The No. 1 Reason Stocks Will Climb Higher

Stock-Markets / Stocks Bull Market May 17, 2015 - 03:06 PM GMTBy: Investment_U

Andrew Snyder writes: There’s no end in sight for this bull market. As long as money is cheap, the gains will continue. It’s great news as we embark on our journey to unleash liberty through wealth.

Andrew Snyder writes: There’s no end in sight for this bull market. As long as money is cheap, the gains will continue. It’s great news as we embark on our journey to unleash liberty through wealth.

But before I show you why there’s plenty more gains to come, let me remind you of two key facts.

First, it’s an Oxford Club maxim that stocks follow earnings. And second, corporate bigwigs get paid more when shares of their companies rise.

It’s simple. Where profits go, share prices follow. And as these figures rise, so does executive pay.

It’s those two simple ideas that tell us why the market is headed nowhere but up.

It’s all thanks to that cheap money we’ve been writing about (here and here). The best news is this trend won’t stop just because the Fed may decide to raise rates by a half a percentage point or even more.

No, as long as money is cheap, executives will continue to borrow money and use the cash to buy shares of their own companies.

Whether it’s artificial or not, the move sends share prices higher. And it’s happening everywhere we look... at astounding levels.

Typically, share buybacks have been thought of as a bonus for shareholders. With no stronger investment opportunities, companies use their cash stockpiles to invest in themselves. It’s always been a controversial idea (pro and con), but now things have grown to a whole new level.

Instead of using cash to reduce the outstanding share count, companies have turned to debt.

It’s a sign of the times - proof that bulls feed on cheap money.

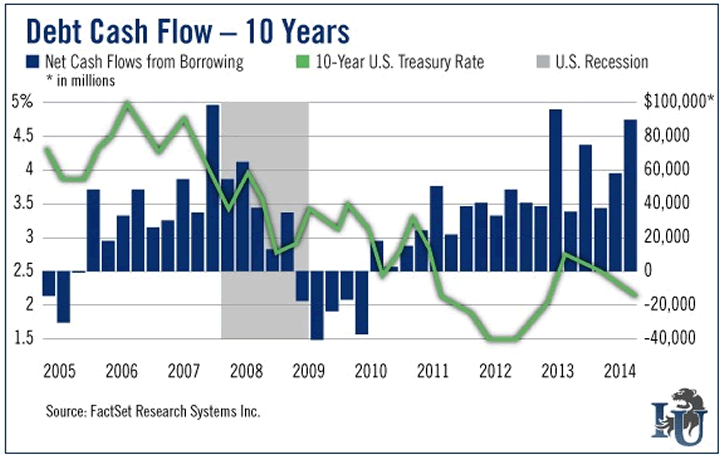

And right now, money is cheap. The benchmark 10-Year Treasury note is barely hovering above 2%, while the average yield on Baa-rated corporate bonds (one notch above “junk” status) hit 4.29% earlier this year... down from 9% in early 2000.

With interest rates falling to levels many folks once thought were impossibly low, companies are borrowing money at record rates. As the chart shows, net cash flow from borrowing has surged over the last 24 months.

But where is all that debt-generated cash going? In many cases, it’s not being used to expand the business. In fact, our sources say capital spending is likely to decrease by close to 4% over the next four quarters.

Instead of using all that borrowed cash to expand their businesses, companies are using it to buy their own shares. It’s become a normal part of investing in a world without interest rates.

Last year was a huge year for share buybacks, with more than $553 billion in purchases. But get this... that figure may finally tickle the trillion-dollar mark in 2015.

With $141 billion in buyback authorizations, April was a record-setting month. Already this year, we’ve seen over $400 billion in planned “Buys.” (To put that into perspective, companies within the S&P 500 spent roughly $3.1 trillion on buybacks from 2001 to the start of the recent spree.)

Everybody’s Doing It

Apple (Nasdaq: AAPL) is the perfect example of what’s going on. Since its share repurchase program began in 2012, it has returned the equivalent of 100% of its after-tax cash flow to shareholders. In fact, it just upped its buyback plan by another $50 billion (it now totals an incredible $140 billion).

Where’s the money coming from? Simple... the dirt-cheap debt market. Last week, the company with the country’s largest cash stockpile borrowed another $8 billion on top of several similar offerings over the last two years.

Again, all that money isn’t earmarked for a new iPhone factory or something else that will help expand the bottom line. No, the company has boldly stated the borrowed money will be used to fund its buyback program... and therefore boost its share price.

Of course, it’s not just Apple. Companies like McDonald’s (NYSE: MCD), Qualcomm (Nasdaq: QCOM), FedEx (NYSE: FDX) and Priceline (Nasdaq: PCLN) have all used billions in borrowed money to fund share buyback programs.

The programs work. Illinois Tool Works (NYSE: ITW) used buybacks to boost its earnings per share by 33% last year. And Bed Bath & Beyond (Nasdaq: BBBY) miraculously used the idea to turn a 10% drop in profits into a gain of a penny per share.

This idea is pervasive. Last year, it’s estimated that one in four companies in the S&P 500 used buybacks to inflate their earnings-per-share figures... which directly inflates the share price.

Again, it’s critical to remember why this is happening. We cannot overlook the fact that share price is very tightly tied to executive compensation - stock-based rewards often total over 80% of an executive’s pay.

The trend helps further explain why stocks continue to climb higher despite an economy that grew at just 0.2% last quarter.

And the thing is... there’s no end in sight.

As long as interest rates are dirt cheap (and we argue we’ve seen the death of “normal” interest rates), the trend will continue. Yellen and her troops at the Fed could raise rates by a full percentage point next month (an absurd idea, by the way) and still not alter the math enough to stop this buyback trend.

Buybacks will continue... and stocks will rise further.

Over the past five years, equity prices have nearly doubled. Curiously, so has corporate debt.

Welcome to the land of no interest rates.

Good investing,

Andrew

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.