Baby Boomers' Future Going Bust

Politics / Pensions & Retirement Mar 11, 2009 - 02:52 PM GMTBy: Mike_Shedlock

The attitudes and values of boomers heading into retirement are changing. They have to.

The attitudes and values of boomers heading into retirement are changing. They have to.

In the wake of a stock market and home price collapse, most boomers are not prepared for the future. Let's explore that idea with a look at Is the Future Going Down the Drain? Baby Boomers Going Bust .

Millions of baby boomers born into the dawn of the most spectacular economic expansion in history are being forced to re-imagine their retirement futures. Few news outlets have failed to seize upon the low-hanging pun: the boomers have gone bust.

Among the adjustments forced by the new circumstances, perhaps the cruelest twist for many boomers is the need to join younger generations in the roommate queue. The housing crash has forced record numbers of late-middle age homeowners to take in boarders or risk becoming boarders themselves. From California to Vermont, home-share organizations founded to assist the elderly are scrambling to meet the demands of newly bust boomers.

“In the last few months we've experienced explosive growth in interest by homeowners age 50-plus to find rooms and roommates,” says Jacqueline Grossmann, Chicago coordinator for the National Shared Housing Resource Center. “The trend now is getting younger and younger. People in their 50s and 60s are losing their nest eggs and increasingly willing to give up their privacy in exchange for rents of $500, $600 a month.”

Boomers are maximizing room occupancy for the same reason that their kids in their 20s and 30s are still competing for the best group rentals on Craigslist: they're broke.

The extent to which boomer wealth was based on home values is highlighted by a new report from the Center for Economic and Policy Research, entitled "The Wealth of the Baby Boom Cohorts After the Collapse of the Housing Bubble."

The report details how the collapse has left the majority of those around retirement-age almost completely reliant on entitlements. The net worth of median households in the 45 to 54 age bracket has dropped by more than 45 percent since 2004, to just over $80,000. Households headed by those aged 55 to 64, meanwhile, have lost 38 percent of net wealth.

The result is that many baby boomers will only have entitlements to rely on in their retirement.”

Make that entitlements, roommates, and each other.

As more and more boomers scale down their retirement plans and consider alternative living arrangements, it's worth asking: Is shared housing such a bad thing for aging boomers? Does a return to the Communal idea, borne of economic necessity, also have emotional, social, and environmental benefits? Why wait for the retirement home or hospice to live with other people? With the nation full of worthless, ridiculously large, and mostly empty houses, why not fill them with the newly penurious and like-minded boomers in need of housing?

Terry S., a 62-year-old self-employed divorced psychologist in Pittsburgh, is one boomer considering the cooperative housing route. Until the crisis hit last year, Terry planned to spend her retirement between Europe and New York City, living off her IRA and savings. But the crash saw her wealth plummet by 60 percent. “My friends and I feel betrayed because we are now in the same or worse position than those who never saved their money, but may have a pension,” she says. The crisis forced her to rethink retirement, and she now plans to buy a house with her friends. She explains the logic:

Some of my friends and I shared a communal house in the 70s. We first came up with this idea [of doing it again] when we were talking about the possibility of having to live in assisted living or nursing homes, and we decided it would be far better to all live together in a big house with friends we knew and loved and hire a nurse and a cook. One of my friends owns a construction firm and he says he can put an elevator in any home for less than $100,000. We have looked at several homes. One was a beautiful house that backed onto a huge city park and had a pool decks all around and could easily be converted into four private residences. It was $600,000, which would only be $150,000 per unit. Much less than the $4,000 a month to have half of a dingy room in a nursing home that smells like urine.

If the deepening economic crisis does lead the boomers back to Countercultural values, a generation will have come full circle. Whether they end up living in a group house, a shared apartment, or a full-on hippie-style commune, studies show that they will live longer and more fulfilling later lives. “The results here are truly amazing,” says Kirby Dunn, pointing to studies that gauge the effects of shared housing. “Across all programs and age-brackets, people say they feel safer, are less lonely, happier, and sleep better. They also call their family less often for help.”

Wealth of the Baby Boom Cohorts After the Collapse of the Housing Bubble

Inquiring minds are reading Wealth of the Baby Boom Cohorts After the Collapse of the Housing Bubble by the CEPR, Center for Economic and Policy Research.

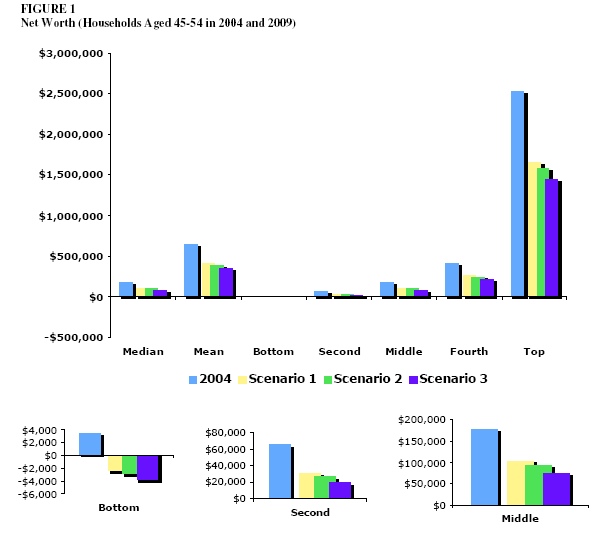

This paper makes projections of wealth for 2009 for the baby boom cohorts (ages 45 to 54 and ages 55-64) using data from the 2004 Survey of Consumer Finance. It updates an earlier paper on this topic from June of 2008 using projections for housing and stock values that are more plausible given the sharp downturn in both markets over the last 8 months, and creates three possible scenarios from best to worst-case for baby boomers' wealth in 2009.

The projections show:

1) The median household with a person between the ages of 45 to 54 saw its net worth fall by more than 45 percent between 2004 and 2009, from $172,400 in 2004 to just $94,200 in 2009 (all amounts are in 2009 dollars). If the median late baby boomer household took all of the wealth they had accumulated during their lifetime, they would still owe approximately 45 percent of the price of a typical house and have no other assets whatsoever.

2) The situation for early baby boomers is somewhat worse. The median household with a person between the ages of 55 and 64 saw its wealth fall by almost 50 percent from $315,400 in 2004 to $159,800 in 2009. This net worth would be sufficient to allow these households, who are at the peak ages for wealth accumulation, to cover approximately 90 percent of the cost of the typical house, if they had no other assets.

3) As a result of the plunge in house prices, many baby boomers now have little or no equity in their home. According to our calculations, of those who own their primary residence, nearly 30 percent of households headed by someone between the ages of 45 to 54 will need to bring money to their closing (to cover their mortgage and transactions costs) if they were to sell their home. More than 15 percent of the early baby boomers, people between the ages of 55 and 64, will need to bring money to a closing when they sell their home.

These calculations imply that, as a result of the collapse of the housing bubble, millions of middle class homeowners still have little or no equity even after they have been homeowners for several decades. These households will be in the same situation as first-time homebuyers, forced to struggle to find the money needed to put up a down payment for a new home. This will make it especially difficult for many baby boomers to leave their current homes and buy housing that might be more suitable for their retirement.

Finally, the projections show that for both age groups, the renters within each wealth quintile in 2004 will have more wealth in 2009 than homeowners in all three scenarios. In the second and third scenarios, renters will have dramatically more wealth in 2009 than homeowners who started in the same wealth quintile.

Homeownership is not everywhere and always an effective way to accumulate

wealth. For those who owned a home in the last few years, the collapse of the housing bubble led to the destruction of much or all of their wealth.

Three Scenarios

The "Three Scenarios" mentioned above relate to projections of the Case-Shiller housing index looking ahead.

Scenario 1: -21.1%

Scenario 2: -25.0%

Scenario 3: -32.9%

The first scenario assumes that nominal house prices decline no further from the level reported in the November 2008 Case-Shiller 20-city index to the 2009 average. The second projection assumes that nominal house prices in 2009 are on average five percent lower than they were in November 2008. The third scenario assumes that nominal house prices fall fifteen percent in 2009.

Already we know the first scenario is out. Moreover it is possible that even scenario 3 is optimistic. So much for the idea the way to accumulate wealth is through real estate.

Buying real estate may have helped one to accumulate wealth if one paid off the mortgage rather than continually borrowing against the equity to take vacations, buy cars, or to "put the money to work".

Nearly everyone attempting to put that money to work has gotten clobbered doing so.

Net Worth - Households Aged 45-54 in 2004 vs. 2009

Only those boomers in the top quintile have close to enough money for retirement. And that is the group hit hardest by the recent selloff. Think that group is going to be vacationing as much as they thought, eating out as much as they thought, golfing as much as they thought, etc.?

I don't.

Moreover, those in the first through fourth quintiles are not prepared for retirement at all. The fourth quintile was arguably close in 2004. They are no longer prepared.

Note: There are 14 sets of figures in the CEPR article. It's well worth taking a closer look.

Structural Demographics Poor

The structural demographics are very poor. Please see Demographics Of Jobless Claims for still more details. Here is a key clip.

Structural demographic effects imply that prospects in the full-time labor market will be poor for those over age 50-55 and workers under age 30. Teen and college-age employment could suffer a great deal from (1) a dramatic slowdown in discretionary spending and (2) part-time Boomer reentrants into the low-paying service sector; workers who will be competing with younger workers.

Ironically, older part-time workers remaining in or reentering the labor force will be cheaper to hire in many cases than younger workers. The reason is Boomers 65 and older will be covered by Medicare (as long as it lasts) and will not require as many benefits as will younger workers, especially those with families. In effect, Boomers will be competing with their children and grandchildren for jobs that in many cases do not pay living wages.

A structural shift in consumption to savings or at least reduced consumption, is in store for boomers. Meanwhile job prospects are looking pretty grim for some time to come across the entire economic spectrum. This economic backdrop is deflationary.

Attitudes towards debt and consumption have changed.

Moreover, the above data suggests those attitudes, particularly among the key boomer group who now needs to draw down on accumulated wealth, are not changing back anytime soon. And it is attitudes, not Fed actions that will determine how long the deflationary period we are in lasts. I touched on the importance of attitudes many time, most recently in All Manias Leave Something Undervalued . Please take a look if you haven't already.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.