The Real Reason Germany Wants its Gold Back

Commodities / Gold and Silver 2013 Jan 29, 2013 - 02:12 PM GMTBy: Money_Morning

Peter Krauth writes: After spending more than 50 years in foreign hands, Germany's gold is finally going home.

Peter Krauth writes: After spending more than 50 years in foreign hands, Germany's gold is finally going home.

In a recent watershed decision the Bundesbank, Germany's central bank, has decided at least half of its gold should be held in its own vaults.

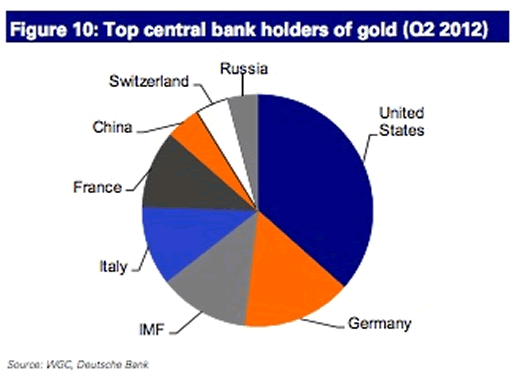

Since the Bundesbank is the second-largest gold holder in the world, that's going to mean moving 54,000 bars of the shiny metal.

So why does Germany want its gold back, and why now?

Part of it has to do with pressure from a grassroots group led by a group of economists, business executives, and lawyers, along with the German Precious Metals Association, who have put together a "Repatriate our Gold!" campaign.

But that's only part of the story...

Official pressure began last October when the German Federal Court of Auditors requested an inspection of the gold Germany stores in foreign central banks.

That sparked something of a political controversy since these gold reserves have never been thoroughly inspected and audited.

What's more, the U.S. Federal Reserve had already refused to allow the Germans to verify their gold despite several attempts.

According to Der Spiegel:

"Finally, in 2007, "following numerous enquiries," Bundesbank staff members were allowed to see the facility, but they reportedly only made it to the anteroom of the German reserves.

In fact, auditors from the Bundesbank made a second visit in May 2011. This time one of the nine compartments was also opened, in which the German gold bars are densely stacked. A few were pulled out and weighed. But this part of the report has been blacked out - out of consideration for the Federal Reserve Bank of New York.

So why would the Federal Reserve deny the Bundesbank a full inspection and audit?

That question has been rich feed for the rumor mills ever since the news broke.

So let's have a closer look at the surrounding facts...

The Significance of the German Gold Repatriation

According to the plan, Germany's gold repatriation will take seven years to complete and by 2020, Germany will store 50% of its gold in Frankfurt. Several analysts consider that, since the gold will only be moving from one vault to another, this transfer will have no measurable market effect.

But I think it's a mistake to make that assumption. Instead, this news could have a significant psychological impact.

Here's why...

Others will follow Germany's lead. The Dutch are already making similar noises, asking for an audit and full transparency. The Netherlands also only has 10% of their gold reserves at home, with the rest in New York, Ottawa, and London. Now it's only a matter of time before others start to ask the same kinds of questions. In a recent tweet, Bill Gross said what many are probably already thinking: central banks just don't trust each other anymore.

Growing concerns about the euro. There are suggestions Germany wants its gold because it's worried its loans to less fiscally responsible sovereigns won't be repaid. But I believe Germany is preparing in case the Euro were to eventually dissolve, so it wants its gold to potentially back a new Deutsche Mark. Perhaps they, too, recognize gold's return to its role as money.

A list of unanswered questions. The first is obvious: Is the gold really there? If so, why would it take seven years for Germany to get its gold back? Would you take the risk of collecting it slowly, or would you want it much faster? Some say the gold's there, yet others disagree. Steve Scacalossi, vice president and director, global precious metals at TD Securities, says Germany's gold is allocated, and therefore can't be lent out, so it will not affect gold lease rates.

Meanwhile, Keith Barron, a geologist and consultant responsible for one of the largest gold discoveries in 25 years, recently told King World News:

"I believe that most of the Western world's gold, which is supposed to be in central bank vaults, has been leased out. Much of it is now in private hands in India, and what remains continues going East to China and other Asian vaults. So most of the Western gold has vanished from the vaults and it's now just a book entry. These various Western countries and bullion banks simply roll these leases over when they come due, and the gold never gets returned back to the countries. So it's very interesting to see what's going on. Obviously the trust is breaking down in the system."

While some could easily dismiss Germany's behavior as that of a distrustful state, there's precedent for Barron's claims.

The Story Behind Portugal's Lost Gold

In 1990 Drexel Burnham Lambert, one of America's largest investment banks, filed for bankruptcy. Drexel's failure is famously blamed on junk bond trader Michael Milken.

But few know that the central bank of Portugal had loaned 17 tons of gold to Drexel. When the firm failed, Portugal's claim on its gold simply evaporated.

That was more than two decades ago at a time when almost no one was interested in gold, which then traded at $380.

Today, gold sells for $1,660 per ounce, and now a lot more people are paying attention.

The fact is, if Germany's gold is really sitting in the vaults of the New York Fed and the Banque de France, it shouldn't take until 2020 for it to make its way back home.

Seven months -- maybe. Seven years means something else is up, and that raises suspicion.

Such a delay makes you wonder if these central banks aren't being forced to "buy back" the gold they may have leased out.

Anthem Blanchard, CEO of Nevada-based Blanchard Vault, a precious metals storage company, appears to agree with PIMCO's Bill Gross.

Mr. Blanchard recently told Canada's Globe and Mail, "most importantly, the action of repatriation signifies the acknowledgement of credit risk and the Bund's [Bundesbank's] concern of any possibility that gold held at the Fed may be over-pledged in some manner."

Meanwhile, the physical gold market is one that many already consider to be rather tight.

If Germany calling in its gold unleashes a run by other nations on central-bank-stored gold, the physical market could react with a massive squeeze.

That's in addition to the fact central banks are stepping up their gold acquisitions. As a group, they bought more gold in 2012 than at any time in almost 50 years.

Now it's entirely possible that fear's been struck in the hearts of central bankers around the world.

That means the price of gold could skyrocket.

For investors, the lesson is simple: Learn from Portugal's failure.

Be like Germany, and get yourself some physical gold.

Source :http://moneymorning.com/2013/01/29/why-germany-wants-its-gold-back/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.