Gold in Euros Surges As ECB To Print Trillion Euros and Greek Election This Sunday

Commodities / Gold and Silver 2015 Jan 24, 2015 - 02:18 AM GMTBy: GoldCore

Stocks, bonds and precious metals surged yesterday as markets cheered the latest wave of money printing on a grand scale.

Stocks, bonds and precious metals surged yesterday as markets cheered the latest wave of money printing on a grand scale.

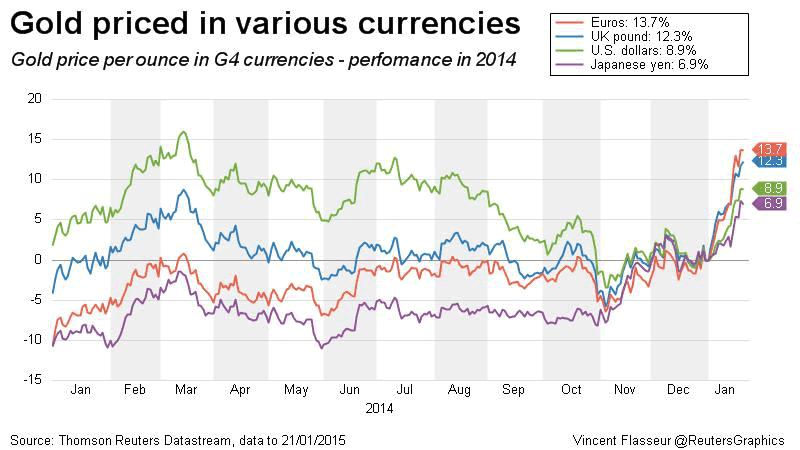

Gold surged 3 per cent in euro terms (see chart below) after Mario Draghi in the ECB announced a massive quantitative easing or QE programme of over EUR 1 trillion from March 2015 to September 2016.

The QE programme is even larger than expected at €60 billion every month rather than the €50 billion that had been expected. The euro fell another 0.9 per cent against the dollar to an 11-year low and has shed another 1% versus the Swiss franc. Gold was nearly 1% higher in dollar and sterling terms also.

Gold in Euros – 5 Days (Thomson Reuters)

Gold is headed for the third week of gains and is 4.2% higher this week and has jumped 9.3 percent this year in dollars and 17% in euro terms as stagnating economies again lead central banks to the default position of ultra loose, zero percent interest rate policies and debt monetisation – the creation of currency to buy government bonds.

Stock and bond markets, increasingly dependent on central bank largesse, ’stimulus’ and support also saw gains. European shares have jumped 1.7%, gaining ground for the seventh consecutive session as traders, banks and many market participants celebrate the ECB’s decision to buy government bonds, and after a strong session for Asian stocks overnight.

Further financial repression mean that borrowing rates for indebted and in some cases insolvent euro zone countries hit new record lows. As we saw with the Swiss franc recently, financial repression and price manipulations can only work for so long prior to being overwhelmed by market forces and the laws of supply and demand.

Gold in Euros – 30 Days (Thomson Reuters)

Silver, the poor man’s gold rose 1.4%. Among other commodities, oil prices jumped, with benchmark Brent crude futures climbing 1.3%, as news of the death of Saudi Arabia’s King Abdullah added to uncertainty in energy markets already facing some of the biggest shifts in decades.

Ultra Loose Monetary Policies and Currency Wars

The ECB moves confirms that ultra loose monetary policies are set to continue globally and currency wars and beggar thy neighbour currency devaluations are set to continue.

As ever context is important. Japan has doubled down and is now printing yen with reckless abandon in what appears to be a last ditch desperate attempt to prevent Japan falling into a Depression.

Canada, Denmark and India have all cut interest rates in recent weeks – showing that ultra loose monetary policies and currency wars are here to stay. Also, the fragile narrative of a U.S. economic recovery and rising interest rates by the Federal Reserve is now being questioned and interest rates look set to remain near zero percent in the coming months in the U.S.

Draghi’s “big bazooka” or weapon of mass delusion was bigger than expected, promising €60 billion every month, although he did not have it all his way and in the small print it is clear that Germany played a large role in crafting the final details.

Angela Merkel had made Germany’s opposition to the ECB underwriting the purchases of bonds of weaker countries well known. The Netherlands, Austria and Finland were supportive of Germany’s stance.

So, it is no surprise that beyond the headlines – which celebrate the fact that the ECB intends to expand the money supply from €2 trillion to €3.1 trillion over 18 months – the ECB will only be directly responsible for 20% of bond purchases.

“While Mr Draghi succeeded in pushing a bigger than expected purchasing package, he failed in ensuring that the risks of asset purchases would be divided equally among eurozone countries with only 20 percent of the QE subject to a regime of risk sharing,” according to the Daily Telegraph.

The balance will be generated by National Central Banks (NCBs). If they buy sovereign bonds which then default they will be liable for the losses. Germany hopes this measure will discourage less disciplined governments from issuing bonds to finance social programs that they cannot afford.

However, the fact that eurozone central banks will now buy sovereign bonds en masse – driving down the interest rates that governments need to pay – means that governments will still be able to run deficits more cheaply.

“It would be a big mistake if countries were to consider that the presence of this programme might be an incentive to fiscal expansion. That would undermine confidence,” Draghi said. “It’s not directed, certainly, to monetary financing at all. Actually it’s been designed as to avoid any monetary financing. It should increase the lending capacity of banks.”

Time will tell how well designed this bazooka is. We would add that a bank’s capacity to lend is only as effective as a consumers and businesses capacity to borrow.

The “irrational exuberance” in markets is a fitting counterbalance to the next hurdle facing the Eurozone economy and political project.

Greek Election and ‘Grexit’ Risk

The elections in Greece on Sunday look set to bring Syriza, the anti-austerity group, to power.

Greece’s pro debt forgiveness Syriza party has widened its lead over the ruling conservatives, two surveys showed yesterday, days before a snap national election. A poll by Metron Analysis to be published on Friday showed Syriza would win 36 percent of the vote, ahead of Prime Minister Antonis Samaras’ New Democracy party which would take 30.7 percent of the vote.

Syriza have made clear that they intend to take a hard line in renegotiating what they regard as an odious debt agreement which forced the losses of reckless banks onto the backs of tax payers who were then “bailed out.”

The big question is if they come to power will Greece leave the monetary union?

The resentment felt in Greece towards the Eurozone will likely result in Syriza having a strong mandate. Syriza have said that they do not intend to drag Greece out of the Euro but will not completely rule that option out. If new terms and debt write downs are not agreed, it may have no option.

From the EU’s point of view any renegotiation would open a can of worms as other “bailed out” countries such as Ireland would likely demand similar concessions. So while Greece exiting the Euro is not likely at this stage, it is possible if negotiation proves fruitless.

MARKET UPDATE

Today’s AM fix was USD 1,293.50, EUR 1,150.29 and GBP 863.49 per ounce.

Yesterday’s AM fix was USD 1,287.00, EUR 1,107.96 and GBP 848.44 per ounce

Gold climbed $10.20 or 0.79% to $1,303.70 per ounce yesterday and silver rose $0.23 or 1.27% to $18.38 per ounce.

Gold denominated in euros has hit its highest since mid-April 2013 this morning at €1,153.13/oz. That has taken its gain for the year to 17.7%, against a 9.4% rise in dollar terms.

Gold bullion retreated below $1,300 this morning as gold appears to be consolidating after recent gains. Spot gold was last at $1,294.70 per ounce, off $5.50 in London.

In other metals, silver was also marginally lower at $18.30 per ounce after earlier hitting $18.40 per ounce, just short of the September high hit in prior session at $18.49 per ounce. Platinum fell from four-month highs and was down $1 at $1,271 per ounce, while palladium gained $1 to $770.

Market attention will not begin to shift to the Greek elections on Sunday. The Syriza party still maintains a lead in the polls. A poll by Metron Analysis to be published on Friday showed Syriza’s lead over the New Democracy party growing to 5.3 points from 4.6 points.

Syriza’s leftist leader Alexis Tsipra’s charisma is winning over the citizens of Greece that struggle with 25% unemployment plus wage and pension cuts. He promises to overturn austerity and demand a debt write-off from European partners.

The left wing anti austerity party could change the landscape of the eurozone as we know it. This uncertainty allied with concerns about ECB QE is increasing safe haven flows into gold bullion.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.