Finding Silver's Bottom!

Commodities / Gold and Silver 2011 Oct 08, 2011 - 11:35 AM GMTBy: Bob_Kirtley

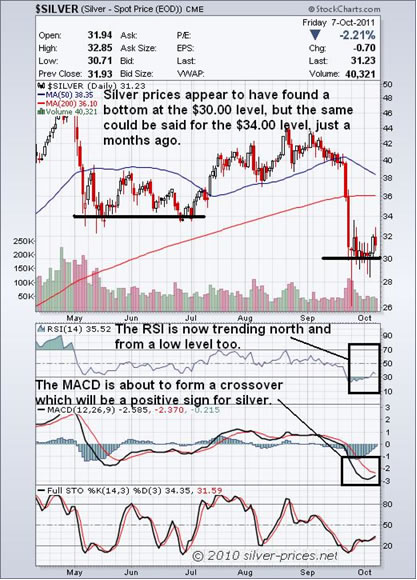

Silver prices appear to have found a bottom at the $30.00 level, however, we are looking at a very short time period and such micro analysis can make monkeys out of us. A few months ago silver prices looked to have bottomed at the $34.00 level, but the ensuing rally was short lived and once again silver got clobbered. From a technical standpoint we can see that the RSI is now trending north and from a low level too, which gives it the room to move a little higher from this point and we view it as a positive indication. The MACD is also well and truly in the oversold zone and about to form a crossover which will be another positive indication of where silver prices are going next.

However, technical analysis has its limitations and any number of factors can come into play and clobber silver once again. As we see it, those who hold the short positions have a vested interest in seeing the prices go lower. The counter argument is that the same applies to the silver bulls, but those bulls who have understood the gold and silver story and the need for ownership have already established a position and may not have the cash to increase their stake, no matter how desirous this may be. To maintain and even boost prices from here we need new blood to enter the market and implement their own acquisition programme. This we think will happen as more people recognize the mess we are in economically and politically, resulting in the quick fix, print money, head in the sand policies that are about as useful as a chocolate fire guard. As the penny drops that they need an alternative to paper money they will make the move, alas, with very little thought and they will no doubt pay over the top to get their hands on the physical silver. As an example, in the last gold bull mania period some of the staff in our office went out and bought fine, exquisitely crafted jewelry, works of art really. The point is though, that when looking for exposure to silver prices you need to acquire silver bars and coins. Works of art are for those experts who thoroughly understand the art business, a totally different market altogether.

Back to the fundamentals, the jobs figures out of the US last night were better than expected when the world's largest economy added 103,000 jobs last month, according to non-farm payrolls report, which has eased recession concerns, but for how long. The outlook is still gloomy so we would expect the next FOMC meeting, scheduled for the 2nd November to come up with some form of QE3.

Over in Eurozone both Spain and Italy have been down graded, why it has taken so long is a puzzle to us, as along with many other countries their paper is bordering worthlessness. And Germany must be questioning the wisdom of committing more and more of their finances to the lame duck, bottomless pit basket cases, that have their hands firmly held out, whilst rebelling against every austerity measure that gets proposed. Nope, it doesn't look too clever out there.

In conclusion, we are not selling any of holdings of the physical metals. We are watching the mining sector for possible bargain buying opportunities, but remain skeptical about their ability to generate returns that match the risk of such investments. Volatility remains the order of the day, and the third string to our bow is options trading, where volatility can be used to our advantage. Beyond this we have nothing else to add as we don't touch the general stocks, rightly or wrongly and we don't see us doing so for some time yet.

That's it from us so have a sparking weekend.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.