taxes , particularly on the higher-earners. This tactic became widely-known as “trickle-down economics”.

The main theory behind Reaganomics was that by relieving much of the tax burden on the wealthy “investor class” and streamlining government regulations and policies to stimulate their risk-taking and investment activities - even if this created additional government debt - jobs would be created that would enhance economic activity, employ the lower and middle classes, and ultimately increase income tax revenues enough to repay the government debts that began the whole virtuous cycle. Meanwhile, living standards and consumption “should” increase and improve the lot of everyone.

Simple theory. It's just that Reaganomics never EVER worked the way it was planned. The primary malfunction (though there were many) was that TO THIS VERY DAY THERE HAS NEVER BEEN ANY MEANINGFUL ATTEMPT TO REPAY ANY OF THE DEBTS REAGANOMICS INDUCED!

By deliberately pursuing this course of massive and irresponsible debt-creation, the governing monetary masters had put our country squarely and resolutely on the path to becoming a debtor-nation of historic proportions and permanently and systematically undermined our financial stability. - David

Initially, ours was a hidden, slow-motion state of economic decline that didn't raise too many eyebrows. However, over the many years that this economic philosophy has been dominant, that rate of decline into debtor status has been deliberately increased year by year (by continually raising the federal debt ceiling) until reaching its current state of harrowing, all-out nosedive when the plunge in our nation's financial condition can be hidden no longer. As Warren Buffet has been known to quip “when the tide goes out, you can tell who's been swimming naked”.

What these central planners hadn't considered (and apparently still don't) is that at some point, THE LAW OF DIMINISHING RETURNS must always kick in. Notice this is considered a law and not just an academic theory. Any student learns about the law of diminishing returns in Economics 101. It appears the only people who ever forget about it are those who rise to the higher levels of finance or enter politics.

As Karl details for us so deftly, we are rapidly nearing the economic limits of our current debt-based system and we're not far from hitting the wall. In this terminal period, it is likely that we will pass through two distinct points of economic emergency - perhaps either in rapid succession or concurrently .

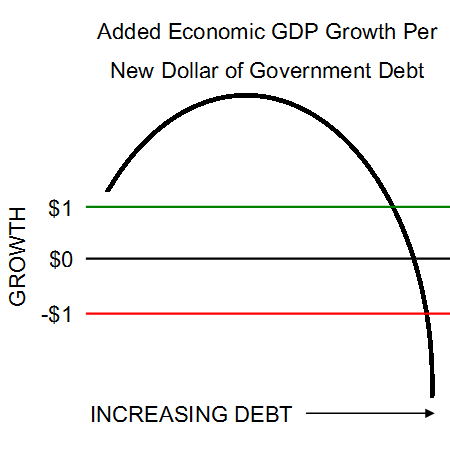

PHASE 1 - During this phase, each new dollar of government debt produces ZERO NEW ECONOMIC GROWTH for our nation's economy

PHASE 2 - During this phase, the camel's back finally breaks and each new dollar of government debt actually BEGINS TO CANNIBALIZE AND DESTROY THE ECONOMIC GROWTH of our country

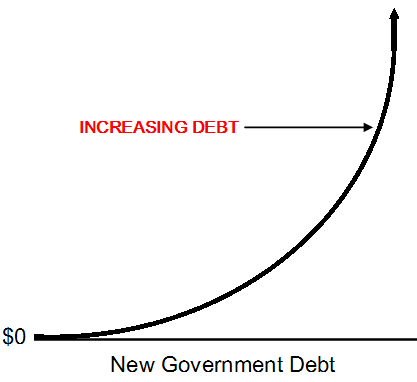

Here is a graph depicting the theoretical plot of an increasing rate of growth of government debt over time. It seems apparent that our current level of borrowing to bail out the world's economic system may have been enough to “blast” all the way through Phase 1 and land us deep in the reaches of Phase 2. By viewing the data on some of the charts used to illustrate last week's post - “The U.S. FED: What! Me Worry?” - the level of debt expansion now is looking very much like we may have reached the near-vertical point on this curve shown by the black arrow:

The second chart (again, theoretical, not real data) is a means of showing the marginal benefit to the economy of increasing the national debt over time. Notice that, at some point, the debt finally grows to the point that it begins to consume all the productive capacity of the economy, just EXACTLY as massive and growing credit card debt would ultimately consume a wage earner and destroy his finances :

Despite the massive debt increases we're witnessing now, it's hard to know for sure precisely where we are on this continuum and, unfortunately, we will not be able to find out for some time yet. But we can safely surmise, with the recent explosion of new government debt and the apparent lack of any positive response in the “real” economy, we may already be deep into the danger zone.

Karl's work reminds us that - no matter how big and powerful we may think we've become - we live within the bounds of the law of diminishing returns and he goes on to show that the only way to set back the clock is to either default on debt or pay it down. Either of these would subject the citizens of our country to levels of economic pain never seen before - or, at least not seen since the Great Depression era.

A default by the federal government would, no doubt, entail either a partial or a complete wipe-out of the dollar and many paper instruments denominated in it. You can use your own imagination to envision the impact this might have on many forms of wealth in our country. Smart investors may be able to find ways of navigating around this type of loss by preserving all or a portion of their wealth in “things”, instruments, and vehicles other than dollars. These folks could potentially buy assets in the future for pennies when compared with today's dollars. I, of course, can't predict when or even if such a default would occur but, if it did, it's impact would be devastating for many Americans and LIFESTYLES AND EXPECTATIONS WOULD BE FORCIBLY REVISED DOWNWARD for most of us.

In the alternative, any attempt to “pay down” our national debt while still supporting the increasing needs of government and the entitlement programs such as Social Security and Medicare/Medicaid would turn workers into wage-slaves who - after taxes were paid - could keep little or nothing for themselves. Any attempt at repayment of the government debt would probably be the death-knell of the consumer-driven economy and could even usher in a wide-scale dependence on work provided by socialist government programs similar to the Works Progress Administration which put millions to work building national infrastructure in the 1930's.

According to an article published May 29, 2007 in USA Today, at $59.1 trillion, the government debt (combined federal and state) STOOD THEN at $516,348 per U.S. household. That was then. In those days, your household's share of “interest only” at a rate of 5% interest per annum would be $25,817.40 in taxes per year. In addition to your other taxes (goods and services you consume), are you paying your share? I know I'm not. This can only mean that no one is and that is why our national debt is going parabolic on us now.

See it here for yourself: “Taxpayers On The Hook For $59 Trillion”

I think it would be safe to say that the total debt has INCREASED SUBSTANTIALLY since May, 2007 when the article was written. Government debt is SO MASSIVE NOW that any attempt at repaying it could consume much of the productivity of all who are presently working and, most likely, the productivity of generations to come. The USA Today article said that “Every U.S. household would have to pay about $31,000 a year to do so (retire the debt) in 75 years” and that's at the old May, 2007 debt figures. Since this enormous overload of debt no longer looks repayable, in my humble estimation, some form of governmental debt default appears to be the only option remaining on the table.

For those of you who have an interest in gaining more depth of knowledge on this topic, I heartily recommend that you delve into reading the debt section in Michael Hodges' “Grandfather Economic Report” linked below.

“Grandfather Economic Report - Debt”

I promise you, reading his report isn't going to put you in a better mood than the one you're in now. But it will show you with the government's own figures exactly what the politicians have accomplished in our names over the past 30, or so, years as we perennially voted for “change”. Could it be that in the end all we'll have left is change?

When you read Michael Hodges' research, you'll learn - perhaps for the very first time in your life - that the true amount of debt you (and each of your parents, and your husband/wife, and each of your children) are carrying WAS in the range of $180,000 per person in the United States!

But that number has grown by leaps and bounds in 2008 (Fannie/Freddie, multifaceted bailouts, systemic re-liquifications, endless wars, ad infinitum) and my current estimate would be closer to $210,000 for each and every one of us right now…and this number keeps growing. So you can multiply that by the number of people in your household to determine your share.

However, it won't stop there either! To put the rate of total debt growth in perspective (including governmental funded, unfunded, and private debt), it has grown somewhere in the range of $45,000 to $50,000 per household per year over the past few years . This annual debt increase is larger than the total gross annual incomes of many of these families. This, to me, is truly numbing…petrifying.

Don't believe it? All you have to do is take a look at the USA Today article I mentioned above for verification of the government debt figures and then add Michael's personal and household debt figures to them (actually he's already done it for you if you read carefully on his site). While you're at it, don't forget that neither USA Today nor Michael have the current debt totals so you'll have to add an extra margin for that, too.

Does this post leave you shaken, depressed, and looking for a healthy solution to the stress caused by all of the above? Looking for a real release? Well, you may think I'm crazy but, like it or not, gardening may be a big part of your future ! So plan ahead and beat the crowd! Buy a good shovel and gloves, some seeds, and a few good books on how to do it. Plan in the Winter, plant in the Spring! You just may find that the fresh air, sunshine, exercise, and your new-found connection to the earth and the plants is spiritually uplifting and the wonderful produce you'll be eating will go a long way toward rebuilding your health from all those institutional-grade restaurant meals of the past 20 years.

When you stop and think about it, these are the kinds of “values” waiting for us when we pull our heads out of the artificial and dizzying world of debt and finance and come floating back down to Earth. In this way and probably many others we have yet to experience, serious downturns can be one of the best things to happen in generations. In times like these, life forces us to rethink, reground, rebalance, and reconnect to what's truly important. Keep a cheerful attitude and invest yourself in building a strong and loving family and community. Money will come and go (by government fiat) but true wealth is accrued in a variety of forms. Diversify your wealth into forms that can never be lost and you'll always have a strong foundation for your continuing happiness. Life may be just about to tell us all to forget about the paper and the endless electronic digits and remember what's real. To that I'd add “it's about time”.

For more interesting articles and commentary please visit: http://www.haasfinancial.com

By David Haas

Consultant

In my consulting practice, I work with individuals, business owners, and professionals. I assist business owners and professionals in several critical areas ranging from business start-up, marketing, operational challenges, employee retention, and strategic planning to personal asset protection, financial, and retirement income planning. Often, these areas relate and need to be integrated to work most effectively. I also assist business owners in developing exit-strategies that enable them to maximize the value of their business interests and preserve their lifestyle in retirement. For individuals, I primarily focus on tax reduction, financial, and retirement income planning.

© 2008 David Haas, Consultant

David Haas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.