Euro Tarp Bailout, Here We Go Again

Stock-Markets / European Stock Markets May 14, 2010 - 02:52 AM GMTBy: Richard_Shaw

The nearly $1 Trillion bailout by Europe of Greece and whichever countries come next, is like an echo of the US TARP rescue of banks in 2008. It is similar in size, similar in its intention to save the banks from their own bad decisions, similar in making taxpayers eventually pay for the mistakes of the banks, and perhaps similar in other outcomes. One outcome that should be noted is that the US and world stock markets continued to fall for several months after TARP. That pattern may repeat. We need to be prepared for that possibility.

The nearly $1 Trillion bailout by Europe of Greece and whichever countries come next, is like an echo of the US TARP rescue of banks in 2008. It is similar in size, similar in its intention to save the banks from their own bad decisions, similar in making taxpayers eventually pay for the mistakes of the banks, and perhaps similar in other outcomes. One outcome that should be noted is that the US and world stock markets continued to fall for several months after TARP. That pattern may repeat. We need to be prepared for that possibility.

"Euro-TARP" is no more than an agreement to do something, but little has actually yet been done. The terms and conditions of actually doing something are not fully known to most investors. The terms may involve fiscal actions by the Greek and other governments that those governments may or may not implement. The populations, particularly union populations, and perhaps far left political groups, may become disruptive of the economy over their dislike of those fiscal actions that are implemented (certainly burning banks, causing death of innocent bank workers last week proves that sort of thing is possible).

So let's not declare an "all clear" just quite yet. That "all clear" will come eventually, but is is hard to believe that a last minute weekend announcement is the end of the crisis. It needs time to mature as a situation.

Let's also not discount the possibility that Monday's strong market rally was substantially a continuing short covering rally after the gift to short sellers provided by the markets on Thursday.

Here is what Mohamed El-Erian, the chief executive of Pimco said Sunday night:

"... policymakers have shifted to a “whatever it takes” approach to crisis management. ... [questions about the bailout] its immediate impact, its durability, and the potential range of unintended consequences. Many questions will need to be answered. They range from the operational (how will all these interventions be approved, financed and executed), to the conceptual (what does this mean for institutional integrity), to effectiveness (will the liquidity injection be used to support fiscal consolidation or end up deferring it). ... We are now in uncharted waters when it comes to how all this will impact the secular workings and make-up of the euro zone."This is what David Rosenburg of Gluskin Sheff had to say today:

"In my opinion, Greece is the same canary in the coal mine that Thailand was for emerging Asia in 1997, which ultimately led to the Russian debt default and demise of LTCM; the same canary in the coal mine that New Century Financial in early 2007 proved to be in terms of being a leading indicator for the likes of Bear Stearns and Lehman. So, the most dangerous thing to do now is to view Greece as a one-off crisis that will be contained. Even with this new and aggressive EU-IMF financing arrangement that has managed to trigger a wild short covering rally yesterday, the risks are still high that the contagion spreads to countries like Portugal, Spain, Italy and even the U.K., which has already received some warnings from the major rating agencies and is gripped with political gridlock in the aftermath of last week’s uncertain election results."

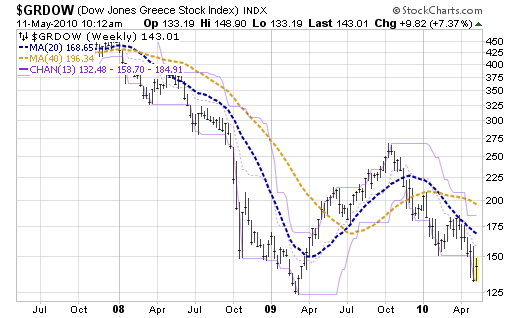

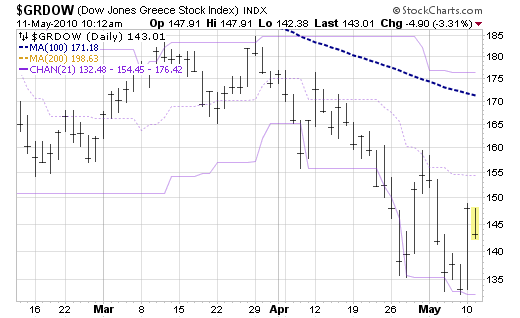

Here are charts of the Greek stock market for 3 years and 3 months --- bad:

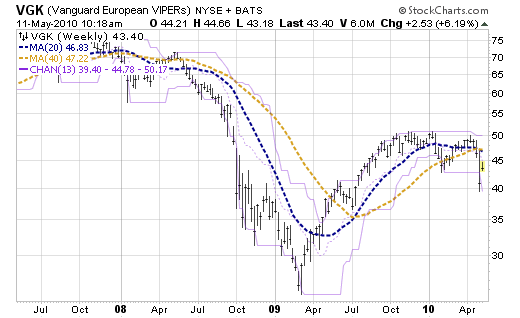

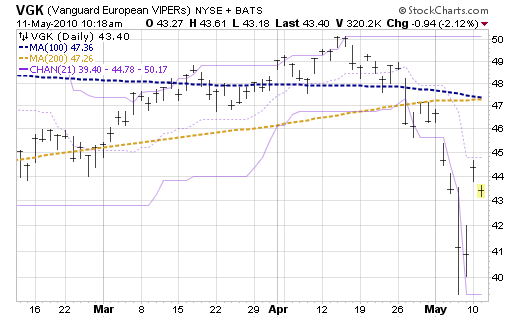

Here are charts of the European stock markets for 3 years and 3 months -- rolling over:

Our Tactical Decision:

European exposure is part of our long-term asset allocation plan. However, we'd say stay away for now. We've been out for months. VGK and Europe stocks funds similar to it began to roll over last October.

The price is below the 200-day average. The 100-day average is about to make a negative cross of the 200-day average. The simple visual pattern of the price chart is down hard for about a month, and despite the rally yesterday, prices now (mid-day May 11) are essentially flat with the day before the big dive last week -- and back then the chart was unfavorable.

Because our philosophy is to own fundamentally attractive securities that are also in an upward trend, we probably wouldn't own Europe for a good while. Given its behavior since October, we'll wait for 53 as one sign that VGK has surmounted its major obstacles.

Of course, if VGK goes low enough, we will have a new entry price that is below 53, but right now its too close in both time and price to a many months long period of sideways to down movement with a fairly visible ceiling in the general 49-51 range.

On the fundamental side, we want to see how Euro-TARP plays out, before we risk precious assets on this sick puppy.

Holdings Disclosure: As of May 11, 2010, we do not have current positions in any securities discussed in this document in any managed account.

By Richard Shaw http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.