Gold: The Hidden Dangers?

Commodities / Gold and Silver 2012 Dec 06, 2012 - 01:40 PM GMTBy: MarketShadows

Courtesy of Dr. Paul Price : Extensive money printing (QE programs) have had many traders stocking up on Gold via ETFs, ETNs, physical coins & bars and through shares of precious metal mining companies. This urge to own hard assets in a soft money environment makes sense on an intuitive basis.

Courtesy of Dr. Paul Price : Extensive money printing (QE programs) have had many traders stocking up on Gold via ETFs, ETNs, physical coins & bars and through shares of precious metal mining companies. This urge to own hard assets in a soft money environment makes sense on an intuitive basis.

The first two of those statements appear indisputable. Is gold really an inflation hedge? That is subject to debate.

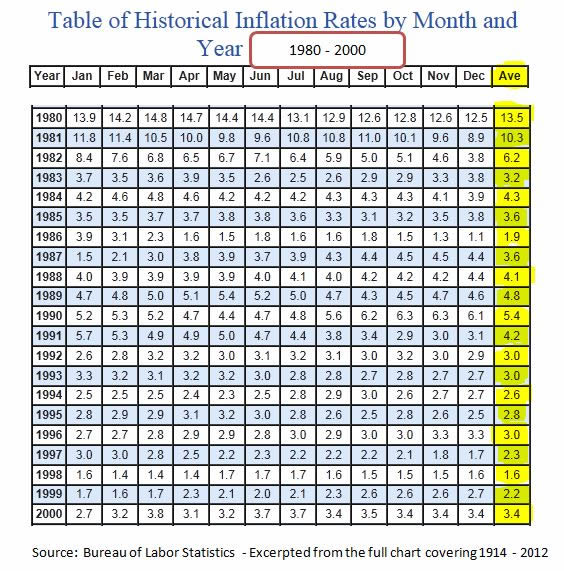

Gold peaked in 1980 at about $850 per ounce. Gold bottomed in 2000 at about $250 per ounce. Annual inflation in the early 1980’s was running in the double-digits. In the 1990s, inflation calmed down but we still saw significant price increases during each and every year. (For more on inflation, see Washington’s Biggest Lie (and Why it Continues to be Told))

CPI (1980 to 2000) inflated by a cumulative 137.24%.

Gold decreased in price by 70.58% (from a high of $850 to $250).

Underperforming by 207.82% over a 20-year period would strain the patience of even the most ardent “gold is an inflation hedge” advocates.

When Gold touched its 1980 high pundits were calling for $2,500 – $3,000 per ounce. 32 years later they’re still waiting. We’ve been hearing $5,000 – $10,000 numbers thrown around recently. Will those predictions prove more accurate? Only time will tell.

Betting on Gold to hold value versus ‘full faith and credit’ fiat currencies does seem appealing. What are the hidden problems with employing some portion of your portfolio in this way?

Recent history shows at least some custodians of your warehoused Gold to have been unreliable. For example, commodity brokerage firms MF Global and Peregrine Financial both failed to protect customer interests in the physical gold ‘safeguarded’ by them.

If you correctly bet on Gold going up you still may never even see your original stake returned, let alone any paper profits. Speculators were willing to risk price fluctuations. They didn’t know they were also subject to outright theft of their property.

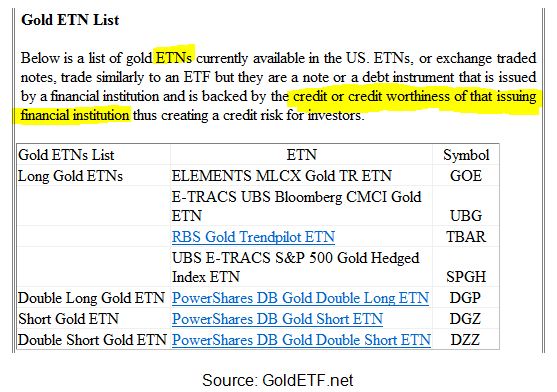

Many traders today play Gold movements with ETNs (Electronically Traded Notes) without knowing these have bigger risks than simply the metal’s price action. These ETNs are unsecured obligations of their issuing financial sponsors

It’s no surprise the list above was compiled by issuers of safer Gold ETFs (Electronically Traded Funds).

Physical delivery of Krugerrands, American Eagle gold coins and or bullion bars, and holding them in your own safe seems to avoid the custodial problems. Now, word from ZeroHedge.com confirms that Chinese companies have been actively promoting the sale of assorted counterfeit gold plated items ‘for legal purposes only’.

See the links below for the original articles reporting on this very disturbing practice. The fakes are of such good quality that even professionals have been fooled.

http://www.zerohedge.com/news/2012-09-24/get-your-fake-tungsten-filled-gold-coins-here

http://www.zerohedge.com/news/tungsten-filled-10-oz-gold-bar-found-middle-manhattans-jewelry-district

Worse still, these practices call into question the authenticity of every existing coin and bar in both private and even government vaults. The only way to confirm purity is to open the packaging and drill into the cores of each and every individual item.

This is expensive to do and decreases the value of the underlying gold even if everything checks out. But who will buy your personal stash without knowing for sure if it is the real thing?

The known counterfeiting of well-respected gold coins and bars has now forever damaged the ability to sell gold without huge, value-sapping authenticity testing.

I used to favor shares of mining companies as a safer, liquid, back-door play on rising inflation. However, worldwide political forces and heavy government debt have been catalyzing repudiation of long-term contracts and unilateral nationalization of foreign assets.

The good of days of paying the promised royalties to less developed nations while mining their natural resources appears to be coming to an end. This explains what look like bargain prices on industry leaders like BHP, RIO, FCX, Newmont Mining (NEM) ABX and others.

All forward estimates may be shot to hell in the political climate that looms just over the horizon. For mining companies with overseas operations, past performance may not be a good gauge of future profitability.

For the individual investor Gold is looking a lot less attractive than it might have originally presented itself.

Disclosure: No position in Gold, Gold ETNs or Gold ETFs.

Market Shadows

© 2012 Copyright Market Shadows - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.