What Happens to Gold If the U.S. Dollar Does Not Collapse?

Commodities / Gold and Silver 2012 Dec 12, 2012 - 09:24 AM GMTBy: P_Radomski_CFA

We follow up on our essay on gold and the dollar collapse from December 4, 2012. In that essay, we speculated what could happen with gold if the U.S. defaulted on its debt in real terms. Today, we describe possible scenarios in the opposite case where the greenback is not destroyed in spite of excessive debt.

We follow up on our essay on gold and the dollar collapse from December 4, 2012. In that essay, we speculated what could happen with gold if the U.S. defaulted on its debt in real terms. Today, we describe possible scenarios in the opposite case where the greenback is not destroyed in spite of excessive debt.

The “imminent” collapse of the dollar has been spoken of years now. Since 2008 this talk has been fueled largely by consecutive rounds of quantitative easing (QE). With QEs at $2.25 trillion and counting, the number of borrowed dollars is hitting new highs and it’s no wonder that the ability of the U.S. to sustain such programs in the future is being questioned.

As we discussed in the above-mentioned essay, it is possible for the U.S. to default on its obligations. Not default in the technical sense of the word but in a more intuitive sense. Let’s explain that. All the U.S. obligations (bonds, treasury bills etc.) are denominated in dollars. So, the U.S. government is to repay its debt in a pre-specified amount of dollars (currently $16.37 trillion). If you consider the fact that the authorities have the sole right to print dollars, it becomes obvious that, at the end of the day, they can simply print money to cover any debt outstanding. This is unlikely, and would have disastrous consequences for the economy, but it’s possible. In such a scenario all the debt would be paid off, but the money the creditors would get would be worth near to nothing. This is what we call a default in real terms. Precious metals investors are holding on to gold as a hedge against such a possibility.

The common misconception, already pointed out, is that the collapse of the dollar is “imminent,” “sure” or “certain.” It’s not. Just as nobody knows what will happen in the future, nobody can say that the dollar will collapse for sure. And, even if somebody is personally quite convinced that the dollar is heading for the gutter, there’s absolutely no certainty when this will happen.

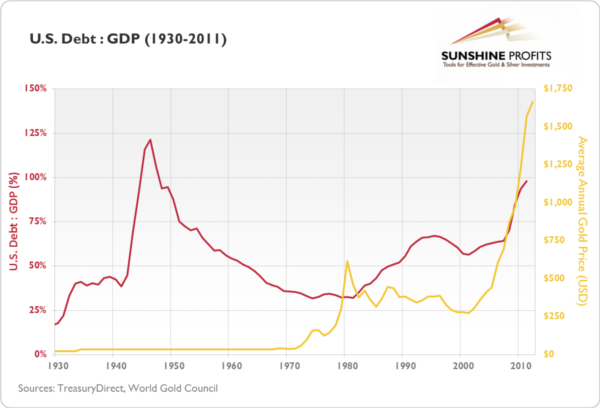

Even though the number of borrowed dollars has never been higher, current debt levels in relation to GDP are not at their historical highs. As of 2011, the U.S. debt to GDP ratio stood at 98.1%. The chart below shows that, in terms of debt, the U.S. economy has already been here.

In 1946, one year after the end of WWII, the debt to GDP ratio stood at 121.3%, its highest historical level so far. Obviously, the economic conditions after WWII were quite different than the conditions we have today, but the point is that in the past the U.S. economy was able to recover from enormous debt levels. It is still possible that it will recover from all the debt the QEs have been amassing.

The implosion of the dollar and the global currency system is not imminent. Can anyone – with 100% certainty – rule out the case in which the countries around the world agree to inflate all currencies gradually until the debts are mostly erased? Or – again with 100% certainty – can anyone say that nobody will come up with a solution that would not lead to U.S. dollar’s destruction?

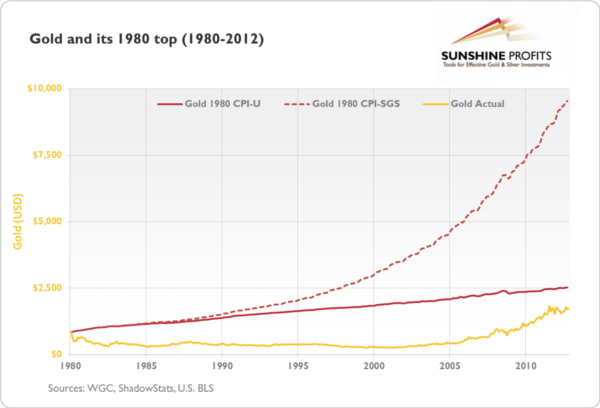

If the widely discussed collapse of the dollar never materializes, in spite of the current debt levels, can it still be a good idea to hold on to gold? It can, particularly if you consider that we are in a bull market and there are no clear indications that this market is to end any time soon. What is more, we haven’t seen a pronounced phase of exponential growth in prices, nor have we experienced the craze of the third stage of the bull market when everybody and their brother would jump at the opportunity to buy precious metals. We provide some comparisons in the chart below.

The yellow line represents the price of a troy ounce of gold between 1980 and 2012. The solid red line is the price of gold during the 1980 top ($850) corrected for the official U.S. inflation numbers and the dashed red line is the same price corrected for inflation numbers as they would have been calculated prior to a change in the methodology of inflation calculation (accidentally, this change coincides with the 1980 top). In other words, the solid red line shows you how expensive gold would have to be to buy you the same things it bought in 1980 if you followed official data. The dashed line shows you how expensive gold would have to be if you took into account unofficial data.

As of the end of November 2012, according to official U.S. Bureau of Labor Statistics, gold would have had to trade at $2,527.24 to match the 1980 top. It traded at $1,719.00, which could imply that if the top were to be seen in the nearest future (very unlikely), gold could shoot up by 47.0%.

Taking a look at the unofficial data, gold would have to appreciate to $9,548.34 to be able to buy you the same amount of goods it did in 1980. Compared to the price of $$1,719.00 (end of November 2012), this would mean an appreciation of 455.5% (!). The target of $10,000 without the collapse of the dollar seems far-fetched, but even if the unofficial numbers exaggerate the inflation, and the latter has been so far somewhere between the official and unofficial numbers, this would mean a possible price for gold beyond $2,500.

If the bull market continues throughout the next years and plays out similarly as the previous one without the collapse of the dollar, we see the gold-going-to-$2,500 scenario as a worst case one and the gold-going-to-$10,000 as a possibility. $2,500 might be a worst-case scenario because:

- The longer it takes for the bull market to end, the higher the nominal target will be (because of the inflation).

- The bull market of 1980 was limited to the U.S. and Western Europe. Right now, there is a much broader audience to participate in the bull market. For instance, countries from Central and Eastern Europe, as well as China and India.

- Technological advances have made the information flow considerably easier than in 1980. It is easier now to enter the market quickly. To reverse one’s position is just a matter of seconds or minutes rather than hours, which suggests that the volatility and price moves in the end phase of the bull market, may be substantial.

In short, if the 1980 top is anything to go by, then even if there’s no dollar collapse ahead of us, it still may be a good idea to be invested in precious metals.

This essay concludes our two-parter on gold and the U.S. dollar. If you haven’t read the first part on gold and the collapse of the dollar yet, you can do so now. Also, if you’ve read both essays and wonder what kind of approach would allow you to get your portfolio ready for both of the scenarios (the dollar collapsing and not), please read our piece on gold and silver portfolio structure.

To read the complete version of this study that is 12 times bigger and sign up for our free mailing list use the following link. You’ll also receive 12 gold best practice e-mails.

Thank you for reading. Have a great and profitable week

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Investment & Trading Website - SunshineProfits.com

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.