Brazil Trys Some Old-Fashioned Capital Controls First

Currencies / Brazil Oct 23, 2010 - 09:09 AM GMTBy: Paul_L_Kasriel

Richard Thies writes: With the second round of the Brazilian presidential election set for October 31st, we thought it would be a good time to focus on the country and steps the next administration can take to limit growing imbalances in the economy as well as the strength of the real. The election has gone mostly unnoticed by markets, in sharp contrast to the 2002 contest, but one need only look to the last few weeks to understand the importance of the vote.

Richard Thies writes: With the second round of the Brazilian presidential election set for October 31st, we thought it would be a good time to focus on the country and steps the next administration can take to limit growing imbalances in the economy as well as the strength of the real. The election has gone mostly unnoticed by markets, in sharp contrast to the 2002 contest, but one need only look to the last few weeks to understand the importance of the vote.

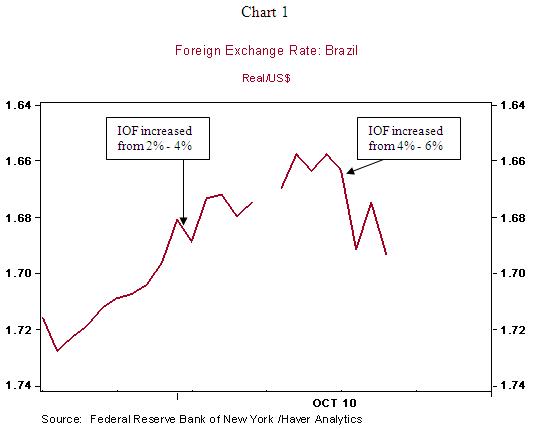

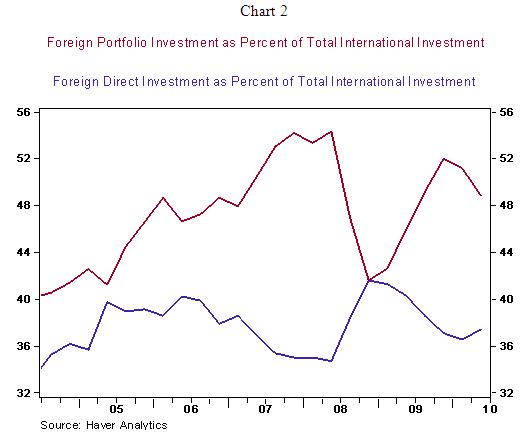

The government has been one of the more vocal in the current 'currency-war' debate, viewing appreciation of the real as a detriment to exporters and the economy at large. Thus, in addition to using the traditional intervention method of selling reais in exchange for dollars (at a considerable loss on the yield differential), Brasilia has been experimenting with some less traditional methods. On October 4th, the IOF tax was increased from 2% to 4% on foreign investment in fixed-income securities only. The policy acts as a de facto tax on corporate issuers and simply funnels more of the foreign capital into equity markets. This had little effect on the value of the real and the impact it will have is distortionary. Just over two weeks later, that tax was increased from 4% to 6%. (Chart 1) This time, the real did see some depreciation, probably due more to concerns over policy uncertainty than actual fundamentals. The other stated goal of the IOF tax when it was first initiated was to increase the percentage of foreign direct investment relative to the potentially flighty portfolio investment. By this measure, the tax has had no visible impact. (Chart 2)

So how does this all relate to next week's election, you ask? It is our belief that Brazil has a tool at its disposal to counteract some real strength that would not need come with unnecessary distortions - fiscal restraint. The likelihood of this tool being used depends largely on the winner of next week's poll. Though the policy stances of the two candidates have not been well-flushed out, it is our view that Lula's handpicked successor, Dilma Rousseff is much less likely to reduce spending than her opponent, José Serra. In fact, we view a Rousseff victory to mean increased future government spending. Despite recent polls showing a narrowing between the two candidates, we continue to find it very unlikely that Serra will pull off an upset on the 31st.

Government consumption accounts for a large portion of nominal GDP in Brazil and the level has been steadily rising in recent years. On a real basis, we expect government spending to increase 4% this year. While it is hard to attack a government for fiscal profligacy when we only project a general government shortfall of 2.3% this year, the deficit only tells half the story. When it is taken into consideration that government revenues increased 14.77% y-o-y at the most recent reading, the government's fiscal stance becomes decidedly expansionary, as well as pro-cyclical.

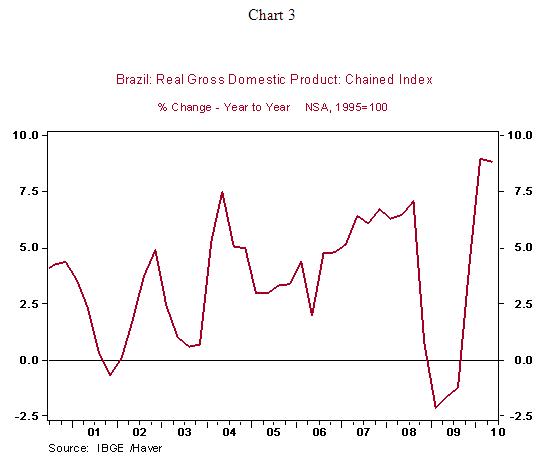

To understand the pro-cyclical nature of the spending, consider that Q2 GDP figures showed an 8.7% y-o-y expansion. (Chart 3) Unemployment has fallen dramatically, from 7.7% last September to 6.2% in September 2010. As could be inferred from the robust employment growth, private consumption is also up strongly this year. This is all a way of saying that government stimulus is no longer necessary. We acknowledge that the country is still in need of considerable social welfare programs to address rampant poverty; however, we believe in the long-term that achieving lasting poverty reduction will be best achieved through macroeconomic stability.

With all else equal, including no changes from the central bank, a reduction in government expenditure should reduce the value of real by slowing down aggregate demand. Admittedly, it is difficult to quantify what the actual nominal impact on the exchange rate of a spending cut would be. However, why not cut unnecessary spending when it will help in the 'currency war,' improve confidence in a historically spendthrift government, and reduce the likelihood of an overheated economy? Seems like a win-win, and then some, but a win-win that becomes less likely with a Rousseff win.

By Richard Thies

http://www.northerntrust.com

is an Associate International Economist at The Northern Trust Company, Chicago. He currently monitors emerging markets in sub-Saharan Africa, as well as several European and Asian countries.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.