Gold Alarm!

Commodities / Gold & Silver 2009 Oct 30, 2009 - 01:56 AM GMTBy: Adam_Brochert

The paperbugs need to fear the future. It is coming. It is inevitable. It is not gloom and doom, it is not guns and food in a wilderness cabin, it is not the end of the world, and it is not the inflation or deflation debate. It is simply a Gold bubble.

The paperbugs need to fear the future. It is coming. It is inevitable. It is not gloom and doom, it is not guns and food in a wilderness cabin, it is not the end of the world, and it is not the inflation or deflation debate. It is simply a Gold bubble.

Of course, when I say that it is a Gold bubble, what I mean is that the Gold bubble has just begun. This occurred when Gold broke out above $1000 strongly, to create $1000/oz as a floor for Gold rather than a ceiling. This clears the way for much higher Gold prices. I don't mean to misrepresent myself as a prognosticator, as we are all just bozos on the speculation bus, but I think the path is now clear for Gold to go much higher. I believe that $2000/oz. is a conservative target for Gold, but $3000-$10,000/oz. wouldn't shock me. In any case, I use the Dow to Gold ratio to guide my thoughts and decisions. I believe the Dow to Gold ratio will reach 2 at a minimum and less than 1 this cycle wouldn't be surprising.

While I place no faith in the government to do anything correctly or in "the people's" best interest (I am not a paperbug that believes in magic government powers, after all), I do recognize the bureaucratic power to destroy a currency. Will they succeed or will we have a Prechterite crash that causes the U.S. Dollar to rise to heights unimagined? These are interesting academic exercises to me, but I am no longer interested in the academic.

What I know is this. The US Dollar provides unacceptable risk and doesn't compensate its holders to take that risk. Period. Cash is king, but one had better hold the correct form of cash! The US and UK are on a crash course with reality and I doubt, if history serves as a reliable guide, that the outcome will be pretty.

Stocks, real estate and corporate bonds are toast, and everyone knows it. In fact, those who invest in such assets are relying on governments to bail out the system many times more. When's the last time that relying on governments to do the right thing made for a wise investment decision over the longer term?

That leaves us with commodities. But the ironic thing is that commodities don't usually do well when the economy is moribund. Sure, they can do well if inflation is rampant and out-of-control, but this is a wish and not a guarantee.

I have cast my lot with Gold. It is an international currency and reflects a cash holding that cannot be debased by government decree or apparatchik stupidity. Is Gold money? Some say it cannot be spent at a Wal-Mart and thus is not money and yet go on to recommend government bonds or Swiss Francs in the same article! When's the last time you used Treasury Bills, foreign currency or stocks to pay for groceries in the United States? If Gold wasn't money, governments wouldn't hoard it and list it on their balance sheet as money.

Anyhoo, Gold is on the threshold of a MAJOR move higher in my opinion. This is not inflation or deflation or anti-Dollar, this is a secular bull market set to enter its mania phase. Gold has been on the rise steadily for ten years. Did I mention that it has trounced stocks, cash, and T-Bonds over the last decade? That's right, over a 10 year period, a piece of "worthless" metal has outperformed stocks. How can Bloomberg and other Wall Street mouthpieces take themselves seriously since this is the case?

Really think about the implications of this fact: Gold has outperformed stocks for 10 years (actually more, but let's stick with an indisputable fact to keep randy paperbugs from trying to argue on a technicality). A piece of metal is a better investment than a bunch of really smart guys with ties and computers. What does this mean?

Don't underestimate Gold here. Don't underestimate the cyclical and secular bull market that continues to astound the critics while remaining a hated and much-maligned asset class. You want love? Go watch CNBC. You want acceptance? Buy what Cramer tells you to buy. You want to make money? Buy an asset class that has gone up only 4 fold in the last decade, is at all time highs, and is hated by mainstream media sources. Every time Gold drops $10/oz., some clown from "traderbank" or some other unknown or even a known outfit has a sound reason why the Gold bull market is over.

From your experience, whatever it may be, does this sound like the way bull markets end? Does anyone remember the dot.com boom? Does anyone remember the oil and real estate bubbles? By the way, watching those who are still touting the oil and real estate bubbles is actually a good exercise. Listen to their wonderful arguments that are based on "sound" fundamental principles and then spook the reality: every asset class has its time under the sun. It is simply Gold's turn.

Gold is not a religion to me, though it is my passion to spread the word of where to put your money. Oil goes up 14 fold over ten years and then collapses. Gold only goes up 4 fold in 10 years, but now it is supposed to collapse without the final mania phase? Yeah, right. And I should buy stocks right now at the top for the long haul, right?

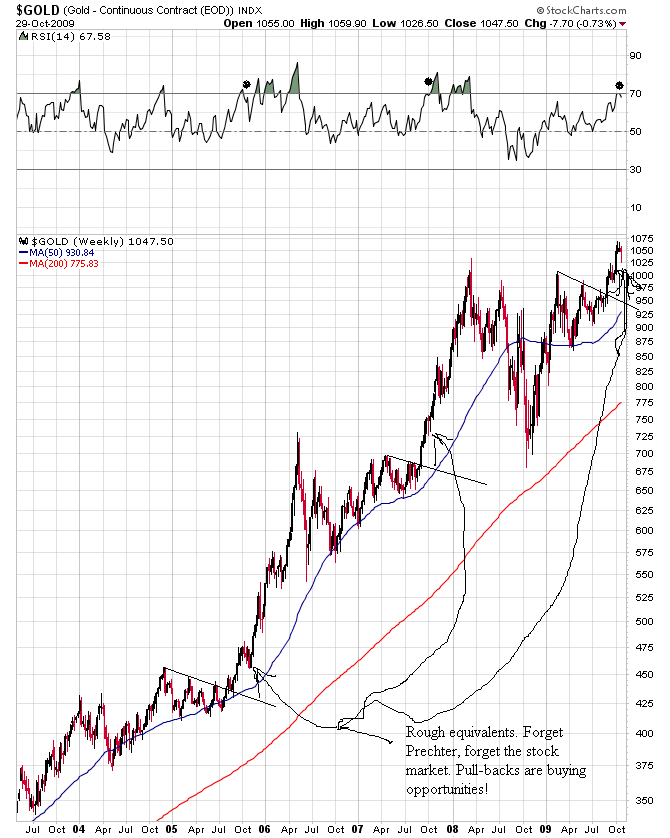

Here's a current 6.5 year daily chart to show you where I think we are in this current intermediate-term Gold bull market thrust, which is not over in my opinion. This ain't mainstream, people. This is calling for a bubble in a freakin' piece of metal. And believe me, investing in Gold is the optimistic scenario. I in no way would invest in Gold if I thought society was about to collapse. In the 1970s, Gold went up 24 fold and society didn't collapse. Investing to me is all about accepting that various asset classes fall in and out of favor. This is what the Dow to Gold ratio is all about. I am not advocating trying to eat Gold, oil, stocks or paper currency instead of food! Without further rambling, here's the Gold chart with my thoughts:

I think we hit $1200-$1600 before spring is over. Could I be wrong? Of course! Could the Gold bull market be over? No. Not possible. An asset class bull market does not end with an absence of public participation and mainstream media scoffing. We are just getting warmed up. The herd still wants to buy Apple, not Gold. Have you purchased any physical Gold yet?

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.