Stock Market Investors Buying Beaten Down Stocks

Stock-Markets / Global Stock Markets Jan 04, 2009 - 09:25 AM GMT Changing the digits on the calendar from '08 to '09 may not have transformed the dire outlook for the global economy, but during the holiday-shortened New Year week investors appeared adamant to put the rout of 2008 behind them.

Changing the digits on the calendar from '08 to '09 may not have transformed the dire outlook for the global economy, but during the holiday-shortened New Year week investors appeared adamant to put the rout of 2008 behind them.

Although mercifully the door has been closed on 2008, let's recap some of the unprecedented movements experienced in financial markets during the year.

Equities:

• MSCI World Index: -42.1% (worst yearly performance since start of Index in 1970)

• S&P 500 Index: -38.5% (worst annual percentage decline since 1937 and 3rd worst on record; largest quarterly [4th quarter: -298] and daily [September 29: -107] points decline ever; 6th worst daily percentage decline [October 15: -9.0%])

• Dow Jones Industrial Index: -33.8% (worst annual percentage decline since 1931 and 3rd worst on record; largest quarterly [4th quarter: -2,330] and daily [September 29: -778] points decline ever; 6th worst daily percentage decline [October 15: -7.9%])

• S&P 500 and Dow Jones: There was no point in 2008 where the indices were up for the year at the close of a trading day. Since 1900, 2008 was only the 4th year (after 1910, 1962 and 1977) where the Dow never had a single day where it closed up for the year, according to Bespoke .

• FTSE Eurofirst 300 Index: -44.8% (worst yearly percentage fall since its creation in 1986)

• Nikkei 225 Average: -42.1% (biggest annual percentage decline on record)

• CBOE Volatility Index (VIX): Historical high in November based on new calculation, but remained below levels seen during the 1987 crash based on an previous calculation.

Treasuries:

• US Treasuries: Yields dropped to lowest levels since 1950.

• US 10-year Treasury Notes: Yields fell by 182 basis points – biggest yearly points decline since 1995 and the second biggest in the last 20 years.

Currencies:

• Japanese Trade-weighted Index: +25.0% (largest annual rise since currency was allowed to float freely in 1973)

• Pound against US dollar: -26.2% (worst annual decline since gold standard was abandoned in 1971)

• Pound against euro: -22.8% (worst yearly decline since launch of single currency in 1999)

Commodities:

• Reuters/Jeffries CRB Index: -36.0% (worst annual performance since inception of Index in 1956)

The table below highlights the performance of the principal asset classes for 2008. While West Texas Intermediate Crude (-53.5%), the S&P 500 Index (-38.5%) and the Reuters/Jeffries CRB Index (-36.0%) recorded large losses, US 30-year Treasury Bonds (+18.6%) fared very well, and the US Dollar Index (+6.0%) and gold bullion (+5.5%) also provided safe havens for risk-averse investors. (The returns for indices in individual countries are given in my December 31 “ Stock market performance round-up ”.)

But the few trading days since Christmas Eve witnessed a strong rebound in global stock markets as investors brushed aside bleak economic data. This resulted in market participants scooping up beaten-down stocks and commodities, mending some of the bruising sustained earlier in 2008. The better spirit of equities was reflected in losses for some government bonds.

Despite a grim ISM report (see section on Economy below), the S&P 500 Index jumped by 3.2% after the release of the data, propelling many stock market indices to almost two-month highs. The MSCI World Index (+5.9%), MSCI Emerging Markets Index (+5.3%), Dow Jones Industrial Index (+6.1%), S&P 500 Index (+6.8%), Nasdaq Composite Index (+6.7%) and the Russell 2000 Index (+6.1%) all gained handsomely (albeit on thin volume) during the week straddling New Year's day.

Source: Daryl Cagle

December also marked the first monthly gain since August for the major US indices, with the Dow Jones and S&P 500 now up by 19.6% and 23.9% respectively since the lows of November 20, 2008.

The “storm” of 2008 has undoubtedly grown quieter in December, with the CBOE Volatility Index (VIX) having declined from 80.9 in November to 39.6 on Friday. Also, the average daily swing in the Dow Jones has fallen to ~300 points compared to ~430 points in November and ~590 points in October, according to Briefing.com .

Christmas Eve trading on Wednesday, December 24 marked the start of the Santa Claus Rally period, made up of the last five trading days of December and the first two of January. With one trading day to go on Monday, the combined gain for the S&P 500 Index for the first six days was 8.0%. The absence of a rally – and one now seems highly unlikely – has often been the harbinger of a sizeable correction or a bear market in the coming year. Hence the saying: “If Santa Claus should fail to call; bears may come to Broad & Wall.”

But risks remain plentiful and Bill King ( The King Report ) reminds us that “just as night follows day, international conflicts follow economic crises”. Escalating violence in the Middle East and tensions between Russia and the Ukraine served as a reminder and caused a 22.9% spike in the price of West Texas Intermediate Crude on the week.

Next, a quick textual analysis of my week's reading material (done between New Year's celebrations). No surprises here with keywords such as “economy”, “financial”, “market”, “prices” and “rates” featuring prominently.

Readers often ask me about Richard Russell's ( Dow Theory Letters ) viewpoint on the stock market. Here is his latest take on matters: “It occurs to me that this is a good time to remember my old friend Marty Zweig's classic warnings: ‘Don't fight the tape, don't fight the Fed'. Well, if you are bearish on 2009, you are indeed fighting the Fed and probably the tape. Why do I say that? Because the Bernanke Fed is going all out in its effort to turn the US economy around. Bernanke says the Fed will do whatever it takes to halt the current trend to deflation and to bring back prosperity and mild inflation to the US.

“The stock market seems to have finally climbed aboard the Fed's bullish bandwagon. All of which brings us to a very dramatic and critical juncture. If the market heads higher in early January, I believe that money on the sidelines [$8.85 trillion – 74% of US market cap] could begin to turn optimistic and even bullish,” said the R man.

From across the pond, David Fuller ( Fullermoney ) added: “The crucial missing ingredient for stock markets to date has been confidence. Nevertheless that could change in January, given the high levels of cash held by most institutional investors. … if stock market indices surprise the bearish consensus and start to break upwards rather than downwards from their trading ranges, institutional investors will be under increasing pressure to participate.”

What the market does over the next few days will give a clue as to the rest of the year, according to Jeffrey Hirsch ( Stock Trader's Almanac ). “S&P gains during January's first five trading days preceded full-year gains 86% of the time.” He also draws attention to the so-called “January Barometer” which states “as the S&P 500 Index goes in January, so goes the year”. “The January Barometer predicts the year's course with a .741 batting average. 12 of the last 14 post-election years followed January's direction,” said Hirsch. Also, the “ninth” year of decades is generally an up year for the stock market with the Dow Jones down only three times in the last twelve decades.

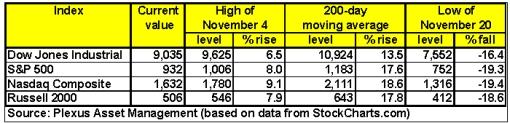

The table below shows the key resistance and support levels for the major US indices. With most global indices having breached the 50-day moving average (and after year-end also having taken out the December peaks), the next target is the November 4 highs, followed by the key 200-day average. On the downside, the December 1 (not shown on table) and the all-important November 20 lows must hold for the uptrend to remain intact.

In my opinion, selective buying in global markets is in order, and '09 may turn out to be a good year for a discerning stock picker. However, make sure to separate the wheat from the chaff because many companies will fall by the wayside during the new year. (Also see my posts “ Stock market internals: further headway in 2009 ” and “ Video-o-rama: Ring out the old, ring in the new ” for more discussion of the outlook for stock markets in 2008.)

Economy

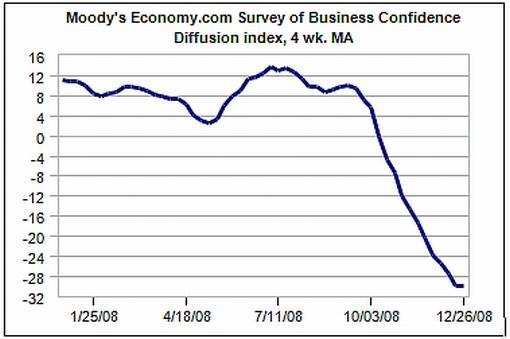

“Overall business confidence improved just a bit at the close of to 2008, but remains very dark with hiring intentions and expectations regarding the outlook in mid-2009 dropping to record lows,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . The Survey results indicate that the entire global economy is solidly in recession.

Further evidence of the worldwide economic crisis came from the Semiconductor Industry Association, reporting that global sales of semiconductors declined by 9.8% in November compared with a year ago, and by 7.2% since the previous month.

Data reports released in the US during the New Year week mostly confirmed the dismal economic outlook.

• The Institute for Supply Management's Manufacturing Index is still contracting and fell by a larger-than-anticipated 3.8 points to 32.4 in December. The index is at its lowest level since 1980, with the forward-looking details also downbeat as new orders plunged to their lowest level since January 1948.

• The S&P/Case-Shiller Home Price Indices reported record annual declines, with the 10-City and 20-City Composite Indices falling by 19.1% and 18.0% respectively.

• The Conference Board's Consumer Confidence Index declined in December to a historic low of 38 – down by 6.6 points from November's 44.7. With consumer confidence in a perilous state, the outlook for spending appears dismal.

• Initial jobless claims decreased by 94,000 to 492,000 for the week ended December 27. Fewer-than-expected claims were filed, but holidays have been known to be more volatile for this indicator. Overall, labor market trends suggest persistent weakening.

• The ECRI Weekly Leading Index increased from 106.8 to 108 during the week ended December 26, but does not alter the Index's overall downward trend. The meaningful decline in the ECRI indicates a severe slowdown that could last deep into 2009.

Commenting on the implications of the worsening employment situation for the US consumer, Mark Vitner ( Wachovia Economics Group ) said credit availability and housing affordability were two important elements of consumer buying decisions, but that an even more important variable was consumers' comfort about their own employment and income prospects.

“Consumers typically have to have a job if they are going to buy a home or automobile. And even if consumers have a job, they are less likely to borrow and spend if they feel their job is at risk or their income could take a hit,” said Vitner.

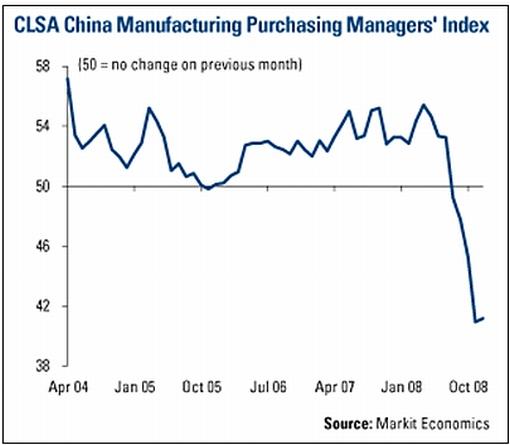

Elsewhere in the world, major economies remain mired in a severe slump. “Europe, Germany, France, and the UK all reported declines in indexes of purchasing managers in December,” said Asha Bangalore ( Northern Trust ). China's factory sector has contracted for the fifth month running according to the CLSA China Purchasing Managers' Index. … the Australian … Manufacturing Index has recorded readings below 50 for seven consecutive months … In sum, weak economic conditions across the world is a challenge for policy makers in the months ahead.”

Source: US Global Investors – Weekly Investor Alert , January 2, 2009.

Assessing the global economic outlook, Nouriel Roubini ( RGE Monitor ) posed the following questions on RealClearMarkets : “So what lies ahead in 2009? Is the worst behind us or ahead of us?

“The United States will certainly experience its worst recession in decades, a deep and protracted contraction lasting about 24 months through the end of 2009. Moreover, the entire global economy will contract. There will be recession in the Eurozone, the UK, Continental Europe, Canada, Japan, and the other advanced economies. There is also a risk of a hard landing for emerging-market economies, as trade, financial and currency links transmit real and financial shocks to them,” said Roubini.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jan 2 | 10:00 AM | ISM Index | Dec | 32.4 | 35.0 | 35.4 | 36.2 |

Source: Yahoo Finance , January 2, 2009.

In addition to the Federal Open Market Committee (FOMC) releasing the minutes of its December 16 meeting (Tuesday, January 6) and the Bank of England's interest rate announcement (Thursday, January 8), the US economic highlights for the next week, courtesy of Northern Trust , include the following:

1. Employment Situation (January 9): Payroll employment is predicted to have dropped by 450,000 in December after a loss of 533,000 jobs in the prior month. The unemployment rate is expected to have risen to 7.0% during December from 6.7% in November. Consensus: Payrolls – -478,000 versus -533,000 in November, unemployment rate – 7.0% versus 6.7% in November.

2. Other reports : Consumer Confidence (December 30), Construction Spending, Auto Sales (January 5), Factory Orders, ISM Non-manufacturing, Pending Home Sales Index (January 6).

Markets

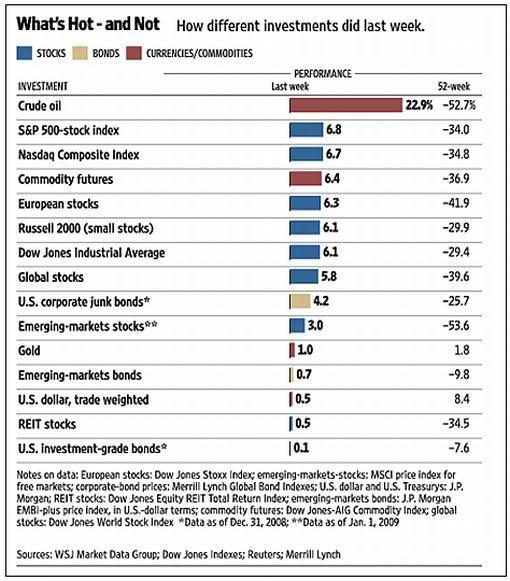

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , January 2, 2009.

Good riddance to 2008! Let's hope that after one of the most tumultuous years in history, conditions will calm down – as always happens after a storm. And may this compilation of news items and words from the investment wise assist in keeping our portfolios on a profitable course.

To all the Investment Postcards readers, thank you for your loyalty and support. And remember, the biggest compliment you could give us is to broadcast word about the site and encourage your family, friends and colleagues to subscribe to the e-mail updates or RSS feeds .

Here's wishing you a blessed and calm 2009!

Source: Daryl Cagle

YouTube: Uncle Jay's review of 2008

“It's been a whole year since Uncle Jay has SUNG an entire episode, and here's the reminder why! It's the year-end review of the news, and maybe it'll seem a little better with music.“

Source: YouTube , December 21, 2008.

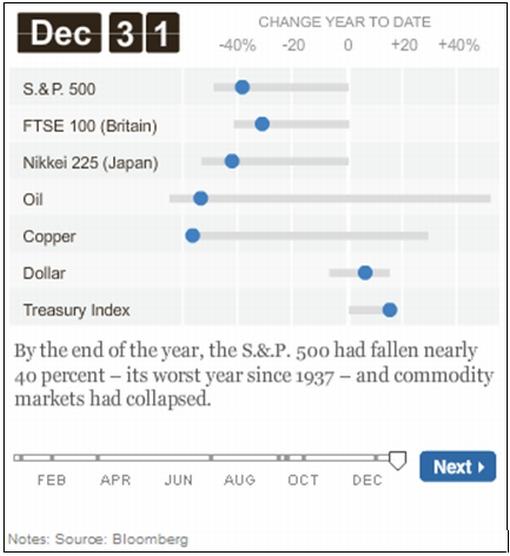

The New York Times: The year in the markets

Click the image for an interactive graph.

Source: The New York Times , December 31, 2008 (hat tip: Barry Ritholtz ).

Bloomberg: A recap of 2008

“A two-minute look into the year that changed the economic landscape.”

Source: Bloomberg (via YouTube ), December 31, 2008.

Win Rosenfeld (The Big Money): The five worst days of 2008

“You know it's been a bad year when you're arguing about what the five worst days were. Between the massive market fluctuations and the biggest banks going belly up, it's hard to know where to start. From a crowded field of contenders, here are The Big Money's five biggest buzz-killers.”

Source: Win Rosenfeld, The Big Money , December 30, 2008.

Bloomberg: Marc Faber's 2009 outlook

Marc Faber says the global economy is going into severe recession and emerging markets will be hit the hardest.

Source: Bloomberg (via YouTube ), December 31, 2008.

Bloomberg: Jim Rogers – “I'm prepared for the worst”

Source: Bloomberg (via YouTube ), December 29, 2008.

CNBC: Map of the markets

“Where to put your money in 2009, with Michael Pento, Delta Global Advisors; David Kotok, Cumberland Advisors; Diane Brady, BusinessWeek; Dave Maney, Headwaters MB; and CNBC's Rebecca Jarvis.”

Source: CNBC , December 31, 2008.

Bill King (The King Report): Unlikely that '09 will be as ugly as '08

“2008 will be a year of historic imfamy. The S&P 500 declined 38.5%, the biggest drop since 1937. The Dow Jones Industrial Average declined 33.8%, the largest drop since 1931.

“It is highly unlikely that 2009 will be as ugly. But this does not suggest that it will be a ‘good' year.

“Back in October we commented that the stock market is following a clear historic pattern. A summer folly rally amid a receding economy and percolating financial duress produced an autumn collapse.

“And an October panic did not generate a low for stocks because during recessions, like in 1907 and 1929, October panic lows yield to new lows in November.

“But then a yearned rally appears. This usually extends into the first day or two of the New Year. But then January turns ugly on anticipated horrid earnings reports that will appear during the second and third weeks of the month. Finally there is a performance gaming rally over the last few days of January.

“When bonds rally sharply in Q4, they tend to make a significant peak early in January. Bonds by then are extended, even ‘over-invested', and corporations and governments tend to burst the dyke by issuing beaucoup bonds for financing needs in the coming year.

“However, this year will be tricky because Weimar Ben is monetizing everything in sight. Weimar Ben can continue to monetize everything and anything – until the market revolts. And the revolt will likely come from the dollar.

“Though Ben and US solons desire a lower dollar in the hope of papering over the US's intractable structural problems, there is a line of demarcation for the dollar. If the dollar descents below that incalculable threshold, it's checkmate, Ben.”

Source: Bill King, The King Report , January 2, 2009.

Financial Times: 2009 – predictions of some known unknowns

“The Financial Times team of pundits is back, once again, to risk its professional reputation on bold predictions of some known unknowns.

“Will the recession end in 2009?

“No, as far as the US, the UK, Spain and Ireland are concerned; possibly Yes for other European economies and Japan. Whatever happens, 2009 will not be pleasant. For all the cuts in interest rates and taxes, higher unemployment will be the dominant issue of the first half of the year, outweighing gains to real incomes from these policies and lower commodity prices. Uncertainty will be the watchword for the year, making any prediction precarious, but there is still a good chance that rising incomes will become powerful forces in the continental European and Japanese economies later in the year. For those economies that need much bigger rises in household savings rates to adjust for the recession, recoveries will be delayed. There is also a good chance the world will enter a debt-deflation trap, although I hope the authorities will do everything to avoid this. But even if we experience genuine green shoots of recovery, as I expect, 2009 will be a year to forget.”

Click here for the full article.

Source: Financial Times , December 30, 2008.

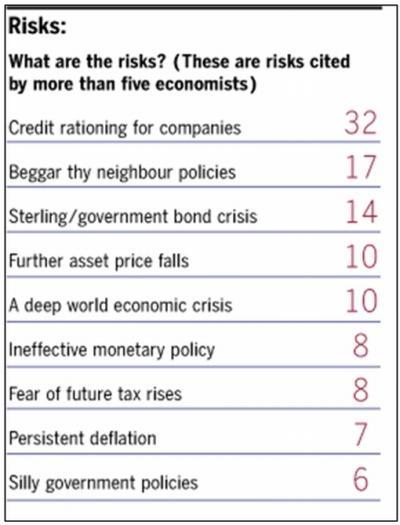

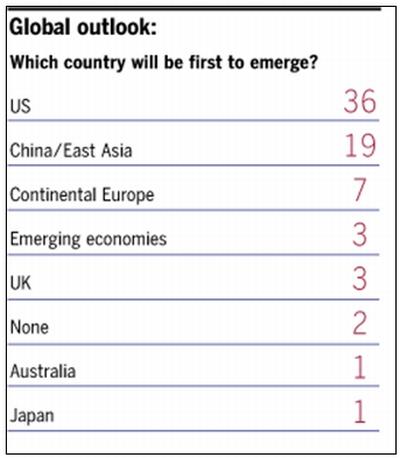

Financial Times: Survey of economists – outlook for 20 09

The Financial Times polled 67 leading economists for their views on the outlook for 2009. The full breakdown of their answers is given below.

1) Recession: How will this recession develop over the next twelve months? Will we see the green shoots of recovery by this time next year?

2) Risks: What are the three main risks that could profoundly exacerbate the recession? How concerned should people be?

3) Global outlook: Which part of the world will recover first and why?

Click here for the full article.

Source: Financial Times , January 1, 2009.

Edmund Conway (The Telegraph): Global economy to shrink for first time since the Second World War

“HSBC has warned that global gross domestic product will contract in 2009, describing this as ‘an extraordinary development in the modern era'. In a comprehensive examination of the economic crisis, it predicts that next year will be the worst in peacetime both for rich countries and the wider global economy since the Great Depression.

“And in a further blow to the Chancellor Alistair Darling, the bank warned that the UK will endure its worst year of growth since the bleak winter recession of 1947, forcing the Bank of England to slash interest rates to only a quarter percentage point above zero. The gloomy forecasts are far more pessimistic than those from the Treasury or the International Monetary Fund.

“Stephen King, HSBC's chief economist, said: ‘For a while, it was possible to pretend that the financial and economic crisis was merely a problem for the major industrialised countries.

“‘Over the last three months, however, that theory has been blown out of the water. We have made savage downgrades to our forecasts with some of the emerging markets bearing the brunt of the bad news. On the basis of nominal GDP weights, we expect global GDP to shrink in 2009, an extraordinary development in the modern era.'

“He added that the serious risk now is that families and businesses will begin to hoard cash rather than spending it, as deflation rears its head across the rich world.

“‘Stuffing cash under the mattress, however, will only end in cumulative tears,' he said. ‘This, after all, was part of the dynamic associated with the Depression in the 1930s.'”

Source: Edmund Conway, The Telegraph , December 27, 2008.

Wolfgang Münchau (Financial Times): World economy in 2009 ─ three priorities for recovery

“It is easy and difficult at the same time to predict the economy in 2009. It is easy to predict it will be an awful year for the US, Europe and large parts of Asia. The industrialised world will be in a deep synchronised recession. Global gross domestic product will probably contract also for the first time since the 1930s. There is not a great deal we can do to prevent this.

“The difficult part of the forecast is to predict whether policymakers will succeed in preventing the recession turning into a depression and lay the foundations for a sustainable recovery in 2010. What I can predict with near certainty is that policy will matter a great deal next year.

“We know that the current driving force behind this downturn is ‘deleveraging'. Overindebted households and undercapitalised banks are adjusting their balance sheets, building up savings in the first case and restricting lending in the latter. There is no chance of a sustained economic recovery until that process is almost complete.”

Click here for full article.

Source: Wolfgang Münchau, Financial Times , December 28, 2008.

Times Online: Car production faces global fall until 2010 “Car production in North America will sink to its lowest level for more than 20 years next year and output in Europe will fall to a 12-year low, with Britain hit the hardest, according to PricewaterhouseCoopers (PwC).

“The accountancy firm is forecasting a 17% drop in the United States to 10.8 million cars and a 12% fall in the European Union to 15.5 million vehicles. Asia Pacific will experience the smallest fall, with a 5% decline to 26 million cars.

“PwC expects world production to fall by 10% to levels of output last seen in 2003.

“Calum McRae, automotive analyst at PwC, said: ‘These figures demonstrate that there is further gloom to come before we can possibly see the effect of any bailouts or incentives.'”

Source: Christine Buckley, Times Online , December 30, 2008.

Financial Times: IMF argues for large stimulus packages

“Across-the-board tax cuts or bail-outs of troubled industries such as the automotive sector are likely to waste government money while doing little to stimulate the global economy, the International Monetary Fund warned on Monday.

“As governments around the world bring in tax cuts and boost spending to combat the global recession, a study by the IMF said such programs must be large but carefully designed.

“‘There is a strong case for doing too much rather than too little,' said Olivier Blanchard, the fund's chief economist. But, he added, tax cuts should be aimed at people likely to spend money rather than save it.

“Although the IMF said it would resist giving a running commentary on policies, Mr Blanchard said signs of the stimulus plan emerging from the camp of US president-elect Barack Obama appeared to be hopeful. ‘The size corresponds roughly to what we think is needed,' he said.

“Mr Obama's team is reportedly considering a fiscal stimulus worth $675 billion to $775 billion, or 5% to 6% of US gross domestic product, likely to include substantial long-term investment spending.”

Source: Alan Beattie, Financial Times , December 29, 2008.

CNBC: Martin Feldstein on the stimulus package

“Discussing the kind of stimulus that should come out of Washington, with Martin Feldstein, Harvard University professor, President Emeritus of the National Bureau of Economic Research, & Council of Economic Advisors former chairman under President Reagan, with CNBC's Steve Liesman.”

Source: CNBC , January 2, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.