Gold, Silver, the Dow, and S&P 500, People are Still Asking “What the Heck is Going On?”

Stock-Markets / Financial Markets 2010 Feb 04, 2010 - 12:53 PM GMTBy: J_Derek_Blain

This morning, I watched a video of the CEO of Gold Fields, Mr. Nick Holland, expressing his surprise at Soro's recent statement that gold is the "ultimate bubble". Mr. Holland said that almost every other market “expert” (my sarcastic quotes) he talked to had a vastly different opinion of the metal - that it was "fundamentally sound" etc.

This morning, I watched a video of the CEO of Gold Fields, Mr. Nick Holland, expressing his surprise at Soro's recent statement that gold is the "ultimate bubble". Mr. Holland said that almost every other market “expert” (my sarcastic quotes) he talked to had a vastly different opinion of the metal - that it was "fundamentally sound" etc.

So, that being said, how does one explain the drop to a new low for this gold bear market, just moments ago? If fundamentals are so good, if the experts all agree that gold is a solid buy and say things like "you just can't go wrong with gold", why is it that the price is in a sharp decline that will carry on for some months and shave nearly (or possibly more than) 50% off the recent highs of over $1200.00 /oz?

It is for the same reason that wherever you are reading this article, there are surely a laundry list of gold and silver forever-proponents, both young gold-bulls and those who have been saying it was the ultimate buy since before some of their readers were born. That reason is sentiment, the psychology towards that particular asset.

We are in the final phase of the unwinding of positive sentiment that has been fueled by easy dollar credit and an overnight-rebound in gold in late 2008 to early 2009, while those stocks that "always go up in the long term" continued to lose a staggering amount of value. We witnessed a flood of people seeking the "Safety" (translation: profits) of gold - Now we watch the unwinding of the speculative chasers, the capital gains hounds.

For gold is not an "investment" - its producers can be, perhaps, but only if you're sharing in their profits - gold is a savings vehicle. For a very long time we have advocated keeping half of one's savings in the precious metals (we favor roughly a 70/30 silver:gold allocation). However, we are not like most gold bulls - we don't profess that $1200 is a fantastic time to buy, and that because the price is so high it must go to new highs.

This is the oldest flaw in the book - one that has been historically proven time and again. The price/demand curve of finance that only exists in the realm of high emotion, little information, and many peers. Price goes up, demand goes up. Price goes down, demand goes down.

Here at Investophoria we try to step back from the foray and take a good look at the big picture. We look at measurements of sentiment (including price) in order to determine where we are in the price/demand curve, how much farther we can go, and when the particular trend will change. All these are integral to a winning strategy of investing, because if one doesn't know all the rules of the game, one has lost the moment they sit down to play.

We only care where the crowd thinks the price is going, in order to measure how many of that crowd are running the same direction. We never have a particular bias for long or short, only the bias that we believe in our analysis and act according to it, on either side of the trade.

So many are shocked by the drop today. The silver-bugs can't believe the price is below $16.00 / ounce, it's not possible! And yet, if they had read our analysis, even just one article published a few weeks ago they might have saved a nail-biting loss of 20% where they knew the price should be going up, and yet watching in horror as it plummeted. Or if the gold-bugs had read the article we published calling the top in gold on November 26, and its subsequent and rapid fall, they might not feel the horror of watching their worthless FRNs go up in value relative to Real Money.

This is going to be a time of trials for all investors of any ilk. The sentiment towards investment in general has been slow to unwind from its 1999 peak (as indicated by dollar volume), and has some years left to go before we get to that point where everyone isn't saying "turn your cash into assets" but "quick, turn your assets into cash!". See the following charts:

We would estimate that there is still much unwinding of positive psychology to be done - another good indicator of an end to the bear market in precious metals will be a level of dollar volume lower than that of 2008's low.

This is still a young down-trend we have just begun - a toddler, compared to the multi-decade bull market that preceded it - in all investment assets. There's a lot of life left in this one, and until it is "over the hill", we plan on profiting from it. With some skill, we were able to open our short position within 1% of the broad market top, as were you , dear readers, if you followed along. All our shorts are growing in value today, as all the hopeful longs and "long-term bulls" are yielding ground. This is a trend that will not only continue, but also pick up in speed and breadth.

It appears gold and silver have resumed their downtrends, as have the markets as a whole. This should be the first of the "big ones" in terms of drops, which we have anticipated for the last several days. It will continue to surprise the vast majority (except you, who have been reading us, of course!).

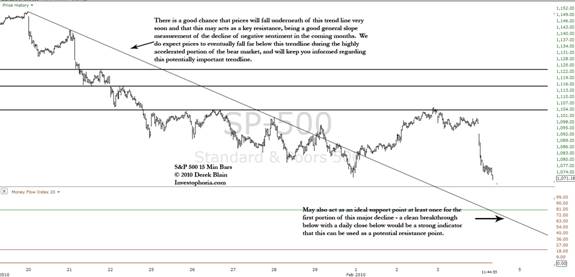

For a link to this chart with readable text, visit:http://3.bp.blogspot.com..

As for gold specifically, it may try one last stab upward before a major downward fall, taking it well below the $1000.00/ oz mark – although the highest probability is that this more major downward move has already begun. Once this level is reached, we are anticipating a highly volatile period of sideways movement before the last leg of its bear market brings within spitting distance of $650.

Silver should follow these price movements as well, however its moves will be far greater in percentage terms and it should fall eventually to the $8.00 / oz or less range. If you want to see some of our arguments for why gold and silver are going to fall, and if you haven't read this article yet, you really should – it’s a fan favorite and hate-mail magnet!

As always, keep your heads up out there!

By J. Derek Blain

© 2010 Copyright J. Derek Blain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.