Why The Dollar and Stocks Could Start Moving In The Same Direction

Currencies / Forex Trading Mar 13, 2012 - 04:12 AM GMTBy: Bryan_Rich

The theme of the global financial markets is now moving more toward the realization that growth will be ultra-slow (if not recession like territory), unemployment will remain persistently high and global economic shocks will continue to roll through. This is an important realization. Up until recently, the consensus has been that each economic shock or event along the way has been holding the world back from a return to normalcy – a full recovery.

The theme of the global financial markets is now moving more toward the realization that growth will be ultra-slow (if not recession like territory), unemployment will remain persistently high and global economic shocks will continue to roll through. This is an important realization. Up until recently, the consensus has been that each economic shock or event along the way has been holding the world back from a return to normalcy – a full recovery.

This past week, Europe (NYSEArca:VGK) seems to have dodged another bullet – extending the timeline of Greece (NYSEArca:GREK) and the euro (NYSEArca:FXE) until the next big hurdle, which is a Greek election in April. China (NYSEArca:FXI) revised down its economic growth … and central bankers from Canada and Europe (NYSEArca:IEV) followed the Fed’s lead by showing less leaning toward more emergency-like monetary policy.

The environment now appears to be shifting for financial markets, for the near term. That shift is away from assessing global economic shock risks, and toward assessing which economies will be performing better in a world of sluggish growth. That means we could see markets behaving differently than what has been typical in recent years.

EURUSD

In the chart below, you can see the key trendline we were watching going into last weekend (the white line) — the line that represents the retracement from the January lows.

We got a break of this line this past week. And looking back at the double top that was marked at 1.3487, the bearish scenario (NYSEArca:EUO) is appearing to play out for the euro — that is, a scenario where the euro theme starts moving away from imminent blow up risk and toward the realities of recession and austerity riddled economies.

The Euro’s Demise Has Been Set in Motion: Are you protected? "Nationalism will emerge. Healthier countries will not see fit to spend their hard earned money to bail out their less responsible neighbors." CLICK HERE to get your Free E-Book, “Why It’s Curtains for the Euro”

I made the point last week, that IF the official interest (i.e. sovereign wealth funds, the Bank for International Settlements, central banks) think that the euro is out of the woods for the moment, they may stop propping it up and start selling what they have accumulated.

With that scenario in mind, you can see the right shoulder of a bearish head and shoulders forming (in the chart below).

This pattern, considering a neckline that comes in just below these lows of the week would target a move back to the January lows … in the mid 1.26 area.

Also supportive of the bearish case, we have the bearish outside day on March 1 that still holds. That was driven by Bernanke’s messaging as he spoke to Congress on Feb. 29 and March 1. That message was clearly less QE3 risk. That’s dollar positive.

Now, let’s look at the alternative scenario (the bullish scenario). This is the scenario we’ve been looking at, that argued for a continuation of the EURUSD retracement into the end of March, early April. We got the extension up to nearly 1.35 – just a bit shy of what was projected (the 1.36-1.38 area).

With the big trend break this week (below the white line in the chart above), the slope of this climb in the EURUSD from January has now flattened some, and the target comes in a bit lower 1.3500 – 1.3750 area. We would need a convincing break below this 1.3080 to take this scenario off the table.

For now, we’ve gotten past the debt deal in Greece. And the funding for Greece to rollover its March 20 debt appears to be a done deal. From here, expect the drama to subside for a bit. The next big risk becomes Greek elections in April, when they determine a new government. From there, we will see if they will indeed have the political will to keep pushing through reform and austerity OR if they will reject and attempt to renegotiate. That would put the bailout funds necessary to keep Greece afloat at risk of being pulled (rescinded from the EU/IMF). Also, the other key risk to the euro that will likely emerge in the coming weeks: Ireland (NYSEArca:EIRL) and Portugal will likely come demanding for a write down in their debt. If Greece gets it … why not us.

If the euro were to bounce from here and keep that trajectory toward 1.3500- 1.3750 area, these issues would throw a big wrench in that continued retracement.

Overall, the longer term moving averages remain bearish for the EURUSD. If we get below 1.3080 in the EURUSD this week, the euro looks like a currency to sell against everything.

For a look at the ultimate fate of the euro, be sure to read my new ebook, IT’S CURTAINS FOR THE EURO … you can read it here.

GBPUSD

In the pound, we looked at this long term line last week. The pound has held this long term wedge pattern, and now trades back toward the middle of this wedge. The downside line would target a move to the 2012 lows of 1.5235 area.

The moving averages remain bearish. On the daily chart, like in the EURUSD, we got a break of this trendline (the white line in the chart below) that represents the move from the January lows.

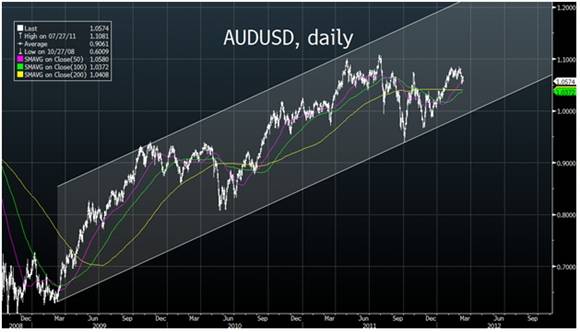

AUDUSD

We got a similar trend break in the AUDUSD (the white line from the November lows). The AUDUSD came back to that line later in the week (now resistance) and failed.

Stepping back a bit, the Aussie remains above the 200-day moving average. So the picture here is a bit more mixed.

And you can see here, the longer term view, the AUDUSD sits toward the middle area of this long term uptrend.

USDJPY

Some of the favored dollar pairs (EURUSD, GBPUSD, AUDUSD) have less clear pictures for a reason. Because much of market focus has turned squarely toward the yen. Given that the Fed, ECB and BOC have now, in the past week and a half, become notably less leaning toward QE, that fuels even more interest in buying USDJPY (as less QE = higher US yields = a potential for a widening yield differential between the US and Japan = a strong dollar). And given a major imminent economic shock has become much less likely in the past week, the appetite to buy higher yielding currencies against the yen is growing.

In the longer term chart above, this channel coming in from the 2007 top shows where this trend change we’ve seen in recent months could take USDJPY. A move to just shy of 100 USDJPY would keep USDJPY in this bearish channel. But given the major policy move by the BOJ to fight a deflation problem they’ve been battling for two decades – this top channel line will be highly vulnerable to break when it gets there.

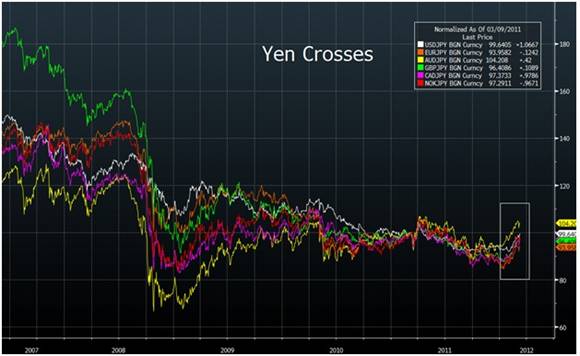

YEN CROSSES

Last week I mentioned that I think people have underestimated the magnitude of this recent BOJ policy change — and the impact on the yen (NYSEArca:FXY). I said “It makes the yen pairs a huge trade opportunity.” In this chart below we can see it taking shape, from the big trend break in USDJPY, we now have seen five consecutive higher weekly closes.

… and the yen crosses have followed.

EMERGING MARKET CURRENCIES

Here’s a look at the emerging market currencies — with the resurgence of the yen as a funding currency (i.e. rebuilding the yen carry trade) we would expect the emerging market currencies to be rallying…but they didn’t participate so much this week

The emerging market currencies were held back due to broad dollar strength … but mostly because Brazil is ramping up its currency defense. It sees the writing on the wall — i.e. that its currency and other EM currencies are vulnerable to big run higher, as part of the need for global economic rebalancing.

S&P 500

Finally a look at stocks (NYSEArca:SPY) here….

We are seeing more of this breakdown of the risk-on/risk-off dynamic. On Friday, the EURUSD got clubbed, but stocks grinded higher.

Stocks here look to make a significant technical breakout (NYSEArca:SSO) if we get above 1378 next week. This red line that broke (in the chart above), which coincided with many of the trendline breaks in currencies this past week, has failed. Stocks now trade back above that line and look poised to take out the 1378 highs.

This correlation break-down of the risk-on/risk-off dynamic is evident in global yields and across other currencies. These behaviors continue to represent a world where monetary policy is ultra-easy and growth has a persistently sluggish outlook. With that, the market is beginning to focus on outperformers, instead of throwing everything in the risk-on/risk-off bucket.

I think the USDJPY trade also plays into the bull case for stocks here. As global investors continue to plow into USDJPY, they use the dollars to buy stocks … and likely treasuries as well. That keeps US yields contained around historic lows and stocks grinding higher.

PS: Despite the drama surrounding bailouts in Europe, the euro still has a very grim outlook. I’ve just penned a new E-Book titled It’s Curtains for the Euro, detailing why I think its ultimately doomed — you can read it here.

Want to subscribe to Global ETF Monthly? To help you through this next wave of global financial crisis that is coming, I’d like to invite you to join my new monthly advisory service Global ETF Monthly. In this monthly publication I share my unbiased research and opinion on the hottest and safest ETF investments, to help you grow your wealth and protect it. Join now! Just click here ….

Bryan Rich began his trading career with a $600 million family office hedge fund in London. Later, he was a senior trader for a $750 million leading global hedge fund in South Florida. There, he helped manage and trade a multi-billion dollar foreign exchange options portfolio. Bryan is the lead analyst of Global ETF Monthly a monthly electronic investment newsletter published by ETF Daily News. Global ETF Monthly focuses on providing the best insight and advice on global investment opportunities by utilizing easy-to-trade exchange traded funds (ETFs).

© 2012 Copyright Bryan Rich - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.