Bitcoin Price Tense Days Ahead

Currencies / Bitcoin Jan 27, 2015 - 05:09 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

The Winklevoss twins seem to be connected to everything about Bitcoin that has hit the media recently. This is an exaggeration but the brothers have been reported to be working on a new regulated Bitcoin exchange, on a Bitcoin ETF. It turned out that they were beaten to opening the first regulated exchange by Coinbase but the brothers seemed undeterred as they spoke with CNN Money:

They [the twins] predict Bitcoin's market capitalization could easily skyrocket to at least $400 billion, or roughly the combined size of modern day payments companies like American Express (AXP), Visa (V), MasterCard (MA) and Western Union (WU).

But the Internet entrepreneurs are taking it one step further. They believe Bitcoin could one day morph into a gold-like asset class -- or even surpass it.

"If Bitcoin is a better gold or seen as a type of gold-like asset, then it could be in the trillions on a market cap," Tyler Winklevoss told CNNMoney. "We do feel those are very real possibilities."

(…)

The twins believe such an ETF would appeal to gold bugs because Bitcoin, just like gold, can be used as a hedge against inflation. They say Bitcoin is more durable, divisible and affordable than the yellow metal.

"If you like gold, there are many reasons you should like Bitcoin," said Cameron Winklevoss.

These statements seem somewhat optimistic. With a total cap of under $4 billion, Bitcoin is very far from the targets proposed by the twins. The current cap of the currency is about 1% of what the brothers envisage for the cryptocurrency. Is it possible for Bitcoin to overtake part of the credit card and money transfer market? Yes, but Bitcoin getting close in size to the combined market cap of major credit card companies seems highly speculative. Bitcoin could go in this direction but we haven’t quite seen that yet and if it’s to gain market cap, we would argue this would take place over the long term, years rather than months.

Another frequently repeated mantra is that Bitcoin is a kind of “new gold.” This is far-fetched, since Bitcoin has been around for only a couple of year whereas gold’s been around for thousands of years. So, Bitcoin’s track record of an alternative asset is nothing to compare with that of gold. We wouldn’t argue that it’s better than gold. More to the point, it’s simply different.

Having said that, it’s still an interesting alternative asset. For starters, because it doesn’t seem to be influenced very much by the stock or bond markets. Bitcoin can appreciate relatively independently of the developments in other markets, which makes it valuable for diversification.

Also, if it turns out that the Bitcoin ecosystem blossoms and this translates into appreciation, a small (!) position in Bitcoin could favorably influence one’s portfolio.

For now, let’s take a look at the charts.

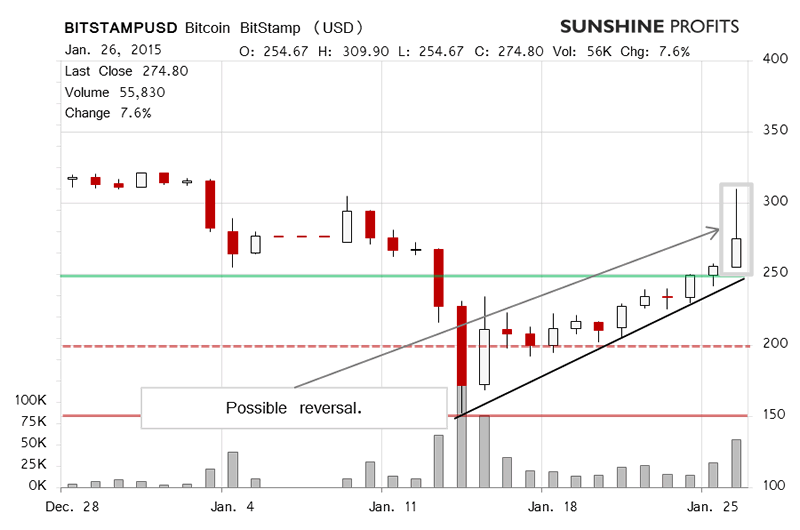

We saw very significant appreciation yesterday on BitStamp. The volume shot up to over BTC55,000. This was the highest level of volume since the violent rebound of Jan. 15 and Bitcoin hit a high of almost $310. At first sight, this was a very strong speculative long signal. But looking deeper, it was possibly more complicated than that. Yesterday we wrote:

Bitcoin went up to above $300 and the volume was also definitely up and relatively significant. Again, this looks like a very bullish development. But there seems to be more to it than just appreciation.

Most notably, Bitcoin has already corrected both on BitStamp and BTC-e from above $300 to around $275. Also, the moves down took place on relatively high volume compared with the moves up. This makes today look like a possible reversal.

At present, our best bet is a reversal and a move back to the possible declining trend line in the proximity of $250. The situation is too unclear to open speculative positions at this time and it looks like there might be more volatility to come. If Bitcoin comes back down below $250, we might bet on the market going down but this is not the case yet.

As a matter of fact, the currency took a dive not only yesterday but also earlier today (this is written around 12:00 p.m. ET), slipping below $250 (solid green line in the chart) and a possible rising trend line (marked in black) at one point. This was a very bearish development since it suggested that Bitcoin might be in for yet another fall.

However, the cryptocurrency has returned to around $260 and above the trend line since then, making the bearish implications somewhat weaker. The volume hasn’t been very weak but at the end of the day it might be lower than yesterday (the day is not over yet, mind).

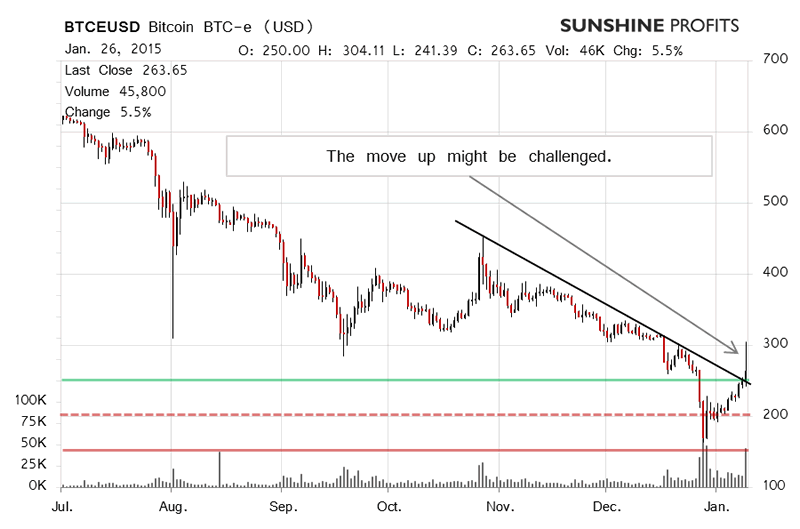

On the long-term BTC-e chart, the recent breakout above a possible declining trend line is visible. Bitcoin retraced back below this line and below the $250 level (solid green line), but came back above both of them. The move below $250 was a pretty bearish development but the appreciation above this level made the bearish implications a lot weaker.

Currently, the volume levels don’t quite suggest what the next move might be. Our best bet is that Bitcoin might move down again but the fact that the cryptocurrency has held up above $250 suggests a risk of a further move up. The situation in the market is very tense now. We might suggest going short if Bitcoin drops below $250 and this is our best bet. This is not the case just now and a move up is not to be ruled out.

Summing up, the situation is very tense we think it’s best to hold off opening speculative positions.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.