European Debt Is ‘Obviously Unserviceable’

Stock-Markets / Eurozone Debt Crisis Dec 23, 2011 - 10:45 AM GMTBy: Chris_Ciovacco

Referencing Kyle Bass’ work in a December 18 video, we noted numerous countries have an unstable combination of debt and revenue relative to the size of their banking system. Another excellent source for debt sustainability analysis comes from Jeffery Gundlach, manager of the 2011 top-performing U.S. bond fund. Mr. Gundlach was recently interviewed by the Financial Times. He does not subscribe to the theory European leaders can “put a Band Aid on a system which didn’t break a week ago, or a month ago, or a year ago. It’s been in the process for years.” His analysis came to the same conclusion as Mr. Bass’; default on unpayable obligations will occur. He also believes growing the way out of the problem is not an option since the debt is “obviously unserviceable”.

Referencing Kyle Bass’ work in a December 18 video, we noted numerous countries have an unstable combination of debt and revenue relative to the size of their banking system. Another excellent source for debt sustainability analysis comes from Jeffery Gundlach, manager of the 2011 top-performing U.S. bond fund. Mr. Gundlach was recently interviewed by the Financial Times. He does not subscribe to the theory European leaders can “put a Band Aid on a system which didn’t break a week ago, or a month ago, or a year ago. It’s been in the process for years.” His analysis came to the same conclusion as Mr. Bass’; default on unpayable obligations will occur. He also believes growing the way out of the problem is not an option since the debt is “obviously unserviceable”.

Mr. Gundlach summarized the gravity of the situation as follows (Financial Times, 12/21/2011):

“The 2008 problem was a private economy problem and businesses – the business owners – do try, and are incentivized by laws and penalties, to tell the truth when they have earnings calls every quarter. The difference here is it is not company-based. This is a government-based problem and a public economy, public sector problem and the issue that’s so problematic is that the politicians won’t tell you the truth.”

The challenge for investors is getting a handle on the next outcome; is it inflationary or deflationary? In the end, “solutions” will most likely include defaults, writedowns, and money printing. Writedowns and defaults point to deflationary/bearish outcomes for risk and inflation-protection assets. Money printing eventually sparks inflation.

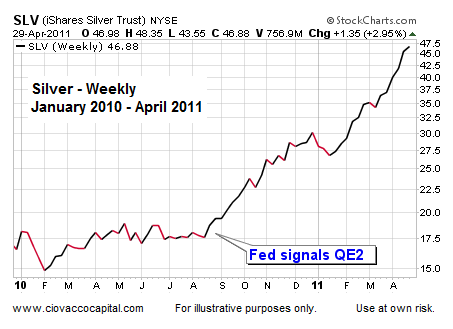

We can understand what the markets are anticipating by examining the intermediate-term outlook for silver, the U.S. dollar, and euro. Silver was a big beneficiary of the Fed’s quantitative easing programs, which captured the market’s concerns about future inflation.

The situation in Europe became more concerning to the markets the weekend of April 29, 2011. Some signs of weakness in China also surfaced; something we may see more of in 2012.

From the Associated Press (4/29/2011):

Investors are concerned about a pair of recent announcements that point to weaker demand and even lower energy prices this year. Greece, at the center of the European debt crisis, said over the weekend that it will miss its lower spending targets despite severe cost-cutting. And China’s manufacturing sector appeared to cool off in September.

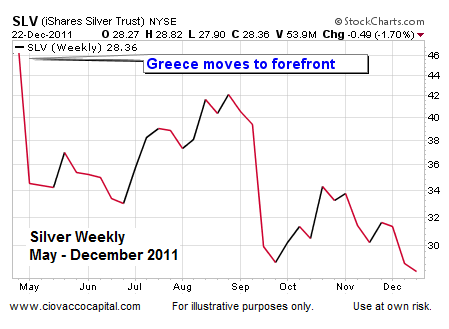

With concerns escalating about unsustainable debt in Europe, silver took on a deflationary/bearish look.

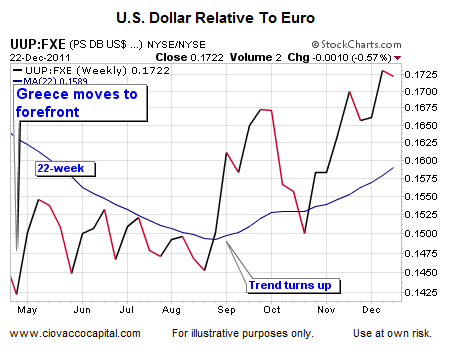

While it is almost comical when you consider the unsustainable debt in the United States, the U.S. Dollar (UUP) is still considered to be a “safe haven” currency. Since Europe became the primary driver of the financial markets, concerns about the health of the euro (FXE) have escalated as shown by the performance of the U.S. dollar relative to the euro. If the strong correlation between the euro and stocks remains in place, the chart below points to renewed equity weakness in early 2012.

While the S&P 500 could rally above 1,300 and the euro could experience a short-covering rally, the trends point to deflationary and bearish outcomes in the first half of 2012. All trends are subject to change, but presently they align with both Mr. Bass and Mr. Gundlach. It is doubtful many market participants understand the numbers in Europe better than these two men.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.