Apple Stocks Five Down Days in a Row: Here’s What to Do Now

Companies / Apple Aug 06, 2015 - 01:10 PM GMTBy: ...

MoneyMorning.com

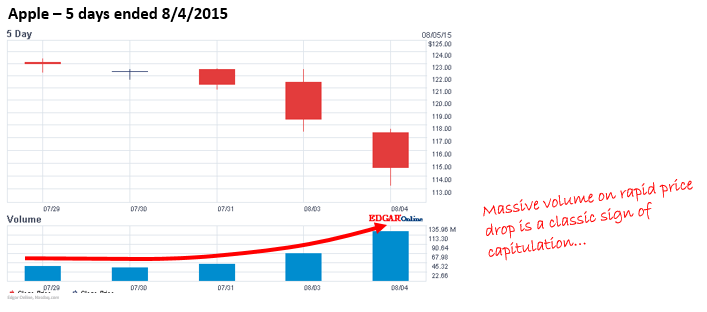

Keith Fitz-Gerald writes: Apple Inc. (NasdaqGS:AAPL) lost another 3.2% yesterday on more than double the usual volume, making many investors wonder if it’s time to throw in the proverbial towel. It finished the day down 14% from the $133 a share high it set in February, and paper losses now tally $133.4 billion.

Keith Fitz-Gerald writes: Apple Inc. (NasdaqGS:AAPL) lost another 3.2% yesterday on more than double the usual volume, making many investors wonder if it’s time to throw in the proverbial towel. It finished the day down 14% from the $133 a share high it set in February, and paper losses now tally $133.4 billion.

To put that in perspective, Apple’s just lost more than McDonald’s, which carries a $95 billion market cap, is worth.

I can’t help but think this is great.

Stocks like Apple rarely, if ever, take a break like this. That means you’ve got one whale of an opportunity on your hands, and a unique chance to buy in when everybody is running the other way.

Today we’re going to talk about why, and the best Total Wealth Tactic to play a situation like this.

The secret is capitulation – and it could mean a double-digit discount for you in one of the most promising sectors in the world.

There’s no question that Apple has taken a beating in recent trading. The stock dropped another 3.2% and closed Tuesday at only $114.64 a share after five consecutive days of selling. Yesterday, in particular, was a blood bath on roughly double the average daily volume.

Ostensibly, the story is about weakening demand in China, which is one of Apple’s biggest markets, and the burden of higher expectations associated with iPhone and smartwatch sales that have fallen short of analyst projections.

We’ve talked about both of these things before. China is no more going to disappear than America is, and Wall Street analysts rarely get it “right.”

So you owe it to yourself to keep things in perspective.

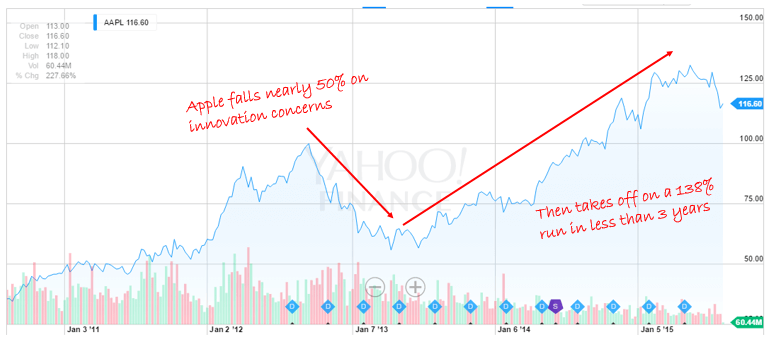

Besides, we’ve seen this playbook before. The stock’s current slump is nowhere near as bad as the one three years ago, when Apple fell nearly 50% on concerns that the company had run out of clever ideas and was being eaten alive by the competition in both the smartphone and tablet markets that it created. If you do the math, that works out to a split-adjusted fall from grace at $100.72 in September 2012 to $55.01 by April 2013. Yet Apple was on track and climbing steadily again by June.

My point is that healthy companies have give and take. Apple has, in fact, fallen below its 200-day moving average 17 times and, in each case, it’s taken about 30 days to get back on its feet.

The way I see it, the current pull-back isn’t unexpected right now, for three reasons I laid out to Fox Business Anchor Deirdre Bolton last night on Risk & Reward:

- Apple makes up roughly 4% of the Dow, 12% of the Nasdaq, and 3.6% of the S&P 500. So it tracks the indices pretty closely, perhaps even drives them. There’s probably some institutional profit-taking, rebalancing, and indexing going on, too.

- Apple is one of the most widely held stocks in the world and, chances are, if you’ve got any sort of retirement plan whatsoever, you own it. That means it’s going to move on individual whim.

- Yesterday’s rout on roughly double the normal average daily volume smells like capitulation, something we haven’t seen in a while.

Ergo, Apple may be a great “buy” at these levels. No, scratch that. Apple is a great buy at these levels. Three to five years from now, the current drop is going to be nothing more than a blip.

Fundamentally, this makes a lot of sense if you think about it.

Apple has a long history of creating devices that fill needs people don’t even understand they have… then turning them into industry standards. That means the iPhone and tablet sales everybody is fixated on now are nothing more than a delivery mechanism and Jobs’ legacy.

Current CEO Tim Cook has made a brilliant pivot into something I’ve termed the ecosphere. Very few people understand the vision, but it’s one that revolves around a product set that hasn’t yet been priced in and products that aren’t yet on the market.

I’m thinking here about things like Apple Pay, Apple powered cars, TVs, even buildings, artificial intelligence, and form factors that haven’t been invented yet but which you can bet are already on Apple’s drawing board.

As for the notion that the watch is a dud… so what. I don’t know a serious trader or investor who thought it was going to be a winner. The thing was a dud from day one, so the market has never priced that in to begin with.

Apple Has Hit an Inflection Point – Just Not the Kind Panicked Sellers Believe

The real value in products like the watch is in the conversation with consumers who are gradually being led to Star Trek-style communicators that will transcend the smartphone, tablets, wallets, and wearable tech we think about today.

We have an aging population that increasingly prefers the simplicity of Apple designs over Droid. So the upgrade path is assured as long as Apple remains true to its design ethos.

And finally, Apple’s probably going to grow revenues and earnings by 25 to 35% a year for the next five to 10 years. That’s rarified air in today’s stimulus-laden, politically charged environment.

But that still doesn’t answer the question of why make your move now, nor the question of how. For that we need to return to the trading itself.

To hear the bears tell it, the selling is so severe that Apple has dropped below not one, but two critical measures. It’s now trading below the 200-day moving average many institutions use as a line in the sand to judge momentum. And, according to Bespoke Research, Apple is farther below its 50-day moving average than it’s been in the past 12 years.

That sounds bad, but here’s the thing… when there’s this much duress and this much pressure, you’re bound to get mispricing. That’s where something called “capitulation” comes in.

If you’ve never heard the term before, capitulation is a technical trading condition that reflects a shift in psychology that’s really a reflection of investors who give up. It’s often a key inflection point characterized by increasingly panicked selling that is much like the crescendo in music… a sharp loud burst.

You can see that very clearly in Apple at the moment. Price has dropped precipitously and volume has spiked to roughly double the most recent average daily levels.

Most investors are in such a rush to sell that they fail to recognize that capitulations are frequently a sign that the bottom is at hand or close to it, because everybody who wants to sell has already sold.

This Simple Total Wealth Tactic Can Mean Double-Digit Discounts on Your Trades

Now, don’t get me wrong. Capitulations are not a sign that you want to blindly buy in. Any company that suffers one could fall further before getting on its feet, including Apple.

Instead, split your money into chunks that you use to buy Apple shares over the next three to five months using one of my favorite Total Wealth Tactics: Dollar-Cost Averaging.

What I like most about dollar-cost averaging is that it helps you avoid the neck-snapping volatility that plagues other investors, especially when it comes to a stock like Apple. It’s also a great way to inject discipline into your investing process automatically, while also removing emotion from the equation.

And finally, dollar-cost averaging lessens the risk associated with buying a large amount of stock at the wrong time, because it helps you work with the markets, not against them.

Over time, you’ll actually accumulate more shares for less, yet still have all the upside you can handle…

Even if Apple drops for a sixth straight day.

Until next time,

Keith

Source :http://totalwealthresearch.com/2015/08/apples-down-five-days-in-a-row-heres-what-to-do-now/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.