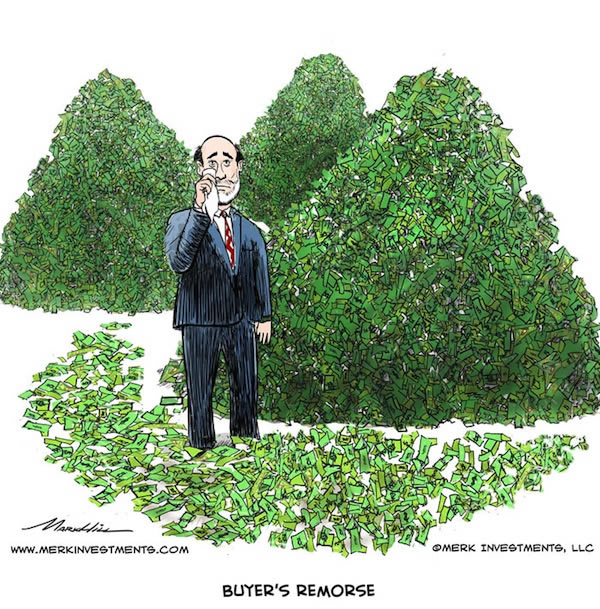

Buyer’s Remorse at the Fed: Investor Implications

Currencies / Fiat Currency Feb 26, 2013 - 11:55 AM GMTBy: Axel_Merk

A couple trillion dollars ago the Federal Reserve (Fed) decided quantitative easing (QE) is what the U.S. economy needed. Now, as an increasing number of Federal Reserve Open Market Committee (FOMC) members caution about the dangers of QE, are we seeing a classic case of buyer’s remorse? More importantly, will it return its merchandise and what are implications for the economy and the U.S. dollar?

A couple trillion dollars ago the Federal Reserve (Fed) decided quantitative easing (QE) is what the U.S. economy needed. Now, as an increasing number of Federal Reserve Open Market Committee (FOMC) members caution about the dangers of QE, are we seeing a classic case of buyer’s remorse? More importantly, will it return its merchandise and what are implications for the economy and the U.S. dollar?

Wikipedia has lots to say about buyer’s remorse:

•Buyer’s remorse is the sense of regret after having made a purchase

•Frequently associated with the purchase of an expensive item

•Arises when faced with a difficult decision

•Uncertainty whether purchase is compatible with purchaser’s goals

•Uncertainty what positive or negative evidence might be encountered post-purchase

Different from buyer’s remorse we are used to, the Fed has what anyone else can only dream of; an unlimited checkbook. The Fed does not need to first earn the money it spends. Au contraire: the more the Fed spends, the more it earns as it creates the money to buy Treasuries through the stroke of a keyboard, crediting the accounts of major banks, then receiving the interest of the securities purchased. So why second thoughts?

Is it because what the Fed buys is expensive? The very intent of the Fed’s strategy is to inflate Treasury prices; lowering yields. Investors shall be forgiven for thinking that Treasuries are overpriced. But investors may also be complacent about their Treasury holdings, as long as they believe the buyer of last resort will continue to be the buyer of first resort thereby providing support to Treasury prices.

Is it because the Fed is faced with a difficult decision? The perceived choice was whether to allow the credit bust to run its course, potentially causing a depression. Perceived, because the choice really started much earlier as the Fed allowed the credit bubble to inflate in the first place. But at the time it was the market not the Fed doing the buying. The Fed was merely sufficiently “accommodative” to allow others to buy and when those buyers went on strike, the Fed pitched in with its unlimited checkbook.

Is it because the Fed is questioning whether its goals are achieved? The stated goals are an inflation target of 2% and low unemployment. At this stage, these goals have not been achieved.

Is it because of the post-purchase evidence? That’s where it gets tricky: an increasing number of FOMC minutes are cautioning about the potential dangers of printing $85 billion a month. Clearly, there are no real bills being printed but rather, accounts of banks credited as Treasuries are purchased. However, that’s money on steroids as physical currency can only be used once by each person, whereas liquidity provided to the banking system may be levered through the rules of fractional reserve banking. That leveraging up has not happened – the “velocity of money” is still lackluster as economists say – but concerns about the “exit” strategy have been on the rise for a couple of reasons, including:

•Potential losses at the Fed. As interest rates rise, bonds fall in value. The Fed does not mark its securities to market, so any losses would only be realized should the Fed sell securities rather than hold them to maturity. It makes it all the more likely that the Fed will pay interest on deposits to mop up liquidity rather than sell bonds.

•Political risks. FOMC members are now concerned about the political fallout from paying interest on reserves as the Fed is de facto giving tens of billions in risk-free profit to banks that have deposits at the Fed.

Which brings us to what ultimately matters: what will the Fed do with this wave of buyer’s remorse? There appears to be no money-back guarantee and there’s no reset button to try a different strategy. It appears Bernanke may well be herding cats as Fed officials appear emboldened to raise their concerns. Indeed, from what we hear from current and former policy makers Bernanke is pretty good at herding cats during FOMC meetings. However, once outside the confines of the official meetings, FOMC members; voting & non-voting, very publicly voice their views. The challenge to Bernanke is that the success of his strategy, to an extent, depends on the credibility that the Fed will stick to its strategy. That’s because especially longer-dated bonds reflect anticipated policy over the longer-term.

That said, we expect Bernanke to reassert his authority, proclaiming that rates will stay low for a considerable period and that the Fed has little motivation to reduce its bond purchases.

What does it mean for the markets? Despite the volatility in the stock market, the bond market has been peculiarly quiet. It’s an eerie quietness that reminds us of past asset bubbles in tech stocks or housing. However, for the time being, Bernanke appears to have had the upper hand. In our assessment, containing the bond market is ultimately the primary goal of everything the Fed has been up to in recent years. That’s because Bernanke firmly believes the early tightening during the Great Depression was one of the biggest policy mistakes of the era. However, historically, the market rather than the Fed controls the long end of the yield curve. That’s why the Fed has indicated rates will stay low for an extended period, has purchased bonds, has engaged in Operation Twist, and ultimately has shifted towards targeting employment; suggesting the Fed will not tighten even as economic growth picks up.

What does it mean for investors? It means investors have redeployed some of their money from pricey bonds into pricey stocks. To us, it suggests that while Bernanke may continue to successfully herd his cats, volatility in the markets may pick up as different scenarios are priced in more earnestly. We have been advocating to consider taking both interest and credit risk off the table. Equity risk may be fine to the extent that one believes quantitative easing will continue to inflate asset prices. Riding such waves may make for great cocktail talk on the way up but finding ways to diversify for when the tide turns may be ever more difficult.

What we have seen is that the very active involvement of policy makers in the markets, both at home and abroad, is directly reflected in the U.S. dollar and exchange rates. If Treasuries are at risk and stocks are pricey, currencies might allow investors to find diversification. Notably, currencies are less volatile than bonds or equities, assuming no leverage is employed. Keep in mind that the U.S. dollar historically has often suffered as foreign investors, that are large holders of Treasuries, de-emphasize bonds, given that bonds may be in a bear market until the next round of tightening.

There appears to be buyer’s remorse at the Fed. The real question however, may be whether investors should have buyer’s remorse for holding U.S. Treasuries. In our upcoming Webinar, we discuss how to manage currency risk in an equity portfolio. Please join us in our webinar on Thursday, March 21, 2013. Please also sign up for our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.