The End Of Oil And The Coming Electric Economy

Commodities / Electricity Nov 27, 2012 - 11:52 AM GMTBy: Andrew_McKillop

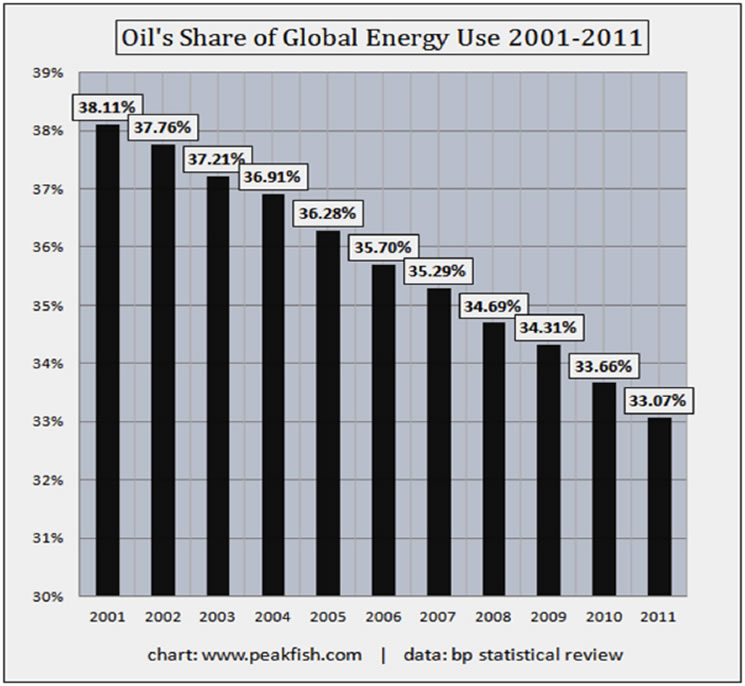

To be sure, rumours of the impending death of oil are exaggerated and anticipate trends - but since 2001 the trend continues. Using IEA data, in 1973 the OECD countries sourced 53% of their total energy supply from oil, underlining that the post-2001 trend is anything but new.

To be sure, rumours of the impending death of oil are exaggerated and anticipate trends - but since 2001 the trend continues. Using IEA data, in 1973 the OECD countries sourced 53% of their total energy supply from oil, underlining that the post-2001 trend is anything but new.

What comes next is the real question. This decline of oil in the global economy easily explains why the weak rebound of global fossil energy demand since the 2008 debt-and-deficit or financial-economic crisis has given wings to, and grown legs along the world's powergrids. These are increasingly fed by renewable-source power supplies. Not only in the US, but also in Japan, and especially in Europe oil use has gone on declining right through “the recovery-that-isnt,” as increasing numbers of especially younger car drivers simply abandon using cars in cities, as jet travel declines, as trucking in many countries shifts to a deployment of truck/rail freight, and as global marine heavy transport has yet to recover 2008 levels of activity, if it ever does.

For several reasons - not only the massive growth of renewable energy and continuing political elite interest in climate change mitigation - the electric power sector is favoured. The "metered economy" offers interesting opportunities, for governments, to more precisely and thoroughly control and tax energy. However, all this opens up new constraints as well as new opportunities, because in the real world, the growth of global electricity supply at the global level is largely driven by coal.

WHAT DO WE DO WITH KING COAL?

Awareness of coal’s role is going to widen and governments are going to be drawn into action over coal. For the moment this has a strong North/South (or West/East) flavour. Most OECD countries, or "the North" have coal-hostile energy, environment, climate and economic policies and regulations. In some cases, especially the US, the explosive growth of shale gas supply applies a strong additional headwind to coal - which Mitt Romney's election campaign tried to exploit against Obama. This did not work. US coal production is heavily mechanized, its coal output per employee is extremely high, for decades it has moved away from the Appalachians, away from deep underground mining, to surface stripmining, but none of this can save it. The lowest cost stripmine producers in the US, today, are forced to sell their coal at prices near $10 a ton: that is $2 per barrel equivalent of energy.

At the other end of the power plant and power grid value chain, electricity consumers in the highest-price countries and regions - Europe and Japan - pay as much as 15-20 US cents per kWh, pricing their electricity at around $300 per barrel equivalent of energy.

Coal-fired power plants still operate in the US, Japan and Europe for sure, but their primacy is heavily compromised. To be sure, the US can and will export cheap coal, but the coming wipeout is traced as renewable power output is ramped up at typical annual rates of 15% or higher, feeding national power systems where annual electricity demand growth is often close to zero. The situation in "the South", or East is totally different. Both China and India are totally dependent on coal-fired power supply, for national power systems where, even today, following a large and continuing decline in annual growth trends, electricity demand still grows at well above 5% per year. China's rebalancing, which surely targets further action to push down China's growth rate of oil demand, also features growth of the "electrotechnical industries", the lighter, higher value added manufacturing industries outside the "classic" heavy industrial domain.

Coal importing is a different story, due to transport and handling infrastructures, and demand saturation effects in several Emerging economies - including China. Coal is no longer a sure bet for investors, with plenty of collateral damage for the unwary, like the London-listed Indonesian-based Bumi Resources Group, which as recently as 2011, on the back of coal import demand forecasts for India, China and other Emerging economies, was a "sure fire winner". Global coal markets have sputtered in the face of slower demand growth in China and this country's increasingly neutral stance on coal, India's coal infrastructure problems and increasingly tight environmental regulations, and the rise of shale gas output in the United States. World coal faces years of "dislocated consumption" trends.

THE RETURN OF CARBON TAX

Other factors will weigh-in heavier. Apart from the pincer effect of soaring US gas output and tighter environmental regulations in all OECD countries, and the menace of new carbon taxes from freshly-reelected Obama's administration, both US coal and world coal face a more important phenomenon which will certainly affect global energy consumption in coming decades.

Much or most of the upswing in Asian coal demand over the past decade, especially in China but also in India, was in fact only due to offshoring of OECD manufacturing capacity. In other words, an increasing proportion of goods purchased by OECD consumers since the year 2000 is the result of goods made in Asia. These goods are made in factories powered by coal-fired electricity. Clothing, furniture, appliances, cycles, scooters and increasingly cars, electronic devices – and certainly iPhones, too – are made with coal.

China’s phenomenal economic growth has been based on exports, notably of energy-intensive goods, starting with steel and petrochemicals, then moving on to a host of manufactured products. These manufactured goods are the real nub of the trade deficit crisis, which deepens and aggravates the US, European and Japanese economic crisis of today. It is carbon consumption by area and region which measures the carbon footprint and hence responsibility for carbon-related climate change (accepting that all global elites believe in global warming, hand on heart). It is not carbon production in particular geographical regions and areas. Until today, the Kyoto framework (the UN-related FCCC) does not take carbon consumption into account, but focuses on carbon production. In Europe and the US, where deindustrialization cuts carbon production, as in the industrially-collapsed ex-Soviet Union, compliance with Kyoto targets is easy. Too easy.

Politically speaking, carbon taxation was and has been a very tough sell, especially in the United States, but this is certainly changing. Immediately after his re-election, trial balloons have come thick and fast from the Obama Administration - with the new angle that carbon taxes are a way to lower the US budget deficit and beat the fiscal cliff. Freak weather events have certainly helped in the US: the new push for carbon taxes comes in the wake of Hurricane Sandy and this summer’s extraordinarily hot American summer and its related drought.

To be sure, carbon tax policy will not necessarily spur faster growth of renewable energy, and even less automatically reindustrialise or "repatriate industry" from abroard - meaning Asia. Essentially, if getting renewable energy infrastructure built was the ultimate climate change mitigating goal, straddling climate policy and energy policy, national feed-in tariffs (FITs), of the kind used in Europe, can do the job. As a policy tool, in Europe, FITs have been a major success - to stimulate renewable energy development. But this has done little or nothing to repatriate industry and, excepting Germany, trade deficit crisis is an ongoing ball-and-chain for European (and increasingly Japanese) national finances.

THE ALL ELECTRIC ECONOMY

As far back as Lenin's Goelro electrification plan for the early Soviet Union, to the USA's Tennessee Valley power plan of the 1930's to create jobs and re-power the US, to the nuclear power development plans of many major powers through 1955-1985, and Germany's Energiewende plan of today - as well as giant programs for electrification in China and India - the all electric economy has attracted policy makers and political deciders for nearly a century. Linked with the political urge to mitigate climate change and cut carbon emssions - and the need to reindustrialise, create jobs and cut trade deficits - the emerging outlook is for the faster development of electrification in many countries.

As we noted at the start of this article, the "metered economy" is a lot easier to control and tax, than the free-ranging, oil-based economy symbolized by the image of mass car ownership - and daily mass traffic jams in polluted cities. For the OECD countries, the age of "Trente Glorieuse" (1948-1975) fast economic growth on the back on oil, steel, petrochemicals, the automobile industry and urban growth is now a long way back in time. Looking at the energy statistics, and in fact, coal was at least as important to this historic growth phase of the West, as oil.

Clean energy and climate change mitigation - and the repatriation of "lost industries" - all point to electricity, from renewable energy sources and clean-burning abundant gas. The critical need to raise government tax receipts is also answered by La Fee Electrique, as French policy makers called their nuclear program, until very recently. Electricity consumers in Europe and Japan, as we already noted, already pay as much or more for electricity, as they pay for gasoline and diesel fuel at the filling station, measured on a unit energy cost basis.

Metering is easy. The electric power industry in many OECD countries has only recently been de-nationalized and can easily be re-nationalized if needed. The industry is heavily concentrated, like the oil industry, but is above all an "onshore industry", unlike oil. The emerging shift in energy, climate and industrial policy in OECD countries, possibly spearheaded by Obama's Administration and certainly focused in Germany by Merkel's Administration, will shift this policy away from climate and energy, and move it towards the urgent goal of reindustrialisation.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2012 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.