ECB Caves in on Temporary Debt Defaults, Which Country Will be Next?

Commodities / Gold and Silver 2011 Jul 19, 2011 - 04:16 PM GMTBy: Mike_Shedlock

As Greek 2-year debt yields hit 39.15% the bond market finally forced the ECB's hand, and Trichet comes out looking foolish, not only on his "we say no to default" stance, even temporary defaults, but also on his ridiculous bluff repeated for the nth time just 2 days ago regarding the acceptance of Greek bonds as collateral.

As Greek 2-year debt yields hit 39.15% the bond market finally forced the ECB's hand, and Trichet comes out looking foolish, not only on his "we say no to default" stance, even temporary defaults, but also on his ridiculous bluff repeated for the nth time just 2 days ago regarding the acceptance of Greek bonds as collateral.

Bloomberg reports Austria Central Bank Head Signals ECB May Bend on Greece

European Central Bank council member Ewald Nowotny suggested the bank may compromise and allow a temporary Greek default as officials scramble to fix a sovereign debt crisis that’s spreading to Italy and Spain before a leaders’ summit in two days.

As Spanish financing costs surged at a 4.45 billion euro ($6.31 billion) treasury bill auction today, policy makers are trying to ease a split that’s pushed interest rates on Spanish and Italian 10-year debt above 6 percent for the first time since the euro debuted 12 years ago. The ECB has until now argued that any Greek default could spark a new financial crisis, derailing a German push to make investors help foot the bill for a second bailout of the country.

Nowotny, who heads Austria’s central bank, issued a statement today concerning the “interpretation” of his earlier comments in an interview with CNBC. He is in “complete agreement” with ECB President Jean-Claude Trichet that the aim is to “avoid any situation that would make it impossible for the ECB to continue to accept Greek sovereign bonds as collateral,” the statement said.

In the CNBC interview broadcast this morning, Nowotny said there’s “a full range of options and definitions, from a clear- cut default, selective default, credit event and so on.”

“This has to be studied in a very serious way,” he said. “There are some proposals that deal with a very short-lived selective default situation that will not have major negative consequences.”

The comments helped boost financial markets amid speculation a solution to the crisis will be found. The euro rose to $1.4197 at 12:20 p.m. in Frankfurt, up from $1.4028 yesterday. Yields on Spanish and Italian 10-year bonds retreated from euro-era highs as stock markets rallied.

Spanish yields fell 17 basis points to 6.10 percent as of 12:35 P.m. in London, while Italy’s yield dropped 23 basis points to 5.72 percent. Greek two-year yields surged to 38.5 percent.

European Union leaders are meeting on July 21 to hammer out a solution to the Greek debt crisis, which has already spread to Ireland and Portugal. While Germany wants private investors to participate in a second bailout package for Greece, Trichet says the central bank won’t accept Greek government bonds as collateral for loans in the event of a default or “credit event.”

“It is our own responsibility, our own decision,” he told CNBC. “We have proved this in the case of Ireland, Greece and Portugal, with regard to what kind of collateral we accept. So there is a certain case for independence.Greece 2-Year Government Bond Yield

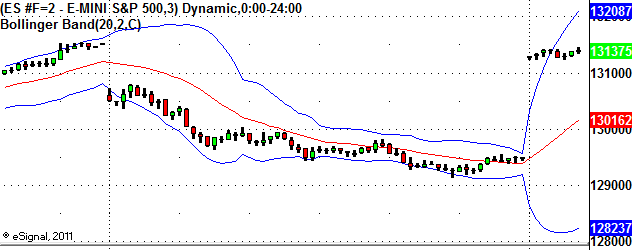

S&P 500 Futures

The market it giddy on the news as it is every time the ECB announces something of essentially no importance.

I have lost count of these opening gaps above the previous high or below the previous day's low, many producing "island reversals".

If the market does not quickly sell off today, we have the potential for another island reversal tomorrow.

ECB's Reversal

On Sunday I commented Trichet Repeats Nuclear Threat to Reject Greek Bonds as Collateral; Verbal Discipline or Big Bluff?

Verbal Discipline or Big Bluff?

Does anyone believe Trichet? Would the ECB dump its holdings of Greek bonds in a panic market?

I am suspicious about the wording "normal eligible collateral".

What about abnormal collateral, conditional collateral, temporary collateral?

The idea that verbal discipline works is nonsense. One look at sovereign debt yields in Greece, Ireland, Spain, Portugal, and Italy is proof enough.

I believe Trichet will look for some excuse to not dump Greek bonds into a panicked market should the rating agencies rule Greek debt in default. Regardless, the sooner the market puts Trichet's verbal discipline to the test, the better off Europe will be.Trial Balloon

Statements by Central Bank council member Ewald Nowotny were likely a "trial balloon" to see how the market would react. Given that the market has not panicked over them, indeed bold yields of the PIIGS are sharply lower except for Greece, Trichet will go along.

Nothing Solved

Details are not even out yet. Then again, short of a common bond "nanny state" the details are essentially irrelevant.

In spite of the stock market euphoria, nothing has been solved in any sense of the word. All of the structural problems remain.

Ireland, Spain, and Portugal are waiting on deck for the next bat at "temporary" defaults

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.