Speculations Reversed - Gold Price Stealth Rally 2014

Commodities / Gold and Silver 2014 Apr 02, 2014 - 05:10 PM GMTBy: Peter_Schiff

So far, 2014 has been a paradoxical year for gold. Many investors aren't even aware that it has rallied almost 8%. On the rare occasion that the financial media mentions the yellow metal, it is only in the context of comparing the recent rise to last year's decline.

So far, 2014 has been a paradoxical year for gold. Many investors aren't even aware that it has rallied almost 8%. On the rare occasion that the financial media mentions the yellow metal, it is only in the context of comparing the recent rise to last year's decline.

In spite of this overwhelming negative sentiment, gold is experiencing a stealth rally as one of the best performing assets of the year. Let's look at some important metrics of the most under-valued sector in this market.

Speculations Reversed

So many investors want to believe that last year was the death knell for the yellow metal that they've stop paying attention to the technical metrics responsible for driving the price down. These metrics have already started to reverse.

Last year, technical speculators - and everyday investors trading behind them - influenced gold's price more than anything else. Notably, 2013 was the first year since their creation in 2003 that gold exchange-traded funds (ETFs) experienced a net outflow of their gold holdings. This played a pivotal role in driving down both the gold price and investor expectations for the yellow metal.

Gold ETFs sold off their holdings by a whopping 881 metric tons last year. GLD, the largest fund, sold 550 of those tonnes on its own. This was influenced by, and then compounded, the effects of extremely bearish gold futures speculators, whose large net-short positions were responsible for some landmark drops in the gold price throughout the year. As is typical with markets, negative sentiment became a self-fulfilling prophecy.

For the previous decade up until last year, physical gold demand had driven the gold bull market. However, ETFs have over this time accumulated a greater and greater share of the market. Thus, last year's sudden ETF sell-off was enough to drive total global gold demand down 15% year-over-year. Even 28% growth in bar and coin demand - resulting in record-breaking total demand - couldn't counter the market's bearish turn. But ETFs are getting back in the game. GLD started adding to its holdings again in February, the first increase since December 2012. And by mid-March, COMEX gold futures contracts had the most net-long positions since November 2012.

Gold Versus Equities

Why are ETF and futures traders reversing their previously bearish positions?

Prices are up in every area of the gold sector. GLD and COMEX futures are both up more than 6% this year. GDX, one of the broadest gold-mining ETFs, is up more than 12%. Even with a sell-off in the last week of March, physical gold was up almost 8% in the first quarter.

Meanwhile, the general stock market is barely performing at all. The S&P 500 and the NASDAQ are up barely 2% YTD, while the Dow is down.

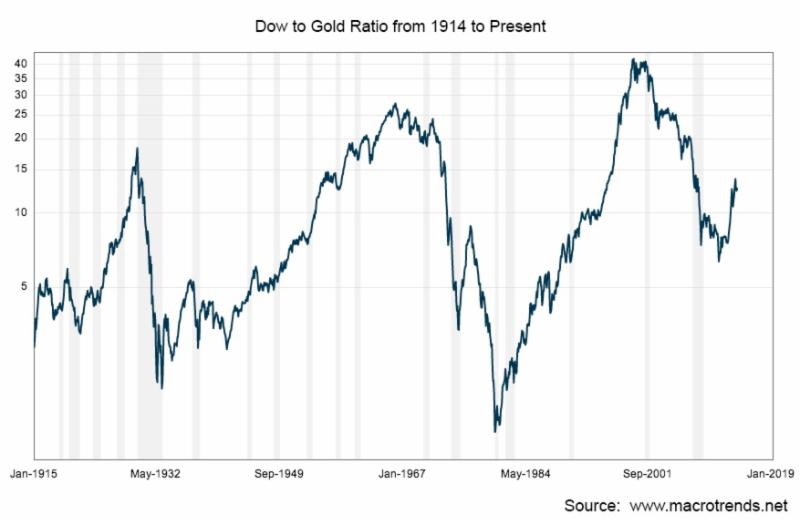

Most importantly, when measured in terms of gold, the Dow has actually started to drop significantly. At the end of March, the Dow was about 12.5 times the gold price. This is already a 9% decline since December. For the majority of the last 100 years, the Dow has traded far below this level.

To get back to its historical average, either the Dow is going to have to drop significantly or gold will have to skyrocket. I believe it will be a combination of both.

Overpriced and Under-Earning

Anyone who really buys the story of economic recovery is likely riding a wave of irrational exuberance after a year in which the major indices hit record high after record high. They don't express the slightest concern that the stock market is already in dangerous bubble territory.

However, one of the most important metrics of stock market valuation completely contradicts this.

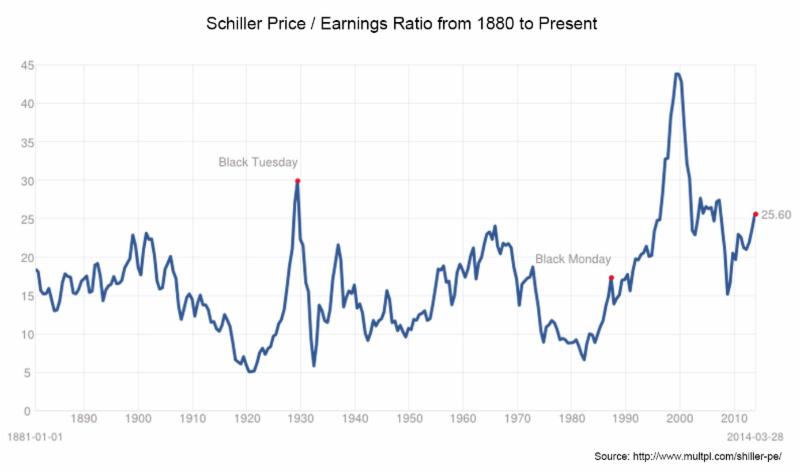

The Shiller Price/Earnings Ratio (Shiller P/E) is well-respected for helping analysts like me identify one of the most over-valued markets in history - the dot-com bubble. This metric gauges the return on investment for someone buying into the broader stock market. A higher ratio indicates investors are paying more for shares of companies that are earning less; therefore, they are receiving less value.

At the end of March, the Shiller P/E stood at 25.60 - almost 55% higher than the historical average of 16.5. As you can see in the chart below, the only previous times the ratio has breached 25 were during the 1929 stock craze, the dot-com bubble, and just before the '08 financial crash.

I would not want to be anywhere near an investment with such poor yield.

Don't Look Back

Investors often make the mistake of investing in the last trade, the same way that governments always fight the last war. After a year in which stocks brought in about a 30% return while gold was pummeled, nobody wants to be the first one to jump back into hard assets.

But fortunes are often made by ignoring the popular trend and buying underpriced assets when nobody else sees their value. Sometimes this is a risky maneuver, but in the case of today's gold market, it's as close as we can get to a sure thing.

It's hard to predict what will trigger the next collapse of stocks, but gold is already on the road to new highs. Janet Yellen is gearing up to unleash a new torrent of freshly printed dollars onto global markets. I'd recommend building your ark well in advance.

Peter Schiff is Chairman of Euro Pacific Precious Metals, a gold and silver dealer selling reputable, well-known bullion coins and bars at competitive prices.

Click here for a free subscription to Peter Schiff's Gold Letter, a monthly newsletter featuring the latest gold and silver market analysis from Peter Schiff, Casey Research, and other leading experts.

And now, investors can stay up-to-the-minute on precious metals news and Peter's latest thoughts by visiting Peter Schiff's Official Gold Blog.

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.