Difficult Times for Dividend Stock Investors

Companies / Dividends Apr 08, 2009 - 08:55 PM GMTBy: Richard_Shaw

In theory, equity income investing creates a reasonably steady and growing income stream from stock investments — a good chance of maintaining real purchasing power of the stream. That contrasts with bonds which create a more reliable, but constant income stream that has no chance of maintaining real purchasing power (inflation protected Treasuries and perhaps some variable rate bonds excepted).

In theory, equity income investing creates a reasonably steady and growing income stream from stock investments — a good chance of maintaining real purchasing power of the stream. That contrasts with bonds which create a more reliable, but constant income stream that has no chance of maintaining real purchasing power (inflation protected Treasuries and perhaps some variable rate bonds excepted).

In practice lately, however, the equity income theory isn't working so well. Dividends are being cut at an historic rate, particularly among banks, but to some degree in other industries as well.

Dividend investing isn't for everybody, but it is attractive and important to some, particularly those who rely on their portfolios to generate cash flow to support their lifestyle.

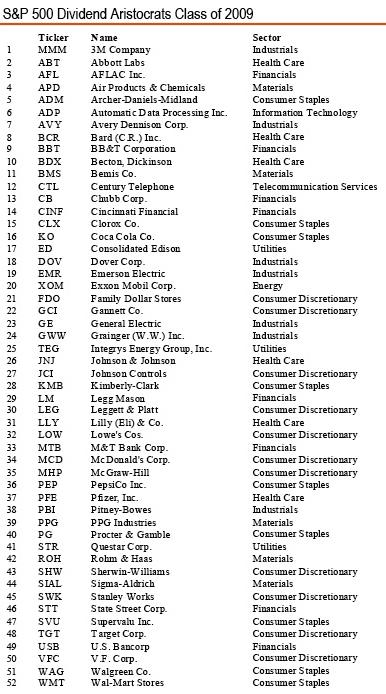

S&P Dividend Aristocrats:

Standard and Poor's may even have to reduce the performance requirements for its Dividend Aristocrats (proxy SDY) to keep the index going. Because the index rules require at least 40 issues, S&P may have to reduce the number of years a company has paid and consecutively increased dividends to a lower number to admit additional companies to keep the count at or above 40. It's currently at 52 members. Some of their major stalwarts have bitten the bullet and cut dividends — a disqualifying event. Only 20 of the 52 members of the S&P Dividend Aristocrats pass the filter we use below.

The 2009 Aristocrats list is shown in this image:

Leading Dividend ETFs Fundamental Portfolio Attributes:

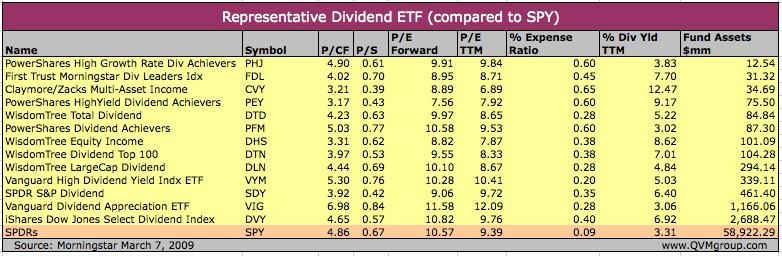

The dividend oriented mutual funds and ETFs (examples: DVY, VIG, SDY, VYM, DLN, DTN, DHS, PFM, DTD, PEY, CVY, FDL, PHJ ) have reduced prospects from which to select strong dividend companies. Some are heavy on financials. Check the current distribution yield and SEC-30 day yield on the funds, because the trailing yield may have substantially evaporated due to dividend cuts.

Here are fundamental portfolio statistics for the example ETFs:

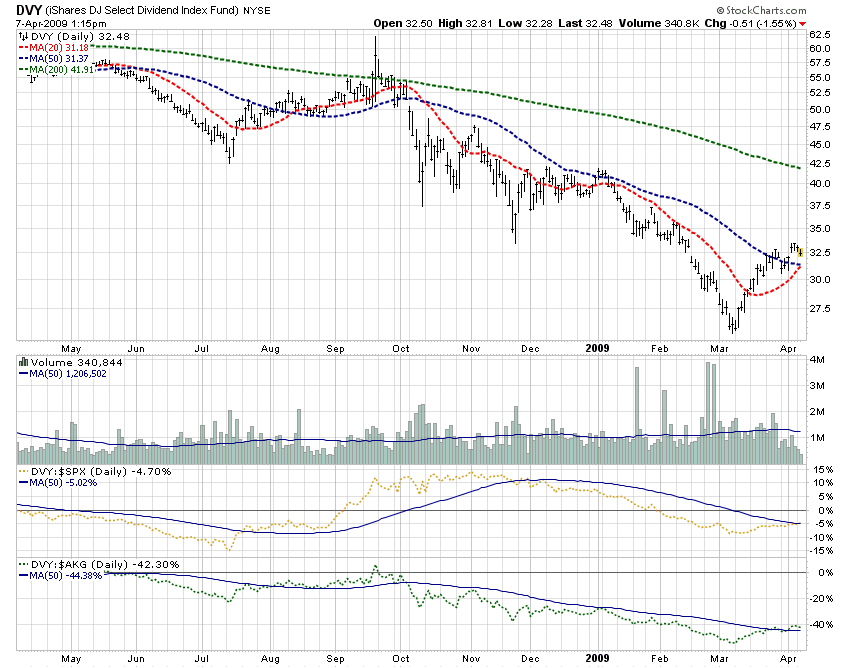

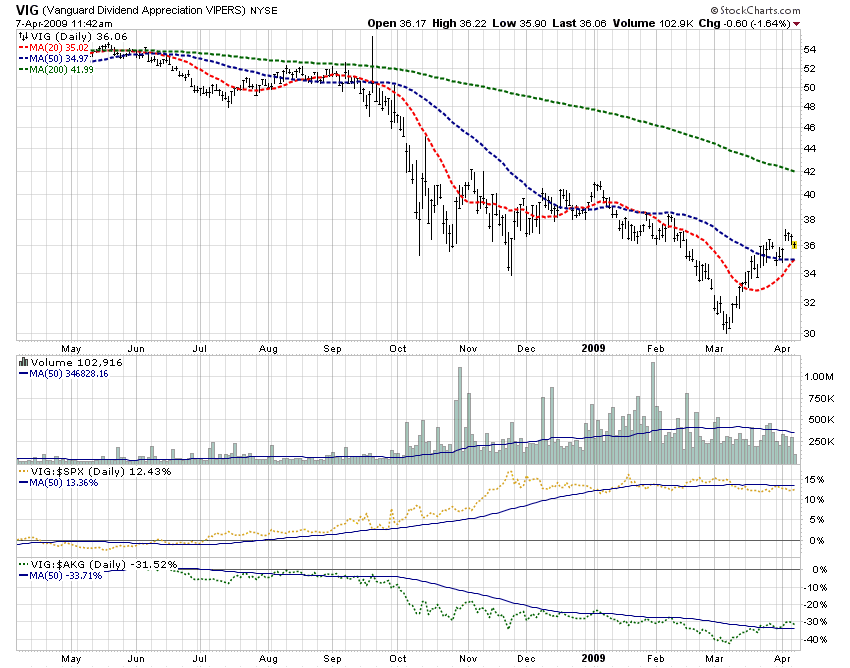

Leading Dividend ETFs Price Behavior:

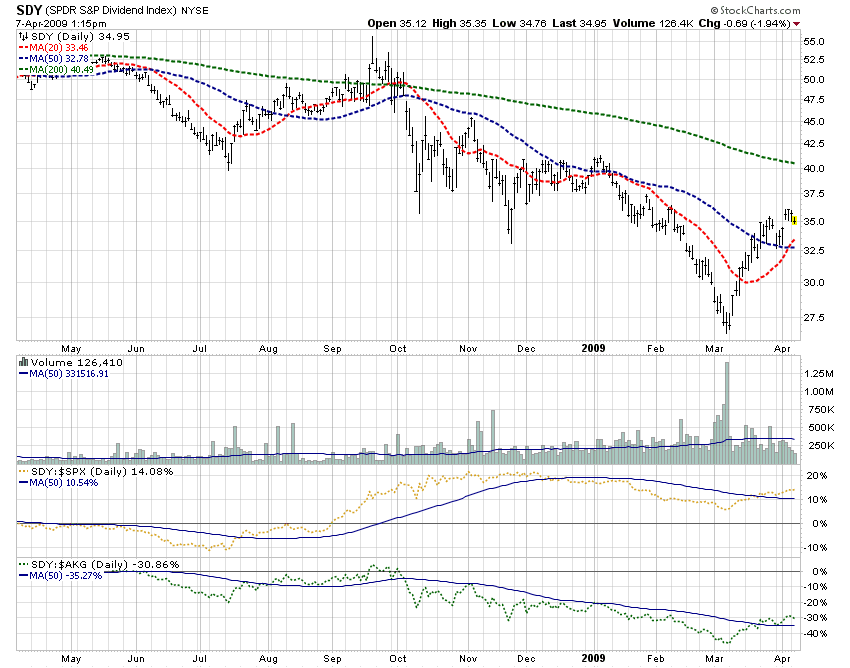

Here are price charts (with performance comparison to the S&P 500 index and the Barclay's Aggregate Bond index) for the three dividend funds with the largest asset bases:

Taking a Census of Dividend Stocks in the Total Stock Population:

We looked into the overall universe of US listed stocks to see what is available to dividend focused investors.

Beginning with a universe of 8,472 stocks, the list reduces to 3,852 by applying a $5 price per share minimum. After a $250 million minimum market-cap requirement, the universe reduces to 2,606 stocks. Then a $5 million requirement for the 3 month average daily Dollar trading volume knocks the list down to 2,498 companies.

If we assume 2,498 to be the count of reasonably eligible companies for a conservative dividend investor, we find that only 1,375 (55%) have a trailing yield greater than 0%. However, if we limit the list to those with a current 105% or lower payout ratio (the > 100% limit gives companies some slack in this trying time), the list reduces to 1,026 stocks (41% of the eligible company count). Except for trusts and partnerships, you would probably put a tighter filter on the payout ratio.

By applying a short-term “hold the fort” test (no reduction in dividends over the last four quarters), the list drops significantly to 677 (27% of eligible companies).

Finally, if we want the real income growth promise of dividends to be met by requiring at least 3-year dividend growth rate of 3%, the list falls further to 464 companies (19% of the eligible list).

Last comes the matter of the trailing yield itself which sees the list squeeze down tight if we require a yield that is competitive with S&P 500 index (around 3.3% trailing and 2.7% forward):

- yld > 0.0%: 464

- yld > 0.5%: 455

- yld > 1.0%: 426

- yld > 1.5%: 386

- yld > 2.0%: 329

- yld > 2.5%: 269

- yld > 3.0%: 213

- yld > 3.5%: 168 (7% of eligible companies).

US Listed Non-US Stocks Important Part of Equity Income Universe:

ADRs are in important part of the list. For example, 6 of the 10 largest market-cap companies in the list are ADRs. That is probably also a good example of the need to think an invest globally more so than in prior years.

[ absolutely no opinion is being expressed here about the attractiveness of these stocks. - just commenting about the non-US composition ]:

- China Mobile (ADR) - CHL

- Royal Dutch Shell (ADR) - RDS.A

- Chevron - CVX

- TOTAL (ADR) - TOT

- Coca-Cola - KO

- Verizon - VZ

- Novartis (ADR) - NVS

- Sanofi-Aventis (ADR) - SNY

- Abbot Laboratories - ABT

- StatoilHydro (ADR) - STO

Dividend Stocks in Their 52-Week Price Range:

[ again, no opinion on the stocks below -- just providing descriptive features of the list ]

Some of the stocks are low in their 52-week price range [ position = price/(52wkHI-52wkLO) ]. The lowest follow:

- Abbot Laboratories - ABT - position = 0.02

- United States Steel - X - position = 0.05

- Teekay - TK - position = 0.07

- FirstEnergy - FE - position = 0.08

- American Ecology - ECOL - position = 0.09

Others are high in their 52-week price range. The highest follow:

- PG&E - PGC - position = 0.64

- TC Pipelines - TCLP - position = 0.65

- Suburban Propane Partners - SPH - position = 0.76

- Sunoco Logistics Partners - SXL - position = 0.92

- Computer Programs & Systems - CPSI - position = 1.00

There is something in the list for bottom fishers and something there for momentum followers, but the list is small for either approach while also focusing on equity income.

S&P Dividend Aristocrats In Our Filter:

The 20 members of the S&P Dividend Aristocrats that pass the filter (at the 3% yield cutoff level) used here are shown below (there are other members of the Aristocrats that continue to as Aristocrats, but that do not yield as much as 3%):

- Abbot Laboratories - ABT

- AFLAC - AFL

- BB&T - BBT

- Bemis - BMS

- Chubb - CB

- Cincinnati Financial - CINF

- Clorox - CLX

- Dover Corp - DOV

- Emerson Electric - EMR

- Johnson & Johnson - JNJ

- Kimberly Clark - KMB

- Coca-Cola - KO

- McDonald's - MCD

- McGraw-Hill - MHP

- M&T Bank - MTB

- Pitney Bowes - PBI

- Pepsico - PEP

- Proctor & Gamble - PG

- PPG Industries - PPG

- Stanley Works - SWK

Summary:

In the end, the conservative equity income investor has a universe of only a few hundred companies from which to select by applying other important selection criteria. There will certainly be turkeys in that final list that must be avoided, and a few solid keepers to be identified and acquired. You'll have your own particular idea as to what defines a “keeper”, but if you seek equity income from US listed stocks the list of suitable companies is not large. Give yourself margin for error in judging the financial strength of companies and their ability to sustain and grow their dividends.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.