The Acquisition of Gold Mining Stocks is a Question of Timing

Commodities / Gold & Silver Stocks May 02, 2012 - 07:36 AM GMTBy: Bob_Kirtley

In an attempt to maximize the profits on our investments we consider that the timing of any purchase of precious metals mining stocks to be of paramount importance. To that end we have not increased our exposure to this sector since our last purchase, which was in February 2011 and on reflection we are pleased with our decision to keep our powder dry until the opportunity presents itself whereby we bag a jolly good bargain.

In an attempt to maximize the profits on our investments we consider that the timing of any purchase of precious metals mining stocks to be of paramount importance. To that end we have not increased our exposure to this sector since our last purchase, which was in February 2011 and on reflection we are pleased with our decision to keep our powder dry until the opportunity presents itself whereby we bag a jolly good bargain.

One of the hardest things to do as an investor is to sit on your hands when it appears that everyone around you is actively engaged on the acquisition trail as they add the latest 'hot stock' to their portfolio. The mantra of buy the juniors, buy the mid caps, buy the large caps, has been trumpeted loud and clear over the last year or so, with the result that many investors have indeed caught the following knife. There are exceptions to the rule and those who are exceptional stock pickers may have secured profitable trades, however, as the HUI, the Gold Bugs Index clearly indicates, its been a poorly performing market sector for the last eighteen months or so.

There are however, many positive observations that can be identified in this sector, such the increases in earnings, the much lower P/E ratios, the cash piles that are starting to mount in the miners coffers, etc. The lower stock prices are too much to resist for some investors as what is on offer represents a bargain when compared to the situation in years gone by. But that comparison does not mean that it is bargain today, it only means that we have a cheaper entry point. In discussions with our various colleagues across the globe, we are given sound and valid reasons for buying gold, which we wholeheartedly agree with. However, those reasons do not automatically apply to gold stocks. They are two very different investment vehicles, the latter being subject to a multitude of downside risks, for which there needs to be a premium in terms of returns, in order to make them attractive to us as investors. Of late the stocks have failed to keep up let alone offer any sort of leverage to gold prices and so, rightly and wrongly we remained patient and were not tempted to buy.

Now, the time to buy could well be coming closer but we would ask you to bear in mind that the advent of the ETF's has rendered trading in gold easy and simple to do. At the click of a button you can be in and out of trade in the same day if you so require. An ETF has its own inherent risks, however it does remove the risk of political uncertainty, poorly managed companies, construction delays, rising labour costs, rising energy costs, etc, that are prevalent in the mining industry.

Another consideration is the possibility of a banking crises, similar to that of 2008. We are all aware of the massive amount of money creation that was required to provide liquidity for what were effectively bankrupt enterprises, towns, states and countries. Well not a lot has changed on that front other than we gained some time in order to try and re-group and we all know that isn’t going too well at the moment. The point being is that should we get a major default, a too big to bail default, then the financial markets will experience the 'mother of all' sell offs as everyone and his dog scramble to liquidate their positions. If such a catastrophe comes our way do you think that gold mining stocks will be spared, not a snow ball in hells chance of that happening. So, with our arms tightly folded we continue to refuse to be drawn into the 'buy now while stocks last' environment and we will wait as patiently as we can for a major correction to deliver rock bottom buying prices for us to take advantage of.

As many of our peers are recommending an accumulate now strategy we would ask that you read as widely as possible in order to gain as much knowledge as you can about this tiny and rather volatile sector. As you can appreciate it is difficult for us to take this contrarious stand at the moment, but it is our hard earned cash that is on the line and so we must trade according to our own research and beliefs.

For the record we do continue to hold onto our core position of mining stocks, our physical gold and our previous premise that the use of options offers leverage were mining does not, is paying off handsomely.

As a retail investor you are unique, its your money and your call to make and so we wish you every success in the implementation of your investment strategy.

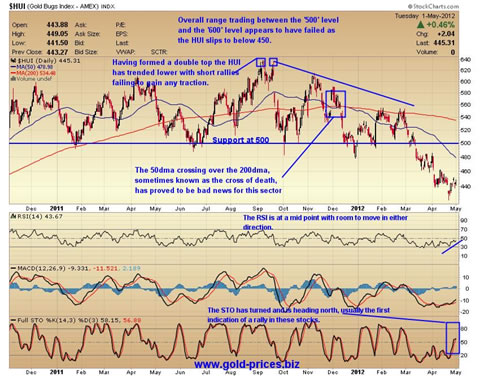

Finally a quick look at the chart of the HUI which is not a pretty sight, as we can see the 50dma has crossed over the 200dma in a downward direction, sometimes known as the cross of death and on this occasion has proved to be bad news for the gold mining sector. The overall trading range had stood between the '500' level and the '600' level, but unfortunately this appears to have failed as the HUI closed below 450 yesterday. The formation of a double top has also been a negative for the HUI as it has trended lower with short rallies failing to gain any traction.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.