Stocks Bull Market Nearly Six Years In And Plenty of Upside Remains

Stock-Markets / Stocks Bull Market Dec 30, 2014 - 02:43 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: It's got to be time to sell, right?

Dr. Steve Sjuggerud writes: It's got to be time to sell, right?

After all, stocks have been going up for nearly six years now – they've got to be near the end of their run... Right?

I disagree...

Don't worry so much about where stocks have been – don't drive by looking in the rear-view mirror. Instead, look ahead.

When I look ahead, I see plenty of room for stocks to run higher. Plenty of upside remains.

Today, I'll show you one simple reason why this boom in stocks isn't over yet.

Let me explain...

During the global financial crisis of 2007-2008, Ben Bernanke (the chairman of the Federal Reserve at the time) slashed interest rates to zero and promised extraordinary measures to get us out of the crisis.

My thesis since then has been that the Fed would keep interest rates lower than anyone could imagine, for longer than anyone could imagine. And I said that would cause asset prices (like stocks and real estate) to soar higher than anyone could imagine.

I called it "The Bernanke Asset Bubble." The thing is, the game is not over yet...

Janet Yellen has now filled Bernanke's shoes as the Fed chairperson. And she's doing the same thing he did... Keeping interest rates at zero.

So the situation is unchanged... The Fed is keeping rates low, and stock prices and real estate prices keep going up.

But what happens when the zero-interest-rate policy ends? What happens when interest rates go up?

Most people don't know it, but history shows stocks can do well once the Federal Reserve starts raising interest rates.

Over the last 30 years, whenever the Fed was in a rate-raising cycle, stocks went up. It's hard to believe, but it's true.

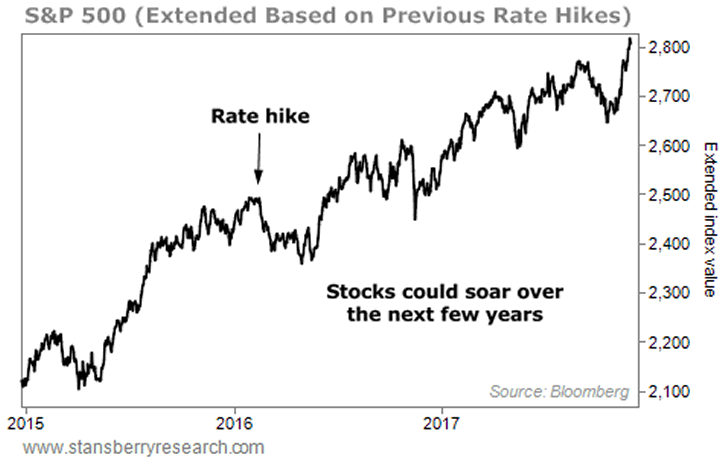

The path that stocks take around the time of the first interest-rate hike is interesting, based on history...

Stocks rise as the interest-rate hike approaches. Then once the interest-rate hike happens, stocks have a relatively minor correction – before heading on to new highs! That has actually been a typical path.

The following chart takes the "average" of what has happened when the Fed has raised interest rates over the past 30 years. There's no guarantee it will happen this way this time around... But think of it as what could happen out to 2017, based on history.

For this chart, we assume that the Fed will raise interest rates in January 2016.

Again, we can't guarantee that what has happened in the past will happen again in the future. But history is our best guide. And the history is clear...

Stocks have gone UP whenever the Fed has been in a rate-raising cycle over the last 30 years.

So rising interest rates don't mean the end of this bull market.

Yes, we are nearly six years in... and yes, the Fed will raise interest rates soon... but based on history, we don't need to fear those things. There's still plenty of upside in this market.

Tomorrow I'll show you one more reason why I don't expect the Bernanke Asset Bubble to end yet... And why stocks could soar as much as 50% from here before the end arrives.

Good investing,

Steve

Editor's note: If you'd like more insight and actionable advice from Dr. Steve Sjuggerud, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the top ways to protect your money, your family, your health, and your privacy. This report will show you the best "common sense" solutions to help you protect yourself from some of the worst elements in America today. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.