U.S. November Employment Situation Supports Fed QE2 Program

Economics / Employment Dec 04, 2010 - 03:27 AM GMTBy: Asha_Bangalore

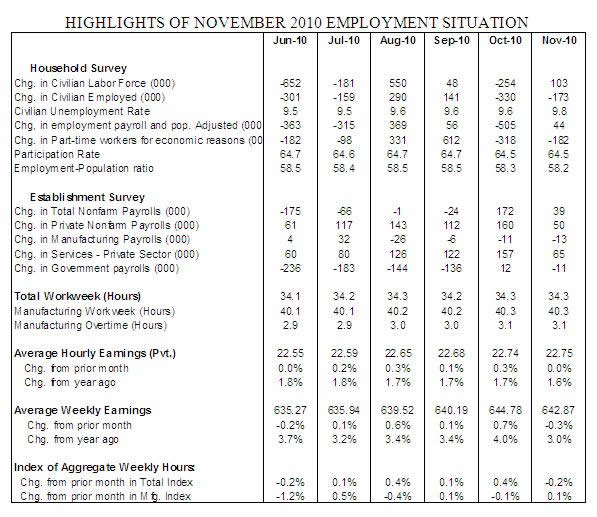

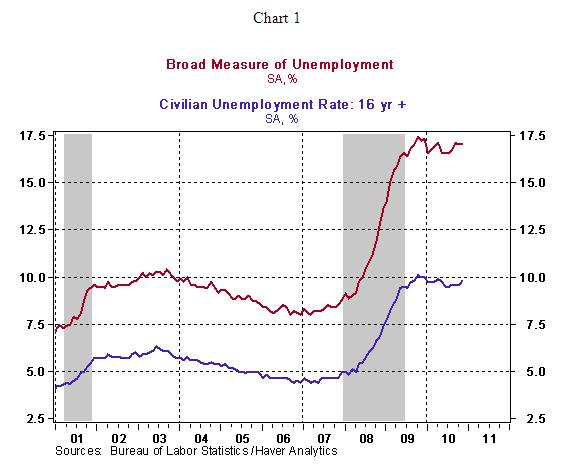

Civilian Unemployment Rate: 9.8% in November, held between 9.5% and 9.6% for five straight months. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low (for the expansion that ended in December 2007) is 4.4% in March 2007.

Civilian Unemployment Rate: 9.8% in November, held between 9.5% and 9.6% for five straight months. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low (for the expansion that ended in December 2007) is 4.4% in March 2007.

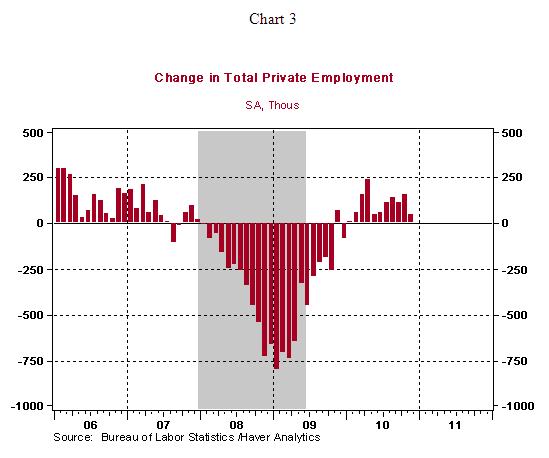

Payroll Employment: 39,000 in November vs. +172,000 in October. Private sector jobs increased 50,000 after a gain of 160,000 in October. Revisions for September and October resulted in a net gain of 38,000 jobs in the economy and 6,000 jobs in the private sector.

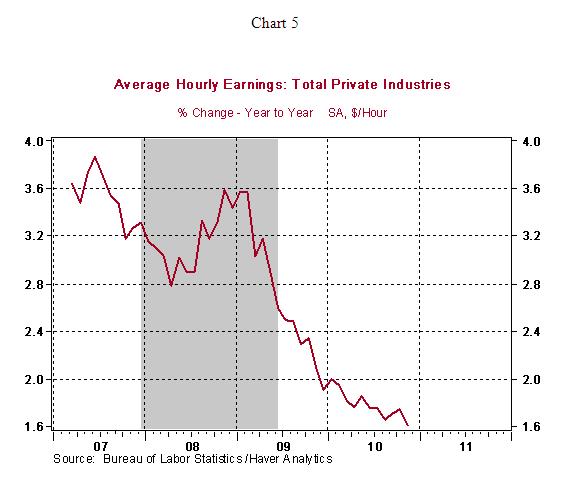

Private Sector Hourly Earnings: $22.75 in November vs. $22.74 in October, 1.6% yoy increase in November vs. 1.7% yoy gain in each of the three months.

Household Survey - The civilian unemployment rate rose to 9.8% in November, after holding between 9.5% and 9.6% for five consecutive months. The broad measure of the unemployment rate inclusive of the marginally attached and involuntary part-time workers who are unable to find full-time employment was unchanged at 17.0%.

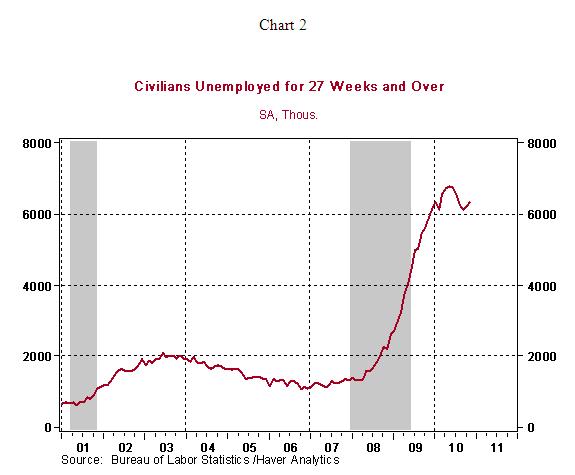

In absolute numbers, there were 15.1 million unemployed in November and 9.0 million working part-time because full-time jobs were not available. There were 6.3 million people who have been unemployed for roughly six months and make up 41.9% of the total unemployed. The Fed remains significantly concerned about the erosion of skills due to long-term unemployment. Chairman Bernanke has frequently cited the unfavorable consequences of persistent long-term unemployment.

Establishment Survey - Total nonfarm payrolls increased 39,000 in November after an upwardly revised gain of 172,000 in October. Private sector payroll employment rose a paltry 50,000 in November vs. an increase of 160,000 in the prior month. Upward revisions of estimates of employment in September and October added 38,000 new jobs in the overall economy and 6,000 jobs in the private sector.

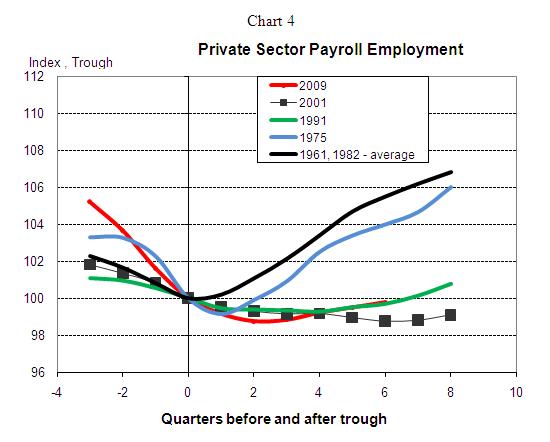

Year-to-date, 1.17 million jobs have been created in 2010 vs. a loss of 4.57 million jobs in the same period of 2009. To this extent, the payroll numbers are encouraging. But when placed in a historical context, the increase in payrolls in the current recovery after six quarters of economic growth (October-November average for 2010:Q4) is marginally better than the business expansion following the 2001 recession, it matches the recovery after 1990-91 recession and it is significantly weaker than other post-war economic recoveries. Chart 4 is an index chart constructed to assess the relative performance of payrolls in each business cycle by setting the level of payroll employment at the trough=100 (Only the first eight quarters of the recovery are shown in the chart to keep it reader friendly. A reading of 103 implies that employment is 3.0% higher compared with the level at the trough.)

Highlights of changes in payrolls:

Construction: -5,000 vs. +3,000 in October

Manufacturing: -13,000 vs. -11,000 in October

Autos: -1,500 vs. +1,200 in October

Private sector service employment: +50,000 vs. +160,000 in October

Retail employment: -28,000 vs. +13,000 in October

Professional and business services:+53,000 vs. +50,000 in October

Temporary help: +39,500 vs. 34,700 in October

Financial activities: -9,000 vs. no change in October

Health care employment: +19,200 vs. +28,900 in October

Hourly earnings moved up only one cent in November to $22.75, putting the year-to-year increase at 1.6%. The earnings and employment numbers suggest only a small gain in personal income during November. The 0.1% increase in the factory man-hours index points to a similar gain in industrial production during November.

Conclusion - Economic reports for November suggest a soft start, following a more upbeat economic landscape painted by economic data of October. Hiring was stronger in October compared with November, auto sales rose in October but held steady in November, the ISM manufacturing survey showed more robust gains in October vs. November. Early estimates of retail sales in November look promising after a noticeable increase in retail sales during October. The Pending Home Sales Index for October posted a 10.4% increase, implying a rebound in homes sales in the November-December period, following a decline in sales of existing homes in October. The mix of economic data for November, particularly the employment report, suggests that predictions of the Fed scaling back on the $600 billion purchase of Treasury securities would have to be revised. The bearish elements of the November employment report support the Fed's QE2 program in an environment of growing skepticism about the net benefits of the Fed's initiative. The December 14 FOMC meeting is most likely to end without any changes to the current monetary policy stance of the Fed.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.