Global Fresh Water Crisis, Peak Water

Politics / Water Sector Aug 27, 2009 - 10:45 AM GMTBy: James_Quinn

“It should be obvious from simple arithmetic that population growth is on a direct collision course with increasingly scarce resources.”

“It should be obvious from simple arithmetic that population growth is on a direct collision course with increasingly scarce resources.”

Jeremy Grantham

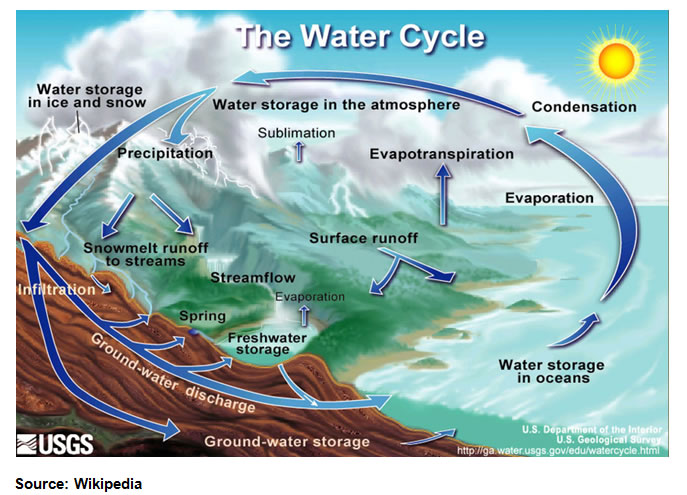

The notion of peak water probably sounds crazy to most people. The earth is 70% covered by water. The water cycle replenishes water on a continuous basis. The global warming enthusiasts tell us that glaciers are melting and oceans are rising. This should make water more plentiful.

But, as they say in the real estate business – Location, Location, Location. Freshwater shortages in the wrong places could have calamitous consequences to those regions, worldwide commodity prices, the economic future of nations with water shortages and possible war. Regional water scarcity means water usage exceeds the annual natural replenishment from the water cycle. The impact of water scarcity can be far reaching. It can lead to food shortages, famine, and starvation. Many nations, regions and states have mismanaged their water resources, and they will have to suffer the long-term consequences.

The peak oil debate gets a tremendous amount of press and generates heated disagreements on both sides. The focus on peak oil has permitted the future water crisis to stay under the radar. As usual, myopic self serving politicians have ignored resource issues for the last 30 years. These were 30 years of debt financed good times with relatively low prices for all natural resources and commodities. The end of this period of low prices is nigh. The brilliant investment manager Jeremy Grantham lays out the future in his recent newsletter:

“We must prepare ourselves for waves of higher resource prices and periods of shortages unlike anything we have faced outside of wartime conditions. In fact, I believe we are already several years into this painful transition but are still mostly invested in denying it.”

The following chart provides a useful comparison of oil and water as resources. While oil is non-renewable and limited, it is replaceable by other more costly alternatives. Water is renewable and relatively unlimited, but there is no substitute and it is only useful in the precise places. The Southwest region of the United States, our fastest growing region, has considerable freshwater constraints and could ultimately run out of water.

Facts & Figures

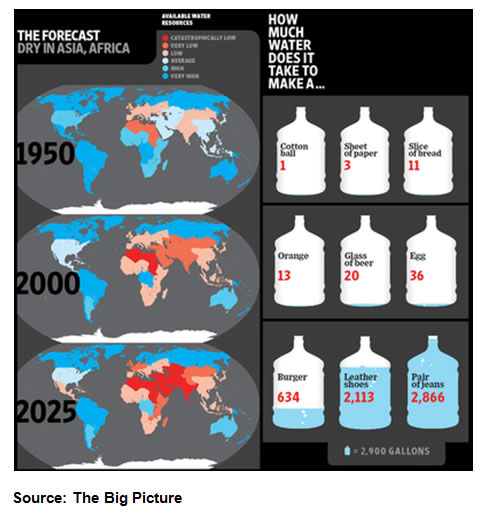

According to the United Nations, by 2020 water use is expected to increase by 40% to support the food requirements of a worldwide population that will grow from 6.7 billion people to 7.5 billion people. The U.N. estimate is that 1.8 billion people will be living in regions with extreme water scarcity. Even though 70% of the globe is covered by water, most of it is not useable because it is saltwater. Only 2% of the earth’s water is considered freshwater. Most of the freshwater is locked up in glaciers, permanent snow cover and in deep groundwater.

Desalinization is a process that can convert saltwater into freshwater, but it is only practically useful on the coastlines and it is 15 times more expensive. The middle of the United States is considered our breadbasket, where the majority of our food is grown. Drought and/or over-consumption of existing sources of water in this sensitive area would have worldwide implications, as the U.S. is a huge exporter of wheat, soybeans, rice and corn. The United States exported $115 billion of agricultural products in 2008 while importing $80 billion, according to the USDA. This is one of the few remaining businesses where the U.S. is a net exporter. Population growth and water shortages could change that equation.

The major challenges regarding freshwater are:

- Tremendously uneven distribution of water on earth.

- The economic and physical constraints of tapping water trapped in glaciers.

- Human contamination of existing water supplies.

- The high cost of moving water from one place to another.

Regional scarcity is not easily solved. Once the extraction of water exceeds the natural rate of replenishment, there are only a few options.

- Reduce demand to sustainable levels.

- Move the demand to an area where water is available.

- Shift to increasingly expensive sources, such as desalinization.

None of these options is available for many areas in the Southwest U.S. The cities of Las Vegas, and Phoenix were built in the middle of the desert. The Hoover Dam, built on the Colorado River near Las Vegas during the Great Depression, created Lake Mead, the country's largest artificial body of water. The lake provides water to Arizona, California, Nevada and northern Mexico - but after several recent years of drought, on top of ever-growing demand, it's dangerously depleted. Housing developments on the outskirts of these towns have been stopped dead in their tracks by lack of water supply. The growth of these major U.S. metropolitan areas is in danger of going into reverse if their long-term water supplies are not secure.

Mike Shedlock noted the difficulties facing the Southwest in a white paper that he wrote on the subject of peak water:

“There is more water allocated to each user from the Colorado River than there is water to allocate. As long as some people are willing to sell their water, this isn’t an immediate problem. Chevron’s water rights for its DeBeque, Colo., shale oil project are leased, not sold, to the city of Las Vegas for drinking water. How will Las Vegas replace that in the future when Chevron won’t extend the lease? Many areas are using ground water that will be used up entirely in just a few decades.”

Potential Impact on Commodities

The United States, for better or worse, is a sprawling suburban dominated country with large supplies of freshwater in some regions and limited amounts in other regions. Suburban sprawl has put intense pressure on local water supplies. The millions of acres of perfectly manicured green lawns and millions of backyard “cement ponds” require vast quantities of water to retain that glorious green hue. The Ipswich River near Boston now "runs dry about every other year or so," according to Sandra Postel, director of the Global Water Policy Project. "Why? Heavy pumping of groundwater for irrigation of big green lawns." In drought years like 1999 or 2003, Maryland, Virginia and the District have begun to fight over the Potomac -- on hot summer days combining to suck up 85 percent of the river's flow. With 67 million more people expected to inhabit the United States by 2030, these water shortages will only become more severe.

Kansas is considered part of the fertile mid-section of our country that has allowed the average American to become morbidly obese. The story of Scott City, Kansas should be a warning to all farming communities in the Midwest. Mike Shedlock describes what happened to Scott City:

“Farmers around Scott City pumped with abandon from the underground reservoir called the Ogallala Aquifer in the 1960s, ’70s, and ’80s, raising record wheat, corn, and alfalfa crops, and never once worrying that they might hit ‘E’ on the tank fueling the economy. But today, in a withering downtown that no longer has a place for residents to buy shoes or dress clothing, some have likened the situation to a car running out of gas.

“‘If you run out of water for your crops, that’s one thing,’ farmer Kelly Crist says, recalling the day about a decade ago when his well went dry. ‘But when you go to your house and turn the shower on and there is no water, it’s a serious situation. Today, the 46-year-old farmer relies on an 800-foot-deep well that pokes into a deeper but smaller aquifer to fill his toilets, sinks, and bathtub.

“Water levels in the Ogallala, which stretches from Texas to South Dakota, vary in depth, and some communities have decades — or even more than a century — before the water runs out.Scott City sits atop a shallow portion of the aquifer. Water experts say that makes it a window into the Plains’ future.

“‘The area around Scott City is beginning to experience what the rest of the region is going to experience if we continue to pump the way we do,’ says Rex Buchanan of the Kansas Geological Survey. ‘If they keep going at the rate they are, it’s not a sustainable lifestyle. Something has to give.’

Food production around the world has begun to flatten or decline. The last 10 years have seen steady erosion in the amount of grain grown per capita. And since wheat and rice and corn are all world markets, with developing countries growing at a breakneck pace, the need for imports elsewhere could drive up the cost of food everywhere. The Chinese are relentlessly converting farmland to industrial uses (even as they continue to demand more meat and grains in their diet). The price spike in 2007 and 2008 was not a onetime event. It was a foreshadowing of a much more costly future for consumers. The U.N. said global food reserves in 2008 were at their lowest level in 30 years, which was good for only 53 days, compared with 169 days in 2007. Peak oil and peak water are misleading terms. They should be changed to peak cheap oil and peak cheap water. We’ll be able to produce oil and water for decades, but it will cost significantly more to do so. This will result in much higher commodity prices as farming requires prodigious amounts of oil and water to produce the food for the 6.7 billion people that inhabit the planet (8.3 billion projected in 2030).

More Dire Consequences

“In real life our species has such a modest ability to deal with distant outcomes or to defer gratification that a bad ending is probably inevitable. We need, it seems, the shock of a Pearl Harbor to really gear up and make sacrifices.” Jeremy Grantham

Americans seem to have a problem facing up to imminent threats until they hit them like a sledgehammer. This penchant for delay is going to cause much heartache and pain for most Americans. Hoping for a good outcome will not work. Thirty years of delay has set the stage for eventual conflict over resources. Peak oil is the more likely trigger for armed conflict. We know who has the oil – Middle East, Russia, Brazil, Canada. We know who needs the oil – United States, China, Europe, Japan. Peak water as a trigger for conflict isn’t on anyone’s radar screen. It is interesting that Brazil, Russia, and Canada also have the greatest amount of renewable freshwater on the planet. South America, which has 28% of the world’s freshwater and consumes only 6%, is the prize. Asia, which has 29% of the world’s freshwater, consumes 50% of all the freshwater on the planet. With high population growth and industrial development something will have to give in Asia.

Total Renewable Freshwater Supply, by Country |

|

| Country | Annual Renewable Water Resourcesa (km^3/yr) |

| Brazil | 8,233 |

| Russia | 4,498 |

| Canada | 3,300 |

| United States of America | 3,069 |

| Indonesia | 2,838 |

| China | 2,830 |

| Colombia | 2,132 |

| Peru | 1,913 |

| India | 1,908 |

| Congo, Democratic Republic (formerly Zaire) | 1,283 |

| Venezuela | 1,233 |

| Bangladesh | 1,211 |

| Myanmar | 1,046 |

Source: Pacific Institute |

|

A looming future crisis of food shortages and skyrocketing commodity prices is inevitable. Peak water will play a significant role in the crisis. The facts are undeniable:

- Droughts in key farming belt areas due to climate change.

- Less snow pack in the mountains resulting in less freshwater flows during growing season.

- Contamination of freshwater sources by industrial waste.

- Soil erosion and depletion of underground aquifers.

- Higher oil prices resulting in higher fertilizer costs, food transport, and industrial agriculture.

- Expansion of bio-fuels as an energy source.

- Worldwide population growth, with developing countries expanding the diets of their middle class.

- Subsidies and tariffs that protect farmers and distort market prices.

- Inability to transport water economically.

War over resources has happened before and it will happen again. Japan attacked Pearl Harbor because the U.S. was cutting off its oil supply. The devastating combination of peak oil and peak water in the next five years will combine to create a commodity crisis that is likely to spur armed conflict as countries contend for declining resources. The question is who will attack who and when. In the meantime, plant a vegetable garden.

To join the discussion of how to take back our country from the banking cartel and government central planners, go to www.TheBurningPlatform.com.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.