Return of the Gold Commission? Would it Raise the Gold Price? Confiscation?

Commodities / Gold and Silver 2012 Jan 25, 2012 - 11:07 AM GMT Newt Gingrich

Newt Gingrich

The answer to this question is threefold

- It depends on him being elected to a position where he can put this into action.

- It depends on how serious he is on the matter.

- It depends on what his objective really is.

With trust in governments dropping to a new low according to some polls, the words of President Hoover come to mind, "We have gold because we cannot trust governments!"

And why should they trust governments, when they look at a residual value of the dollar at 15% of its value since the U.S. left the link to gold? It's this depreciation that is becoming more and more important. The importance of the issue has risen in line with the globalization of the dollar, particularly now that the U.S. is utterly dependent on the investment of foreign dollar surpluses being reinvested back into the dollar and U.S. Treasuries. Unless this is properly and effectively handled in time, there will be a day when foreign investors say that enough is enough. At the moment, foreign governments are working hard to neutralize the damage a dollar, lacking credibility, will do. So it's only a matter of time before a major dollar financial accident takes place. The invigoration of gold in the monetary system is long overdue, but now it is receiving some serious initial attention. Hopefully, it is not just a political ploy to take the wind out of Ron Paul's campaign?

What has happened by his raising the subject onto the political stage is that it is no longer a side-lined academic issue. From now on as it follows the fortunes of Gingrich and his success it will impact the gold price inside the U.S. of A.

Why Gold's Return to the Monetary System Been Blocked?

Government and bankers currently believe that gold places to great a restraint on them and their management of the monetary system. They will not accept a lump of metal at a fixed price limiting the money supply. The Gold Standard set a dollar price to gold that did not change from $20 an ounce to $35 an ounce until 1935. It held that level until 1971 when it was raised to $42 an ounce. Since then like the proverbial ostrich with it head in the sand, the gold price has been ignored in 'official' circles.

Today central bankers and government favour paper money as they use it to 'maintain price stability', to stimulate the economy through the expansion of the money supply, to pay import bills with freshly printed money, to increase money supply in line with global international trade -in its role as the reserve currency. Indeed if it had to pay for imports with gold, it would founder very quickly. The ability to print money is the principal reason why gold is to be avoided in anything like a repeat of the Gold Standard. With Gingrich's promise of a Gold Commission, will we see a serious attempt to return gold to the monetary system? Let's look at the last one.

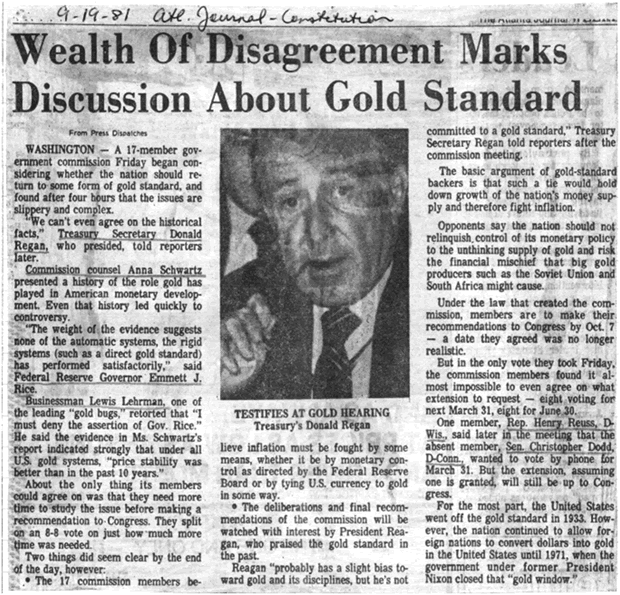

The 1981 "Gold Commission"

Under Treasury Secretary Donald Regan, the subject came up, but as you can see from the following cutting from September 1981, the issue was not handled with a view to using gold again. It was a token gesture to proponents of gold to pacify them. Really it was just a sad mockery of the treatment of gold. Thereafter the subject was not treated seriously at all. It was not until the euro was created and limited gold sales were made by European central banks to help the establishment of the euro as a credible currency, was the subject of gold mentioned again.

In the Washington Agreement and successive agreements thereafter, gold was described as "an important element of global monetary reserves." It was at that point it ceased being mocked as "a Barbarous Relic".

The Washington Agreement, despite its being an agreement to sell gold, was the most significant event responsible for gold's rising price. Once it became clear that the European central banks, who were the signatories to the agreements since the turn of the century, had lost their appetite for selling gold as the price started to rocket from 2005 onwards, even central bankers started to take gold seriously again.

The silence from the developed world on the subject is deafening now. Will this continue?

Politicians are adept at feeling out the public by leading from the front and Newt Gingrich is no fool. He has seen the public's reaction to the bait he threw out on the subject. Most Americans want to know that their dollar will hold its value in the future. They're fully aware that its current value is 15% of 1971's value and know that the Pension pay out they will get when they finish their working life may not be sufficient to cover their old age. So it's turning out to be a good electioneering ploy at least. But as the leader of the Republicans, can we really expect him to walk this road?

Gov't Raising Gold Prices?

As one competent commentator projected, it will take a gold price of around $45,000 to compensate for the loss of value in gold and for it to be at a price that will allow the money supply to remain at present levels and for some time, sufficient to supply global dollar monetary needs.

Yes, it is a fact that if anything -like a return to a 'workable' gold standard--is to be contemplated then we will have to see a very substantial lifting of the gold price.

One of the neat tricks the Roosevelt government pulled back in 1935 was to expand the money supply by expanding its gold holdings quickly and massively. By not altering the dollar exchange rate against other currencies but devaluing the dollar by 75% against gold, the price of gold not only shot up in the dollar but in all other currencies as well. The bullion banks were quick to arbitrage the differential between the $20 exchange rate and the $35 price of gold and sell as much as they could find the world over to the U.S. So the U.S. bought in gold at $35 and boosted their gold reserves to around 26,000 tonnes. This was quite a coup and lifted the money supply to levels that lifted the U.S. out of its depression -while pulling in the developed world's gold ahead of the Second World War.

In the last few years we've seen a dramatic increase in the money supply in the developed world, but as is always the case with potential out-of-control inflation, money supply is increased this fast to fill the holes left by plummeting asset values in government and banking hands. The process can accelerate as the value of that money depreciates. This has and is happening now. Can this continue ad infinitum?

Of course not -even now emerging world central banks are buying annually, more than the Central Banks of Europe did at their most vigorous via the central bank gold agreements at 450 tonnes in 2011. Make no mistake -this is not just a swing away from the bloated dollar component of their reserves, but a counter to all currencies under the control of governments. It's more significantly an expression of central bank worries about currencies.

It will be recognized that this is not the gold price rising but the value of currencies (against gold) falling.

Gold Confiscated Again?

The second neat trick, before that, in 1933 under the gold standard, was to remove the danger of gold price manipulation by private gold owners by barring private ownership of gold. Thus gold became the sole domain of government. This was a key factor in the successful operation of gold's role in the monetary system.

It would have to be repeated in any future gold price dominated system, or would it?

But let's get one thing very clear -there is no chance of a repeat of the gold standard as it was in the past. Certain fundamental changes have taken place to prevent that from happening, so we have to look at a structurally-altered system for anything like the gold standard to work. Is that possible?

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2012 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.