Where Is the Inflation?

Economics / Inflation Jan 16, 2013 - 07:50 AM GMTBy: Mark_Thornton

Critics of the Austrian School of economics have been throwing barbs at Austrians like Robert Murphy because there is very little inflation in the economy. Of course, these critics are speaking about the mainstream concept of the price level as measured by the Consumer Price Index (i.e., CPI).

Critics of the Austrian School of economics have been throwing barbs at Austrians like Robert Murphy because there is very little inflation in the economy. Of course, these critics are speaking about the mainstream concept of the price level as measured by the Consumer Price Index (i.e., CPI).

Let us ignore the problems with the concept of the price level and all the technical problems with CPI. Let us further ignore the fact that this has little to do with the Austrian business cycle theory (ABCT), as the critics would like to suggest. The basic notion that more money, i.e., inflation, causes higher prices, i.e., price inflation, is not a uniquely Austrian view. It is a very old and commonly held view by professional economists and is presented in nearly every textbook that I have examined.

This common view is often labeled the quantity theory of money. Only economists with a Mercantilist or Keynesian ideology even challenge this view. However, only Austrians can explain the current dilemma: why hasn’t the massive money printing by the central banks of the world resulted in higher prices.

Austrian economists like Ludwig von Mises, Benjamin Anderson, and F.A. Hayek saw that commodity prices were stable in the 1920s, but that other prices in the structure of production indicated problems related to the monetary policy of the Federal Reserve. Mises, in particular, warned that Fisher’s “stable dollar” policy, employed at the Fed, was going to result in severe ramifications. Absent the Fed’s easy money policies of the Roaring Twenties, prices would have fallen throughout that decade.

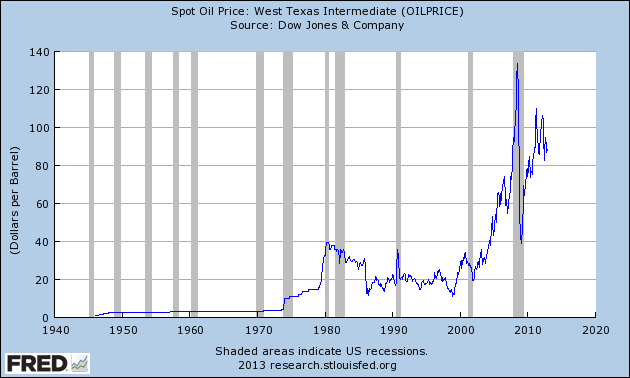

So let’s look at the prices that most economists ignore and see what we find. There are some obvious prices to look at like oil. Mainstream economists really do not like looking at oil prices, they want them taken out of CPI along with food prices, Ben Bernanke says that oil prices have nothing to do with monetary policy and that oil prices are governed by other factors.

As an Austrian economist, I would speculate that in a free market economy, with no central bank, that the price of oil would be stable. I would further speculate, that in the actual economy with a central bank, that the price of oil would be unstable, and that oil prices would reflect monetary policy in a manner informed by ABCT.

That is, artificially low interest rates generated by the Fed would encourage entrepreneurs to start new investment projects. This in turn would stimulate the demand for oil (where supply is relatively inelastic) leading to higher oil prices. As these entrepreneurs would have to pay higher prices for oil, gasoline, and energy (and many other inputs) and as their customers cut back on demand for the entrepreneurs’ goods (in order to pay higher gasoline prices), some of their new investment projects turn from profitable to unprofitable. Therefore, you should see oil prices rise in a boom and fall during the bust. That is pretty much how things work as shown below.

As you can see, the price of oil was very stable when we were on the pseudo Gold Standard. The data also shows dramatic instability during the fiat paper dollar standard (post-1971). Furthermore, in general, the price of oil moves roughly as Austrians would suggest, although monetary policy is not the sole determinant of oil prices, and obviously there is no stable numerical relationship between the two variables.

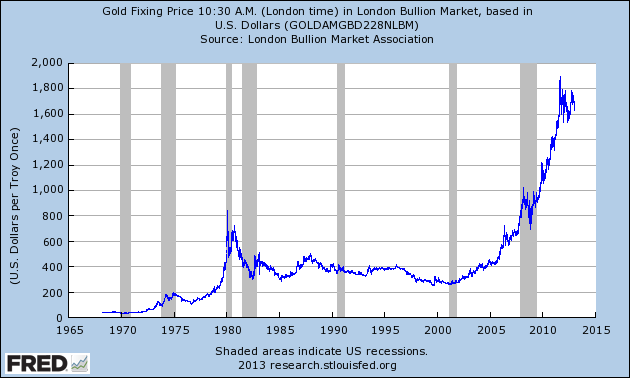

Another commodity that is noteworthy for its high price is gold. The price of gold also rises in the boom, and falls during the bust. However, since the last recession officially ended in 2009, the price of gold has actually doubled. The Fed’s zero interest rate policy has made the opportunity cost of gold extraordinarily low. The Fed’s massive monetary pumping has created an enormous upside in the price of gold. No surprise here.

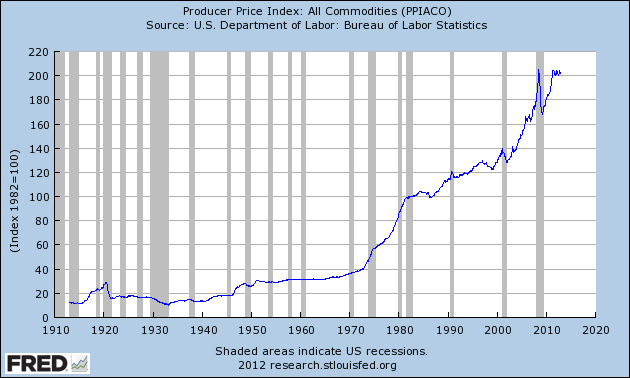

Actually, commodity prices increased across the board. The Producer Price Index for commodities shows a similar pattern to oil and gold. The PPI-Commodities was more stable during the pseudo Gold Standard with more volatility during the post-1971 fiat paper standard. The index tends to spike before a recession and then recede during and after the recession. However, the PPI-Commodity Index has returned to all-time record levels.

High prices seem to be the norm. The US stock and bond markets are at, or near, all-time highs. Agricultural land in the US is at all time highs. The Contemporary Art market in New York is booming with record sales and high prices. The real estate markets in Manhattan and Washington, DC, are both at all-time highs as the Austrians would predict. That is, after all, where the money is being created, and the place where much of it is injected into the economy.

This doesn’t even consider what prices would be like if the Fed and world central banks had not acted as they did. Housing prices would be lower, commodity prices would be lower, CPI and PPI would be running negative. Low-income families would have seen a surge in their standard of living. Savers would get a decent return on their savings.

Of course, the stock market and the bond market would also see significantly lower prices. Bank stocks would collapse and the bad banks would close. Finance, hedge funds, and investment banks would have collapsed. Manhattan real estate would be in the tank. The market for fund managers, hedge fund operators, and bankers would evaporate.

In other words, what the Fed chose to do ended up making the rich, richer and the poor, poorer. If they had not embarked on the most extreme and unorthodox monetary policy in memory, the poor would have experienced a relative rise in their standard of living and the rich would have experienced a collective decrease in their standard of living.

There are other major reasons why consumer prices have not risen in tandem with the money supply in the dramatic fashion of oil, gold, stocks and bonds. It would seem that the inflationary and Keynesian policies followed by the US, Europe, China, and Japan have resulted in an economic and financial environment where bankers are afraid to lend, entrepreneurs are afraid to invest, and where everyone is afraid of the currencies with which they are forced to endure.

In other words, the reason why price inflation predictions failed to materialize is that Keynesian policy prescriptions like bailouts, stimulus packages, and massive monetary inflation have failed to work and have indeed helped wreck the economy.

Mark Thornton is a senior resident fellow at the Ludwig von Mises Institute in Auburn, Alabama, and is the Book Review Editor for the Quarterly Journal of Austrian Economics. He is the author of The Economics of Prohibition and co-author of Tariffs, Blockades, and Inflation: The Economics of the Civil War. Send him mail. See Mark Thornton's article archives. Comment on the blog.![]()

© 2013 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.