Economic Napalm - Stock Market and Economic Crash to Begin Now!

Stock-Markets / Financial Crash Aug 23, 2013 - 06:11 AM GMTBy: Ty_Andros

The smell of economic NAPALM is in the air as the central bank printing presses have allowed mispricing, malinvestments and market imbalances to mushroom to EXPLOSIVE levels. Now the money printing is set to slow and some of the insolvent can be expected to fall to their doom as the tide of money recedes.

The smell of economic NAPALM is in the air as the central bank printing presses have allowed mispricing, malinvestments and market imbalances to mushroom to EXPLOSIVE levels. Now the money printing is set to slow and some of the insolvent can be expected to fall to their doom as the tide of money recedes.

This has set the stage for a BLACK swan of unknown identity to set off the conflagration. The Black swans are too numerous to mention but we are going to identify a few of them in this edition of fingers of instability.

ECONOMIC Optimism abounds as dead cat bounces in Keynesian HEADLINE economic illusions provide those who live within the MAIN STREAM MEDIA matrix of misinformation HOPE. This is the vast majority of the public and investors in general. Of course nothing could be further from the truth, they really live in a world of willful blindness.

IN REALITY these people are the frog in the slowly boiling water of the unfolding depression which began in 2008. The depression masked by debt masquerading as economic growth first and wealth second. The bonds and money which have been printed out of thin air are just the next step in the unfolding SYSTEMIC insolvency which is MUSHROOMING on a daily basis.

Actually no wealth has been created (but GARGANTUAN future liabilities have been), it is just the opposite. It is the consumption of wealth and misallocation of capital to consumption rather than investment and creating a BOOM from credit expansion on grandest scale in history. The BUST will be equally SPECTACULAR!

Just this week it was announced that Japan's government DEBT has surpassed 1 Quadrillion yen ($10 trillion US dollars and 200%+ of GDP), with most of the new debt/money PRINTED out of THIN AIR.

As we near the 1st birthday of QE to infinity the approximate total MONEY printed out of THIN AIR since its inception in September 2012 is $1 million million dollars ($1 trillion or $20,000 million per state). You would think an economic recovery should be in FULL swing.

The bottom line is that the Federal Reserve has bought approximately 110% of all treasury issuance since Jan 1. In fact, subtract Fed balance sheet expansion from GDP growth and a DEEP recession is clearly VISIBLE.

The money didn't go into the economy; it went into the banks (FOREIGN and DOMESTIC) to relieve them of toxic mortgage securities and into treasuries to fund a MORALLY AND FISCALLY insolvent central GOVERNMENT IN Washington DC. The public and private sector have virtually left the arena for RISK FREE SECURITIES. Think about that... How far will GOVERNMENT bonds have to fall (yields rise) before investors will be attracted to them again?

All the treasury money went into consumption, and not a cent went into investing in the future. Most of the debt is to buy overpriced malinvestments, government debt and toxic bank assets which do not produce more that they cost and purely consumption by Something for Nothing societies aka Developed World Welfare States.

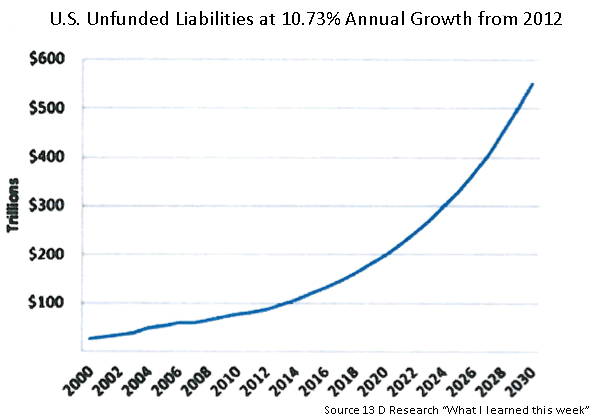

In addition to GOVERNMENT debt compounding at 6-8% over the last five years UNFUNDED LIABILITIES are compounding at almost double that rate:

These are socialized CENTRALLY PLANNED economies in all but name only, directly (state owned monopolies) or indirectly (regulated). They control all the means of production and confiscate most income either thru taxation or theft of purchasing power of the respective currencies through deficit spending of money printed out of thin air.

There has been no austerity where government spending is concerned since the Global financial crisis in 2007. GOVERNMENTS have exploded in size. Which Governments present as growth, to cut government will cut reported economic growth. Their growth has been funded by major new BORROWING, taxes and fees on every part of the societies they control.

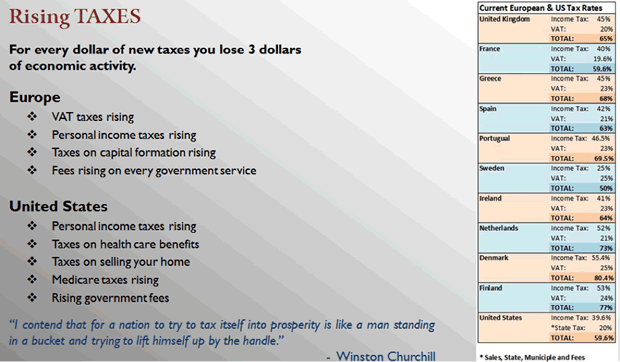

Confiscation of incomes is now approaching virtually slavery for those that produce wealth. Take a look at the meager amounts are left to the citizens of the developed world's Socialist/welfare states:

TOTAL Taxes range from 59 to 80% depending on where you look. This DOES not include government fees which are up 10 to 100% or the cost of runaway regulation discussed in the last edition of TedBits.

Ever wonder why the auto industry is free-fall in Europe? Gasoline in the United States averages $3.50 a gallon in Germany it is $12 dollars, the difference is TAXES. This is why business formation and industrial production is at multi decade lows . In Europe the entrepreneur is extinct and so too is REAL ECONOMIC growth; in the US the assassination in UNDERWAY!

In no country has spending actually been cut, just the rate of growth in spending. To fund EXPANDED government spending, promises to CONSTITUENTS (something for nothing societies, crony capitalists and special interest elites) taxes and fees have been raised on the private sectors and on the public at large.

There is no reason to create wealth in the developed world anymore as it will be confiscated for REDISTRIBUTION to special interest supporters. Do you think that might affect the behavior of producers and entrepreneurs? For supporters of socialist/progressive BIG government it is NEVER enough to fund their VOTE BUYING and corruption...

Its only small and medium size businesses that are paying TAXES as they are unable to INFLUENCE public servants for tax loopholes and regulatory FAVORS as BIG BUSINESS does with their lobbying.

In the United States the CIVIL war was fought to end slavery. To President Lincoln, the very idea of one person taking the fruits of another person's labor IE: "SLAVERY" was VILE, immoral and repugnant and he went to war to end the practice. It still is in my mind.

Now the SOCIAL WELFARE governments throughout the developed world have implemented the same practice and call it FAIRNESS. Can you say George Orwell's Animal Farm? There is no reason to produce wealth in these societies as to do so RESULTS in confiscation by the something for nothing societies which are cannibals of the worst sort.

ECONOMIC Growth will never resume until those that produce nothing or consume more than they produce are stopped from eating those that do!

"The democracy will cease to exist when you take away from those who are willing to work and give to those who would not." ~ Thomas Jefferson

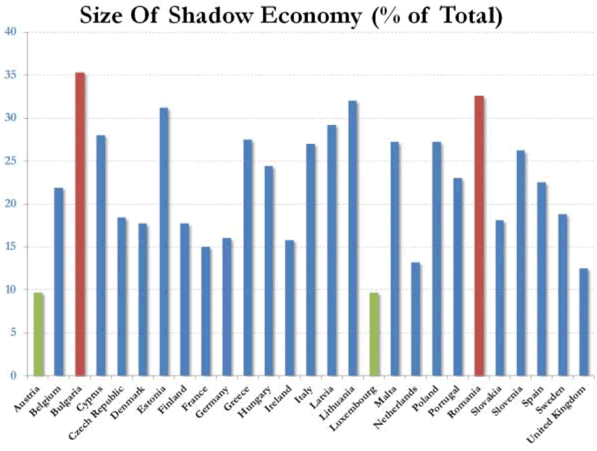

REAL Wealth creation has and is now FLEEING to places OUTSIDE the grasp of the welfare states locusts and will continue to do so. Look at the size of the underground economies in Europe (courtesy of www.zerohedge.com):

Throughout the social welfare states, as taxes and regulation have RISEN to confiscatory levels, underground economies have mushroomed to average 22.1% of the EU economy to escape CONFISCATION and the TAXMAN. It set to rise further.

This is also why wealth creation as represented by manufacturing and intellectual property have moved to low tax JURISDICTIONS such as IRELAND, SWITZERLAND, Singapore, Hong Kong, Cayman Islands, and of course the biggest tax haven in the world: the UNITED STATES, etc.

Many in the main stream media call tax minimization (all done within the letter of the laws) NEFARIOUS and UNFAIR. Ha Ha. It nothing more nefarious then SELF PRESERVATION from thinly disguised social welfare state slavery called FAIRNESS! It is people and businesses FLEEING (looters with government guns) through whatever doors are available to them!!!

For wealth creators and international businesses it is either move to places that reward capital and wealth creation or become UNCOMPETITIVE in the global marketplace; aka OUT OF BUSINESS.

Businesses and entrepreneurs do not work for the government. They work for themselves, shareholders, employees and customers. The most important being the customer by providing more goods and services for less money for which they are REWARDED by earning the customers' business.

Let me tell you something about corporate taxes: corporations don't pay them, their customers do in higher prices and their employees do in lower wages.

Higher corporate taxes mean less job security and fewer jobs as money moves from productive activities in the developed world to the emerging world where they can STAY globally competitive. This is WHY the developed world's ability to create wealth, jobs and economic growth has been HOLLOWED out over the last 5 decades as they FLEE the centrally planned socialist economies of the west.

( Author's note: In my opinion, this is NOT Doom and GLOOM , it is one of the greatest opportunities in HISTORY. Invest properly for this outcome and Prosper, invest looking in the REARVIEW mirror and your wealth will be irreparably DAMAGED. Volatility is opportunity for the prepared investor. As it is priced in and markets ZOOM higher or LOWER to price in collapsing economies and money printing huge opportunities are created. Is your portfolio structured to thrive? The greatest transfer of wealth from those that hold it in paper and financial assets to those that don't is UNDERWAY. Restoring fiat currencies to sound money and absolute return alternative investments with the potential to thrive in all market (up, down and sideways) conditions is what I do. If you have an interest in learning more and working with Ty: CLICK HERE

Until the wealth confiscation, and crooked regulations (crony capitalism) are removed there will be no recovery in REAL terms, all economic growth is a measure of money printed out of thin air and false phantom growth done to HIDE what centrally planned socialist economies have DESTROYED in REAL wealth creation.

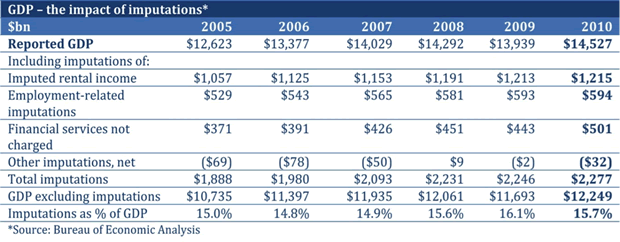

FAKE Phantom growth has mushroomed in the developed world. It is an illusion of business activity and GDP when none has occurred, such as free checking accounts, and imputed rent from fully paid for housing. Take a look at GDP when phantom growth is taken out:

Recently it was announced that accrued pension liabilities (Corporate and Government) which have not been funded will be added to PREVIOUSLY reported gdp and called PAID wages to create a LARGER false headline GDP number to BOOST/FOOL the masses that socialist/progressive government policies are DESTROYING.

For example: the state of Illinois has unfunded pension obligations of approximately $100 billion dollars which is simply nothing in today's GDP reports. Now it will be counted as fully funded and added to paid wages in the past and into the future In reality, they will NEVER be paid into or out.

Nationally unfunded state and municipal pensions are underfunded by approximately $3 trillion, now that will be added into past gdp reports as paid wages. Big new lines of PHANTOM GDP to FOOL YOU!

This will be repeated for every unfunded obligation whether it is state, municipal, corporate or federal. It will add TRILLIONS to previous (approximately $3.7 trillion) and future growth reports but NO REAL economic growth is actually there or wages paid. Government sponsored DECEPTIONS to FOOL you! The New York Times just reported it is a $560 billion dollar addition of PHANTOM GDP

In Amerika and Europe if you can't get the numbers to work: GOVERNMENTS JUST LIE to you ABOUT IT!

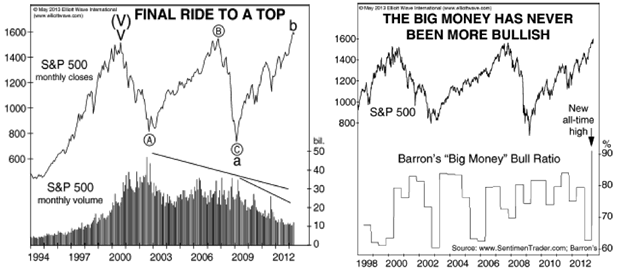

As over $12 trillion dollars ($12 million million dollars, +$2 million million scheduled) have ROLLED off the printing presses since 2007-8 financial systems (banks), federal governments (plunge protection team) and central banks have morphed into masters of MANIPULATION of prices. Take a look at the stock market and volume since the REAL top in 2000 courtesy of www.elliotwave.com:

Volume should be confirming price, but it has been steadily declining since the REAL top in 2000. Actually it is worse than it looks because if you subtract High Frequency trading (legalized front running which accounts for approximately 2 out of every three trades illustrated) volume is the lowest in 2 decades and sentiment is at ALL TIME HIGHS and the public has said NO MORE for me!

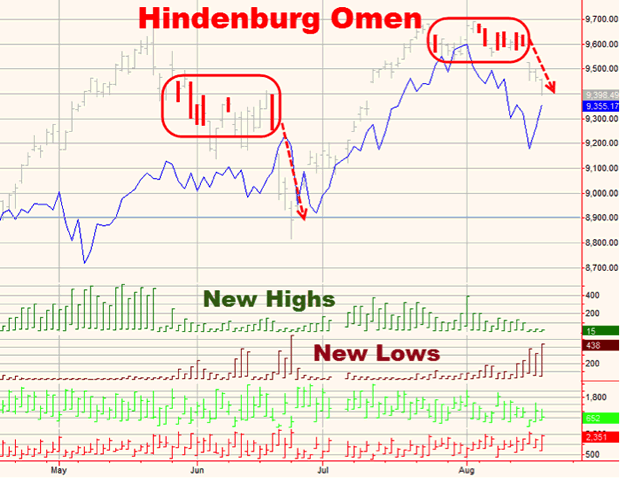

The biggest cluster of HINDENBERG Omens in history has just been completed signaling internal divergences typically seen before BIG market pullbacks. (courtesy www.zerohedge.com)

Notice the cluster just after the taper was announced in June, the market started to decline and the fed blinked and in a burst of hot air talked and walked it back. Now taper talk is back, the cluster has repeated and the smart money is exiting while the dumb money is told: This time is different, BUY BUY BUY and it never is...

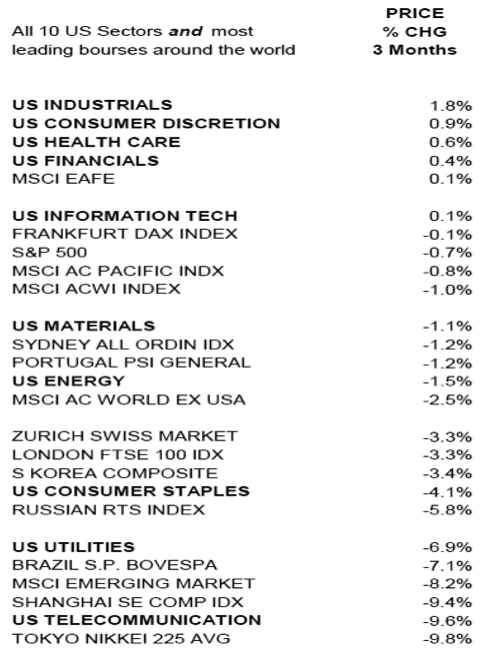

Oppenheimer's Carter Worth's latest "Money in Motion" missive identifies topping formations in big names and sectors: Consumer staples - Phillip Morris, Coca Cola, Nestle, SAB miller, Unilever, WAL-MART, McDonald's; TELECOMS - ATT; Manufacturers - Samsung; Energy - Exxon Mobil; REITS - Simon property group; Chemical and agriculture - Syngenta and Monsanto; Homebuilders - Sherwin Williams; Pharma - Sanofi; SAP AG, British American tobacco, BASF, IBM, Accenture, Zurich Insurance group AG and EBay. That is a chorus of BIG caps spread across many sectors that have TOPPED or are TOPPING as he puts it. He says he could have put up three for every stock mentioned. Then he provided a table:

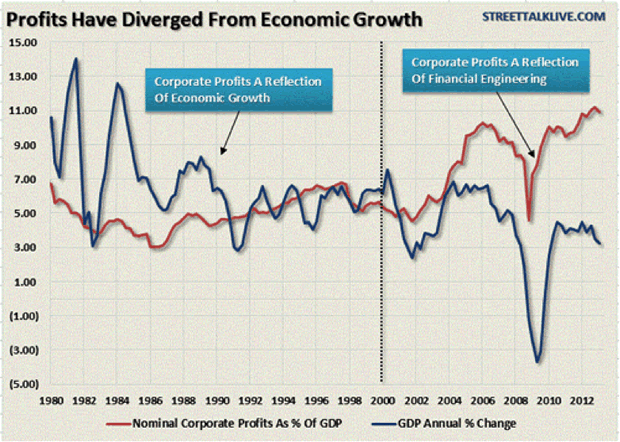

Stocks are working on huge reversals on the charts. RARELY in history have economic fundamentals deviated from Stock prices as we see today (chart courtesy of www.streettalklive.com):

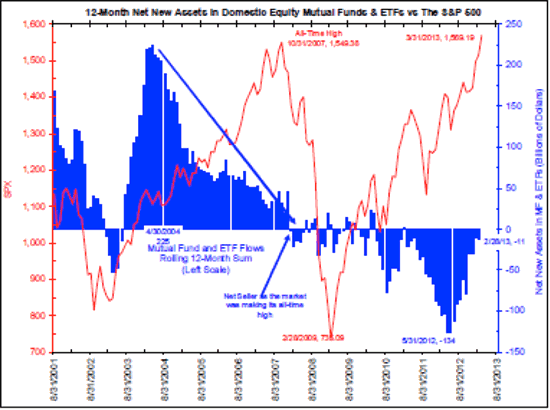

This is a result of regulatory and tax uncertainty, and the collapse in CAPEX as SMART money knows there is NO TOP LINE growth. Next we have an excellent chart of cash flows into mutual funds and ETF's and the price of the S&P 500 from www.biancoresearch.com:

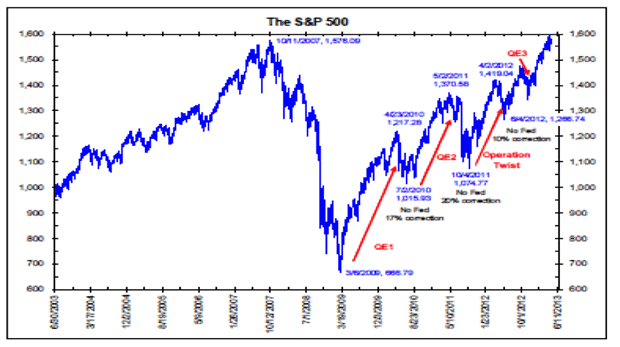

Let's see, constant outflows since the March 2009 lows and a RISING market. Can you smell something fishy? Can you say MANIPULATED? Next we have a chart of the S&P 500 demarked by money printing versus no money printing, also from Bianco research:

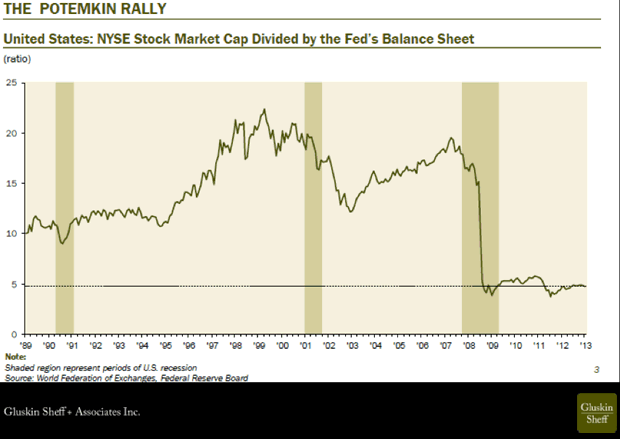

Every time the printing press has STOPPED it was bombs away. The Rally we are seeing in the stock market is an illusion if you adjust for FED MONEY PRINTING (www.gluskinscheff.com):

Thus, all the great new highs we see in U.S. stock markets is NOTHING MORE than stocks repricing to REFLECT the LOSS of PURCHASING POWER of the US dollar they are denominated in. It certainly is not reflective of an improving economy.

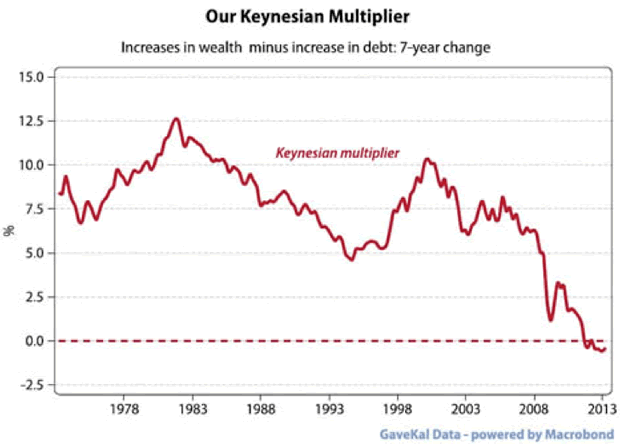

You can do the previous exercise measuring increases in wealth after being offset by increase in debt (courtesy Gavecal data and www.zerohedge.com):

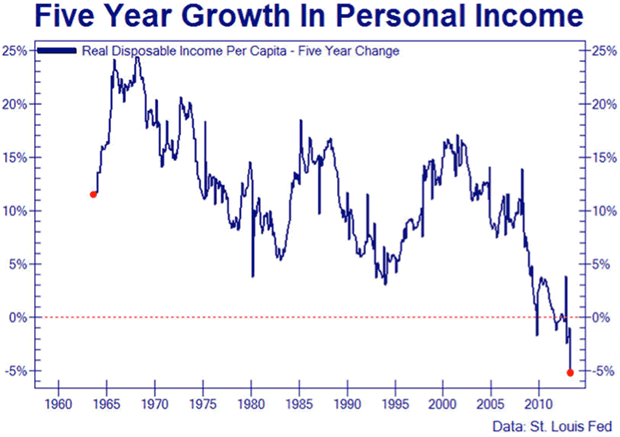

Once again REAL wealth creation disappears just like the stock gains Growth in PERSONAL incomes is EQUALLY BLEAK

This is not the face of a recovery or fuel for economic EXPANSION!

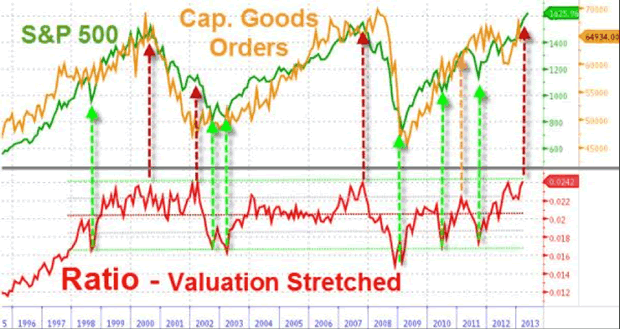

Zerohedge just recently published a chart from Diapason commodities and Charles Hugh Smith overlaying capital goods order with the stock market since 1996 and it would indicate very stretched valuations:

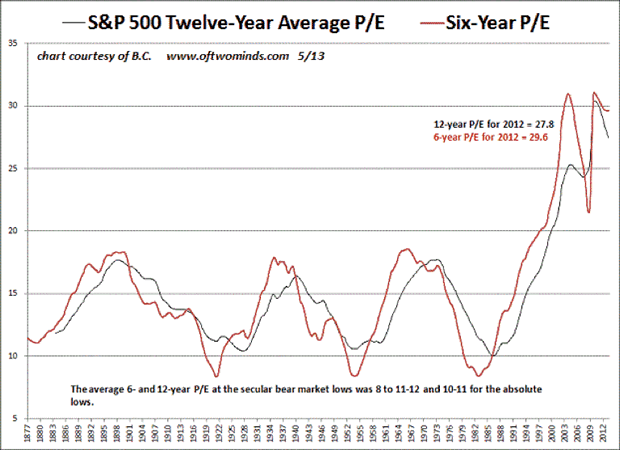

And PE's are near the 2007-2008 highs. Can you say priced to perfection?

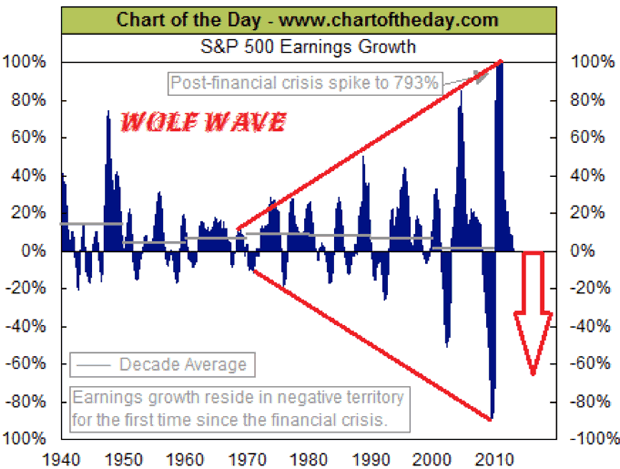

Can these stocks rise further? Of course, especially when over $5.1 billion dollars (5,100 million by BOJ and FED combined) are being printed daily with MUCH MORE to COME. But a fly has entered the ointment as year over year profit growth is now ZERO and should begin a decline to new lows following the wolf wave. Just this week Wal-Mart warned, missed revenues and profit estimates as did: MACYS, Nordstrom's, and Cisco.

This is a very predicative pattern. I used it in an April 2007 commentary to predict the 2008 crash, so let me say I predict an economic and stock market crash to begin unfolding now. Those earnings lows were last seen heading into November 2008 when the chosen one ascended to power. I am looking for a similar collapse into November 2014 elections.

That is the face of a wolf wave and it commenced in August 1971 when unsound money in the reserve currency of the world was unleashed on the trusting citizens of the developed world. Wolves eat things, in this case economies and earnings.

The Wolf Wave is the face of fiat money creation oscillating out of control. Either TOO HOT or TOO COLD, unbelievably enough I believe it is too cold if the financial system is going to avoid implosion in the short term. In the long run there is NO ESCAPE.

Central banks, public servants and banksters have ENGINEERED many new emerging bubbles in financial assets. Keep in mind, Mark Carney, the incoming Bank of England president and ECB Chairman Mario Draghi are warming up the helicopters in recent PUBLIC statements.

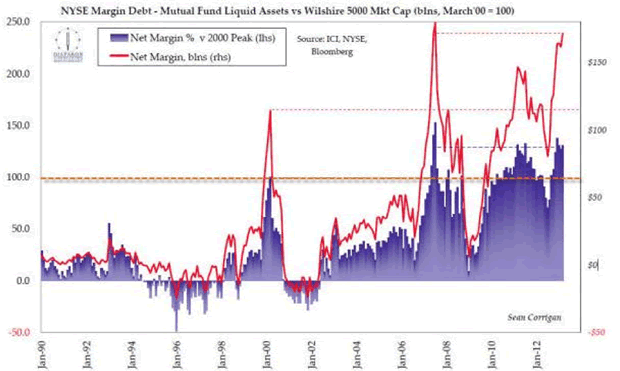

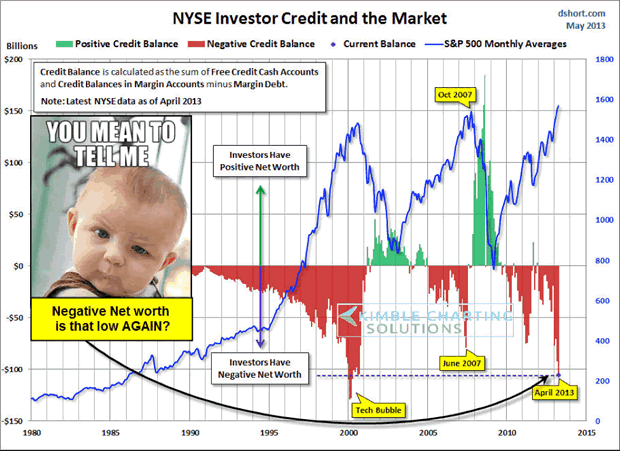

Margin debt aka LEVERAGE is at peaks preceding EVERY major stock market crash in the last 14 years from www.dshort.com :

As you can see margin debt is a REFLECTION of price in the stock markets, looking at it another way with an S&P 500 overlay:

Ouch, do you think now is the time to be LONG the MARKET? Can you say BUBBLE FORMING? As we go to press (August 21, 2013) new ALL TIME highs in LEVERAGE in the chart above should have been reached. Investors have superhuman confidence in the Bernanke PUT aka QE INFINITY. Now they are in the sights of the HFT traders.

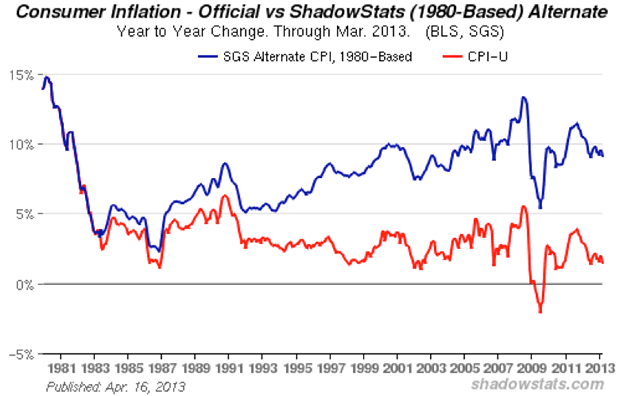

When you look at the financial repression existing in today's society all of us need to subtract the difference between REAL and reported inflation.

The lies just get bigger and bigger to cover up the theft of purchasing power through money printing. They design their policies around the red line (to keep interest rates deeply negative to support economic growth, keep Ponzi economies alive and inflate asset prices which they call GDP) and let the public deal with the blue line.

This Guarantees NEGATIVE interest rates and financial repression FOR as FAR as the EYE can SEE. REAL wages and LIVING standards as measured in purchasing power are in FREEFALL...

All returns on your investments need to be adjusted by the difference between both lines to see if you are making or losing money after debasement.

This is why the MIDDLE class is DEAD, robbed/destroyed by printing press and PROGRESSIVE SOCIALIST politics. Someday FINANCIAL assets (MISPRICED malinvestments all) will decline (leverage fails) to provide a real return after real inflation and it will be an old fashion COLLAPSE/CRASH. We are just waiting for people to WAKE UP?

In conclusion: The powers that be in the developed world say an economic recovery is in place, don't believe it for a moment. Just look under the covers of their REPORTS and RELEASES and discover the rot is as deep or deeper as political solutions (designed to benefit the governments, elites and banksters) to practical problems FAIL.

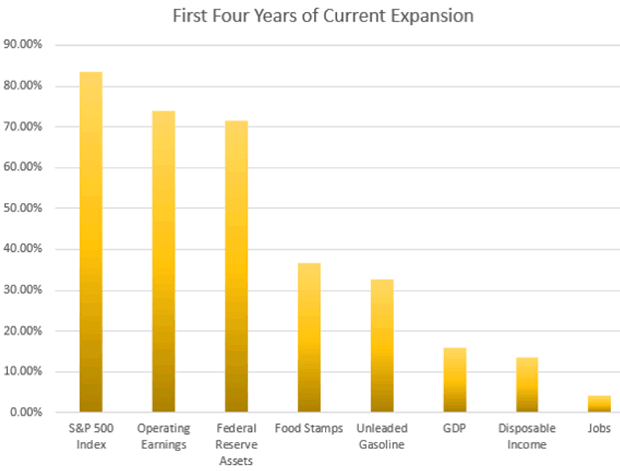

Just look where growth has been in the last four years, note that GDP, income and jobs have barely grown, properly adjusted for politically correct lies they are NEGATIVE aka NO REAL RECOVERY in underlying economies:

In general, as a long time market observer of more than 3 decades I feel confident in saying the smell of NAPALM is in the air. The question is what will ignite it? You shall see in the next edition of this commentary!

![]()

For greater insight into the philosophy behind Tedbits, have a look at the Tedbits Overview - To help understand our mission in serving you, the TedBits Overview gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

You can view Archives of the TedBits Newsletter here.

If you know of someone who you think would enjoy the TedBits Newsletter or the information on TedBits.com, please feel free to forward them this email. They must subscribe to TedBits, with your recommendation (the forwarding of this e-mail), they can subscribe for free.

Comments or Questions?

As always, we welcome any comments or questions. Click here to contact us or email to comments@TedBits.com

Author's Note: I hope that you enjoy the newest edition of the TedBits Newsletter. My goal is to bring you the latest information touching on a wide variety of subjects and how they relate to global economics. Expressed in the Newsletter are my opinions, which do not necessarily reflect those of the TedBits website. I simply ask you to think and rethink your views; if along the way I offend you, I apologize. No offense is ever intended; please take none from my words.

![]()

The Federal Reserve is clear they want LOW RATES and are managing them to virtually ZERO. Based on the Shadowstats INFLATION analysis, the 10 year note yields should be about 12% to give a real yield after inflation. When this market clears they will be and financial asset markets and the banking systems will crash with them.

As we go to press the 10 year note is failing and falling out of a bear flag signaling a move to approximately 3.6% or a doubling of interest rates since MAY. Global central banks are in the process of losing their grips on the long end of the bond markets globally.

We now live in a world where conventional monetary policy (regular interest rates) is FEARED. Rightly so as normalized (market determined) interest rates spell the death of ASSET BACKED economies, financial systems and financialized economies which will collapse with higher rates...

Don't miss the finale of the "Fingers of Instability" series where we put the GLOBAL bomb er bond markets into the crosshairs in the next issue of Tedbits. Let's call it the mother of all BLACK SWANS...

Subscriptions are free at CLICK HERE

Sincerely,

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.