Another Sign QE2 is Undermining the Economic Recovery

Stock-Markets / Quantitative Easing May 03, 2011 - 01:15 AM GMTBy: Clif_Droke

A rather eye-opening headline appearing in the financial press is worth discussing here because it’s symptomatic of a bigger problem plaguing the economy. This problem will only increase in the coming months and there’s ample reason for believing it will eventually undermine the cyclical bull market in stocks. The headline reads, “Kimberly-Clark to hike prices after profit falls.”

A rather eye-opening headline appearing in the financial press is worth discussing here because it’s symptomatic of a bigger problem plaguing the economy. This problem will only increase in the coming months and there’s ample reason for believing it will eventually undermine the cyclical bull market in stocks. The headline reads, “Kimberly-Clark to hike prices after profit falls.”

The article appearing in the Associated Press today stated that this represents the third such price hike for Kimberly-Clark, the maker of Huggies and Kleenex. As the article observed, “It's a refrain that's becoming familiar – and, to budget-conscious shoppers, tired – this spring. Rising commodities prices are taking center stage at a number of companies, from restaurants to clothing manufactures, who say they have no choice but to pass along those price hikes to customers.” The company said it would raise prices for its paper products ranging from 3 to 7 percent.

As the A.P. article also aptly observed, “During the recession, customers got used to discounts on diapers and other items, so it's not likely that they'll take kindly to being asked to pay more.”

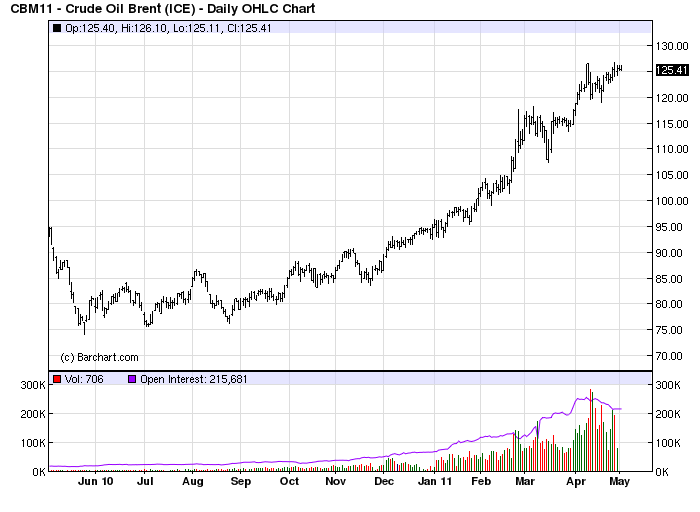

The increase in retail prices is being driven by the Fed’s latest quantitative easing (QE) program which began late last fall and is scheduled to continue until late June. While it’s very much a subject of debate just how much QE2 has done to improve the economy, what isn’t debatable is the extent to which QE2 has resulted in rising commodity prices as large institutional speculators and hedge funds have taken advantage of the easy money and have driven key commodity prices, notably oil and ag commodities, to ever higher levels in recent months. The oil price increase alone is having a drastic spillover impact on fuel and transportation costs, which adds even further to the upward pressure on retail prices.

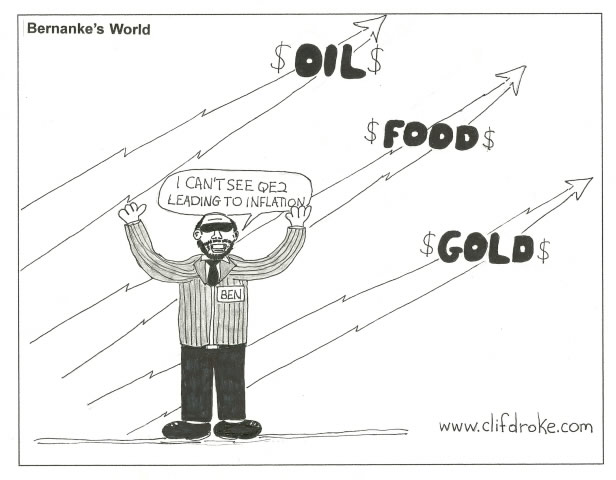

Fed Chairman Bernanke has repeatedly affirmed his commitment to continuing the quantitative easing with the stated goal of reducing the unemployment level. He also continues to downplay the impact the Fed’s loose money policy could be having on commodity and retail price inflation. The problem is that Bernanke refuses to see what everyone else can clearly see, namely the fact that the Fed’s excessively loose money policy is driving up the cost of living for millions.

Bernanke and other members of the Fed's monetary policy-setting arm have consistently stated their belief that the Fed’s accommodative monetary policies are still warranted even though a weaker dollar has been driving commodity and energy prices higher. At last week’s FOMC meeting, Bernanke et al repeatedly upheld the Fed party line that higher inflation is only temporary and that the threat of deflation outweighs the short-term dislocations brought about by the Fed’s inflationary policy. In the real world, however, there’s a growing fear that higher input costs – or even the expectation for higher costs – will deter businesses from hiring.

No one really expects the Fed to launch another round of monetary easing, or QE3, but neither do the experts expect the Fed to begin a round of monetary tightening. It seems, though, that Bernanke is more concerned about keeping the economy propped up through monetary stimulus than in risking another price commodity price bubble. If he persists in this attitude much longer it’s likely we’ll witness at some point a repeat of the 2008 scenario in which an exorbitantly high crude oil price conspired with other factors to grind economic demand to a near halt.

The re-emergence of the commodity price bubble is already making its presence felt in rising prices at the pump, at the grocery store and in the higher prices that corporations across many industries are charging consumers for their products. One well known analyst, Bert Dohmen of the Wellington Letter, asked in a recent report, “What has fueled the new bubbles? The Fed! The real reason for the stock market up move this year is that the Fed is stepping on the accelerator as never before. Look at the fantastic money growth in “Adjusted Reserves,” which is the fuel for future loan growth, if banks ever start lending again. It is directly controlled by the Fed. In the two months ending March 23, it’s growing at a 388% annualized rate! We have never seen such growth before. Astonishing!”

As Dohmen points out, that money has to go somewhere and it’s going toward speculation as it always does. The first quantitative easing program after the credit crisis arguably had a salutary effect on the financial system and helped revive investor and consumer confidence in the wake of the worst financial disaster since the Great Depression. QE2 has been largely superfluous and has done more to aid commodity speculators than anything else. This in turn is exerting an upward bias on retail prices, which is raising the cost of living for individual consumers and also putting pressure on corporate profit margins. Sooner or later this negative influence will stop the economic recovery dead in its tracks.

Last week was an historic occasion for the Federal Reserve. It marked the first time in its 98-year history that the central bank held a public press conference. One of the topics at the press conference was the effect that the Fed’s QE2 monetary easing policy might be having on fuel prices. Fed chairman Bernanke stated, “Our interpretation of the increase in gas prices is the economist’s basic mantra of supply and demand.” On that same day the price of oil reached a new post-2008 high.

In making this statement the Fed is officially taking up the line that QE2 has had a negligible effect on the cost of fuel. Furthermore, the Fed claims that its loose money policy isn’t filtering into the speculative markets for oil and other commodities. In other words, the Fed is effectively denying what most observers can plainly see.

Bernanke further stated, “The Federal Reserve believes that a strong and stable dollar is both in the American interests and in the interest of the global economy.” As he said this the dollar index reached a new post-2008 low.

Once again the Fed is denying the obvious. Its policies are weakening the dollar and flooding speculative markets with fuel for additional asset price increases. Yet the Fed’s claim is that it’s primary interest in maintaining price stability (i.e. a stable dollar). The simple fact of the matter is that the Fed’s money policy has created price instability.

From the above observations we can infer that the Fed is caught in a web of contradictions and policy blunders. Every Fed president of our lifetime has had a defining characteristic which has always had an indelible impact on his monetary policies. Former Fed Chairman Alan Greenspan, for instance, was a reactionary. His monetary policies were extremely erratic and akin to riding on a roller coaster. Whenever the financial markets went into a tailspin or the economy weakened he would overreact and loosen money until the problem was reversed. Then he would become alarmed at the speculative bubbles his loose money policies created and he would react by tightening money to an extraordinary degree. This would of course lead to financial market turmoil, which in turn would touch off another cycle of action and reaction for Greenspan.

Despite his reactionary nature, Greenspan at least had one thing in his favor, namely alacrity. He would act quickly at the first sign of trouble. After the 1987 stock market crash he acted promptly to reverse what was, at the time, the worst stock market crash since 1929. His problem was that he never knew when to put the monetary brakes on.

Bernanke’s defining characteristic is by now becoming obvious. Like his predecessor Greenspan he has a hard time knowing when enough is enough of a particular monetary policy stance. Unlike Greenspan, however, he is extremely slow in reacting to a developing monetary crisis. When he took over the reigns of the Fed from Greenspan in 2006 it was becoming increasingly obvious that Greenspan’s tight money policy from the previous years (which contributed to the bursting of the housing bubble) would have to be reversed, at least in some measure. Yet in the critical years 2006 and 2007 he consistently sat on his hands and did nothing. His inaction contributed to the size and scope of the credit crisis. By the time he finally took serious action the financial edifice was completely engulfed by flames and the crisis was twice as bad as it would have been otherwise.

Now we’re seeing Bernanke’s fatal character flaw, namely slowness of response, coming to the fore again. He would have been justified in stepping off the monetary accelerator last spring after QE1 ended. Instead he decided to embark on another round of monetary easing (QE2) and this has only resulted in the extraordinary price increases for many essential commodities, including oil.

“I do believe that the second round of securities purchases [QE2] was effective,” Bernanke said last week. “We saw that first in the financial markets. The way monetary policy always works is by easing financial conditions. We saw increases in stock prices.” Unfortunately “we” also saw – and continue to see – increases in food and fuel prices.

If Bernanke’s latest statements are any indication, he still doesn’t get it. One can only wonder how high prices will have to rise before he finally wakes up to the foolishness of his continued loose money policy.

The other problem revealed at last week’s Fed press conference is that Bernanke still favors the now obsolete measure of the stock market as the ultimate barometer for the overall condition of U.S. business. While equities may still well reflect the condition of the global economy and of U.S. multinationals like General Electric or Coca Cola, it no longer accurately reflects the status of smaller, domestically based businesses. Moreover, participation among middle class Americans in the stock market has diminished drastically in recent years. There was a time when an extended stock market rally could result in the “wealth effect” and cause an improvement in consumer confidence and spending. While this is still the case with wealthy Americans, stock market rallies aren’t as big a stimulus for consumer spending and investment as they used to be.

While Bernanke remains fixated on the stock market, a better choice would be to focus on the U.S. dollar index and the crude oil price charts. This provides a much clearer picture of the impacts Bernanke’s money policy is having on the financial market and the economy.

Another result of QE2 is the steady rise in the price of gold and silver. While it can be argued that metal prices are somewhat over-extended and “overbought” the Fed’s loose money policy will only whet investors’ appetites for gold for as long as money remains loose and the dollar remains under pressure. QE2 is scheduled to end in June, at which time many analysts expect the Fed to launch another round of monetary easing. I have a hard time seeing this, however. Though we’re only a few weeks from the end of QE2, I suspect the loud clamor over the rising cost of food and fuel will put sufficient political pressure to bear on Bernanke to stop – temporarily at least – quantitative easing. If the financial market suffers a severe correction after QE2, as it did last spring after QE1 ended, Bernanke will undoubtedly be tempted to press on the monetary accelerator once again.

It has long been my position that the peaking of the 6-year cycle scheduled for around the beginning of October this year will likely see the end of the recovery. The Fed ultimately won’t be able to halt the underlying forces of long-wave deflation but it can have a short-term impact on mitigating deflation, which is what we’re witnessing now in the commodities market. Unfortunately the short-term impact is also creating a potentially catastrophic distortion on retail prices that will ultimately inflict severe economic damage before deflation makes its presence known once again.

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.