The ‘End’ of QE – Hype or Tripe?

Interest-Rates / Quantitative Easing Feb 23, 2013 - 07:32 PM GMTBy: Andy_Sutton

I am going to say right up front that there is going to be quite a bit of sarcasm in this essay. I say this simply because of the ludicrous nature of our marionette-esque talking heads in the mainstream financial press in this country. They are truly amazing, taking molehills and making mountains out of them and vice versa. In one segment telling us that there in fact will be no criminal charges against anyone involved in the HSBC drug/terrorism money laundering scandal – if they talk about it a all – while in the next advocating holding the next ten generations hostage by supporting the continued subsidy of said corrupt organization et al with fiat money printed from nothing with the debt placed on the taxpayer’s tab.

I am going to say right up front that there is going to be quite a bit of sarcasm in this essay. I say this simply because of the ludicrous nature of our marionette-esque talking heads in the mainstream financial press in this country. They are truly amazing, taking molehills and making mountains out of them and vice versa. In one segment telling us that there in fact will be no criminal charges against anyone involved in the HSBC drug/terrorism money laundering scandal – if they talk about it a all – while in the next advocating holding the next ten generations hostage by supporting the continued subsidy of said corrupt organization et al with fiat money printed from nothing with the debt placed on the taxpayer’s tab.

And now we have another London whale – the purported potential ‘end’ of quantitative easing (aka QE or QE infinity or QE in absurdum). Anyone who takes the time to go back over any period of monetary easing in recent history knows full well that the not-so-USFed’s open market committee is comprised of both doves and hawks. The doves win most of the battles and this is one of the reasons we’ve seen such low (and now negative) interest rates. The doves are also the reason we have QE to begin with. But the hawks always get their two cents in too and there are always a couple of them around to put a sense of balance on things. Otherwise the not-so-USFed might seem ‘irresponsible’. Imagine that! Say it ain’t so.

However, we can list several undeniable (unless you happen to be one of the many brain-dead Keynesian Ph.Ds that US universities relentlessly crank out) realities that are associated with QE – and what might happen if it were to end. One of the biggest tragedies of the past half century is that, thanks in no small part to the US financial press, debt has become ‘cool’. There was a time when it was bad to have debt. Then a mortgage became acceptable, and then a car payment became acceptable and so forth.

1 – Hooked on Debt - If you’ve ever driven a standard shift automobile (or even tried) and ground the gears, you’ll know what I’m about to say here. Our economy, country, and people as a whole are hooked on debt. And even worse, they’re now hooked on extremely cheap debt. I’m talking about debt priced well below equilibrium thanks to massive subsidies by none other than the USGovt and the not-so-USFed. The fact that nearly all in the media and most policy analysts continue to ignore is that there is in fact no free lunch. The taxpayer picks up the tab for every bit of these subsidies. The government puts it on the taxpayer’s bill in the form of blowout deficit spending – with no end in sight. The not-so-USFed puts it on our bill by blowing the supports out from under our currency and forcing all of us to pay more for goods and services because the value of our dollar has been so grossly eroded. Think I’m lying? Check out the graphic below, right from the Minneapolis Fed’s website:

If you take the reciprocal of $23.67 you’ll find that the dollar has lost almost 96% of its purchasing power since the not-so-USFed took the reins a century ago. A dollar doesn’t even buy a nickel’s worth. Great stewardship huh?

Even our corporations are hooked on debt as the last essay pointed out. The entire system is engorged with it. So what happens if someone yanks the punch bowl from the debt engorgement party? The party stops faster than you can say Jon Corzine. (Sorry Jon, you might have gotten away with that whole MF Global thing scot free, but we’re not letting you off the hook that easy.) Insert the gnashing and grinding of metals gears inside your stick shift transmission. The party comes to an ugly end. Mortgage rates and the housing market has a double dip that’ll multiply the number of tent cities in America inside 6 months. Interest rates go up and the federal deficit heads for Mars as interest payments soar. Anyone with an adjustable rate mortgage is buried because most could barely afford the lower, subsidized rate. Forget paying a market rate of interest.

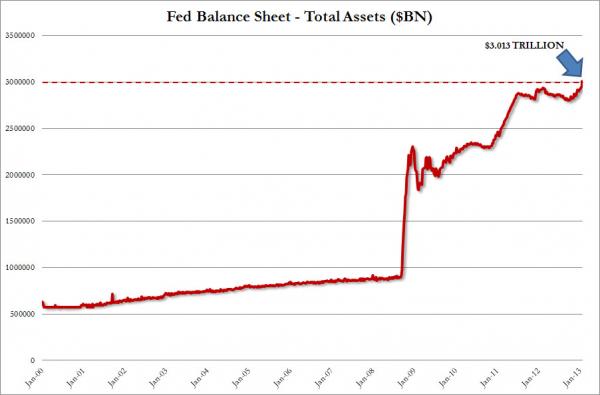

QE is the monetary grease that keeps the skids moving, the gears lubricated, and the party going. In a normal monetary paradigm, lowering interest rates would accomplish much of this, but we’re so far gone, we can’t do it on just near zero rates. Nobody wants our junk bonds and so the not-so-USFed must put on its crisis management hat and play buyer of last resort.

We are hooked on debt. Ending QE will suicide the USEconomy. And every single one of these folks knows it. Double that for government politicians. The idea that these people are incompetent is a bald-faced lie. They know exactly what the consequences are regarding all of these actions. Keep that in mind as things progress forward.

Personally I don’t see QE (and with it the current monetary paradigm) ending until the banks own nearly every capital and/or producing asset in this country via debt, mortgage, or similar lien. America is between a rock and a hard place; we need to end QE because doing so is essential to the continuation of any semblance of liberty. However, doing so will cause massive economic pain. Pain that few appear willing to endure.

2 – Hooked on Profits – The current scam of QE enables banks to ramp up their risk programs to pre-2008 levels with little or no fear of consequences. Any ‘bad’ assets, or what we call ‘Oops’ in the financial world, will be absorbed by Bennie the Brain and his band of Bankers. It costs them nothing and don’t forget these banks own the not-so-USFed, NOT the other way around.

This is the ultimate case of ‘Heads we win, tails we still win – and you lose’. Who in their right mind would want to end this kind of a party? And don’t forget Goldman Sachs CEO Lloyd Blankfein’s infamous quote – “we’re just doing god’s work”. Since you mentioned it Lloyd, the God of the Bible abhors theft, deception, false balances, and pretty much every practice you guys use to make your billions. Enough said.

We can take things a step further and connect our two major points as well. It is insanely lucrative to create debt from nothing, and then charge interest (in the form of future economic labor input). This is one of the reasons there are so many incentives to use credit. Think of the myriad rewards programs available to credit card holders either in the form of cash ‘rebates’ or shopping cards. Used wisely, these programs can provide an extra month’s worth of groceries each year just by purchasing items you’ll need, then paying the bill in full at the end of each month.

However, used unwisely, you end up doing little more than creating an annuity for the credit card company (bank). In short, you work your fanny off to pay a debt that was created from nothing. It costs the banking system nothing to do any of this, but if you’re not careful it’ll cost you everything.

With all this in mind, does it seem even remotely likely that we’ll see the end of QE or even a slight pullback? The scariest possibility is that the QE programs are maintained or even extended while the not-so-USFed asserts publicly that the program has been scaled back. The institution itself has zero transparency. Our Congress doesn’t even possess the intestinal fortitude necessary to demand an audit. Who is running whom here anyway, you might ask? Continuing that line of reasoning, the last thing this country needs is another dose of false hope. We’ve already suffered nearly a dozen years (at a minimum) of false hope and the balance sheet of everyday Americans reflects that.

Of one thing there is little doubt. The media here in the US will ballyhoo anything the bankers and policymakers can conjure up and do it with finesse and more than enough doublespeak, smiles, and good cheer. Their ratings are in the tank and so irrelevant are they becoming that this very modest (and largely unknown) column now has more ‘viewers’ than the majority of the top ten most watched TV news ‘talk’ shows. If you think that’ll stop them from pushing the big lies, think again.

If nothing else, hopefully this encourages you to diversify your sources of information. There are tens of thousands of information and news sources available. Some are good, some aren’t. Judge each by their fruits. There is no possible way to make educated decisions about anything if your assumptions going in are false because of bad information.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.