Bond Market Investors Near the Exit, Stock Market Rally Over Already?

Stock-Markets / Financial Markets 2009 Jan 03, 2009 - 11:53 AM GMT

The Federal Reserve and Wall Street are congratulating themselves on averting disaster in the financial markets. A report issued by the Department of Treasury had this to say, "Treasury, working with the Federal Reserve, the FDIC (Federal Deposit Insurance Corp.) and other regulators, has taken the necessary steps to prevent a financial collapse." "The most important evidence that our strategy is working is that Treasury's actions, in combination with other actions, stemmed a series of financial institution failures. The financial system is fundamentally more stable than it was when Congress passed the legislation.”

The Federal Reserve and Wall Street are congratulating themselves on averting disaster in the financial markets. A report issued by the Department of Treasury had this to say, "Treasury, working with the Federal Reserve, the FDIC (Federal Deposit Insurance Corp.) and other regulators, has taken the necessary steps to prevent a financial collapse." "The most important evidence that our strategy is working is that Treasury's actions, in combination with other actions, stemmed a series of financial institution failures. The financial system is fundamentally more stable than it was when Congress passed the legislation.”

But have they averted disaster, or simply postponed it? Remember, their prescription for saving our financial institutions was the same as what caused the problem in the first place…more debt. These institutions don't have a liquidity problem. They have a solvency problem. Extending more debt to an insolvent institution doesn't make it any healthier. It may even make the problem larger.

In the meantime, there is a dearth of positive forecasts for 2009. There is little faith in the markets.

Playing the blame game.

Global economic imbalances helped to foster the credit crisis by pushing down global interest rates and driving investors towards riskier assets, outgoing US Treasury Secretary Hank Paulson told the Financial Times. In a valedictory interview, Mr Paulson cast the crisis as partly the result of a collective failure to come to terms with the way the rise of emerging markets was reshaping the global financial system. These imbalances – arising from differences in the inclinations of different nations to save and invest – are reflected in large current account deficits and surpluses around the world.

No, Mr Paulson, it was too much debt and the willingness of the Federal Reserve and Treasury to extend even more.

Is the rally overdone?

( Bloomberg ) -- The decline in U.S. manufacturing deepened in December as demand for such products as cars, appliances and furniture reached the lowest level since at least 1948, signaling further cutbacks in factory jobs and production this year. The Institute for Supply Management's factory index fell to 32.4, below economists' forecasts and the lowest level since 1980, from 36.2 the prior month. Readings less than 50 signal contraction. The group's new-orders measure reached the lowest level on record and prices slid the most since 1949. Folks, this doesn't look good for 4 th quarter corporate profits.

( Bloomberg ) -- The decline in U.S. manufacturing deepened in December as demand for such products as cars, appliances and furniture reached the lowest level since at least 1948, signaling further cutbacks in factory jobs and production this year. The Institute for Supply Management's factory index fell to 32.4, below economists' forecasts and the lowest level since 1980, from 36.2 the prior month. Readings less than 50 signal contraction. The group's new-orders measure reached the lowest level on record and prices slid the most since 1949. Folks, this doesn't look good for 4 th quarter corporate profits.

Bond holders are near the exits.

-- Treasuries started 2009 on a down note Friday in the first trading day of the new year. Government-issued bonds are coming off their best year since 1995, returning more than 13.7% to investors in 2008, but analysts say support for bonds could come to a crashing end in 2009. Investor appetite for government debt has kept funding rates impressively low, but continued appetite is a potential concern in 2009," said Thomas Lee, a strategist for JPMorgan. "We believe investors are beginning to appreciate that risk aversion has hit maximum levels. "

-- Treasuries started 2009 on a down note Friday in the first trading day of the new year. Government-issued bonds are coming off their best year since 1995, returning more than 13.7% to investors in 2008, but analysts say support for bonds could come to a crashing end in 2009. Investor appetite for government debt has kept funding rates impressively low, but continued appetite is a potential concern in 2009," said Thomas Lee, a strategist for JPMorgan. "We believe investors are beginning to appreciate that risk aversion has hit maximum levels. "

Gold rally may be over.

( Bloomberg ) -- Gold fell as the dollar climbed against the euro, eroding the appeal of the precious metal as an alternative investment. Silver and platinum futures rose. “The dollar is a little stronger, which was an additional weight that gold is fighting against,” said Frank McGhee , the head dealer at Integrated Brokerage Services LLC in Chicago. Gold futures for February delivery dropped $4.80, or 0.5 percent, to $879.50 an ounce on the Comex division of New York Mercantile Exchange. The metal still climbed almost 1 percent this week.

( Bloomberg ) -- Gold fell as the dollar climbed against the euro, eroding the appeal of the precious metal as an alternative investment. Silver and platinum futures rose. “The dollar is a little stronger, which was an additional weight that gold is fighting against,” said Frank McGhee , the head dealer at Integrated Brokerage Services LLC in Chicago. Gold futures for February delivery dropped $4.80, or 0.5 percent, to $879.50 an ounce on the Comex division of New York Mercantile Exchange. The metal still climbed almost 1 percent this week.

Japanese stocks finish their worst year ever.

-- ( Bloomberg ) -- Japan stocks posted their biggest annual drop in 2008, a year punctuated with market records as the global recession and the surging yen imperiled company earnings.

-- ( Bloomberg ) -- Japan stocks posted their biggest annual drop in 2008, a year punctuated with market records as the global recession and the surging yen imperiled company earnings.

The benchmark Nikkei 225 Stock Average sank 42 percent, eclipsing the next-biggest slumps of 39 percent in 1990 and 27 percent in 2000. The broader Topix index also fell by the most ever, with all but one of its 33 industry groups losing ground.

Chinese investors see record declines, too.

-- ( Bloomberg ) -- Chinese stocks fell for an eighth day, with the benchmark completing its first annual decline as economic growth cooled and exports and industrial production shrank. The CSI 300 Index , which tracks yuan-denominated A shares listed on China's two exchanges, retreated 15.71, or 0.9 percent, to 1,817.72 at the close. It has lost 66 percent this year, after more than doubling in each of the past two years since it was introduced in April 2005. The stock market is closed for the rest of the week for the New Year holiday.

-- ( Bloomberg ) -- Chinese stocks fell for an eighth day, with the benchmark completing its first annual decline as economic growth cooled and exports and industrial production shrank. The CSI 300 Index , which tracks yuan-denominated A shares listed on China's two exchanges, retreated 15.71, or 0.9 percent, to 1,817.72 at the close. It has lost 66 percent this year, after more than doubling in each of the past two years since it was introduced in April 2005. The stock market is closed for the rest of the week for the New Year holiday.

…and you think it's bad here?

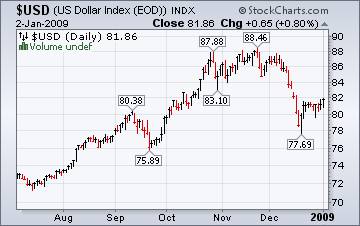

( Bloomberg ) -- The euro fell the most in two weeks against the dollar and dropped versus the yen after a European manufacturing report showed the recession is deepening in the 16- nation region. “There's a lot more weakness in Europe ahead,” said Sean Callow , a senior currency strategist at Westpac Banking Corp. in Sydney. It appears that the Eurozone is planning on lowering its interest rates as their economy stumbles.

( Bloomberg ) -- The euro fell the most in two weeks against the dollar and dropped versus the yen after a European manufacturing report showed the recession is deepening in the 16- nation region. “There's a lot more weakness in Europe ahead,” said Sean Callow , a senior currency strategist at Westpac Banking Corp. in Sydney. It appears that the Eurozone is planning on lowering its interest rates as their economy stumbles.

Priced for foreclosure?

How bad has the housing market gotten? With home values dropping by faster rates each month, a real estate agent near Detroit said that if houses weren't priced as low as foreclosures, they simply would not sell. That grim assessment underscored numbers released Tuesday showing that home prices in 20 metropolitan areas across the country dropped at a record rate of 18 percent in October from a year earlier as the fallout from the financial collapse reverberated through the housing market.

How bad has the housing market gotten? With home values dropping by faster rates each month, a real estate agent near Detroit said that if houses weren't priced as low as foreclosures, they simply would not sell. That grim assessment underscored numbers released Tuesday showing that home prices in 20 metropolitan areas across the country dropped at a record rate of 18 percent in October from a year earlier as the fallout from the financial collapse reverberated through the housing market.

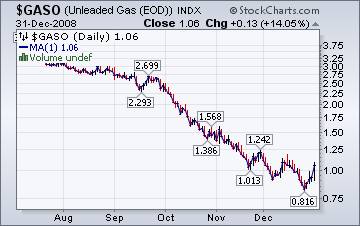

Gasoline prices still trending down.

The Energy Information Administration reports that, “For the fifteenth consecutive week, the national average price for regular gasoline fell. The price shrank 4 cents to 161.3 cents per gallon – the lowest since January 19, 2004 and 144 cents lower than the price a year ago. Prices also fell in all major regions, with the price on the East Coast slipping 4.1 cents to 163 cents per gallon. In the Midwest, the price dropped the most of any region, shrinking 5.6 cents to 156.7 cents per gallon.”

The Energy Information Administration reports that, “For the fifteenth consecutive week, the national average price for regular gasoline fell. The price shrank 4 cents to 161.3 cents per gallon – the lowest since January 19, 2004 and 144 cents lower than the price a year ago. Prices also fell in all major regions, with the price on the East Coast slipping 4.1 cents to 163 cents per gallon. In the Midwest, the price dropped the most of any region, shrinking 5.6 cents to 156.7 cents per gallon.”

Natural gas prices decreased for the week in the lower 48 states.

The Energy Information Agency's Natural Gas Weekly Update reports, “ The coldest temperatures of the season to date covered much of the northern half of the country this report week, boosting demand related to space heating on both coasts and across the Northern Plains and Midwest population centers. Prices increased throughout the country outside the Northeast, with the biggest increases occurring for supplies from the Rocky Mountains (particularly for delivery into the Northwest).”

The Energy Information Agency's Natural Gas Weekly Update reports, “ The coldest temperatures of the season to date covered much of the northern half of the country this report week, boosting demand related to space heating on both coasts and across the Northern Plains and Midwest population centers. Prices increased throughout the country outside the Northeast, with the biggest increases occurring for supplies from the Rocky Mountains (particularly for delivery into the Northwest).”

How little we know.

It's the end of an era . We know that 2008, much like 1932 or 1980, marks a dividing line for the American economy and society. But what lies on the other side is hazy at best. The great lesson of the past year is how little we understand and can control the economy. This ignorance has bred today's insecurity, which in turn is now a governing reality of the crisis.

Go back to the onset of the crisis in mid-2007. Who then thought that the federal government would rescue Citigroup or the insurance giant AIG ; or that the Federal Reserve , striving to prevent a financial collapse, would pump out more than $1 trillion in new credit; or that Congress would allocate $700 billion to the Treasury for the same purpose; or that General Motors would flirt with bankruptcy?

In 2008, much conventional wisdom crashed.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.