Netflix Share Price Crash on Loss of Subscribers

Companies / Tech Stocks Oct 26, 2011 - 06:38 AM GMTBy: EconMatters

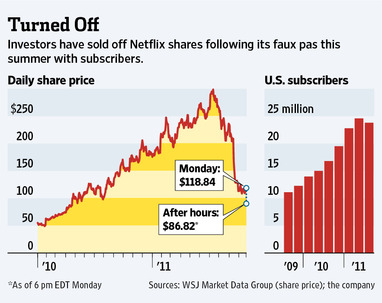

Shares of Netflix (NFLX) plummeted almost 35% to $77.37 in one day on Tue. Oct. 25 after reporting losing 800,000 U.S. subscribers in the third quarter, and predicting an unprofitable 2012 mostly due to its aggressive international expansion plan. The magnitude of the share price drop caught option traders off guard even though the options market had priced in a 15% swing in either direction.

Shares of Netflix (NFLX) plummeted almost 35% to $77.37 in one day on Tue. Oct. 25 after reporting losing 800,000 U.S. subscribers in the third quarter, and predicting an unprofitable 2012 mostly due to its aggressive international expansion plan. The magnitude of the share price drop caught option traders off guard even though the options market had priced in a 15% swing in either direction.

The company has been on a downward spiral unable to contain subscriber revolt in the past 3 months triggered by its customer infuriating 60% prices increase and splitting its DVD rental into a separate company called Kwikster. The end result? Hell has no fury like a Netflix customer scorned.....en masse.

|

| Chart Source: WSJ.com, Oct. 25, 2011 |

The abrupt cancellation of the Kwikster spinoff on Oct. 10 turned out to be too little too late. The company has lost $11 billion in market cap, and is now worth only 25% of what it was on July 13 when the stock was flying high at $298.73. The chart below shows a reversal of fortune between the year-to-date stock performance of Netflix and Netflix competitor - Amazon (AMZN). (Amazon's shares are also under pressure mostly due to its digital price war with Apple, but we don't see Amazon drop 75% in three months either.)

|

| Chart Source: Yahoo Finance, Oct. 25, 2011 |

Netflix's abandonment issue is not just limited subscribers and investors. According to Businessweek, at least five analysts downgraded Netflix on Tuesday, "citing lost management credibility and a dwindling subscriber base amid strong competition." (EconMatters already downgraded Netflix as early as Nov. 2010, and again in January 2011, and October 2011)

This is a classic case of strategy execution blunders which could be detrimental to a company that has no differentiable products like Apple (AAPL) and Samsung, albeit with a mediocre business model, and has to rely on service quality and reputation.

Another sign of the over-confidence of Netflix management: The company, reportedly has been spending its cash on repurchasing shares at extreme values above $200, instead of preserving capital for rainy days. Now the massive loss of subscribers has put Netflix cashflow under pressure, and may have become a source of concerns with at least one Netflix content partner as WSJ reported that

"DreamWorks Animation SKG CEO Jeffrey Katzenberg said in an interview Tuesday that he is "unequivocally" confident that Netflix will continue being able to keep paying for movies and television shows at its current rates." It is not a good sign when a business partner has to tell reporters that he is confident about your ability to pay (so that his company stocks (DWA) won't get dragged down as well). DreamWorks Animation recently struck an exclusive deal with Netflix worth about $30 million a picture replacing DreamWorks current deal with HBO, which expires in 2013. .

With its reputation and creditability threshed in just three months, there could already be conversations at the board of directors level regarding Reed Hastings staying on as the CEO, as Busienssweek reported,

"....Reed Hastings, responding to questions, said he has no plans to step down and declined to comment on discussions with Netflix directors."

Its U.S. subscriber base was the ace in the hole for Netflix in getting deals from movie studios and to finance its international expansion. Now Businessweek quoted Netflix projecting to add only up to 52,000 domestic streaming customers over the holiday period, while losing as many as 3.63 million high-margin DVD subscribers,

So ironically, Netflix may need to do some heavy marketing to earn back riled subscribers, which may involve hefty price cuts and incentives. In any case, most indicators point to a suffering of near term profitability, and a long and lonely road back to the past glory.

For now, it seems most of the market bulls have leaned the lesson on Netlfix as WSJ notes,

".... Weekly put options to sell [Netflix] shares for prices like $70 also were active. Roughly 172,000 Netflix put options traded, versus roughly 177,000 calls."

Disclosure: No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.