Turning Deflating Dollars Into Inflating Gold

Commodities / Gold and Silver 2010 Oct 05, 2010 - 03:49 PM GMTBy: Barry_M_Ferguson

Isaac Newton gave us a fundamental law of physics. Every action has an equal and opposite reaction. In the investment world, currency is the action. Since the US is still the biggest economic player, the US dollar moves everything. Some things have the same action as the dollar. Others are the opposite reaction of the change in the value of the dollar.

Isaac Newton gave us a fundamental law of physics. Every action has an equal and opposite reaction. In the investment world, currency is the action. Since the US is still the biggest economic player, the US dollar moves everything. Some things have the same action as the dollar. Others are the opposite reaction of the change in the value of the dollar.

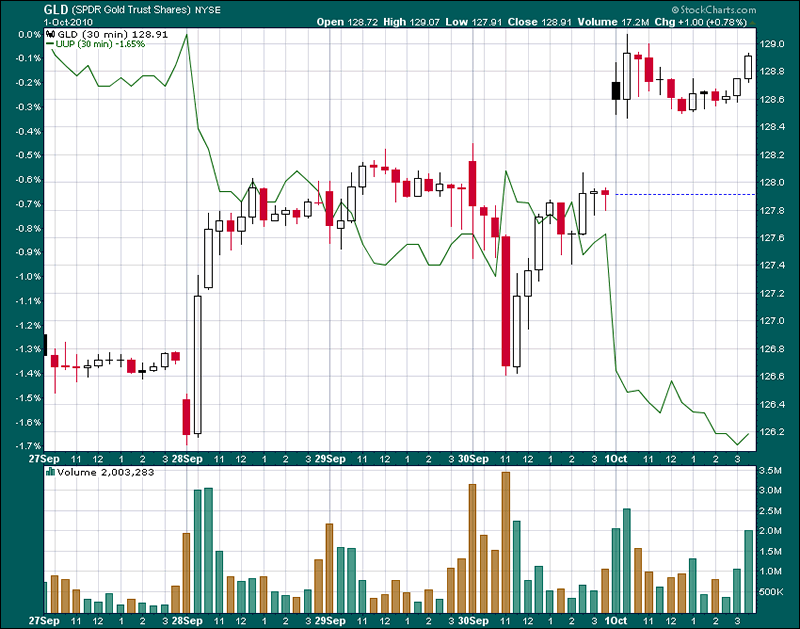

Like it or not, commodities like oil and sugar rise in price when the dollar drops in value versus other currencies. More precisely, commodities rise in price when the dollar drops in value versus gold. Commodities are the equal and opposite reaction of the currency trend action. We can make the same analogy with gold and silver. As the dollar falls, gold and silver rise. The chart this week (see below) shows the relationship of the intraday trading for this past week with the US dollar represented by the green line (the ETF UUP) and the gold ETF, GLD, represented with the candlestick line. They are opposite action and reaction. The only question of the day is whether or not gold is in a bubble.

The answer is gold is not in a bubble as long as the dollar continues to lose value. Ditto for silver. Now we have to ponder the trend of the dollar going forward. On that question, there seems to be unanimous agreement that the Federal Reserve is determined to drive the dollar down and finish off the job they started in 1913. They have already embarked on quantitative easing that is nothing more than creating dollars from thin air to buy Treasuries from shill banks who then put the dollars into the stock casino. The Fed continues to talk QE and from their FOMC meeting in September, they have even offered the prospect of deflation as an excuse to inject more cash in the casino. Coupled with tens of trillions of debt and a Congress spending money like a drunken sailor at a strip bar, there seems to be no end to the amount of currency that has been, and will be, created. This is inflation and not deflation. The Fed just lies about deflation so they will have an excuse to print more dollars. Why do they do this?

Their only mission is to manipulate the stock casino’s indices higher (or at least keep them from falling) while they rape the country of its assets. They enlist the aid of their shill banks through an extension of economic dominance and control. Very simply, they are here to take everything we've got. Right now they are confiscating our real estate. The health care tax is a confiscation of our medical treatment. They will soon confiscate our retirement accounts. They know that they can use the stock indices as a ruse to dupe the dopes into thinking all is well while promulgating the belief that the Fed is here to help. In real terms, the US dollar has lost more than 50% of its value since 2001 while the Dow has remained at the same level of ten years ago - 10800. The truth is the Dow has lost 50% in terms of purchasing power. To say, or think, that the Dow is holding its own is a ruse. One could argue this point in that in truth, the dollar as measured by the USD has lost some 25% (from $105 to $78 as of this writing) of its value over the past 10 years. However, that action has affected a commodity reaction that has forced most commodities higher by 25% or more. Thus, we have experienced a 50% loss in purchasing power. This is a very simple explanation but we can pick and choose our benchmarks. For instance, the CRX index is up some 300% and the WTIC (West Texas Intermediate Crude) is up over 50% in the same time span. Gold is off the charts in appreciation! In real purchasing power terms, the dollar is getting decimated.

The destruction in purchasing power is even worse in real terms. Ten years ago, we could have sold our USD at $105 and bought 3 barrels of WTIC at $30 per barrel. Today, we can sell our USD at $78 and buy not even a full barrel of oil priced at $81 (price as of 10/01/2010). The action of a devaluing dollar is causing an alarming reaction in the real decline of living standards and affordability. Yet, the Fed is stupidly turning devalued dollars into gold. At least, for those that own gold!

We might wonder why the dollar hasn’t fallen further towards zero. To that point, the Fed has completely taken over the stock indexes and manipulates them, and currency, every day. Their allegiance is their own currency – US Treasuries. The Fed knows that the currency it issues, Federal Reserve Notes, is worthless. They use them to buy US Treasuries. Treasuries give them ownership rights to US assets when default eventually happens. In the meantime, they have to manage the default process. To stave off a complete and cataclysmic real estate collapse, the Fed has taken on the task of manipulating the Treasury yields lower by buying them up like doughnuts at fat camp. They are using POMOs, REPOs, and QEs while at the same time, they are extending the use of derivatives that are supported by Treasury collateral. They have also advanced their lying campaign to include the ridiculous idea of deflation which also induces investors to buy more Treasuries. I think Treasuries are a good buy but not because there is deflation. They are a good buy because the man with the golden printing press is buying them. Rising Treasury prices are meant to confound the gold accumulators. Treasury purchases require US dollars. That creates dollar demand (in an artificial way) which in turn mutes the ascent of gold. Otherwise, gold would be a lot higher right now than the current price of just north of $1,300 per ounce. So as the Fed continues to debase the currency, they are turning dollars into gold. Where will the price of gold go from here? Where will the Dow go from here?

We should take the Fed at their word. They want inflation! Their weapon is currency manipulation. Yes, the Dow can be inflated like commodities. A quick look at the chart shows a microscopic one-week view of the dollar and gold. The question of a trend can therefore be answered. As long as the Fed continues to destroy the dollar, gold and silver both can be considered to be following an inverse trend reaction to the dollar devaluation action and neither is in bubble territory. We should own what the Fed inflates. This is how deflating dollars can be turned into inflating gold!

9/27/10 - 10/01/10 Intraday 30-minute bars: GLD = candlestick, UUP= green line

Chart courtesy StockCharts.com

Barry M. Ferguson, RFC

BMF Investments, Inc.

www.bmfinvest.com

Publisher of Barry's Bulls newsletter - Subscriptions at $120/yr 12 issues

Advisory services offered through BMF Investments, Inc

© 2010 Copyright © 2010 Copyright Barry M. Ferguson - All Rights Reserved

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.