Stock Market Investor Sentiment: Dumb Money Still Betting on Hope

Stock-Markets / Stock Index Trading Mar 01, 2009 - 03:59 PM GMTBy: Guy_Lerner

The "dumb money" still appears to be holding out hope that the "test" of the November, 2008 lows will pay dividends. Despite the weak price action, these investors are not bearish to any great degree. In fact for the 13th week in a row, the "dumb money" remains neutral and on the wrong side of the trend.

The "dumb money" still appears to be holding out hope that the "test" of the November, 2008 lows will pay dividends. Despite the weak price action, these investors are not bearish to any great degree. In fact for the 13th week in a row, the "dumb money" remains neutral and on the wrong side of the trend.

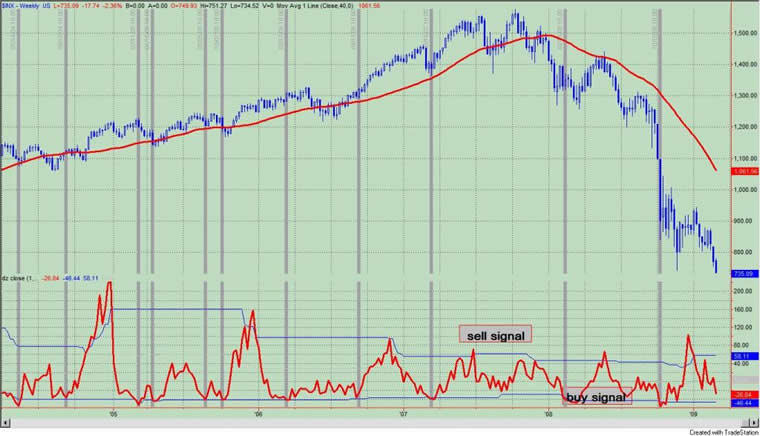

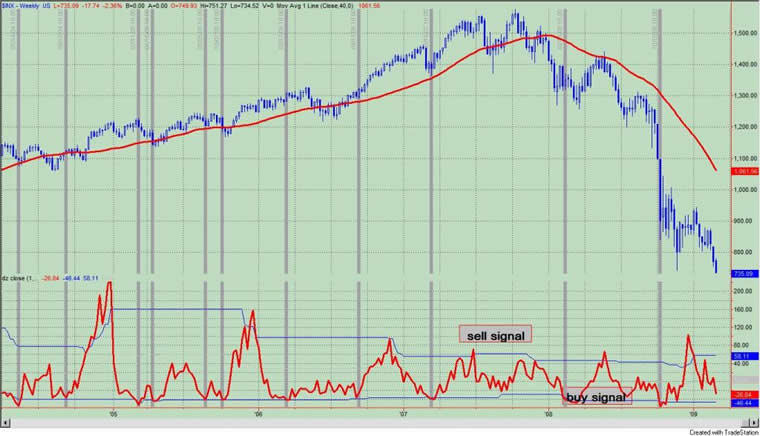

The "Dumb Money" indicator is shown in figure 1. The "dumb money" looks for extremes in the data from 4 different groups of investors who historically have been wrong on the market: 1) Investor Intelligence; 2) Market Vane; 3) American Association of Individual Investors; and 4) the put call ratio.

Figure 1. "Dumb Money"

As you can see in the figure, the "dumb money" is close to being bearish, and this would be a bullish signal. But they are not quite there yet, and while we can always quibble over a "near miss", the rest of the sentiment picture still is not supportive of higher prices.

For example, see the "Smart Money" indicator in figure 2. The "smart money" indicator is a composite of the following data: 1) public to specialist short ratio; 2) specialist short to total short ratio; 3) SP100 option traders. The "smart money" indicator has had one moderately bullish reading over the past 20 weeks.

Figure 2. "Smart Money"

Other sentiment data, like the Rydex asset data, is not supportive of higher prices either. I discussed the "pitfalls" of the Rydex data in this article , and present an oscillator version of leveraged bulls v. the leveraged bears asset data in figure 3, a weekly chart of the S&P500. This indicator still has a ways to go before a buy signal would be in effect.

Figure 3. Rydex Asset Data/ Leveraged Bulls v. Leveraged Bears

The last piece of data comes from Insider Score , a service that monitors and scores corporate insider buying and selling. I can report that their "entire market" assessment is neutral. At the index level, companies in the S&P500 show a modest level (1 standard deviation) of buying; insiders at NASDAQ and Russell 2000 companies are not buying to any great degree and in aggregate, they remain neutral on the markets.

In sum, the "dumb money" is close to being bearish (i.e., a bull signal), but they are still neutral. It is "close but no cigar". The "smart money" and company insiders have yet to turn bullish. More bulls need to be converted to bears, and this should be confirmed by the "smart money" turning more bullish. I have been saying this for months: lower prices are the only way for the "dumb money" to throw in the towel and the "smart money" to become more bullish. It would be this kind of environment that generates the highest likelihood of a market bottom leading to a contra-trend, tradeable rally.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.