Netherlands, Germany Have Euro Disaster Plan - Possible Return to Guilder and Mark

Commodities / Gold and Silver 2014 Nov 28, 2014 - 12:46 PM GMTBy: GoldCore

The Dutch and German governments were preparing emergency plans for a return to their national currencies at the height of the euro crisis it has emerged. These plans remain in place.

The Dutch and German governments were preparing emergency plans for a return to their national currencies at the height of the euro crisis it has emerged. These plans remain in place.

German Gold Deutsche Mark - (Special Edition)

The Dutch finance ministry prepared for a scenario in which the Netherlands could return to its former currency - the guilder. They hosted meetings with a team of legal, economic and foreign affairs experts to discuss the possibility of returning to the Dutch guilder in early 2012.

The Dutch finance minister during the period has confirmed that Germany also discussed such scenarios.

At the time the Euro was in crisis, Greece was on the verge of leaving or being pushed out of the Euro and the debt crisis was hitting Spain and Italy hard. The Greek prime minister Georgios Papandreou and his Italian counterpart Silvio Berlusconi had resigned and there were concerns that the eurozone debt crisis was spinning out of control - leading to contagion and the risk of a systemic collapse.

A TV documentary broke the story last Tuesday. The rumours were confirmed on Thursday by the current Dutch minister of finance, Jeroen Dijsselbloem, and the current President of the Eurogroup of finance ministers in a television interview which was covered by EU Observer and Bloomberg.

“It is true that [the ministry of] finance and the then government had also prepared themselves for the worst scenario”, said Dijsselbloem.

“Government leaders, including the Dutch government, have always said: we want to keep that eurozone together. But [the Dutch government] also looked at: what if that fails. And it prepared for that.”

While Dijsselbloem said there was no need to be “secretive” about the plans now, such discussions were shrouded in secrecy at the time to avoid spreading panic on the financial markets.

When asked about Germany, Dijsselbloem said he couldn’t say whether that country’s government had made similar preparations.

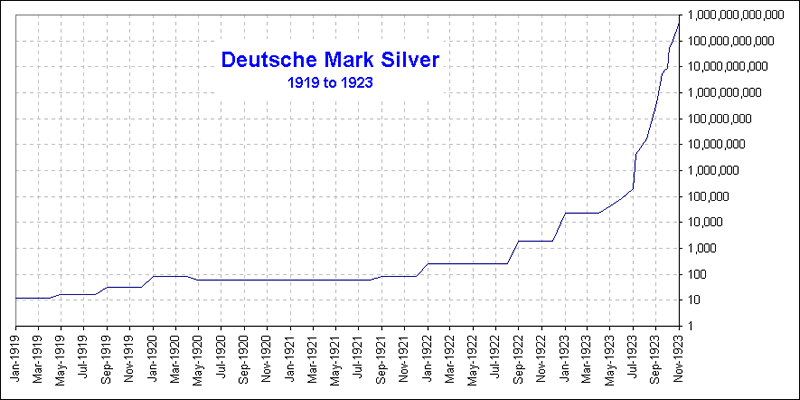

German Silver Deutsche Mark - (1951-1974)

However, Jan Kees de Jager, finance minister from February 2010 to November 2012, acknowledged that a team of legal experts, economists and foreign affairs specialists often met at his ministry on Fridays to discuss possible scenarios.

“The fact that in Europe multiple scenarios were discussed was something some countries found rather scary. They did not do that at all, strikingly enough”, said De Jager in the TV documentary.

“We were one of the few countries, together with Germany. We even had a team together that discussed scenarios, Germany-Netherlands.”

When the EU Observer requested confirmation from Germany, the German ministry of finance did not officially deny that it had drawn up similar plans, stating simply:

“We and our partners in the euro zone, including the Netherlands, were and still are determined to do everything possible to prevent a breakup of the eurozone.”

This is quite a revelation. At that time the German finance minister Wolfgang Schauble had said that the Euro could survive without Greece. Whether it could survive without the Dutch is another matter entirely.

A Euro without Holland and especially Germany is currently inconceivable. De Jager also states that other countries found the prospect of a Euro break-up frightening.

So much so that they buried their heads in the sand rather than deal with the situation facing them. It appears that no emergency contingency plans were made in the unfortunately named PIIGS nations - Portugal, Ireland, Italy, Greece and Spain.

One has to wonder if the plans would have been made public had a TV documentary not forced the Dutch government to confirm the claim.

It is interesting to note that it is these two countries, Germany and Netherlands, whose citizens have also been at the forefront of the gold repatriation movement currently sweeping across Europe - France's second largest party entered the fray this week.

In a climate with a lack of faith in fiat currencies, any return to a purely fiat guilder or mark would be risky in the absence of the confidence that gold backing provides.

Despite the implication that secrecy is no longer necessary because Europe is over the worst we believe the Dutch repatriation of 20% of it's sovereign gold from the U.S. indicates that the Dutch are still, wisely, preparing for the worst - whether that be a euro crisis or indeed a dollar crisis and an international monetary crisis.

Their stated reason for returning their 122 tonnes of gold to Netherland’s soil was to instil public confidence in the Dutch central bank.

The prospect of a Euro-break up is a frightening one. It would appear that most Eurozone nations are ill-prepared and indeed unprepared for.

As always we recommend investors act as their own central bank by taking delivery of bullion or keeping gold and silver in secure, allocated and segregated vaults in safer jurisdictions such as Switzerland and Singapore.

For investors and savers currently using the euro, it begs the important question do you have a euro failure contingency plan?

Indeed, for investors and savers internationally using other fiat currencies, it begs the important question do you have a currency failure contingency plan?

While the risks in peripheral European nations of reversion to their national currencies and currency devaluations have diminished – some risks still remain.

The risk is that individual national governments may elect to take this route rather than suffer deflationary economic collapse and Depressions. Alternatively, it could happen through contagion or a systemic event like the collapse of a large European bank, a la Lehman Brothers, that leads to a domino effect jettisoning a member state out of the monetary union.

It could also come about should the German people and politicians decide that the European monetary project is not worth saving or they decide that it cannot be saved and elect to return to the Deutsche mark.

All significantly indebted nations, so called PIIGS and non PIIGS such as Japan, the UK and the U.S. are at risk of currency devaluations.

Competitive currency devaluations or the debasement of currencies for competitive advantage and currency wars poses real risks to the long term stability and prosperity of all democracies in the world and to the finances and savings of people in all countries.

Get Breaking News and Updates On Gold Markets Here

MARKET UPDATE

Today’s AM fix was USD 1,184.50, EUR 950.80 and GBP 753.98 per ounce.

Yesterday’s AM fix was USD 1,196.50, EUR 959.20 and GBP 758.96 per ounce.

Yesterday’s PM fix was USD 1,194.75, EUR 956.49 and GBP 758.19 per ounce.

The U.S. markets were closed for a national holiday.

Gold in USD - 5 Days (Thomson Reuters)

In London, spot gold was down 0.6% at $1,184.44 in late morning trading. In Singapore, gold extended losses falling to a one-week low, on expectations that plunging oil prices could sap inflationary pressure, curbing the metal's appeal as a hedge for traders.

Silver was down 1.1% at $16.04 an ounce, spot platinum was flat at $1,223.55 an ounce and spot palladium was up 0.1% at $809.50 an ounce.

The bullion market is awaiting the outcome of a referendum in Switzerland this Sunday that could force the Swiss National Bank to raise gold holdings to 20% of its forex reserves, repatriate its bullion, and undertake never to sell gold reserves.

The most recent opinion poll showed support among voters for the ‘Save Our Swiss Gold’ Initiative and the ‘yes’ side had slipped to 38% and the ‘no’ side are at 47%. A surprise 'yes' vote could prompt the Swiss central bank to buy about 1,500 tons of gold over the next five years. We believe the referendum will be closer than is currently expected and believe a “yes” vote is still possible.

Crude oil hit four-year lows near $70 a barrel, as OPEC refused to cut back production following a plunge of over 30% in oil prices since June.

Saudi Arabia blocked calls yesterday from Russia and poorer members of the OPEC oil exporter group for production cuts to arrest a slide in global prices. OPEC ministers meeting in Vienna left the group's output ceiling unchanged despite global oversupply, marking a major shift away from its long-standing policy of defending prices.

Gold in USD - 10 Years (Thomson Reuters)

In the Eurozone inflation slowed in November to match a five-year low, signalling the European Central Bank may expand its unprecedented ‘stimulus’ program. President Mario Draghi, who will lead a meeting of policy makers on December 4, says he wants to raise inflation “as fast as possible” and repeated yesterday that policy makers are united in their commitment to do more if needed.

Deutsche Bank Quits Precious Metals

Deutsche Bank is winding down its physical precious metals trading business, moving to further scale back its exposure to commodities after recent issues with financial regulators and alleged market manipulation.

The bank said in a statement that it “will retain some precious metals capability through its financial derivatives business.”

Increased regulatory scrutiny of how market benchmarks are set spurred an overhaul of precious metals fixings, price-setting rituals dating back a century for gold and silver, this year. Deutsche Bank said in January it would pull out of the daily gold and silver fixes. The bank was one of five gold and three silver members that participated in setting London fixings, benchmark rates used by mining companies, jewelers, refineries, mints and central banks to buy, sell and value bullion.

Indian and Chinese Demand Very Robust

India's gold imports could climb to around 100 tonnes for a third straight month in November as dealers buy heavily for fear of curbs on overseas purchases, especially as the wedding season gets going.

China's net gold imports from main conduit Hong Kong rose to 77.628 tonnes in October from 68.641 tonnes in September as the world's biggest gold buyer saw strong demand for jewellery and bars. Total imports from Hong Kong to the mainland rose to 111.409 tonnes last month from 91.745 tonnes in September.

China is again heading for gold demand of some 2,000 metric tonnes in 2014 as seen in the Shanghai Gold Exchange (SGE) data year to date.

Gold As Safe Haven In Recent Years and In Non Western World Today

Citi’s Willem Buiter attack piece on gold was one of the most unbalanced anti gold pieces of research that we have ever seen and we have seen a lot. To say it lacked nuance is an understatement. Indeed, it played very loose with the truth regarding gold indeed.

The timing of the piece by Citibanks Dutch economist is interesting indeed - coming in the week that the Dutch repatriated 122 tonnes of their gold from the Federal Reserve and the Swiss go to the polls in their ‘Gold Initiative’- and it wreaks of a lot of nervousness in the corridors of certain banks and central banks.

The Dutch Central statement this week regarding the importance of their gold reserves is worth noting:

“In addition to a more balanced division of the gold reserves...this may also contribute to a positive confidence effect with the public.”

An economist working in a bank argues with the reality of human nature, physical nature and 6,000 years of history and calls gold a 6,000 year bubble.

Of course the real bubble is in banks, stocks, bonds and our modern Ponzi financial and monetary system.

Gold will still be around and likely still protecting people when many of the banks of today have gone the way of the dodo.

The very anti- gold position of Buiter is similar to many today - many of whom have a very short term, myopic, “western centric” view of the world and only see it through they eyes of dollars, pounds and euros.

This limited view blinds them to the reality of gold as a store of wealth throughout history and again today.

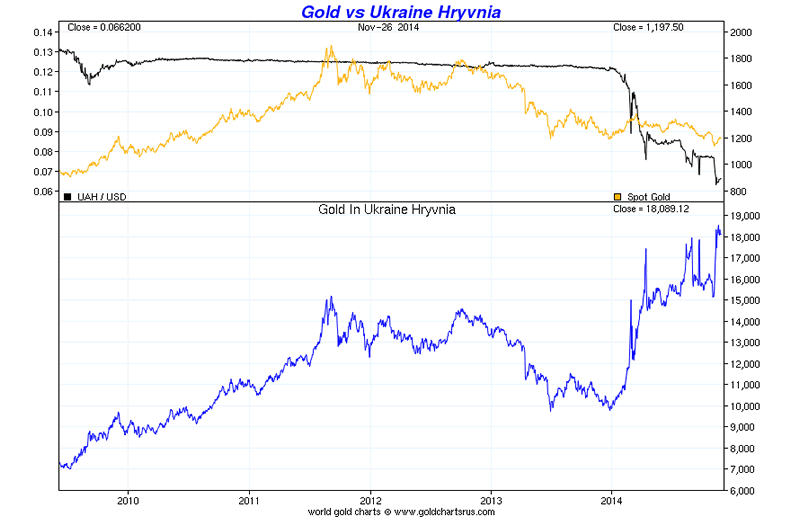

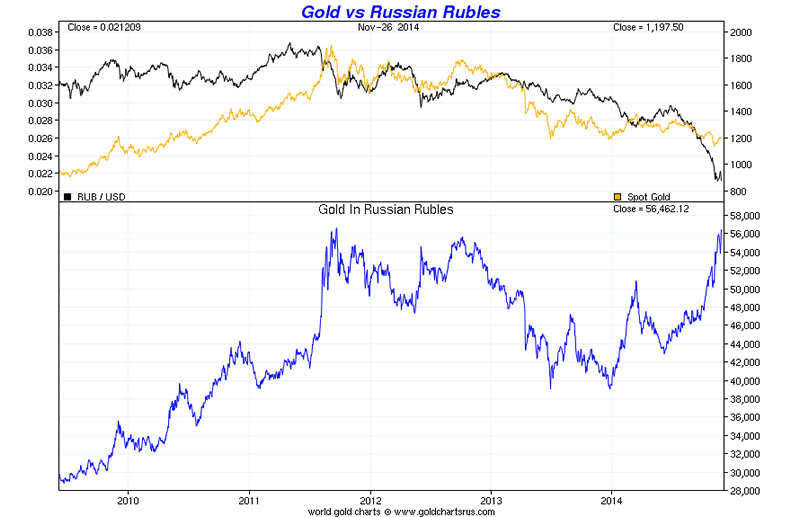

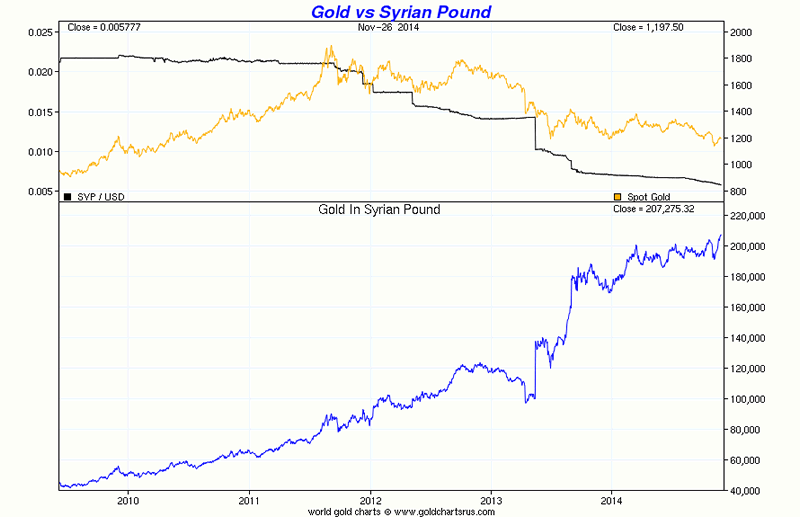

Willem Buiter should go to Syria or Ukraine today and speak to people there. They would tell him about the value of gold.

Conclusion

We are surprised that gold is lower this week given the backdrop of the Swiss gold referendum on Sunday, the Dutch repatriation of 122 tonnes of their gold this week and continuing very strong Russian, Indian and Chinese gold demand.

More short term weakness is possible and support is at $1,130/oz and $1,100/oz. We believe that gold is unlikely to go below that due to robust global demand but a close below $1,100/oz could lead to a sharp fall to the huge level of support which is the round number and near 50% retracement at $1,000/oz.

Smart money is accumulating bullion on the dip in anticipation of higher prices in 2015 and in the coming years.

We await the Swiss gold referendum with bated breath. It should make for interesting price movements Sunday night and Monday.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.