Stocks, Bonds, and Gold Inflection Point Market Trend Forecasts 2013

Stock-Markets / Financial Markets 2013 Jan 06, 2013 - 12:35 PM GMTBy: Darah_Bazargan

Most are sunk in contemplation, and hopelessly clinging on to the ever- changing era of big government spending.

Most are sunk in contemplation, and hopelessly clinging on to the ever- changing era of big government spending.

Central bankers and big financial institutions are borrowing money from the FED at rates near zero, and then reinvest it into the ten year or thirty year notes, which are paying 2% to 4%. From the standpoint of any financial institution, it is logical and also more profitable than say, lending to a risky borrower.

Quantitative Easing was- and is now-the Fed's response to this credit crunch, BUT!- with money being created out of thin air! And this new infusion of liquidity will inevitably flow back to the same institutions that initially purchased these long term government debt instruments! Overall, the hopeful consequence is to saturate the debt market and encourage creditors to invest elsewhere-- i.e. business owners, entrepreneurs, and the everyday consumers.

Bond prices and their corresponding yields will have an inverse correlation. If prices rise, then yields will fall. When the FED intervenes it creates the illusion of demand, making prices go up. In theory, their intent, is for bond holders to cash out with a profit, then consider loaning really-where there is MORE RISK.

Interestingly enough, this theory is only a theory, not a solution. When the government increases spending through measures of stimulus plans, the budget deficit will soar. This debt, however, must be repaid and consequently, higher taxes will largely fall on the wealthy, but also on the middle class because most, if not all will receive reduced payouts. Higher taxes will also cut back consumer spending, forcing companies to operate with fewer employees. The result is higher productivity because one worker is doing the job of two, or three in the extreme.

This all will come at a time of rising inflation because despite the Fed's efforts to keep rates (yields) low, their plan is failing. International creditors are quietly fleeing from bonds because of fears of a possible default. They will focus internally on the growth of their domestic economy. Bond holders will take their bread and butter back to their homeland to focus on the very products that create organic growth and exports for all.

Mind you, the technical picture must accommodate this inevitable outcome. And as we all watch from a far, the bond market is cracking, but has not imploded, at least not yet. I suspect that this sideways bearish pattern will ultimately give way in the early part of 2013, and at the same time initiate its Bear Market in full effect.

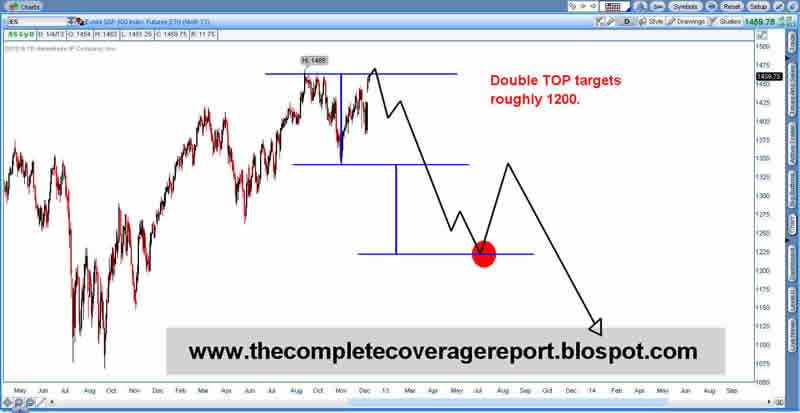

We have a major turning point approaching in all markets, not just bonds. The corresponding cycles for stocks and Gold, both long and short, will manifest into a decouple process that- I have long maintained!

Investors should be prepared for the coming tax hikes and rising long term capital gains, which together hold little to no incentive for owning stocks. This will be the true culprit for a worsening stock market, actually a Bear Market; while the media misdirects you with political theater to alleviate the worries of going off the fiscal cliff.

As for the Dow Jones, it too doesn't look very promising either.

But there will come a time, a time long before the Fed downsizes its balance sheet, if unemployment ever reaches 6.5%. A time far removed from improving GDP or the presumption of an economic recovery. A time when bearish conditions seem extended indefinitely and there is no end in sight! In the same breath investors will rush out of bonds and enter the only non-government asset that in the times of pervasive gloom outperforms any other market---GOLD!

The CC Report offers two subscriptions -- $9.95/month or $100/year. It is well worth the information received.

Darah

www.thecompletecoveragereport.blogspot.com

© 2012 Copyright Darah Bazargan - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.