Gold Versus Stocks, the Trade of the Decade

Commodities / Gold & Silver 2009 Aug 09, 2009 - 12:25 PM GMTBy: Adam_Brochert

Stocks have been a terrible investment over the past decade and they are about to get worse. Gold has been one of the best if not the best investment over the past decade and is about to get better. When you examine investments via relative merits, Gold has trounced general equities. Gold has also trounced paper cash, regardless of the fiat currency held, as well as real estate and commodities over the past decade.

Stocks have been a terrible investment over the past decade and they are about to get worse. Gold has been one of the best if not the best investment over the past decade and is about to get better. When you examine investments via relative merits, Gold has trounced general equities. Gold has also trounced paper cash, regardless of the fiat currency held, as well as real estate and commodities over the past decade.

Despite this vast outperformance and the fact that Gold is safe and retains its value over the long term, it continues to be a relatively shunned asset class. This is bullish and will help sustain the "wall of worry" that continues to drive the current secular Gold bull market.

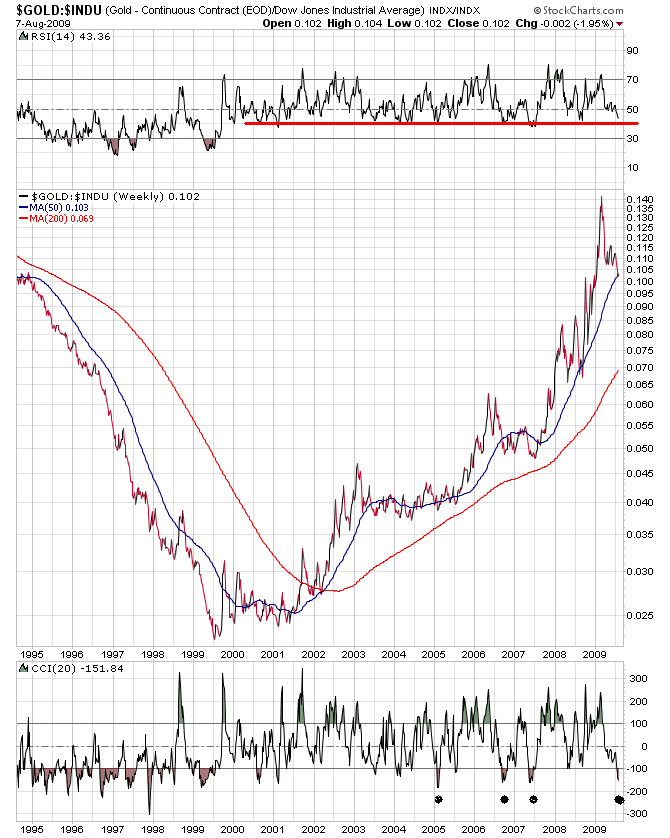

The Dow to Gold ratio is a key concept in my investment strategy. Although I also like to take risks trading, my core investment and savings continue to be held in physical Gold. Expressed as a reverse ratio (i.e. Gold price divided by the Dow Jones Industrial Average or Gold to Dow ratio), Gold is about to continue its trend of outperforming the stock market. This trend began at the turn of the century and has a ways to go in terms of price action. The Dow to Gold ratio will reach 2 and may even go below 1 before this secular stock bear market is over.

Some may argue that the US Dollar will outperform Gold in a deflationary environment, but that has not been the case since the current cyclical bear market began in October of 2007 or since the current secular bear market began in 2000. Things could change of course and the timeframe one selects will certainly alter the comparison. But the time frame I am interested in relates to the long term Dow to Gold ratio, which is what I am using to make my long-term decisions related to my core physical Gold holdings (and no, I am not talking about fraudulent paper proxies like the GLD ETF).

I would not advise selling Gold until the Dow to Gold ratio has reached 2 and I personally may wait to see if it goes even lower. Looking at a long-term ratio chart of the Gold to Dow ratio indicates a pending bull move is coming in this ratio, which means that Gold will be outperforming the Dow Jones again. I suspect the move in this ratio chart will be dramatic given the unfolding events in the economy boiling under the surface and the current stages of the respective Gold bull and stock bear markets. Here's the current Gold to Dow chart (15 year weekly log-scale chart up thru Friday's close):

Now, I am still expecting one more short-term break lower in Gold and Gold stocks this month, which will be a buying opportunity for investors. However, looking at the more intermediate to long-term time frame, there is no change to the trade of the decade. The trade of the decade is to sell general stocks and buy Gold. Even if Gold fails to make spectacular gains, it will continue to rise relative to stocks and provide the holder an ability to buy far more stocks at a future date.

Currently, the Dow to Gold ratio is approaching 10. Since this ratio will get to 2 or lower, Gold will continue to become much more valuable relative to general equities. With history as a guide, the final stage of collapse in the Dow to Gold ratio towards parity won't take long. Trade in your general equities for Gold while there's still time, as this fall promises to be exciting in a bad way for equity holders.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.