Gold Is In Hot Water

Commodities / Gold and Silver 2010 Dec 17, 2010 - 03:52 PM GMTBy: J_W_Jones

Life has a funny way of reminding a person that he is not really in control of what is going on around him. While he may be proficient in a few specific areas, his overall knowledge is limited. Last night my hot water heater decided to go on vacation and I thought I'd try to be a real man and fix it. I have a general knowledge of how a hot water heater works, but it dawned on me that knowing how it works and fixing it are two totally separate things.

Life has a funny way of reminding a person that he is not really in control of what is going on around him. While he may be proficient in a few specific areas, his overall knowledge is limited. Last night my hot water heater decided to go on vacation and I thought I'd try to be a real man and fix it. I have a general knowledge of how a hot water heater works, but it dawned on me that knowing how it works and fixing it are two totally separate things.

I immediately realized that I was in over my head and made arrangements to have a repair man come and fix my hot water heater. He arrived first thing this morning and I asked if I could watch not only out of curiosity, but to understand how my hot water heater worked and to learn about the man that was fixing it. He was gracious and took the time to explain my issue thoroughly and as I am writing this he is replacing my heating elements.

The interesting thing about this whole chain of events is that he brought up investments with me. Not because he wanted to talk to me or thought I knew anything, but simply because he knew I worked in that field. When you live in a relatively small town and people knew what you do for a living, they are generally quick to ask questions. He told me what he was doing with his retirement accounts and his plans for retirement in great detail.

I immediately respected him for his general knowledge and it was apparent he had done his own homework. He had made wise decisions, saved money, and invested wisely. Clearly the man working on my hot water heater was planning for a quality retirement lifestyle and it sounded as though his planning was going to pay off. He brought up that he had purchased the copper ETF $JJC when he noticed that copper pipe was becoming more difficult to acquire and he was paying more for it.

Then the conversation changed dramatically as he explained to me that he had recently bought gold coins and the gold ETF GLD. Immediately my ears perked up as I follow gold and oil quite closely as regular readers are aware. He wanted to know if I thought he should buy more on dips and if he had purchased gold at a good price. He told me he thought he had bought around the $1,200 an ounce price level. I replied that I was not qualified to offer investment advice, but that I expected gold was likely going to go through a mild pullback in coming days and weeks.

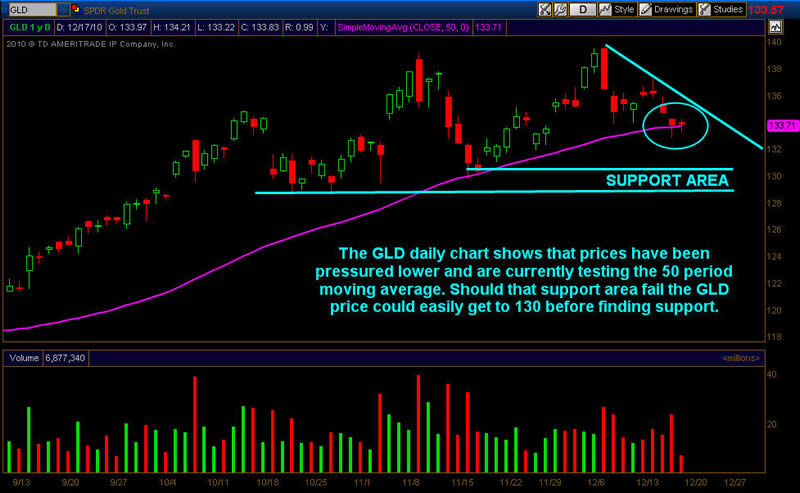

He did not really ask any questions, but he said he was planning on adding to his position in GLD as he indicated that acquiring physical gold today is quite difficult. I told him that longer term I think gold will be an outstanding asset class to own, but I would be patient and wait to buy when the weakest gold bulls bow out. This conversation went on for about 15 or 20 minutes and eventually he got back to his work and I got back to my screens. I immediately looked at the GLD chart and this is what I saw this morning:

My previous article, A Correction in Gold is an Option discussed the overwhelming bullishness that gold and silver were garnering with the retail crowd. After publishing that article last week I received more than a dozen emails that I would classify as hate mail. I was called names, I was sent a poorly written manifesto of the future collapse of fiat currency, and finally my favorite email which was just two words in the subject line, mother ($#$$@# – I'll let your imagination try to figure out that one). I have written about a variety of asset classes and none of them have the near vigilante bullishness associated with gold.

Gold bugs believe that the world as we know it is going to collapse. They believe that in a few months they will be bartering their gold for food, land, and valuables. Some of them believe the central bankers are working together to create a giant world order. The emails that I have received speak for themselves. There is a growing fear among the retail / middle class investor and the war often discussed between the haves and the have-nots wages on.

When sentiment is running this high and the repair man working on my hot water heater is discussing with me his gold ownership and his desire to own more, it would seem bearish. I have heard and read countless stories about taxi cab drivers talking about the stocks they were trading during the dot-com bubble. I vividly remember having coworkers who had no experience in real estate buying multiple homes to “flip” during the housing boom. Today the man working on my hot water heater is telling me about his gold ownership and how he plans on buying more.

I do not need to remind readers what happened after the technology bubble or the housing bubble, but what if commodities are in bubble? Some have argued they are, others say they are only beginning to rise as hyperinflation is on the way. It seems the real argument in this discussion is more about inflation versus deflation. I for one am not an expert in this field or any other based on my experience last night with my hot water heater, but financial markets tend to operate in the opposite of the herd's expectations.

The gold trade is full, physical gold is hard to purchase, and the dollar has declined significantly in the past 10 years. There are many expert economists that are screaming inflation is coming and that commodity prices such as precious metals, grains, and energy prices are going to skyrocket. It seems that is the rally cry coming from economists and the herd's investment habits seemingly back up this notion. I am a contrarian trader and investor as I have struggled to make money following the herd. Is the herd leaning toward inflation right now?

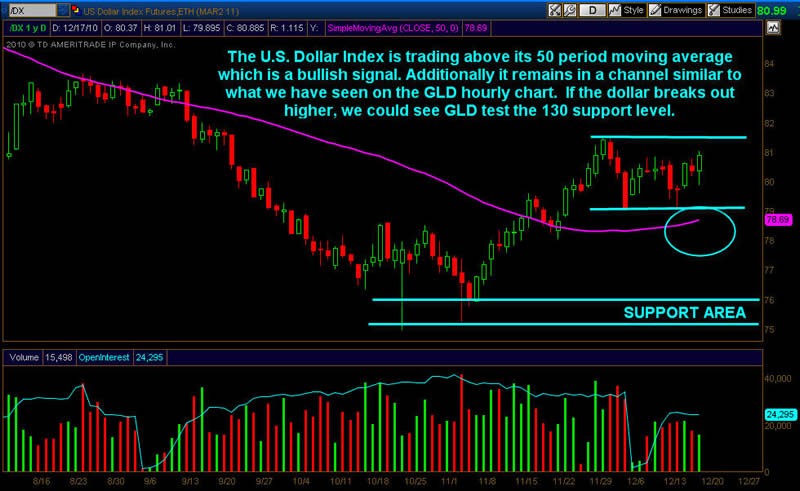

Gold can hold its value during a deflationary period so long as that period of time is relatively short. However, a long term deflationary period could be troublesome for gold bulls. Again, I am not an expert in these matters, but it sure seems as though there is a growing battle between the deflationists and inflationsists and the herd appears to back the inflationists. While that does not necessarily mean that inflation will not rear its head, it just might mean a period of deflation will occur prior to that move. It would appear to me that a mild correction in gold is possible and I intend to use that correction as a buying opportunity. The U.S. Dollar Index futures chart is listed below:

With sentiment running this high, retail investors crowding into precious metals, and the dollar receiving no love – this is a perfect contrarian storm. This situation is the very reason that gold could correct deeper and longer than what many investors might expect causing the retail crowd who was buying around the $1,425-$1,450 price level to get nervous and sell, just when price is about to change direction. This seems to be an ongoing situation that inevitably happens in almost every asset class at some point or another.

While I do expect lower prices in gold in the short run, I still remain bullish in the long term. At the end of the day, I have always made more money trading against the herd than trading with it. If my hot water repair man is discussing buying gold, it would make sense that the smart money would be selling into the retail investors and traders during price peaks and buying from them near the intermediate lows. Interestingly enough, the chart below illustrates the heavy volume selloffs that have been taking place in gold.

In closing, I'm sure this article will arouse more gold bugs from their slumber and fill my email inbox with more hate mail. I will shrug it off as I always do, but the real question I have is am I going to have hot water tonight?

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.