Should You Trust Your Instincts on Gold?

Commodities / Gold and Silver 2013 Jul 30, 2013 - 03:59 PM GMTBy: Don_Miller

Recent events in San Francisco and at La Guardia Airport made me recall a terrifying experience years ago. It was my last flight of the year, and I was headed home for Christmas. The plane was speeding down the runway to take off, when the pilot suddenly reversed thrust and slammed on the brakes; the plane shook like I have never experienced before as the pilot aborted the takeoff. As we stopped mere feet from the end of the runway and caught our breath, the pilot came on the intercom and announced, "I'm sorry to frighten you, ladies and gentlemen. I have been flying for many years. There was nothing on our instrument panel that says we have any kind of problem. It just did not feel right, and I want to have some things checked out before we go vaulting into the air."

Recent events in San Francisco and at La Guardia Airport made me recall a terrifying experience years ago. It was my last flight of the year, and I was headed home for Christmas. The plane was speeding down the runway to take off, when the pilot suddenly reversed thrust and slammed on the brakes; the plane shook like I have never experienced before as the pilot aborted the takeoff. As we stopped mere feet from the end of the runway and caught our breath, the pilot came on the intercom and announced, "I'm sorry to frighten you, ladies and gentlemen. I have been flying for many years. There was nothing on our instrument panel that says we have any kind of problem. It just did not feel right, and I want to have some things checked out before we go vaulting into the air."

We taxied back to the gate and several mechanics descended on the plane. Within ten minutes they made the announcement that the flight had been canceled due to mechanical difficulties. As I exited, I stuck my head in the cockpit door and exclaimed, "Captain, I will fly with you any time - thank you! I hope you have a wonderful Christmas season." As a seasoned traveler, it was probably the only time in my life that I was happy about having a flight canceled.

It just doesn't feel right

As of this moment, the business columns are blaring headlines about the Dow and the S&P hitting new highs seemingly every other day, even with our modest pull-back in June. At the same time, gold and gold stocks have been taking a beating. If you’re like a lot of us at Casey Research and have positions, regardless of size, in gold and silver, it can certainly be a test of courage and patience.

At times like this, it seems appropriate to review why we made certain decisions in light of new facts. Have things changed? Is it time to adjust our holdings? Sell off our metals, back up the truck, or something in between?

As luck would have it, Federal Reserve Vice Chairman Janet Yellen shed some light on the subject recently. Bloomberg's headline from earlier this spring, Yellen Says Fed Should Press on With QE Amid Limited Risk, sums it up well. Basically she reiterated that the Federal Reserve will keep on purchasing $85 billion in government debt for the foreseeable future, even if the current chairman has made suggestions they may consider scaling back at some point (no date given, of course).

And even Fed Chairman Bernanke’s recent comments on raising rates were tempered with his strong warning against raising them too soon. OK, no changes here, folks; we will continue to spend money we don't have, and the Fed will cover our butts.

Why pay attention to Ms. Yellen? Because she’s the front runner to replace Chairman Bernanke. Someone else may eventually be chosen, but her name is coming up in a lot of conversations.

The same day I read about Ms. Yellen, my copy of BIG GOLD hit my inbox. In the introduction, our own Jeff Clark has this to say about the situation (italics his):

"[T]he fundamental drivers for investing in gold have not changed. If they had, then we should sell, but clearly they have not. This is a short-term correction within a secular trend, despite what some may proclaim.

The primary impetus for a sustained gold bull market is that government debt is a structural problem, in the US and across the globe. Most of it will never be paid - and more piles up every day, to the tune of tens of billions of dollars. The economies of the world's indebted nations are not and cannot grow fast enough to pay off the debt (GDP shrunk [sic] last quarter in the US, the Eurozone, and Japan), and outright default or restructuring (i.e., a "soft default") isn't an option. The only politically acceptable way out is for government to create the money to service the debt and pay its bills, inflation be damned.

This default-by-inflation has been repeatedly employed by governments throughout history. We don't see a different outcome this time.

The Fed has said it wants inflation - and we're sure it'll get what it wants. No forecast comes with a guarantee, but it seems virtually certain that central banks will continue to print money. Since those currencies can't get "unprinted," they'll eventually enter the system and fuel double-digit rates of price inflation. When that process starts to unfold, gold and silver will respond, as they dependably have throughout history."

And of course I caught a quick glimpse of talking heads on CNBC enthusiastically discussing the Dow. One of the experts made a snide remark that all the gold nuts talking about Zimbabwe need to step aside because they just want to make some money.

Much like the pilot, my intuition is sending me a message. I know I'm heavily in the market with my share of metal and stocks, because I have no choice. They took away our interest income. Most of my peers feel the same way. We are not heavily in the market because we want to be; we really have few other choices.

Maybe the Dow will continue its run up, even with the occasional blips we’ve seen over the past couple months. But to many of us it feels more like the Great Depression than the roaring '20s. Real unemployment is still through the roof, record numbers of people are on food stamps and disability (just recently the number of those on food stamps of any sort surpassed the number of those working), and we see study after study about our net worth decreasing rapidly. Investors who generally eschew risk have very few outlets for generating real income.

So here is what we should be thinking

Let the talking heads at CNBC continue to make fun of us. I think we can do two things at once: make some money and do everything we can to protect ourselves against a possible Zimbabwe moment.

There are certain potential catastrophes that can be so threatening we must take steps to insure ourselves even though the probability of one actually occurring is slim. It’s like keeping a small fire extinguisher under your kitchen sink and hoping you never have to use it. I cannot put my life savings and my family at risk by trivializing dangers potentially on the horizon.

While CNBC may want to pooh-pooh the probability of something similar happening in our country, we all know that creating massive amounts of currency out of thin air always results in the currency collapsing, or at the very least being revalued in a way that most of us will suffer from. A prudent investor (particularly one on either side of the cusp of retirement) would do well to take out some insurance. That is generally done by investing in metal, farm land, and other forms of hard assets.

In the same Bloomberg article quoting Ms. Yellen, there is another clue for us: "Kansas City Fed President Esther George has warned that prices of some farm land have hit 'historically high levels.'" I’ve heard the same thing from folks in America’s heartland when I recently visited family in Illinois. I wonder if the CNBC folks think that is a mere coincidence.

In the fall of 2011, I attended the Casey Summit, which featured three speakers who had lived through hyperinflation in their home countries. They shared their personal experiences with us and I shared some of this in an article earlier this summer.

All three speakers went through very similar cycles. All said inflation was rising and then it spiked to astronomical proportions.

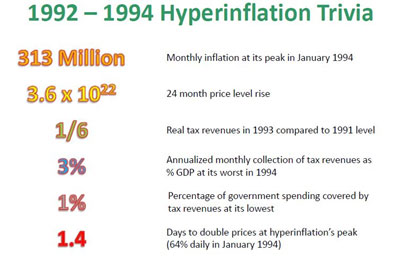

The following are a couple of slides used by the speaker from the former Yugoslavia. Note the last line that indicated that during its hyperinflation, prices doubled on average every 1.4 days.

The presenter showed a 500-billion denominated bill, which had the same purchasing power a 500 bill had just 24 months earlier. His slides documented the hyperinflation, starting at 5.00 and building up to 500 billion.

Can this happen in the United States? Are we immune from the natural laws of economics?

We see inflation on the rise in the US and know our government is not telling us the truth about it. We have discussed the record debt and Federal Reserve spending until we are blue in the face. And we know that very few of our elected officials are serious about significant cuts to federal spending to rein in debt and borrowing.

So what do we do right now?

I have yet to see anyone present any logical economic premise that concludes that our country will not eventually see a currency collapse. Many have put us down, called us "gold nuts" and the like, and trivialized our concerns. Just show me the facts.

Instead, I see several clues that reinforce my concerns. Throughout history thousands of currencies have collapsed, but precious metals have held their value. It should come as no surprise to learn that over the last few years China, Russia, and many central banks have been stockpiling gold. Germany and Venezuela quietly announced earlier this year that they are repatriating their gold stores overseas—not coincidentally mostly from the US—back to their shores. Not wanting to start a panic or gold rush, they played it down by saying they just think it is easier to store their metal inside their own borders. It sits in a lump and earns no interest whether at home or abroad, so there must be a good reason why they are going through all that effort and expense.

At Casey Research, we have regular editors' conferences. The subject of two of the more animated ones earlier this year was precious metals and the direction of the market. If I may summarize, we came to several conclusions.

- We may be in for a rough ride in the short term; however, the fundamental reasons for owning gold and silver have not changed.

- The reasons to own gold and silver are more evident than ever before.

- At the end of the day, none of us is selling, and we are going to be ever alert for some terrific buying opportunities as they come up.

Sure, all the contraptions on the airplane might be telling us everything is just fine: the Dow reaches new highs; unemployment drops another tenth of a point; and cheap credit is endless. But as experienced pilots, we're reading into the market beyond what the gauges are saying. That's the sort of insight that can mean the difference between a crash landing and a takeoff for the value of your portfolio.

So is gold going to start charging upward or take another nosedive any time soon, or just plod along in a tight range? I don’t know. At least not for the short term, but long term it seems the fundamentals point upward. For now we’re getting our returns from good-paying, reliable dividend stocks using our monthly income plan. It’s a strategy used by thousands of investors who are getting dividend income every month from some of the safest, most stable stocks on the market. I’ve recently updated a presentation laying out the details of this plan. You can find it here.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.