The Greater Depression Smoot-Hawley Redux

Economics / Protectionism Feb 04, 2011 - 02:17 AM GMTBy: James_Quinn

As the Greater Depression continues along a parallel pathway with the Great Depression of the 1930s, Congress is about to commit the same blunder it made in 1930. The rocket scientists in the House of Representatives in September passed the Currency Reform for Fair Trade Act, which aims to crack down on Chinese currency manipulation by targeting imports from China and other countries with currencies that are perceived to be undervalued.

As the Greater Depression continues along a parallel pathway with the Great Depression of the 1930s, Congress is about to commit the same blunder it made in 1930. The rocket scientists in the House of Representatives in September passed the Currency Reform for Fair Trade Act, which aims to crack down on Chinese currency manipulation by targeting imports from China and other countries with currencies that are perceived to be undervalued.

The vote was 348 to 79, with more than 100 Republicans voting in favor of the bill. It died in the Senate before the mid-term elections, but Representative Sander Levin, Representative Tim Ryan and Representative Tim Murphy are expected to reintroduce the bill when the House returns in February from a congressional district work break. Senators Shumer and Casey are also planning legislation to punish the Chinese for unfair trade practices.

The head rocket scientist, Nancy Pelosi, declared:

“For so many years, we have watched the China-U.S. trade deficit grow and grow and grow. Today, we are finally doing something about it by recognizing that China’s manipulation of the currency represents a subsidy for Chinese exports coming to the United States and elsewhere. We owe that to American workers.”

This legislation is part of the Democrats’ “Make It in America” initiative that endeavors to increase domestic manufacturing and creating new American jobs. In classic congressional fashion, they are attempting to pass a bill that will make them look good in the eyes of their constituents, but will exacerbate already dangerous world trade imbalances.

You can count on Congress to pander to unions, protectionists, and America Firsters with hollow legislation, when 40 years of bad decisions, bad policies, and bad choices placed us in this situation. When you have made legislative choices that will require the U.S. government to borrow another $6 trillion in the next four years and you already owe someone $868 billion, it is not a good idea to punch them in the nose.

The U.S. is running an annual trade deficit exceeding $500 billion per year. It has not run an annual trade surplus since 1975. The trade deficit peaked at $769 billion in 2006, subtracting 5.7% from GDP. The enormous trade deficits are a result of government spending policies, Federal Reserve monetary policies, and corporate outsourcing that have gutted the industrial base of the U.S. These policies resulted in personal consumption expenditures surging from 62% of GDP in 1970, to 71% of GDP in 2009.

The trade deficits are not the fault of the countries selling goods to American consumers. Trade subtracted 3.5% from growth in April through June, the most since 1947, as imports surged at the fastest pace since 1984.

The trade deficit with China reached a record level in August of $28 billion, as imports skyrocketed. The U.S. is on track to exceed the 2008 record trade deficit with China of $268 billion. The facts that you don’t hear from the protectionist crowd is that exports to China are on track to reach $84 billion in 2010, 20% higher than the previous peak in 2008. Exports to China have increased by 525% since 2000, while imports from China have increased by 340%. The storyline about China not allowing U.S. imports into their country is false. Putting tariffs or quotas on goods coming from China will not create jobs in America and will only deepen and lengthen the current depression, just as it did in the 1930s.

Protectionism During the Great Depression

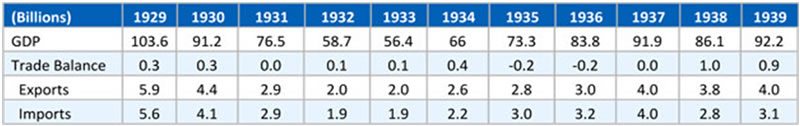

The complete collapse of worldwide trade during the 1930s, with its root in trade protectionism, did not cause the Great Depression, but it certainly didn’t help. In 1929, exports totaled $5.9 billion and accounted for 5.7% of GDP. By 1933, exports had plunged to $2.0 billion and accounted for only 3.5% of GDP. Imports plummeted by an equal amount. Global trade declined by 60% as tariffs were imposed and retaliation created a downward spiral. The U.S. provoked the trade war with the passage of the Smoot-Hawley Tariff Act.

Senators Reed Smoot and Willis C. Hawley sponsored the bill, and it was signed into law on June 17, 1930, by Herbert Hoover. It raised U.S. tariffs on over 20,000 imported goods to the highest levels since 1828. The new tariff imposed an effective tax rate of 60% on more than 3,200 products and materials imported into the United States, quadrupling previous tariff rates. According to the U.S. Statistical Abstract, the overall effective tariff rate was 13.5% in 1929 and 19.8% by 1933.

It seems politicians never change. During the 1928 presidential campaign, Herbert Hoover promised to help beleaguered farmers by increasing tariffs on agricultural products. After getting elected, Hoover asked Congress for an increase of tariff rates for agricultural goods and a decrease of rates for industrial goods. The Republican-dominated House and Senate did him one better and increased tariffs across the board.

In May 1930, a petition was signed by 1,028 economists asking President Hoover to veto the legislation. Henry Ford begged him to veto the legislation. Hoover opposed the bill and called it “vicious, extortionate, and obnoxious” because he felt it would undercut his pledge to international cooperation. Then he proved that he was a standard-issue weak-kneed politician by signing the bill. Hoover’s initial instinct proved correct. The international community levied their own tariffs in retaliation after the bill became law. Canada, Britain, and other European countries immediately imposed their own tariffs. World trade came to a grinding halt.

Germany, with its war reparations, was particularly vulnerable to this contraction. Ironically, the U.S. was the lender to the world during the 1920s. American lending propped up the entire world economy. Former allies paid war-debt installments to the U.S. chiefly with funds obtained from German reparations payments, and Germany was able to make those payments only because of large private loans from the U.S. and Britain. Similarly, U.S. investments abroad provided the dollars, which alone made it possible for foreign nations to buy U.S. exports.

By killing world trade with the Smoot-Hawley tariffs, the U.S. shot itself in the foot and contributed to worsening the Depression in Germany. This inadvertently led to the rise of Hitler. Talk about unintended consequences.

Decades of Bad Choices

Blustering politicians like Nancy Pelosi and Chuck Schumer are attempting to ram through populist legislation in order to appear to be on the side of the American people. The Treasury secretary of the United States has declared China a currency manipulator. Chinese Premier Wen Jiabao responded in kind:

“If we increase the Yuan by 20% to 40%, as some people are calling for, many of our factories will shut down and society will be in turmoil. If China saw social and economic turbulence, then it would be a disaster for the world.”

They are playing a high-stakes game of chicken, and the ante is much higher than it was in 1930. Exports account for 12.5% of our GDP today, versus 5.7% prior to the Great Depression.

The United States was a net exporter when the 1970s started. Our enormous trade deficits, which subtract from GDP, were not imposed on us by foreign countries. We are in this predicament because we made appalling choices.

We chose to allow the Federal Reserve to inflate away 95% of the purchasing power of the USD since 1971. We chose to elect politicians that have driven the national debt from $371 billion in 1970 to $13.6 trillion today. We chose to support “free trade” legislation that allowed corporate CEOs to gut our industrial base and ship good-paying jobs to China, while filling the pockets of these executives with millions. We chose to spend rather than save and invest in our country. We chose to become a consumer debt-centered society, relishing in the cheap goods we could buy from China on credit. We chose low prices at Walmart over small-business owners and sustainable domestic production of goods. Decades of bad choices cannot be reversed through taxation, tariffs, and quotas.

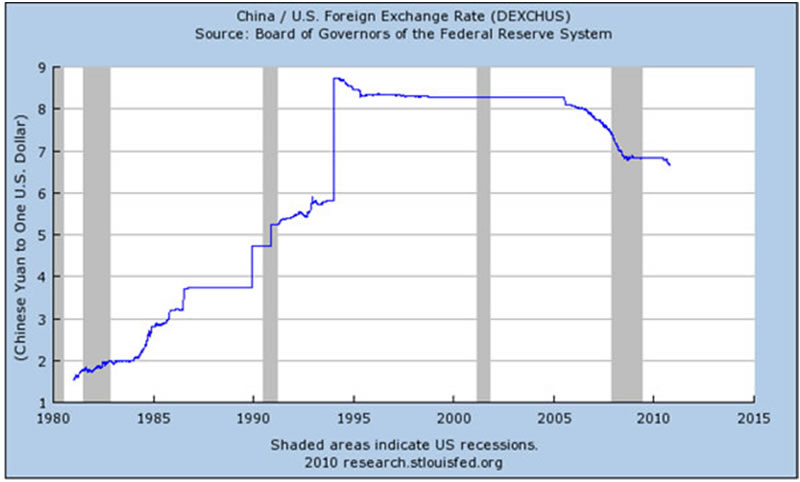

The Chinese have pegged their currency to the USD since 1995. For a decade, the U.S. was just fine with the peg, as American consumers got cheap goods, American corporations reaped huge profits from outsourcing, and banks raked in billions by lending money to everyone. Now that we have entered the Greater Depression, the finger pointing and accusations have begun.

Politicians and the people who elected them want someone to blame for their bad choices. The Chinese are the bogeyman that forced Americans to buy on credit. They forced American corporations to offshore millions of U.S. jobs. If the U.S. had a strong dollar policy, ran surpluses, and lived within its means, the Chinese peg would be meaningless.

U.S. GDP has grown by 335% since 1985. Over this same time frame, exports to China have grown by 1,800%, and imports from China have grown by 7,700%. Do politicians actually believe that imposing 30% tariffs on all Chinese products will magically create new manufacturing jobs in America? The 42,400 factories that have closed since 2001 and the 5.4 million manufacturing jobs lost are not coming back. A 30% upward revaluation of the yuan or 30% tariffs on Chinese products would devastate an economy that is still 70% dependent upon consumer spending. Just as in 1930, protectionist measures would boomerang and smack America in the back of the head.

If the pandering politicians in Washington D.C. are myopic enough to ignore the lessons of the past and start a trade war with China and/or the rest of the world, the possible implications would be:

- An immediate increase in the prices of goods from China, which would proportionately hurt the lower and middle classes who shop at Walmart.

- Retaliatory tariffs and protectionist policies by other countries, resulting in a decline in U.S. exports.

- A net loss of U.S. jobs as the decline in consumer spending-related jobs will far outweigh any benefits to exporting businesses.

- A decrease in world trade, resulting in a deepening of the current worldwide depression.

- Possible unintended consequences similar to what happened in Germany after the hyperinflationary collapse of their currency (dictators, war, chaos).

The investment implications of trade barriers, tariffs, quantitative easing, and currency debasement are clear. Gold, silver, and virtually all commodities are likely to soar in this environment. To find out how to profit from this certain trend, check out Casey Research’s BIG GOLD REPORT.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.