Stock Market Blows Off Bad Unemployment News

Stock-Markets / US Stock Markets Feb 07, 2009 - 11:36 AM GMT The unemployment numbers were the worst in 35 years. Horrible news, right? Clearly, the economy is a shambles, right? What is the market's reaction? Why, a rally ensues, of course.

The unemployment numbers were the worst in 35 years. Horrible news, right? Clearly, the economy is a shambles, right? What is the market's reaction? Why, a rally ensues, of course.

Conventional wisdom is that bad news will cause a market decline. However, when the market is so beaten down, bad news fails to have the same effect. The stock market is a forward looking animal. It does not live in the now, it focuses on the future. Based on Friday's action, the notion of a bottom forming is more plausible.

Over the past two days, the market has shown renewed strength. After dipping down on Thursday, the market has rallied. Both the DJIA and S&P 500 have moved up on increasing volume. This is in stark contrast to the decline at the beginning of January, when losses occurred on lower volume. Apparently, the smart money is buying at these levels.

The DJIA is still the laggard index. It faces resistance in the 8400 area as well as at its 50 dma. The S&P 500 has shown more strength. While it breached the 850 area it still faces resistance at around 870. It will also be retesting its 50 dma for the fourth time in less than two months. Maybe the fourth time is a charm.

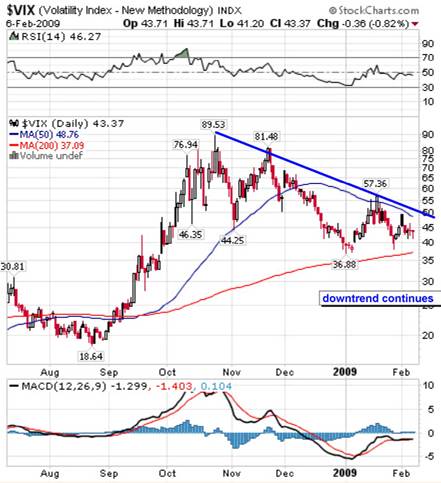

As for investor sentiment, while there have been upward spikes on the VIX, it is still in a downtrend. Little by little, excessive fear is leaving the market. Reduced trader anxiety points to more favorable trading conditions for the bulls.

One thing still missing is market leadership. While education and biotechnology stocks have been the better performers recently, no group has taken the lead. Moreover, education stocks are not necessarily the kind of leaders you want if a rally develop; this type of stock is bought on the belief that the unemployed will return to school to hone their skills as opposed to finding jobs.

Right now, the market is trading sideways. While a bull market may ultimately develop, no one can ever be certain. Unless one is day trading, the best thing to do is sit out the storm. Let the market show its strength; there will be plenty of time to make a profit.

Positions: None

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

© 2009 Copyright Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.