Under the Big Stock Market Top

Stock-Markets / Stock Markets 2011 Feb 09, 2011 - 07:05 PM GMTBy: PhilStockWorld

1,332. That is a 100% in the S&P since it's March 2009 low of 666 (see David Fry's chart). Does it matter? Can we expect even a LITTLE pullback after a 100% run or is it "to the moon Alice" and maybe Mars and Jupiter while we're at it as the Federal Reserve's multi-Trillion Dollar thrusters send us to the stars, breaking the bonds of gravity (and logic) as they send stocks every higher in an expanding universe of freshly supplied money. As fellow stock market physicist, Art Cashin said yesterday:

1,332. That is a 100% in the S&P since it's March 2009 low of 666 (see David Fry's chart). Does it matter? Can we expect even a LITTLE pullback after a 100% run or is it "to the moon Alice" and maybe Mars and Jupiter while we're at it as the Federal Reserve's multi-Trillion Dollar thrusters send us to the stars, breaking the bonds of gravity (and logic) as they send stocks every higher in an expanding universe of freshly supplied money. As fellow stock market physicist, Art Cashin said yesterday:

The Newtonian Rally Continues – A mild paraphrase of one Sir Isaac Newton’s laws of force and motion (inertia) says that a body in motion will stay in motion unless acted upon by some counterforce. That seems to be the guiding rule for the QE2 rally since it started with the Jackson Hole speech before Labor Day.

Yesterday, the Dow rallied for the sixth straight day. Simultaneously, treasuries fell for the sixth straight day. It was a low volume levitation, however. The NYSE volume failed to make it to 900 million shares.

Does the low volume indicate we are losing thrust or was it merely a function of the end of the Fed's current POMO schedule forcing us to coast on momentum for a day as they prepare to fire stage three thrusters to help the S&P achieve final escape velocity? As I said to Members yesterday:

The Fed can feed $3.5Tn into the thrusters and you can have a spectacular launch that looks like it’s heading straight to the moon but it’s right at the peak, when you need to fire that second stage perfectly, that you have the highest probability of failure. When a market escapes gravity – you will know it. Like the Nasdaq in 1999 and oil in 2008 – not just a little up every day but spectacular gains that go unpunished. That’s what we’ll see if they hyperinflation begins to creep into the markets.

As I had pointed out years ago in our educational post on "Stock Market Physics":

What we have in this chart, along the dotted line, is an actual picture Kepler’s third law of motion in action as the Nasdaq forms an elliptical orbit as it attempts to escape. By simply applying the following formula we can see where the Nasdaq is going:

- T = time since the last crash

- a = total number of points gained

- G = bearish sentiment + bad news

- M = total value of the global market

- m= total value of the Nasdaq

In absence of new fuel (inflows), we can expect some sideways drift – something has to change in the formula (kidding about being able to predict where we are going by the way!) for us to break orbit.

What the Fed has done with their $3.5Tn meddling in the markets is introduced a new factor: The ever-expanding money supply and, like our expaning universe, it means that we have an outside force acting on the markets that make all our other measurements invalid. It's kind of like saying "How fast will you fill a one gallon container using an 8 ounce glass of water if you can pour one glass every 30 seconds?", which has a straightforward answer. What the Fed has done by drowning us in money is added to that question "...if you are standing at the bottom of the ocean." See, makes a difference in an otherwise straightforward calculation, doesn't it?

What the Fed has done with their $3.5Tn meddling in the markets is introduced a new factor: The ever-expanding money supply and, like our expaning universe, it means that we have an outside force acting on the markets that make all our other measurements invalid. It's kind of like saying "How fast will you fill a one gallon container using an 8 ounce glass of water if you can pour one glass every 30 seconds?", which has a straightforward answer. What the Fed has done by drowning us in money is added to that question "...if you are standing at the bottom of the ocean." See, makes a difference in an otherwise straightforward calculation, doesn't it?

But (and it's a Big But), what if the question is "How many 8 ounce glasses can a gallon container hold?" Now it doesn't matter if you fill that gallon container at the bottom of the ocean or back on the moon - the answer is always going to be 16 glasses. So, while the Fed may be able to affect the rate at which stocks return to their "full" value, it remains to be seen whether or not they can affect the FACT of what that full value should be. To some extent, we expect inflation to expand the bottom lines of the companies we invest in - so they "expand" in "value" along with the expanding universe of money that the Fed is creating.

The Fed, as we know, claims there is no inflation. If there is no inflation, then those rising input costs that companies are reporting must be something else and the idea that they can pass those costs along to the consumer is also an impossibility because, if there is no inflation, how will the consumers get money to pay more for everything? See, even in a market universe awash with cash - we still have to balance our equations, don't we?

It's going to be a loony day on our lunar market mission as Ron Paul (aka 'Gravity") squares off against Ben Bernanke (aka "The Bernank - Pilot who Sits in the Bubble") about the wisdom of applying more thrust (aka "Quantitative Easing") to the expanding economic ship (aka "Mass") which is already moving at a dangerous speed (aka "Inflation"). Doctor Paul seems to be the only one concerned about the fact that the economic ship took off without any passengers, or at least only 10% of them and that's why today's hearing is titled: "Can monetary policy really create jobs?" We will be hearing testimony from Austrian-school economist Thomas DiLorenzo, whose testimony includes the great lines:

As applied to today’s economic situation, it is obvious that the artificially low interest rates caused by the policies of the Greenspan Fed created an unsustainable boom in the housing market. Thousands of new jobs were in fact created – and then destroyed – giving an updated meaning to Joseph Schumpeter’s phrase “creative destruction.” Many Americans who obtained jobs and pursued careers in housing construction and related industries realized that those jobs and careers were not sustainable after all; they were fooled by the Fed’s low interest rate policies. Thus, the Fed was not only responsible for causing the massive unemployment that we endure today, but also a great amount of what economists call “mismatch” unemployment. The skills that people in these industries developed were no longer in demand; they lost their jobs; and now they must retool and re-educate themselves.

In summary, the Fed’s monetary policies tend to create temporary and unsustainable increases in employment while being the very engine of recession and depression that creates a much greater degree of job destruction and unemployment.

In summary, the Fed’s monetary policies tend to create temporary and unsustainable increases in employment while being the very engine of recession and depression that creates a much greater degree of job destruction and unemployment.

Ohio University's Richard Vedder will read the following into the record:

On the fiscal side, politicians unfettered by rules behave like unsupervised alcoholics in liquor stores. Thus we need some sort of constitutional constraints on governmental fiscal actions.

I said last week, as we prepared for the upcoming testimony: "In the words of the immortal Flounder: "Oh boy, is this great!" We rarely get an opportunity to have this kind of political fun - I can only hope that Ron Paul doesn't disappoint us by selling out and rolling over for the Fed, as so many wannabe game-changers have done in the past.

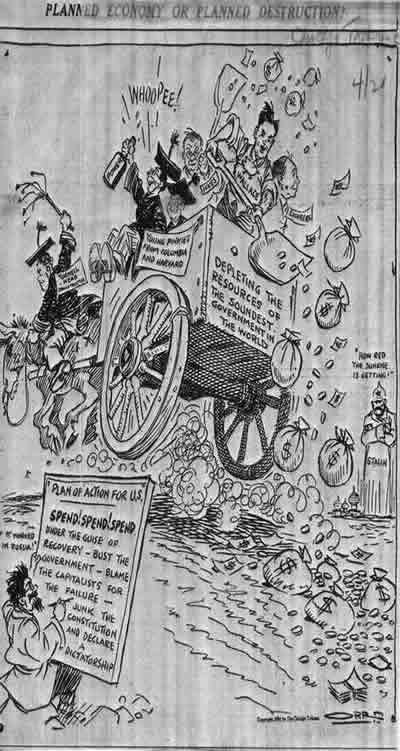

There's nothing new going on here, the cartoon on the right is from the Chicago Tribune in 1934, expressing concern over how much money the government was spending to bring us out of the depression. Note the "kids" drunk with power in cart? They are called "Pinkies" from Columbia and Harvard, a reference to the far left of the day. You can see a menacing Joseph Stalin on the right edge saying, "How red the sunrise is getting". As it turned out we could not borrow and spend our way out of the depression, the government measures only insured that it lasted a few extra years.

Today it is all about G (from the equation above), which is Sentiment. Right now, there are no bears. They have all been taken out and shot and are as extinct as moose would be if Sarah Palin had more free time and helicopters to hunt them down with. Helicopter Ben has murdered the bears, pushing bearish sentiment to the lowest levels since the great capitulation of 1999 when even the most value-oriented investor began to say: "$1Bn for a sock puppet that sells dog food on-line? Sure, sounds great."

- We're paying $2Bn for a company that doesn't even have a sock representing them but does allow you to make a reservation with your IPhone (OPEN) - a mere 168 times projected 2011 earnings will buy you a share.

- We paying $11.5Bn and 73 times earnings for a company (NFLX), also with no puppets, that charges $8.95 a month to watch movies on-line, which is nice but my cable company has hundreds of movies and TV shows on-demand included in their service for free and, of course, there are at least 6 other companies offering or planning to offer the same service and they all think they will get 50% of the market while holding their margins. Good luck!

- We are paying $22Bn and 48 times earnings for a company that does not have a sock puppet, but does have Captain Kirk, whose acting ability has, on occasion, been compared to that of a sock (PCLN). What does Priceline do that is so unique that they deserve a p/e ratio 150% higher than Apple Computer, who earn in a week three times more than PCLN does in a year? Why they have on-line travel reservations. Isn't that BRILLIANT? I mean, who else could possibly do that?

Things are a little crazy out there and I think we're getting into a dangerous place where sentiment could change and that could, however briefly, cause us to pull back off our lofty highs but, then again - if we're filling a jug of water at the bottom of the ocean - it's not a good idea to bet that no one will get wet. Until Uncle Ben is actually forced to turn off his money hose - this rising tide will continue to lift all ships.

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.