As Cyprus Dust Settles, Talk of Reciprocity and Whispers of Retribution

Politics / Eurozone Debt Crisis Mar 30, 2013 - 06:15 PM GMT On Friday at high noon the banks of Cyprus opened for the second day in a row and with minimal queues, and almost no trouble from a citizenry who have become the latest abused poster child for the global financial banking syndicate’s campaign of financial destruction through Europe.

On Friday at high noon the banks of Cyprus opened for the second day in a row and with minimal queues, and almost no trouble from a citizenry who have become the latest abused poster child for the global financial banking syndicate’s campaign of financial destruction through Europe.

The tension fueled by the fear of financial loss and hardship was palpable yesterday morning when the banks finally opened up after 15 days, but no major incidents took place in Nicosia. The Cypriots surprised the world again on Friday, re-enforcing their reputation as the most calm, cool and collected member of the European Union. This is probably down to the fact that this particular Mediterranean civilisation, in the words of one old resident, “has been occupied for 3,000 years”.

That’s not diminishing the present day reality of an island divided by a war with Turkey in 1974, and a capital city which now has its own version of Check Point Charlie dividing Greek Cyprus and Turkish Cyprus.

PHOTO: No danger of a bank run on Friday, as some Cypriots taking it easy.

Capital controls will be in effect for the next 7 days (300 euros per day withdraw limit), and many believe that some form of capital controls will be around for many months to come. Friday night was somewhat of a party atmosphere on the Larnaca Beach boardwalk, as many people appeared to be out gladly spending some of the euros they manged to withdraw over the last few days – an understandable and universal reaction after any shortage.

Now that the danger of an immediate run on the banks has subsided, we spent Friday talking to residents to try and find out what caused this crisis and who might be held responsible.

Former President Demetris Christofias has become one such focus of the people’s anger.

Lucious Petrou, a retired local farmer says, ”Imagine the timing of Christofias resigning only five weeks ago, and then our banks closing their doors three weeks later?”

“Our Communist President came into power with a 1 billion euro surplus and left with what will be a 17.5 billion euro debt to the international bankers. Where is he now?”

Most residents are confident that Christofias will be dragged into the dock during the upcoming judicial inquiry into the banking collapse.

Of course, that’s the big question on everyone’s minds: why Cyprus? Why now? Social Democrat and avowed communist Demetris Christofias came to power in 2008 through a coalition government, after campaigning on the populist platform of the “reunification of Cyprus”, bringing the Greek and Turkish sides together in a bi-zonal federal state. The people liked the idea, but instead they got an economic meltdown.

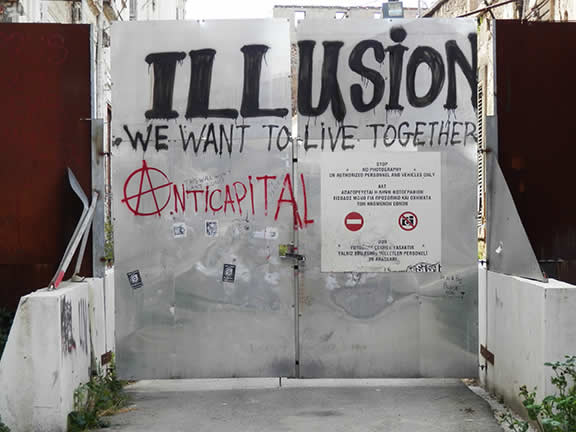

PHOTO: Divided Cyprus – Capital Nicosia dreams on one day reuniting the Greek and Turkish Cypriots again.

Other shadowy players in this story mentioned in the cafes of Nicosia include the USA, who with the help of Henry Kissenger, were the architects of the Turkish invasion in 1974 and masters of the IMF today. Like the British, the US also have a military presence on the island to go with their 300 plus other bases and installations scattered throughout Turkey. Many Cypriots believe that the US have been using their multi-lateral institutions like the IMF to kick Russian influence – and money out of Cyprus, and thus, out of Europe. There are an estimated 50,000 Russians living in Cyprus, concentrated around the city of Limassol, along with many off-shore corporations, and hundreds of thousands more coming to visit year-round. If the US, or the EU wanted to lean on Russia – particularly in Syria, then this would be the first place to start.

We also discovered that there are also 30,000 plus Chinese who have established a burgeoning European beachhead in nearby Pathos, and one would expect that there were at least a few hundred Chinese millionaires, or billionaires, who took a sizable haircut too this week – but you won’t find that one in the mainstream media.

One other name kept coming up again, and again, as we combed the back streets of the old town in Nicosia. His name is Andreas Vgenopoulos, the Greek tycoon and chairman of the controversial Marfin Investment Group, and the man who inflated the now failed Laiki Bank’s financial balloon – which was doomed to pop three weeks ago, taking the whole of the Cyprus economy down with it.

The story behind his inflated success and failure is a bizarre Ménage à trois between Dubai, Athens and Nicosia. It appears that Mr Vgenopoulos steered a massive ponzi scheme which attracted the usual suspect crowd of high-flying financiers, naive and corrupt politicians and overpaid government bureaucrats, who flocked to his over-cooked honey pot of accessible capital backed up the same junk bonds and overvalued paper which brought down Cyprus’s northern EU neighbor Greece only 2 years earlier. By the time Cypriots knew what was going on, the bottom had already fallen out of their balance sheet – forcing Nicosia to go cap in hand to the ECB, and later to the IMF.

Vgenopoulos, it seems, was the Troika’s agent provocateur in this story – he lit the match, left the building with all the loot and watch it burn from across the sea.

PHOTO: Reporter Patrick Henningsen finds out what the people are saying in the coffee houses of Nicosia.

Last but not least, people seemed very suspect, and somewhat offended, by the Germans, who magically opened-up their bond market, promoting investment into everything from solar energy to “secure investment” – at the very same time the Cyprus economy was flushed down the Euro- toilet by the Troika.

What’s worse, however, is that the elite Troika (Brussels, Berlin and the IMF) had known about this contagion and also that Cyprus would collapse well in advance of this month’s bank holiday – but they just stood back and watched as the moussaka to hit the fan, to swoop in with more crisis loans which has ultimately given them complete financial control over the economic destiny of the island. It’s like the heroin dealer trying help a recovering addict by giving them a kilo of smack. What will happen if the European and Cyprus banks re-hypothecate all this new debt-based issued money from the Troika? And what about the bankers’ using these latest loans to parlay a piece of Cyprus’s untapped gas and oil reserves? We’ll find out in a year, until then, it’s watch and wait.

Even worse, imagine the heroin dealer, after giving the recovering addict a final kilo smack, proceeds to steal the addict’s furniture, sell-off his house and cut the wages and pensions of everyone living in the house.

One winner so far, is the private security company G4S, who have been contracted to provide extra guards throughout Cyprus in case the people lose their patience with the government and their Troika masters in Europe. It’s been a relatively easy gig for them so far in Cyprus. If it happened anywhere else, there would have been riots in the streets. If the Troika tries to steal depositor’s money in Spain, G4S probably won’t cut it, and the Spanish government would probably give the security contract to someone like Blackwater - as was done already in Greece.

When the dust settles, it doesn’t take a genius to figure out that every Cypriot will know who robbed them, and how it was done. Now, in their deceptive laid back fashion it seems, the people are deciding how best to even the score.

….

Watch the UK Column Live TV program on Tues at 1pm GMT, and visit the UK Column website for more reports from Cyprus.

Also, you can listen to daily reports this week from Cyprus at The Pete Santilli Show, M-F 12pm PST/7pm GMT.

Editor Patrick Henningsen

© 2013 Copyright Patrick Henningsen - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Patrick Henningsen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.