Still Lower Prices Ahead For Crude Oil?

Commodities / Crude Oil Nov 15, 2014 - 02:28 AM GMTBy: Sy_Harding

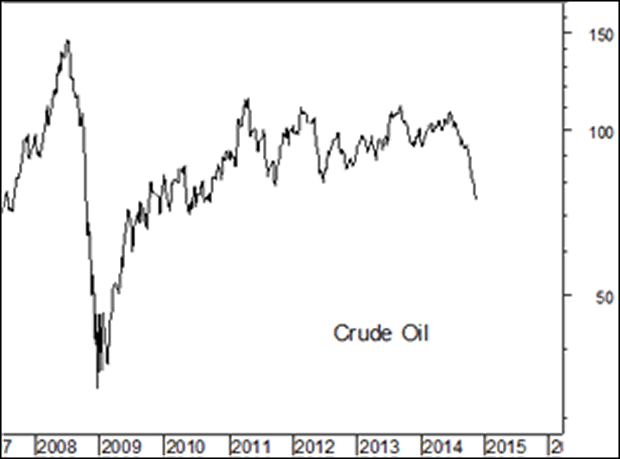

Crude oil prices, at a four-year low, have plunged 30% in the past six months, and it looks like they are destined to fall further.

Crude oil prices, at a four-year low, have plunged 30% in the past six months, and it looks like they are destined to fall further.

In its monthly report, released Friday, the International Energy Agency said, “Our forecasts indicate that barring any new supply disruptions, downward price pressure could build further through the first half of 2015.”

The driving forces are clear enough.

Slowing global economies have oil and energy demand slowing, while booming oil production, particularly in North America, has created supply surpluses.

Crude oil output in the U.S. is at its highest in almost 30 years. The U.S. Department of Energy reported on Thursday that U.S. crude production has reached an average of 9 million barrels a day.

Meanwhile, the OPEC nations are producing at their highest rate in more than a year. And while they normally try to maintain high oil prices by cutting their output, they show no inclination to do so this time around. That may be due to the emergence of the U.S. as a major oil producer. If OPEC nations take a hit to their economies by cutting production, the U.S. would benefit from the increased demand for its production.

It is most interesting that with the evidence that still lower oil prices lie ahead, perhaps through the first half of 2015, investors have been buying the dips in a big way, repeatedly convinced the bottom is in.

ETF.com reported Thursday that new money has been pouring into crude oil etf’s at an unusual pace, $400 million in just the last six weeks. They include into the United States Oil Fund ETF, symbol USO, and the iPath S&P GSCI crude oil ETN, symbol OIL.

Oil does look to be oversold on the charts. But so far, buying the dips has been very costly for those doing so.

The longer-term picture may be of more importance. Oil prices decline with global economic slowdowns, and certainly did so in the 2008-2009 recession.

After running up from $33 a barrel in 2008 to $114 in 2011 as global economies recovered, oil prices stalled as global economies softened in 2011. This year, the global economic slowdown broadened, and became more pronounced, particularly in the 18-nation euro-zone and China. And oil prices have been declining more sharply.

Unfortunately, global economic growth is still slowing, showing no signs of turning back up yet. So, it would seem the International Energy Agency is more likely to be correct in expecting oil prices to decline through the first half of next year, than are investors buying the dips on belief that the bottom is in for oil prices.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.