Stock Market Uptrend Trying to Extend

Stock-Markets / Stock Markets 2013 Mar 23, 2013 - 07:08 PM GMTBy: Tony_Caldaro

Quite a choppy week in the US markets after four gaps openings. We had to go back to the end of June 2012 to find a similar week of indecision. That one ended with the indices eventually moving higher. For the week the SPX/DOW were mixed, and the NDX/NAZ were mixed. Asian markets lost 1.6%, European markets lost 1.9%, and the DJ World index lost 1.0%. On the economic front, reports continue to come in positive. On the uptick: housing starts, building permits, the FHFA index, existing home sales, the Philly FED, leading indicators, the WLEI, and the monetary base. On the downtick: the NAHB index and weekly jobless claims rose. Next week we get the final revision to Q4 GDP, the Chicago PMI and PCE prices.

Quite a choppy week in the US markets after four gaps openings. We had to go back to the end of June 2012 to find a similar week of indecision. That one ended with the indices eventually moving higher. For the week the SPX/DOW were mixed, and the NDX/NAZ were mixed. Asian markets lost 1.6%, European markets lost 1.9%, and the DJ World index lost 1.0%. On the economic front, reports continue to come in positive. On the uptick: housing starts, building permits, the FHFA index, existing home sales, the Philly FED, leading indicators, the WLEI, and the monetary base. On the downtick: the NAHB index and weekly jobless claims rose. Next week we get the final revision to Q4 GDP, the Chicago PMI and PCE prices.

LONG TERM: bull market

With the DOW at all time new highs, and the SPX recently within 12 points of a new high, one could certainly state the FED’s liquidity programs, and Government spending, have averted a depression. The FED recognizes this accomplishment, as most other central banks are effectively doing the same thing. So why is it some american politicans complain about government spending on one hand. Then with the other hand pass bills to continue it. Politics!

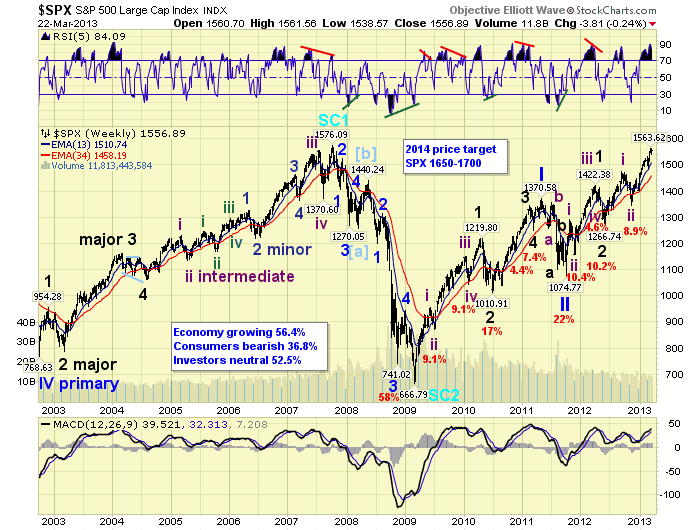

The Cycle wave [1] bull market continues to unfold from the March 2009 low. The first two, of five, Primary waves ended in 2011, and Primary III has been underway since then. Primary I divided into five Major waves with a subdividing Major wave 1. Primary III is also dividing into five Major waves, but both Major waves 1 and 3 are subdividing. Major waves 1 and 2 completed in mid-2012. Major wave 3 has been underway since that low. Intermediate waves i and i completed in late-2012, and Intermediate wave iii has been underway since then.

Before this bull market concludes it will still need to complete Intermediate waves iii, iv and v to end Major wave 3. Then after a Major wave 4 correction, a Major 5 uptrend to complete Primary III. Finally, a Primary IV correction will be followed with a Primary V uptrend. We expect this wave pattern to conclude in late-winter/early-spring of 2014. With the SPX topping out somewhere between 1650-1700. Until then enjoy the bull market.

MEDIUM TERM: the relentless uptrend continues

After a choppy week, and then a thorough review of the charts, we must conclude the market is still in an uptrend until it breaks what we consider critical support. This Intermediate wave iii has naturally been dividing into five Minor waves: SPX 1424, 1398, 1531, 1485 and 1564 so far. Minor 1 was a simple wave, Minor 2 an irregular flat, Minor 3 subdivided into five Minutes waves, Minor 4 a zigzag, and now Minor 5 may be subdividing into five Minute waves as well.

Despite the extreme overbought condition on the weekly chart, and the negative divergences on the daily charts, there may been a bit more upside before this 3 of 3 of 3 wave concludes. As a result we have upgraded the SPX hourly chart to display this potential subdivision. The upside may be limited to the OEW 1576 pivot range, or even extend to the 1614 pivot range. Currently Minor wave 5 (79 pts) is nearly equal to Minor 1 (81 pts). If this uptrend extends to the 1614 pivot, then Minor 5 would be about equal to Minor 3 (133 pts). These are natural fibonacci wave relationships.

The one caveat is that the market does not break below critical support, which is now at SPX 1539. Should this occur, then a downtrend is likely underway. With the market closing at SPX 1557 on friday, there appears to be about 20 points risk on the downside with the potential upside may be as high as 60 points. After this uptrend does end, we then expect about a 4.5% correction before the next uptrend begins.

SHORT TERM

Medium/short term support is at the 1552 and 1523 pivots, with resistance at the 1576 and 1614 pivots. Short term momentum ended the week overbought. The short term OEW charts vacillated all week between positive and negative, ending positive, with the reversal level at SPX 1552.

As noted above we are allowing for a potential extension of Minor wave 5 from the late February 1485 low. The two largest pullbacks during this rally have been a quick 24 points (1525-1501) and a zigzag 25 points (1564-1539). These two lows could be labeled Minute ii and Minute iv of Minor 5. The price activity off that low, SPX 1562 and then 1544, could be Micro waves 1 and 2 of Minute v. Should the market clear SPX 1562, then 1564, it is certainly on its way higher. Keep in mind, however, a drop below SPX 1539 would invalidate this count signalling a downtrend is probably underway. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly lower losing 1.6% on the week. China, Hong Kong, India, Singapore and S. Korea remain in downtrends, with China improving.

The European markets were all lower on the week losing 1.9%. Greece and Italy remain in downtrends.

The Commodity equity group were all lower losing 2.2%. Brazil and Russia are in downtrends.

The DJ World index is uptrending but lost 1.0% on the week.

COMMODITIES

Bonds remain in a downtrend but finished flat on the week.

Crude is still downtrending but gained 0.5% on the week.

Gold is downtrending as well but gained 1.1% on the week.

The USD continues to uptrend gaining 0.5% on the week.

NEXT WEEK

Tuesday kicks of this holiday shortened week with Durable goods, Case-Shiller, Consumer confidence and New home sales. Wednesday: Pending home sales. Thursday: Q4 GDP (est. +0.3%), weekly Jobless claims, and the Chicago PMI. Friday, while the markets are closed: Personal income/spending, PCE prices and Consumer sentiment. As for the FED, on monday at 1:15 PM FED chairman Bernanke gives a speech in London, UK. Best to your week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2013 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.