Gold And Silver Reverse Bubble. Huge Rally When Broken. Note Bitcoin

Commodities / Gold and Silver 2013 Nov 30, 2013 - 12:14 PM GMTBy: Michael_Noonan

Gold and silver are in reverse bubbles, if you will, where price has been both severely distorted and suppressed by central banks, the visible tools of the otherwise hidden moneychangers, those on the top of the population pyramid who want to control and enslave the entire world in a totalitarian state of existence. Ironically, the best and only hope for the [not so] free world comes from China and Russia. It is a twisted world in which we live.

Gold and silver are in reverse bubbles, if you will, where price has been both severely distorted and suppressed by central banks, the visible tools of the otherwise hidden moneychangers, those on the top of the population pyramid who want to control and enslave the entire world in a totalitarian state of existence. Ironically, the best and only hope for the [not so] free world comes from China and Russia. It is a twisted world in which we live.

There are so many pieces to the entire puzzle, and for all the known ones, those which are most important are unknown to the great majority. All one can do is to continually monitor events and prepare accordingly. The best predictor of the future has always been past behavior. For centuries, the most reliable preparation has been the ownership of gold.

There is no evidence that it will be any different, this time around. In fact, given the gross manipulation of both gold and silver, once this artificial reverse bubble bursts, the results will be equally distorted to the upside. Where not too long ago, one often heard $5,000 to $10,000 the ounce for gold, the numbers have accelerated to as high as $50,000 and $500 the ounce for gold and silver, respectively.

If anyone wants a glimpse into what the future holds for gold and silver, just look at how Bitcoin has rallied to $1,200+!!! Not even two weeks ago, it traded at $460, and now, it is almost worth the same as an ounce of gold. Without any warrants as to the reliability or sustainability of this recent phenomenon, it clearly shows the appetite for an uncontrolled [by central banks/governments] alternative to any fiat currency. The world is finally waking up to the central banker's huge fiat Ponzi scheme.

Bitcoin is a digital currency, aka a crypto-currency, that has no intrinsic value. For now, it is an anonymous e-currency taking the world by storm. What seems to be the strongest point for acquiring Bitcoin is that it is continually going up in value, and it is momentum, not fundamentals, that keeps carrying the day. It runs the risk of becoming a Tulipcoin.

Putting aside whether the novelty of Bitcoin can survive any number of stress tests, which it has not yet had to do, any way possible for operating outside of the existing central banking cartel's fiat scheme has enormous appeal. We do not see Bitcoin going up in value so much as the fiats are eroding in confidence. Where it used to take $400 in fiat Federal Reserve Notes, [FRN] to buy a Bitcoin, it now takes over $1,200 FRNs to buy the same coin. This exposes the downside to fiats.

This is the good news for gold and silver holders. Once the suppressive manipulation bubble bursts for gold and silver, the number of fiats it takes to buy an ounce of gold, [currently about $1,260] and an ounce of silver, [ about $20], will rise in value, as in true measured value. Bitcoin is the precursor for how reality will immediately set in and catapult precious metals that will likely leave Bitcoin in the dust.

As to why the Western central bankers continue to successfully manipulate/suppress gold and silver is open to debate. In large, central bankers set and control currencies world-wide, and most people are oblivious to the insidious nature of fractional reserve banking and the corrupt criminal enterprises that run them. They do it because they operate with impunity and get away with it.

China is becoming an unexpected center stage protagonist for ridding the world of the fiat "dollar," once and for all. It has become their mission, one in which they will not fail.

There is a book entitled "The Ugly American," from 1958 and a film in 1963 that was popular for some time. Its focus was on America's inability, even unwillingness to understand foreign cultures, and particularly true of the American government. To that can now be added another adjective, "The Ugly and Ignorant American." The country is filled with a population that remains clueless about its de facto and bankrupt corporate federal government, and especially its own fiat currency.

China will become the wake-up that will show the world how America is, and has been for a few decades, a Third World country living off the fumes of a once thriving nation. We hope to address China as the likely replacement for both national and monetary superiority, next week.

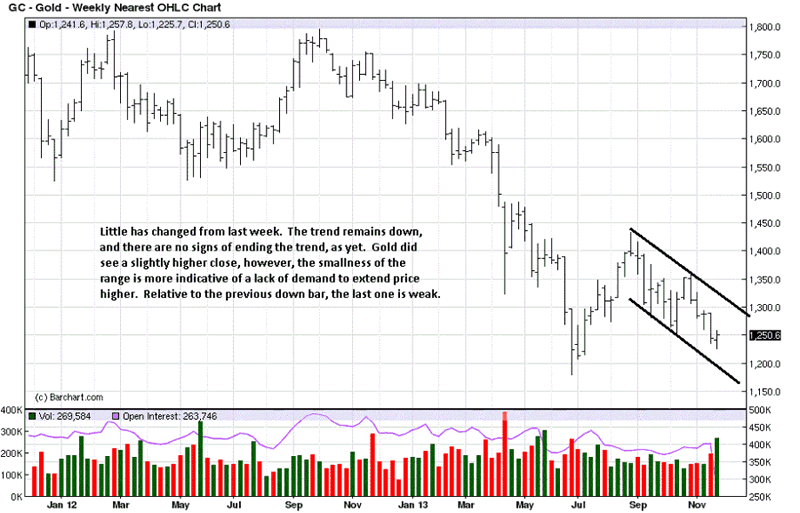

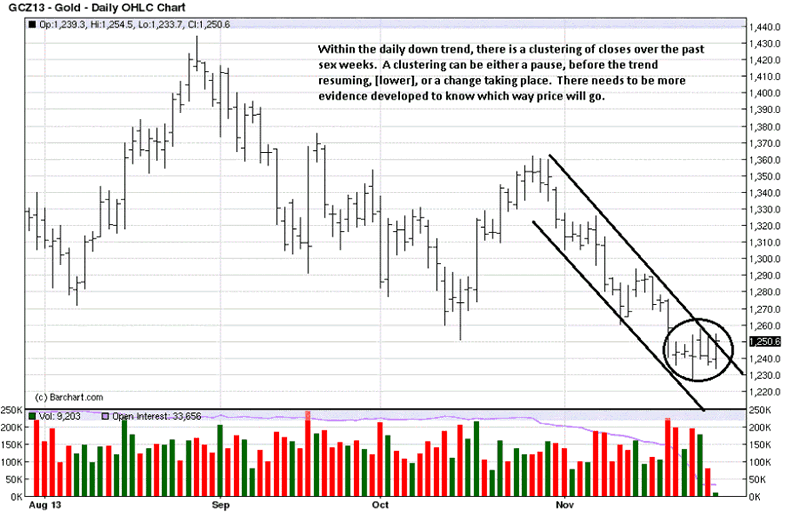

A look at the charts. There has not been any notable change in the charts since last week. The dramatic rise in Bitcoin is the best reminder for all those buying and holding physical gold and silver, for whatever length of time and at whatever price, better days are assured. It is just a matter of time.

It could be said that the nine week rally from the June low is being corrected by a 13 week decline, which is relatively more labored. While a positive, it does nothing to suggest a turnaround, at this point.

The noted clustering of closes can take price in either direction. One of the advantages of reading developing market activity is that it is followed, not led or anticipated in advance. This means we do not have to know in advance which direction price will head, in the week or more, ahead. Instead, we wait for a concrete signal, and then go with prevailing market strength. It is the best way to avoid being on the wrong side of any market.

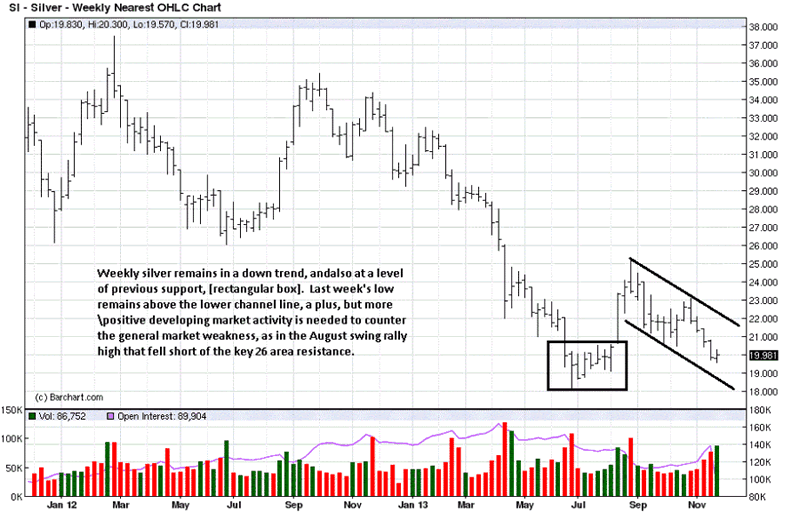

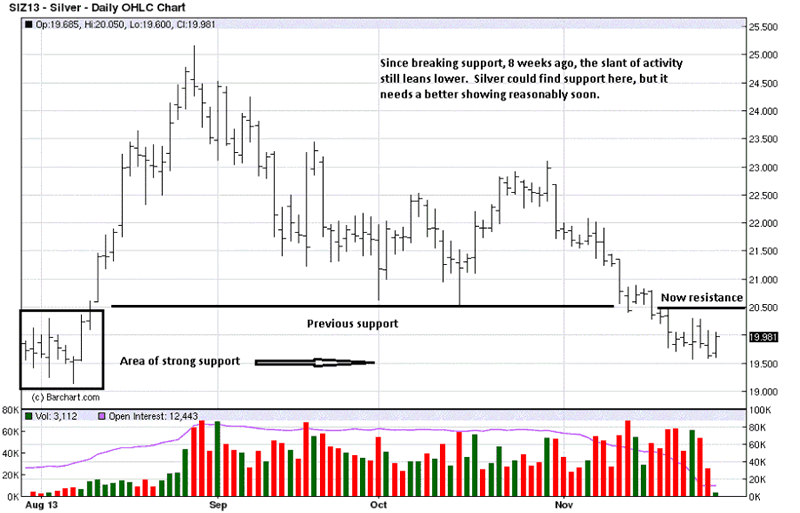

Silver's strong August swing high rally has been negated by the much slower decline that is now trading under the strong rally bar, 3rd from the August swing high. Until the small range of last week, the preceding decline, none of the 4 bars overlapped by much, indicative of a liquidating market. Whether the small weekly range becomes significant, as a potential form of stopping action, remains to be seen.

Price could still go marginally lower and not break the previous zone of support. In any down trend, sellers have proven themselves. The onus is on buyers to demonstrate the ability to effect change. For now, there is no evidence that buyers are stepping in and taking over. The ongoing "fate" of precious metals remains in the central bankers pockets.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.