Is Big Inflation Coming?

Economics / Inflation Jan 25, 2009 - 01:51 PM GMTBy: Mike_Shedlock

Adam Hamilton at Zeal is predicting Big Inflation Coming .

Adam Hamilton at Zeal is predicting Big Inflation Coming .

The growing legions of deflationists see an unstoppable depression-like deflationary spiral approaching like a freight train. They cite some convincing data. The stock markets have been cut in half in just a year. In the past 6 months, some key commodities prices fell farther and faster than they did in the entire Great Depression. House prices are down by double digits across the nation, with no bottom in sight. And credit is a lot harder to come by today than in any other time in modern memory.

My Comment : Well yes, that is convincing data. Indeed a perfect 15 out of 15 conditions experienced in the great depression are happening today as discussed in Humpty Dumpty On Inflation .

Of course Humpty Dumpty can and does pretend that deflation is specifically about money supply, totally ignoring credit. And those same Humpty Dumpties were amazed by the collapse in commodities and were crushed shorting treasuries because they did not see this coming.

In light of these universal falling prices, how could we not be entering a sustained deflationary period? The case may seem airtight, but I'd like to offer a contrarian view in this essay. Believe it or not, despite 2008's price collapse there is plenty of overlooked evidence suggesting big inflation is coming. You won't hear much about this on CNBC, but it could have a big impact on your investments in the years ahead.

My Comment : I am not sure what Hamilton means by "sustained". We have been in deflation for about a year, and maybe it lasts another, or five. Then again, perhaps we drift in and out of a slow growth recessionary period much like Japan for a decade. We have to take this one step at a time.

Inflation and deflation are purely monetary phenomena.

Inflation is not just a rise in prices, lots of things can drive prices higher. Inflation is the very specific case of a rise in general price levels driven by an increasing money supply.

My Comment : That last sentence puts the cart in front of the horse. Inflation is not rising prices; rising prices are a result of inflation (an increase in money supply and credit).

Acknowledging that debt-financed house prices are a special case that may indeed be deflationary (contraction of credit), I am focusing on stocks and commodities in this essay. From October 2007 to November 2008, the flagship S&P 500 stock index plunged 51.9%. About 4/7ths of these losses snowballed in just 9 weeks during the stock panic. From July 2008 to December 2008, the flagship Continuous Commodity Index plummeted 46.7%. Almost half of this mushroomed during the stock panic.

Deflationists argue these price drops are proof of deflation, and most people today believe this. But they are only deflationary if they were driven by a contraction in the money supply. Stocks and commodities are generally cash markets. Credit such as stock margin can be used, but it is trivial relative to the market sizes. And real commodities purchased for industrial uses are paid for in cash or near-cash (short-term trade loans), not multi-decade loans like houses. So the money supply during 2008's slides is the key.

My comment : What deflationist has argued that commodity price declines are proof of deflation? Can I have a name? Most mainstream media is concentrating on prices.

More to the point, no single indicator alone can constitute proof. However, 15 out of 15 symptoms one might expect to see in deflation should be ample proof for anyone.

If available money to spend indeed contracted, then the deflationists are right about seeing deflation in 2008. But if the money supply fell by less than stocks and commodities plunged, was flat, or even grew, then deflationists are wrong. When prices fall simply because demand declines (too much fear to buy anything immediately), this is merely supply and demand. If money didn't drive it, then it isn't deflation.

There is the humpty dumpty argument again. And again I reply that it is foolish to ignore credit (debt). Debt is actually more important than money simply because it dwarfs base money. And much of that debt cannot be paid back and that is why banks are failing.

Come to think of it, I need to add bank failures to my list. That makes a perfect 16 out of 16 things.

The key point in this rebuttal is that money supply does not have to shrink to cause deflation unless you insist on a humpty dumptyish definition that has no real world practical application.

Here is a practical application: There is no money to pay back loans. What cannot be paid back will be defaulted on and the default avalanche has been triggered. Once an avalanche starts, it is impossible to stop.

That avalanche of defaults amounts to deflation if it exceeds the expansion of money supply.

Banks are attempting to hide the avalanche by not marking their books to market. Citigroup alone is sitting on over $800 billion in SIVs of dubious value. However pretending credit will be paid back does not make it so, just as ignoring an avalanche does not stop it.

Hamilton goes on and on with straw man arguments about what deflationists believe. In practice I do not know a single deflationist who believes the strawman Hamilton is rebutting.

Hamilton also talks about various money supply charts as if they are proof of inflation. Here is my rebuttal.

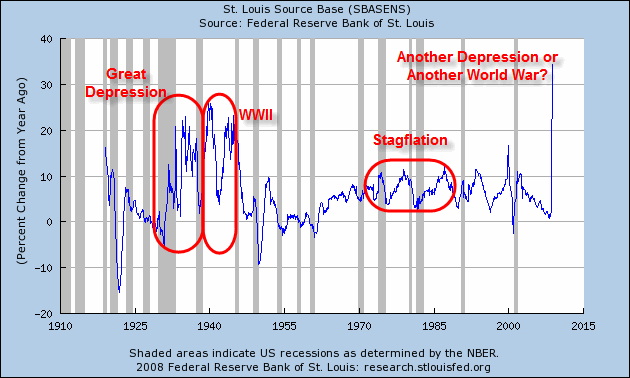

Base Money % Change From A Year Ago

Hamilton's definition shows there was massive inflation during the great depression, starting in 1931!

Of course that is ridiculous. But it is what one must conclude if one defines inflation as an expansion of money supply alone.

That chart shows why it is foolish to look at one indicator as proof of inflation. A more practical approach and a more practical definition, gives more practical results.

Soaring base money supply is not proof "Big Inflation Is Coming" soon, just as it was not proof that "Big Inflation" was coming in 1931. There cannot possibly be any other logical conclusion when confronted with the data.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.