Canada in Recession Admits Canadian Central Bank, Operation Twist?

Economics / Recession 2015 Jul 19, 2015 - 07:41 PM GMTBy: Mike_Shedlock

... The Solution: More Bubbles; Operation Twist Canadian Style?

... The Solution: More Bubbles; Operation Twist Canadian Style?

The Bank of Canada admitted on Wednesday that Canada was in Recession. Well sort of.

Bank of Canada Governor Stephen Poloz is afraid to speak the "R-Word". Instead, Poloz phrased it this way: "Real GDP is now projected to have contracted modestly in the first half of the year."

Shades of Voldemort

Poloz further went out of his way to state the "R-word is unhelpful".

Pressed by reporters to just come out and use the R-word, Poloz dug in.

"I just find the discussion quite unhelpful," he sniffed. "It's especially unhelpful when what has happened to the economy is very narrowly defined."

Recession an Easy Call

Calling the Canadian recession was one of the easiest calls ever. I did so on January 31, in Canada in Recession, US Will Follow in 2015.

What made the Canadian recession easy to spot was the Canadian yield curve inverted out to three years following a surprise rate cut by the Bank of Canada on January 21.

It remains to be seen if the US follows. The US contracted in the first quarter, but the second quarter rebound was a bit stronger than I expected.

On January 21, in response to the surprise cut, I wrote Canadian Recession Coming Up: Yield Curve Inverts Following Unexpected Rate Cut; Loonie at Six-Year Low.

In that post I awarded Canada the "Blue Ribbon" for the first yield curve inversion of any major country following the great financial crisis. I am not aware of anyone else noticing or commenting on the yield-curve inversion at the time.

Denial Sets In Already

Two consecutive quarters of GDP contraction are a sufficient but not necessary condition for recession. Indeed the NBER, the official arbiter of US recessions, has called the start of recessions in quarters in which GDP was positive.

I have not seen anyone deny a recession when there has been 2 quarters of negative growth, "mild" or not, until now.

The Globe and Mail amusingly claims Canada's Fall into Recession Far from a Sure Thing.

The question of whether Canada slipped into a recession in the first half of 2015 may depend on our definition of "recession." And most of us have been using the wrong one, says one of the country's top experts on measuring business cycles.

Many commentators pointed at the Bank of Canada's revelation this week that the Canadian economy likely contracted in the second quarter as evidence that the country met the "technical" definition of a recession: two consecutive quarters of declining gross domestic product. Indeed, much was made of Bank of Canada Governor Stephen Poloz's unwillingness to even utter the word "recession" after the central bank's interest-rate cut Wednesday.

The Solution: More Bubbles

Apparently, if you don't like the word recession, you not only don't say it, you change the meaning of it.

Then you need to do something to make the problem go away. The tried and true central bank method the world over is to blow more bubbles.

Pater Tenebrarum at the Acting Man blog offered his well thought out take in Bank of Canada Decides More Bubble-Blowing is Needed

You Can't Keep the Printing Press Idle for too Long ...

We have recently portrayed Canada's new central bank governor Stephen Poloz, to whom we have alternately referred to as a comedian and a delusional bubble blower. This may perhaps strike some readers as uncharitable; then again, central economic planning bureaucrats should be fair game, especially as nearly all of them are slaves to hoary inflationism and are apodictically certain to do grave damage to the economy, based on economic theories that at best deserve to be called a form of voodoo. It's really that bad.

As readers may recall, Mr. Poloz has continued where his fellow bubble-blower and predecessor Mark Carney left off, by keeping the bubble blown with all his might. We imagine he may be a bit intimidated by the truly daunting size the combined real estate and consumer credit bubbles have attained in Canada. To call them monuments to monetary megalomania would be an understatement. Among developed nations, only the bubbles in a few Scandinavian countries and Australia can hold a candle to them.

We were therefore decidedly unsurprised when it emerged yesterday that the Bank of Canada has cut rates again - apparently the Canadian economy has entered an official recession, which must however not be mentioned.

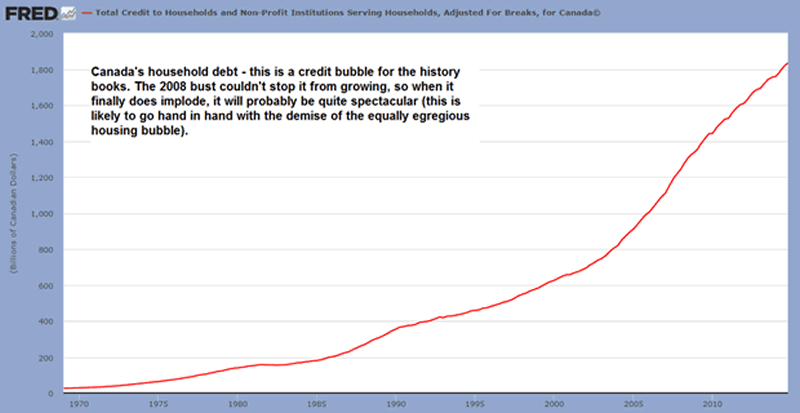

Canadian Household Debt

Bubble for the Record Books

The above chart reads "This is a credit bubble for the history books. The 2008 Bubble couldn't stop it from growing, so when it finally does implode, it will probably be quite spectacular. This is likely to go hand-in-hand with the demise of the equally egregious housing bubble."

Chart courtesy of Pater Tenebrarum. Pater also offered these pertinent comments.

- Several years go already about one third of Canadians reported in a survey that their debt worries caused them to have sleeping problems. We can certainly believe it.

- Stephen Poloz, comedian, gifted pantomime, delusional bubble blower and hoary inflationist, sprung directly from the John Law School of economics (just as the rest of the developed world's central planners), is trying to prolong the bubble's life some more. So far, he has been successful, but he is riding a tiger. The sooner such policies are discredited, the better it will be for all of us, even though the process is likely to be painful for many.

Change 'likely' to 'will be' and many to 'nearly everyone, but especially those who got into the real estate bubble in the latter stages' and Pater is precisely correct.

Yield Curve Still Inverted

By the way, portions of the Canadian Yield Curve are still inverted, albeit very slightly. I compiled this list of rates today from Investing.Com.

- 30-Year: 2.242%

- 10-Year: 1.562%

- 7-Year: 1.154%

- 5-Year: 0.705%

- 4-Year: 0.446%

- 3-Year: 0.383%

- 2-Year: 0.423%

- 1-Year: 0.445%

- 6-Month: 0.435%

- 3-Month: 0.400%

- 1-Month: 0.390%

Note the inversion: 1M, 3M, 6M, 1Y, and 2Y yields are all higher than the 3Y yield.

Operation Twist, Canada Style

I smell an "Operation Twist" type move by the Canadian central bank to rectify this horrific "recession-signaling" condition.

If so, the sweet spot for banks and hedge funds to front-run the trade appears to be 5Y or 7Y notes.

Then again, some banks may already be in on it. I suspect some of them were not at all surprised by the surprise announcement in January. That's simply the way the system "works".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.