Bernanke's Credit Crisis "Nuclear Option"

Stock-Markets / Credit Crisis 2008 Mar 25, 2008 - 07:39 AM GMT Seven days and 12 hours after Fed Chairman Bernanke's history-breaking actions, while financial markets continue to gyrate wildly, market pundits continue to debate madly.

Seven days and 12 hours after Fed Chairman Bernanke's history-breaking actions, while financial markets continue to gyrate wildly, market pundits continue to debate madly.

Their incessant question: Why?

Why has Bernanke squandered the nation's scarce financial resources to rescue Bear Stearns, a firm thoroughly addicted to some of the most reckless risk-taking in the world today?

Why despite Bernanke's own warnings about the resulting moral hazard — rewarding irresponsible gambling and punishing prudent behavior — has he thrown down the gauntlet and risked creating one of the most extreme moral hazards in U.S. history?

Why did he suddenly break with nearly seven decades of Federal Reserve history and, for the first time since the Great Depression, invoke an obscure article in the Fed's charter to support the junkiest securities in the land?

In short ...

Why Did Bernanke Deploy The Monetary Equivalent Of the Nuclear Option ?

Few investors know the answer to this question. Fewer still know what to do about it.

But you must not be among them. To survive and thrive in these confusing times, you need a sharper understanding of what impact the Fed is — or is not — having and what the next phase of the crisis could bring.

We don't presume to have all the answers. But we do know this:

Despite Bernanke's history-making steps to pump enormous sums into the nation's economy, he has failed to stem the escalating credit crisis.

To see the evidence first-hand, put yourselves in the shoes of an executive at a relatively large American company.

You're in charge of corporate finance. Your job is to borrow money, sometimes lots of money.

But your company doesn't merit an investment-grade rating. So you're concerned about how much money you can actually raise and what kind of interest you'll have to pay.

Here's what happens next ...

May 23, 2007 Before the Credit Crisis

Your plan is to issue 5-year bonds in three parcels — one now, one in a couple of months and a third within a year or less.

The timing for your first bond issue couldn't be better: Investors snap it up. So you easily raise the money you want for now.

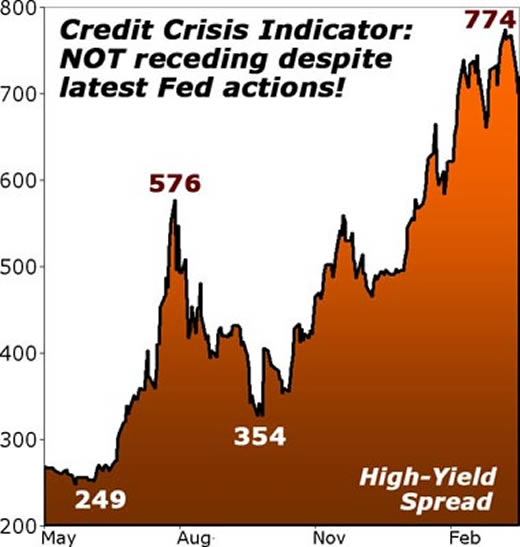

Moreover, all you have to pay is 249 basis points (2.49 percentage points) more than the U.S. Treasury Department pays when it borrows money for the same five years.

Considering that the U.S. Treasury has the best investment rating in the world — and that it borrows money at the cheapest rates in the world — that's darn cheap.

In fact, it's one of the smallest premiums over Treasuries that any company like yours has paid in years.

Moreover, this spread — the difference between the interest rate on high-yield corporate bonds and the rate on equivalent Treasury issues — is a key credit crisis indicator .

It gives you immediate insight into the level of stability — or instability — in the nation's credit markets.

It helps tell you, at a glance, whether the crisis is over or not ... whether it's getting better or worse ... and to what degree.

July 30, 2007 Crisis Indicator Surges: More Than Doubles to 576!

Just nine weeks go by. But in that short time, the market environment has been transformed from day to night.

The mortgage crisis has burst onto the scene. Major Wall Street firms are announcing massive losses. Investors are running in fear. And their faith in any private company like yours — whether you're involved with mortgages or not — is shaken to the core.

In the wake of these shocks, the credit crisis indicator explodes higher, flashing red: Instead of paying just 249 basis points more than the Treasury, you now have to pay a whopping 576 points more than the Treasury.

It's one of the most rapid — and most alarming — surges in this critical indicator in history.

August - October, 2007 Fed's First Massive Response: Crisis Indicator Falls to 354

Within days, Fed Chairman Bernanke jumps in to attack the credit crisis.

He slashes interest rates.

He injects massive amounts of fresh money into the U.S. banking system.

He even persuades central banks in Europe to do the same.

And sure enough, it has an impact: By August 23, the premium you'd have to pay for 5-year money over and above the Treasury drops to 395 points. By October 11, it falls to just 354 points.

The pundits on Wall Street come out in droves and declare "the crisis is over." They heap praise on the Fed. And nearly everyone, especially Mr. Bernanke, breathes a great sigh of relief.

But in reality, the crisis is not over. Despite all of Bernanke's efforts, he is unable to get the genie back into the bottle — unable to fully restore confidence or tamp down the festering crisis.

The first telltale sign: He fails to get the credit crisis indicator back down to its March levels.

The second telltale sign: In mid-October, the credit crisis indicator starts surging again.

March 10, 2008 Credit Crisis Indicator Explodes: This Time to 774 Points!

Rumors begin to swirl about troubles at the nation's fifth largest investment bank, Bear Stearns; and unbeknownst to most investors, credit markets are on the verge of a massive breakdown.

In your continuing role as corporate finance officer, your timing to offer a third and last bond issue couldn't be worse:

Instead of paying a premium of just 248 points as you did with your May 2007 issue ...

Instead of paying a premium of 576 points as with your July 2007 issue ...

You now have to pay an exorbitant premium of 774 points!

The credit crisis indicator is deep in the red zone, flashing extreme danger for all credit markets.

Last Monday, March 14, 2008 Fed Deploys the Nuclear Option

Over the weekend of March 12 and 13, the two most powerful economic decision-makers in the nation — Fed Chairman Bernanke and Treasury Secretary Paulson — huddle with Wall Street executives to find a solution to the latest and most lethal threat of all: A meltdown on Wall Street that could plunge the entire economy into a state of paralysis.

The immediate trigger is the feared collapse in $14 trillion of Bear Stearns' trades in an esoteric area called "derivatives." But these high-risk bets and debts are certainly not limited to Bear Stearns. Quite the contrary, as I demonstrated one week ago in " Closer to a Financial Meltdown ," several other big-name firms, including the giant JPMorgan Chase, are taking even greater risks.

March 20, 2008 Crisis Indicator Fails to Decline Significantly: Ends the Day at Nose-Bleed Level of 719!

It's Thursday, March 20. Wall Street traders are anxious to leave early to prepare for the Easter holiday.

Only three days have past since the Fed's announcements of history-making cash infusions into the brokerage industry; two days have gone by since the Fed's three-quarter-point rate cut on Tuesday.

But the credit crisis indicator has barely budged from the red zone. If you had to issue a 5-year bond today, you'd still be paying a nose-bleed premium of 719 points over the equivalent Treasury issue.

Yet despite this obvious failure by Bernanke to ease the tension in the corporate bond market, pundits again declare that "the crisis is over."

Major Lessons to Learn

As Bernanke's funny money flows into the brokerage and banking industry, it's possible that the intensity of the crisis will temporarily diminish and the crisis indicator will decline a bit more.

But the lessons from this recent experience are clear:

Lesson #1

Speed and Acceleration

The credit crisis is spreading quickly and with increasing momentum. Within less than a year's time, the spread between high-yield bonds and equivalent Treasury yields has swung from 249, one of the lowest levels in decades ... to 774, one of the highest levels in decades.

Lesson #2

From Bad to Worse

At each successive phase of the credit crisis, news of failures has bust onto the scene with greater power — first the failure of Bear Stearns' two hedge funds last June ... then the massive losses announced by HSBC, Merrill Lynch, Citibank and UBS ... now the shocking failure of Bear Stearns itself.

Lesson #3

Escalating Fed Response

At each successive phase, the Federal Reserve has responded with ever larger cash infusions, deeper rate cuts and sharper breaks with traditional Fed policy, culminating in the "nuclear option" announced one week ago.

Lesson #4

Diminishing Results

Most worrisome of all, at each successive phase, the effectiveness of the Fed's actions seems to be diminishing.

At best, it is able to bring credit crisis indicators like the high-yield spread back down to their previous highs . But so far, the Fed has been consistently unable to restore the credit markets to the stability witnessed in the previous phase.

Our conclusions are simple:

- The crisis is far from over.

- It's likely to get a lot worse.

- To prevent a massive collapse, the Fed will have to continually escalate its response, injecting ever greater quantities of cash into the banking system.

- If you haven't done so already, you must get your money to safety now — and our recommendations are unchanged:

Step 1. If you own vulnerable assets, don't be afraid to dump them. If you're taking a profit, pay the taxes. If you're taking a loss, bite the bullet and move on. In either case, just sell. And if you have a personal adviser, be sure to work as a team to reduce your exposure.

Step 2. For your savings, be sure to own ...

- U.S. Treasury bills or Treasury-only money market funds such as American Century Capital Preservation Fund (CPFXX) , Dreyfus 100% U.S. Treasury Money Market Fund (DUSXX) , Fidelity U.S. Treasury Money Market Fund (FDLXX) and Weiss Treasury Only Money Fund (WEOXX) plus ...

- Strong foreign currencies like the CurrencyShares Japanese Yen Trust (FXY), plus ...

- Gold, using an ETF like streetTRACKS Gold Trust (GLD).

Step 3. For protection — and profit — seriously consider inverse ETFs. (See Special_Report.pdf .)

Step 4. Turn this crisis into a potentially massive profit opportunity with commodity ETFs. ( Click here for our emergency online teleconference.)

Above all, stay safe!

Good luck and God bless,

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.